July 30th, 2025 | 07:00 CEST

Trump's Tariffs & Takeovers! BioNTech, PanGenomic Health, Pfizer, and Valneva Targeted by Speculators

The US-EU tariff agreement has now been finalized. Many sectors of the European economy will now face additional burdens and margin cuts. The biotech and pharmaceutical industries have been spared, as medicines and active pharmaceutical ingredients are among the few product groups that are traditionally traded duty-free in transatlantic trade. This is due to international agreements, such as the WTO Pharmaceutical Agreement, which both the EU and the US have signed. Clinical trial drugs, active ingredient imports, and vaccines are also mostly exempt from tariffs. Valneva is currently making headlines with its chikungunya vaccine, BioNTech and Pfizer are continuing to sell COVID-19 vaccines on a small scale, and PanGenomic is surprising everyone with a new AI-powered health platform. A lot is going on in the sector – who are the big earners?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , PANGENOMIC HEALTH INC | CA69842E4031 , PFIZER INC. DL-_05 | US7170811035 , VALNEVA SE EO -_15 | FR0004056851

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Valneva – 30% price increase for the chikungunya vaccine

There was movement in Valneva's share price last week. The trigger for a significant rise of almost 30% was encouraging news from the European Medicines Agency (EMA). The restriction imposed in May on the chikungunya vaccine IXCHIQ has been lifted. According to Valneva, the EMA has withdrawn the temporary restriction on use in people aged 65 and over after its safety committee (PRAC) completed a detailed reassessment of the vaccine. The committee had taken action in May after isolated reports of serious side effects, particularly in older people with underlying medical conditions. The EMA clarifies that IXCHIQ remains contraindicated in immunocompromised individuals and should only be used after careful consideration of the benefits and risks and in cases of increased risk of infection. IXCHIQ was first approved in the EU in June 2024. By breaking through the EUR 3.00 mark, the share price has broken its negative trend for the first time in months. Analysts at First Berlin have confirmed their "Buy" rating with a 12-month price target of EUR 8.10. There is plenty of room for growth!

PanGenomic Health – NaraCare.AI brings body and mind into balance

Anxiety and depression are now widespread conditions in our challenging modern times. Many people still lack meaningful or substantial support in these areas. PanGenomic (NARA) recognized this market gap during the COVID-19 pandemic and has been developing digital, AI-based platforms for individual health promotion ever since. The focus is on the NARA app, which uses genetic characteristics and behavioral data to create naturopathic recommendations. Other platforms include Mindleap.com and MUJN. Mindleap provides digital support for stress management and connects users with online therapists, while MUJN offers diagnostics for cognitive disorders. The central Nustasis AI bundles various data, evaluates it scientifically, and provides personalized therapy recommendations.

The NaraCare.AI platform now closes the loop to a holistic approach to health. By consciously tuning into body and mind, NaraCare.AI combines features from the mental health app Nara, the telemedicine solution Mindleap, and the MUJN diagnostic tools. Using modern AI models, it delivers personalized recommendations for alternative treatments, including evidence-based information on effectiveness, dosage, and possible side effects. Users or their therapists thus receive targeted support in choosing natural healing methods. In addition, an integrated e-commerce store for alternative health products will be available.

"Consumers and healthcare providers face the challenge of understanding which alternative health products are right for a person's overall health. We believe our NaraCare.AI platform can become a trusted source for consumers and healthcare providers across North America," said Maryam Marissen, President and CEO of PanGenomic Health.

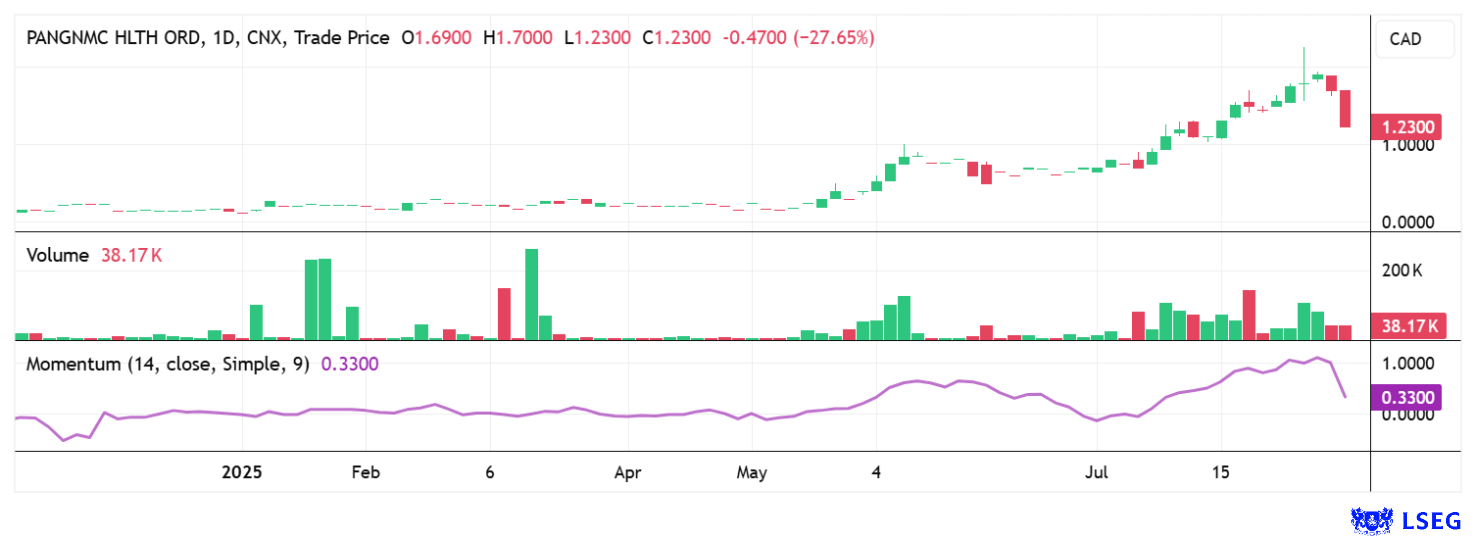

PanGenomic shares (ticker: NARA) are currently enjoying great popularity. In just two months, the share price jumped from CAD 0.18 to over CAD 2.00 – a tenfold increase. At these price levels, the first profit-taking occurred. The warrants issued in January can now be exercised at CAD 0.13 until August 25, 2025, according to the terms and conditions. This should make the stock significantly more liquid with several million new shares and provide interested investors with a promising entry point. Due to high volatility in some cases, we recommend placing limited orders.

BioNTech and Pfizer – Are the titans back on track?

Where do vaccine experts BioNTech and Pfizer stand in this positive environment? Between 2020 and 2022, they were able to generate high double-digit billion profits with their successful Comirnaty vaccine. Today, they face different challenges in the COVID-19 business. While BioNTech continues to benefit primarily from the COVID-19 vaccine, revenues are declining significantly. In Q1 2025, the Mainz-based company reported revenues of only around EUR 182 million and a net loss of over EUR 415 million due to high research expenses. For the full year, BioNTech expects revenue of EUR 1.7 to 2.2 billion, which is significantly below the previous year's level. At the same time, the Company is investing heavily in its oncology pipeline and new mRNA therapies to broaden its long-term positioning. Fortunately, it still has around EUR 16 billion in cash.

Pfizer, on the other hand, is proving more robust in terms of operations: In Q1 2025, the Company generated revenue of USD 13.7 billion, with a forecast of USD 64 billion for the full year. Pfizer is not only relying on vaccines, but also on the COVID-19 drug Paxlovid and several successful blockbusters. The Company has imposed a strict cost-cutting program and is investing heavily in new therapeutic approaches. Both companies have submitted updated versions of their COVID-19 vaccines to the EMA for the 2025/26 vaccination season, signaling that they continue to anticipate sufficient demand. While BioNTech has to manage the transition from a single-product company to a pharmaceutical group, Pfizer remains traditionally broad-based. In the long term, the focus on mRNA-based oncology could be a competitive advantage for BioNTech. Both stocks are cyclically interesting as blue chips with solid balance sheets. On the LSEG platform, the 12-month average price targets are USD 135.50 and USD 28.50. Pfizer also offers a 6% dividend. The quarterly reports on August 4 and 5 could be exciting!

The biotech sector is making a comeback. Valneva and PanGenomic Health are already well on their way to delivering attractive returns for investors. A balanced portfolio should also include blue chips such as BioNTech and Pfizer. This will help calm nerves in volatile times.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.