January 23rd, 2025 | 07:45 CET

Trump is back! NATO rearmament with Rheinmetall, Renk, Hensoldt and Nova Pacific Metals

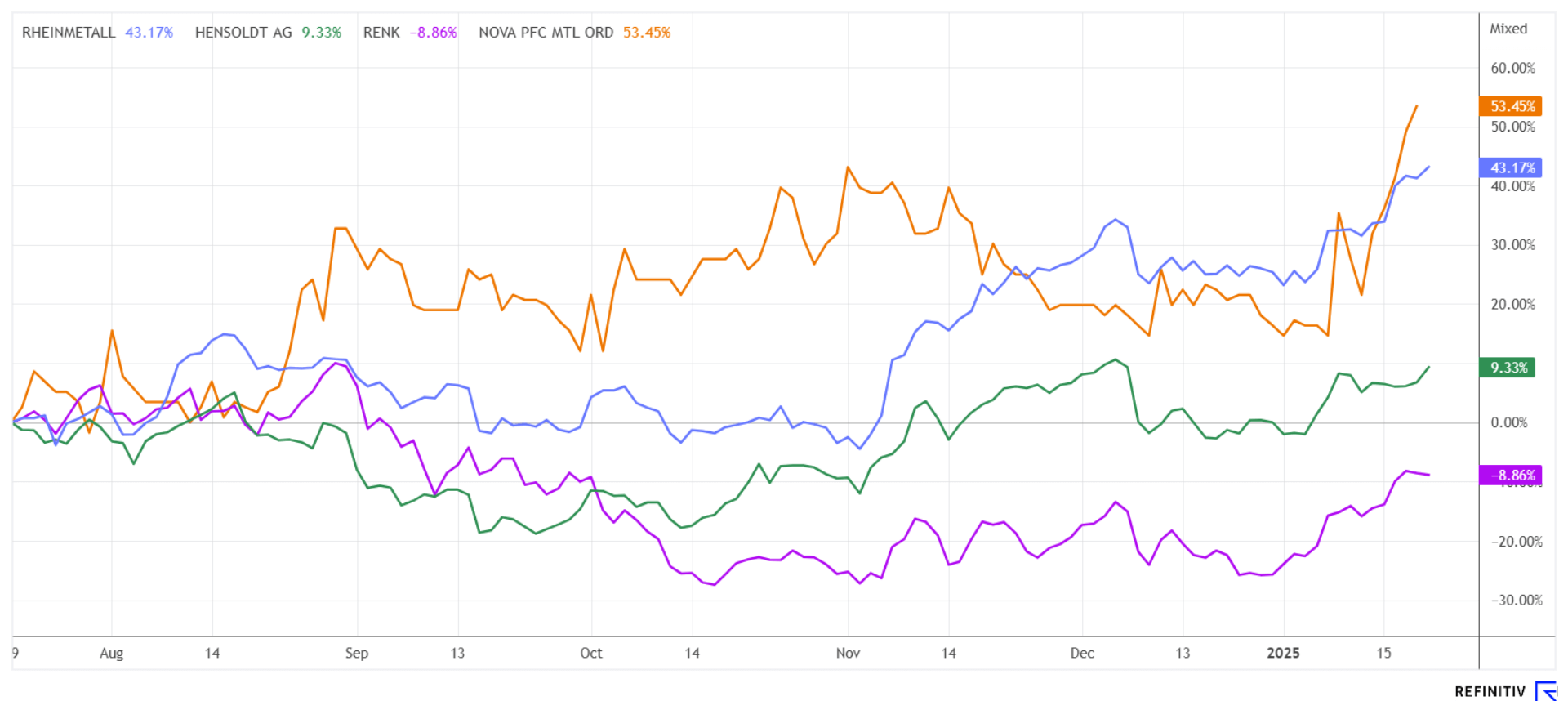

After a grand inauguration night, the 47th US President Donald Trump is diving straight into government business. The first decrees include an exit from the WHO and the Paris Climate Agreement. At the same time, he repeated his demand that NATO countries drastically increase their investment budgets if they expect to continue to be protected by the US. What this could mean for the planet is alarming. For the stock market, this means getting out of Greentech stocks and into high-tech and defense for the time being. Strategic metals are also coming back into focus because nothing will move forward without them. Where can investors still make a return now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , RENK AG O.N. | DE000RENK730 , HENSOLDT AG INH O.N. | DE000HAG0005 , NOVA PACIFIC METALS CORP | CA66979J1066

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall – NATO must invest billions

The Rheinmetall share has been a long-running success story for weeks. At the beginning of the week, it reached a new all-time high of around EUR 705. As a reminder, the title was still trading at around EUR 90 in January 2022. Then Russian troops invaded Ukraine, and the world changed dramatically for German defense stocks as well. The dramatic increase in military insecurity in Europe led to a boom in the arms sector. Now, under Trump, Washington is also demanding a clear signal from the North Atlantic community.

Rheinmetall is active in many areas of armaments and thus benefits from major orders, particularly from European countries. The cooperation with international players has helped to conquer global market shares for armored vehicles up to and including state-of-the-art weapon and protection systems. Today, Rheinmetall is synonymous with technological excellence in highly sensitive areas. Recently, the Düsseldorf-based company formulated ambitious targets for the coming years up to 2027: revenues are to increase to EUR 20 billion and deliver an operating margin of 18%.

The day before yesterday, the Federal Cartel Office approved a joint venture with the Italian company Leonardo under the name Leonardo Rheinmetall Military Vehicles (LRMV). This decision clears the way for the new Lynx and Panther models. The collaboration between two of Europe's leading defense technology providers should not only result in tanks for Italy but also for the export market. Rheinmetall is currently trading at a 2025 P/E ratio of 23, but taking into account current forecasts, it will fall to 13 by 2027. NATO is likely to become a major customer, so selling the stock would be premature.

Nova Pacific Minerals – Strategic metals as a scarcity factor

Strategic industrial metals such as copper, nickel, lithium, and rare earth elements are crucial to North America's national security. These raw materials are essential for high-tech applications, military equipment, and the energy transition. The increasing demand in the defense and energy industries makes their availability particularly critical. In the United States, the Department of Energy (DOE) has already placed copper, uranium, and lithium on the list of critical raw materials in 2023, as growing shortages could lead to a bottleneck. The United States and Canada have so far been heavily dependent on imports. They are trying to diversify their raw material supply and increase the number of domestic mining operations in order to reduce geopolitical risks.

Nova Pacific Metals is a Canadian exploration company focused on the Lara Volcanogenic Massive Sulfide Project (Lara VMS Project) on Vancouver Island. This brownfields development project has a significant historical resource rich in critical and precious metals and is located at a site with excellent infrastructure. Nova Pacific's forward-looking strategy includes confirmation and infill drilling, the completion of an updated mineral resource estimate (MRE) and, prospectively, the preparation of a pre-feasibility study.

As announced yesterday, the planned drilling program at the Lara VMS project is now set to be significantly expanded. This decision follows a comprehensive compilation and analysis of the project's historical database, which has uncovered further potential within the Coronation Zone. The expanded drill program now comprises 49 drill holes totalling 10,000 metres, whereas only 19 drill holes were originally planned. CEO Malcolm Bell explains: "The results of this historical database compilation have exceeded our expectations and strengthened our belief in the exceptional potential of the Lara Project." The present update provided a nearly complete data set for 226 historical drill holes, including important information such as drilling logs, drill hole examinations, samples, and certificates. The expanded database now provides a comprehensive overview of the property's potential, with assay values for zinc, silver, gold, barium, copper and lead, as well as specific gravity measurements. There are few multi-metal properties with as much gold discovered as yet.

With the positive outlook for base and precious metals, Nova Pacific is well-positioned to benefit from the growing demand for copper, zinc and other key minerals. Following the recent capital increase, Nova Pacific is fully funded for this expanded program with a budget of CAD 2.6 million and expects drilling to commence in Q2 2025. NVPC shares jumped by a good 10% to CAD 0.45 and remain in demand. With a timely exercise of outstanding warrants at CAD 0.40, cash could increase by almost CAD 10 million. The current market capitalization is a low CAD 20 million. The stock is also liquidly tradable on Tradegate in Frankfurt and Stuttgart. The time to position is now!

Renk and Hensoldt – The second row in defense

With the handbrake slightly on, defense stocks Renk and Hensoldt are trying to match Rheinmetall's strong performance. Rheinmetall's products seem to be in greater demand, with revenue growth of around 20% annually. Analysts expect only a 10% improvement in revenue at Hensoldt and Renk over the next few years. Moreover, their valuations relative to revenue are high. The price-to-sales ratio at Hensoldt is 1.9, and at Renk, it is as high as 2.4. At the fast-growing Rheinmetall, it is currently 2.1. With such close competition, investors are likely to opt for the top performer!

However, the relative disadvantages could soon be a thing of the past because Renk manufactures gearboxes, drives, suspension systems, slide bearings, and couplings used in armored vehicles or ships and in heat pumps. 75% of new orders now come from the defense business. Renk's shares rose to EUR 38 shortly after the IPO in 2024. Then, the investment company Triton continued to cash in, and the price fell back to EUR 18. A decent recovery is likely here soon.

Hauck Aufhäuser Investment Banking upgraded the stock to "Buy" in January, setting a price target of EUR 52. The paper is one of the firm's top picks for 2025. The current order backlog of the defense electronics specialist ensures a good predictability of revenue growth, wrote analyst Simon Keller. Thanks to technologically outstanding products, the order intake should soon grow even faster than revenues, the expert said. With prices around EUR 37, there is an upside potential of around 40%.

It continues at full speed! Donald Trump's obscure decisions are creating a strong differentiation among economic sectors. While armaments and high-tech continue their advance, Greentech is under massive pressure. In Europe, defense stocks remain in demand. The demand for strategic metals remains for all high-tech applications, and Nova Pacific Metals is excellently positioned here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.