January 12th, 2026 | 07:20 CET

Boom & Bust 2026 – Where can investors still position themselves? BYD, BMW, DroneShield, and Power Metallic Mines

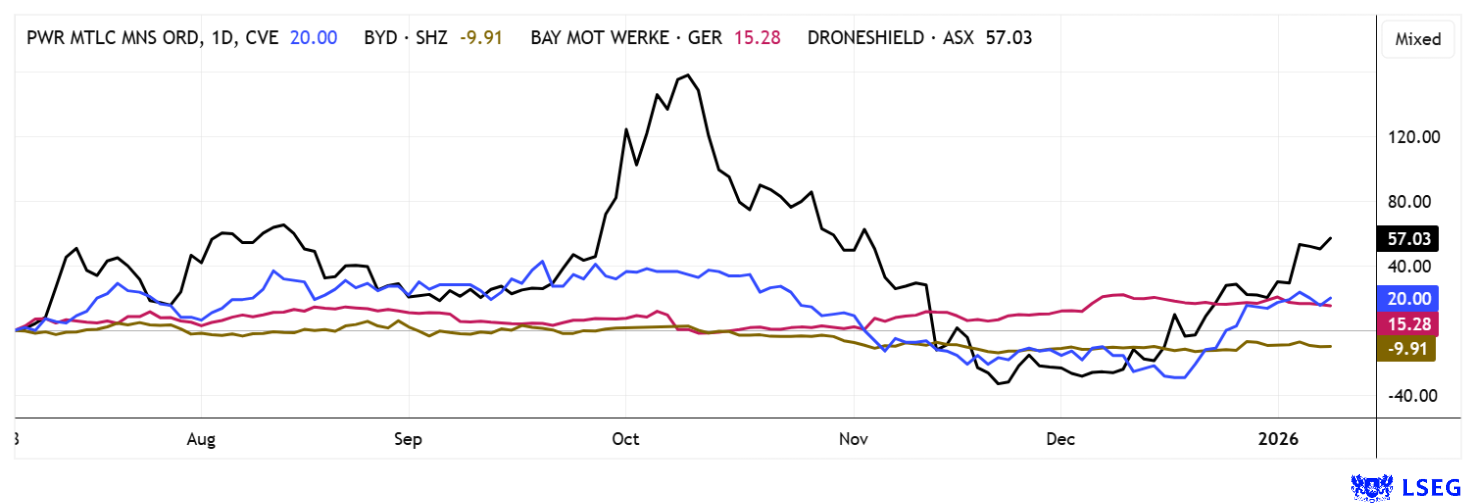

New highs every day – it is nothing short of a miracle. The international trouble spots around Ukraine, Gaza, and Venezuela appear to be growing with the addition of Syria and Iran. This means the next gear for the arms industry. The under-militarized NATO countries, in particular, are likely to continue to push ahead, as the US's guarantee of support for Western countries is no longer considered viable. Those who can no longer defend themselves today are at risk of being overrun by trigger-happy dictators. This makes things interesting for DroneShield and Power Metallic. The automotive industry must also show how it can get consumers back behind the wheel. The capital markets remain highly valued and extremely exciting, but the eternal one-way street of high tech still seems to have many potholes. Which stocks can overtake on the right?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , BAY.MOTOREN WERKE AG ST | DE0005190003 , DRONESHIELD LTD | AU000000DRO2 , POWER METALLIC MINES INC. | CA73929R1055

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD versus BMW – Two automotive giants step on the gas

The automotive year 2025 did not bring any major advances over 2024, as many e-consumers are waiting for the new subsidy in 2026. Now, tax incentives are returning in a significantly different form, with the focus on private individuals with low and middle incomes as well as electric company vehicles. A new subsidy of around EUR 3,000 is planned for the purchase of electric vehicles and plug-in hybrids, subject to EU approval and new subsidy guidelines. Chinese manufacturer BYD clearly led the market for electric vehicles in 2025, setting a new record with 4.2 million units sold. The US industry leader Tesla only sold 1.64 million units, but was still well ahead of German premium manufacturer BMW with around 442,000 units.

The market is difficult for EU companies. This is because the import tariffs imposed by the EU on China are currently having little effect, as BYD can offer discounts of over 25%. These are significantly higher than the special tariffs of 17.4% that have been imposed. In 2026, however, the tide will turn once again. BYD plans to double its dealer network and will soon open its plant in Hungary. This is likely to cause a storm, as the EU special tariffs will then be abolished. Despite problems in China and a weak Q4, BMW increased deliveries in 2025 by 0.5% to a total of 2.46 million units. However, Europe and the US were able to compensate for the China business, with the electric versions of the Mini being particularly in demand. Management expects the new models to provide an electric boost in 2026, especially in China. On the LSEG platform, 14 out of 26 analysts expect BMW's share price to reach around EUR 90, and the share was already slightly higher on Friday. BYD shares, which have consolidated by 45%, are once again being enthusiastically recommended. Here, the potential is estimated at a full 36%. It will be exciting to see how the two manufacturers fare on the capital markets. After all, BMW pays a dividend of close to 5.5% and is worth only half as much as its competitor.

Power Metallic Mines – Part of the North American supply chain for critical metals

Critical metals have become the silent backbone of modern industries, from automotive manufacturing to defense and energy. In the context of growing US-China tensions, access to these materials increasingly defines technological sovereignty. North America is emerging as a reliable counterweight to unstable global supply chains, and companies with access to copper, nickel, and precious metals are gaining strategic importance. Energy supply also remains a key issue. This is because the global expansion of artificial intelligence and cloud infrastructures is driving electricity demand to unprecedented levels and exposing the weaknesses of today's grids. Long-term energy scenarios show that grids with a high proportion of renewable energy require storage in the TWH range, which requires massive investments and enormous quantities of conductive metals. Against this backdrop, raw materials such as copper and nickel are gaining a key role in energy, mobility, and digitalization. At the same time, geopolitical upheavals and a loss of confidence in international financial and legal structures are causing prices for precious and industrial metals to rise. The pressure is mounting!

It is precisely in this environment that Power Metallic is positioning itself with projects in Québec, a region known for political stability, reliable approval procedures, and strong infrastructure. The Company has rapidly expanded its land position around the NISK area, laying the foundation for a contiguous polymetallic system. Macroeconomically, the situation is further exacerbated by forecasts indicating structural bottlenecks for nickel and historically low copper inventories from 2027 onwards. However, Power Metallic is benefiting from repeated high-grade drill results combining copper, nickel, and precious metals in economically relevant concentrations.

A large-scale drilling program in 2026 is planned to refine the geological model and continue delivering news flow. After multiple financing rounds, Power Metallic is well equipped to deploy modern exploration technologies and advance multiple target areas in parallel. In recent days, there has been an increase in value of over 80% in response to suspected short attacks in December. With a market capitalization of around CAD 300 million, the Company is emerging as a potential partner for industrial companies looking to secure future supply of critical metals. The Company is currently showing impressive momentum; as a result, the share price could surge at any time on news.

CEO Terry Lynch provided an overview of the current status of exploration work in Québec at the December International Investment Forum (www.ii-forum.com).

DroneShield – European follow-up order worth USD 50 million provides boost

The Australian drone defense specialist is back. After astonishing price distortions since October, the market value managed to swing back up from lows of EUR 0.80 to EUR 2.30 by Friday. Who would have thought? The trigger was news of a European NATO follow-up order valued at just under USD 50 million. The customer is said to be an unnamed military unit that processed the contract through a European reseller. The order includes handheld drone defense systems, related accessories, and software updates. DroneShield has most of these products in stock and expects all deliveries to be completed in Q1 2026. The primary product sold is the DroneGun Mk4, an ultra-portable system designed for rapid deployment against unmanned aerial systems in diverse operational environments. With estimated revenues of around AUD 250 million in 2025, DroneShield enters 2026 with positive momentum. Whether it will be enough for new record prices is questionable. Investors should note that once the AUD 300 million revenue mark is reached, extensive employee bonuses and options are triggered, a factor that contributed to the 80% price decline in Q4 2025. Caution!

The stock market is currently navigating a multitude of influences. While automotive manufacturers are gradually adapting to the challenges of complex supply chains, companies like Power Metallic and DroneShield are attracting particular attention amid these upheavals. The Australian drone defense specialist is achieving a short-term turnaround, whereas Power Metallic appears well-positioned for substantial upside following a period of consolidation.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.