November 7th, 2024 | 07:45 CET

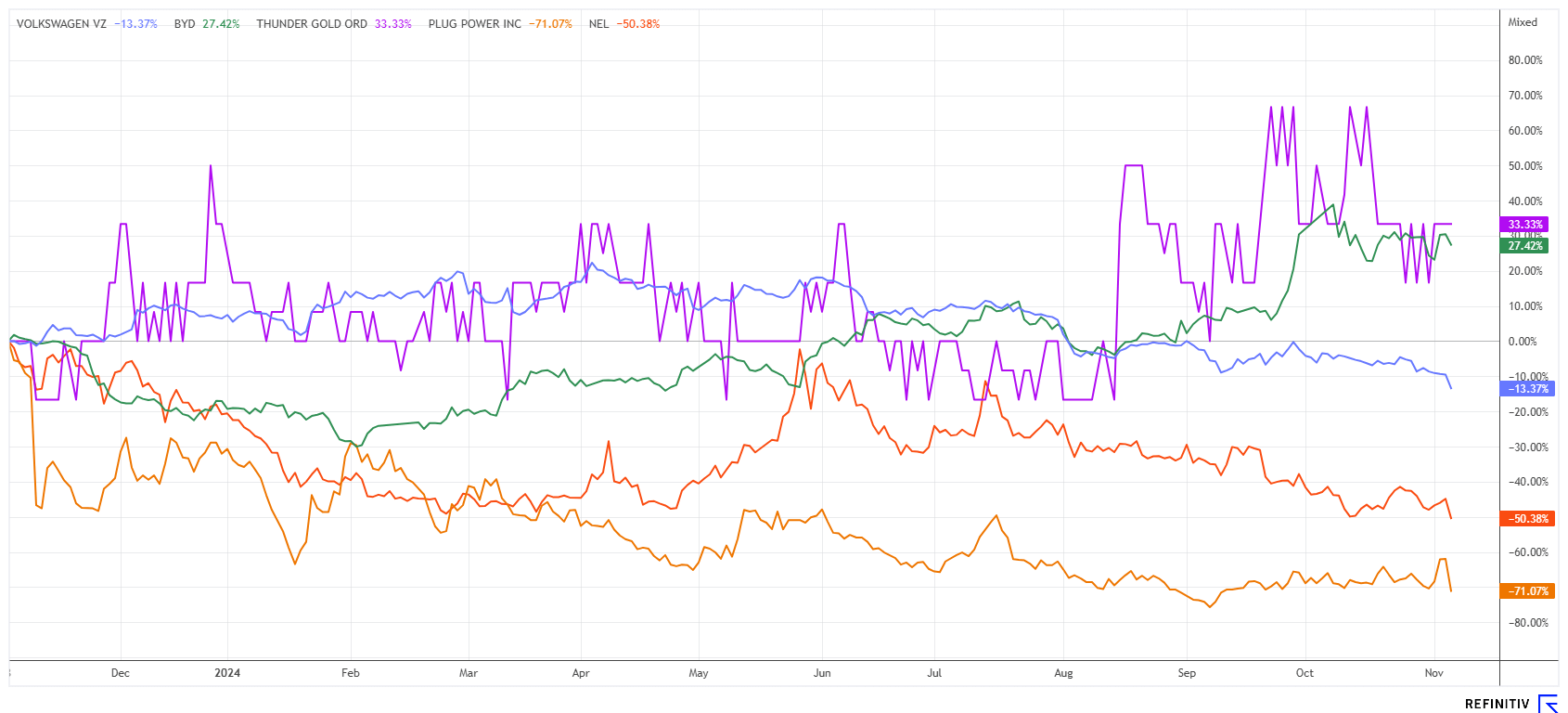

Trump triumphs! What happens now with gold, e-mobility and green tech? BYD, VW, Thunder Gold, Nel, and Plug Power in focus

The US election is over. Donald Trump is moving back into the White House. Along with a tougher stance on China, conservative voters in the US are hoping for a greater focus on their own country. America needs a complete renewal of its infrastructure and will push ahead with armaments, so commodities of all kinds will come into focus. For Europe, the degree of responsibility for its own affairs will increase significantly, and the development of stable supply chains is imperative. Trump supports Bitcoin, so gold may have to give up some of its recent gains. What are the yield or loss drivers for investors now? After the election, investors should separate the wheat from the chaff to ensure their portfolios are properly positioned.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , THUNDER GOLD CORP | CA88605F1009 , NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We quickly learned that the tailings are high-grade, often as high as 20 grams of gold per tonne; because they are produced by artisanal miners, local miners who use outdated technology for gold production. [...]" Ryan Jackson, CEO, Newlox Gold Ventures Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD and Volkswagen – Growth versus restructuring

Since the abolition of the environmental bonuses, that is, the subsidies for electric vehicles, new e-vehicle sales have fallen by over 70%. If consumers favor combustion engines again, import tariffs will no longer play a role. In October 2024, a total of 232,000 new vehicles were registered in Germany. Hybrids performed particularly well again, accounting for more than 85,000 of them. Plug-in hybrids alone recorded an increase of more than 18% compared to the same month last year, with around 19,300 units. The figures for pure electric vehicle manufacturers such as BYD and Tesla paint a mixed picture, as the previous year's level is already a distant memory. Currently, the Texans are down more than 50%. Whether the much-praised ID.7 at VW was able to create an e-car boom is not clear from the statistics. However, one thing is clear: the Wolfsburg-based company can be pleased overall with the sharp increase in demand. The carmaker accounts for almost 19% of all new registrations, but VW is still facing a major restructuring due to the weak performance of its subsidiary Audi.

In the current year, the carmaker has so far generated a profit of EUR 8.9 billion. This corresponds to a decline of 30.7% compared to the same period in 2023. If the figures for the full year were to hold, the Wolfsburg-based company would currently be trading at a 2024 P/E ratio of 3. 8. Analysts have recently dramatically lowered their price targets, with only 15 out of 28 experts on the Refinitiv Eikon platform issuing a "Buy" vote with an average price target of EUR 116. Chinese competitor BYD, with its integral technology approach, is growing at around 15% a year and could overtake rival Tesla in 2024. However, the Chinese company's 2024 P/E ratio is 16 compared to VW's 30, but the share price has doubled in the last 3 years, while VW has almost halved from its high. As far as the new President Trump is concerned, there is a lot to be said for a new trade war with China, but perhaps also with the EU. Whether automotive stocks are the best choice remains to be seen. Caution at the platform edge!

Thunder Gold – Lots of gold in Ontario

Although gold was among the losers yesterday, the long-term uptrend remains intact. In October, the ounce reached a new all-time high of around USD 2,785. American investment banks estimate the target line for 2025 to be between USD 2,850 and USD 3,250. This puts a strong focus on producers and explorers. Attractive properties have been in demand again for several months because the grades are declining worldwide and must be replaced by new, mineable resources. This is what gets the takeover carousel going.

The Canadian province of Ontario is known for mining, good infrastructure, a responsible social approach and a friendly jurisdiction that supports local projects. The Canadian explorer Thunder Gold (formerly White Metal Resources) owns the Tower Mountain gold property. It is located just off the Trans-Canada Highway, approximately 50 km west of Thunder Bay. The 2,500-hectare property surrounds the largest exposed intrusive complex in the eastern Shebandowan greenstone belt, where most of the known gold occurrences have been outlined either within or proximal to intrusive rocks. The gold at Tower Mountain is hosted in extremely altered rock, with anomalous gold in drill holes extending from the intrusive contact for 500 meters along a strike length of 1,500 meters and to a depth of over 500 meters from surface. The area around the intrusion shows identical geology, alteration and geophysical responses, representing a compelling exploration opportunity. Thunder Gold has already identified mineralization from 0.75 to 13.2 grams per tonne through surface rock sampling.

Work is currently focused on the P target, with soil geochemical sampling of 60% of the site already completed, with assay results expected in November. Thunder Gold's approximately 206 million shares are currently trading between C$0.04 and C$0.05. This puts the market capitalization at a low CAD 8.3 million. Should gold continue its rally as expected by many experts, Thunder Gold stands to be considerably revalued.

Nel ASA and Plug Power – The Trump losers

One sector has to be classified as the clear loser of the Trump presidency – the so-called green stocks. As if stocks like Plug Power and Nel ASA hadn't lost enough over the last 3 years, the landmark election has added insult to injury. Donald Trump is considered a "climate change denier," and alternative energies and investments in hydrogen or solar energy are not exactly on his list of preferences. What is interesting about yesterday's movement is that the lows already reached in 2024 are likely to hold. So if reason returns and the Republican administration also speaks conciliatory words in the direction of future renewal, yesterday's sell-off with losses of 6 to 25% would certainly be a good sign. The fact that the Trump supporter and promoter Elon Musk, of all people, is experiencing a 14% increase in Tesla could also be a flash in the pan because, after all, from this point of view, the Texan company is certainly no longer selling thousands of cars a year, as the share price suggests. Dynamic investors can, therefore, make good use of the special movements for medium-term dispositions.

Political stock markets have short legs. Yesterday, this only applied to a few stocks that were clearly attributed to the Biden administration. However, armaments and the old economy were able to shine, with the partial regression to the Stone Age boosting precisely these stocks. Increasing geopolitical conflicts should continue to drive oil and precious metals in the long term. Thunder Gold impresses with a good project and an experienced management team.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.