October 7th, 2025 | 07:00 CEST

Total boom! Not 10% returns per year, but per day! The portfolio rockets: Almonty, Plug Power, Nel ASA and AMD

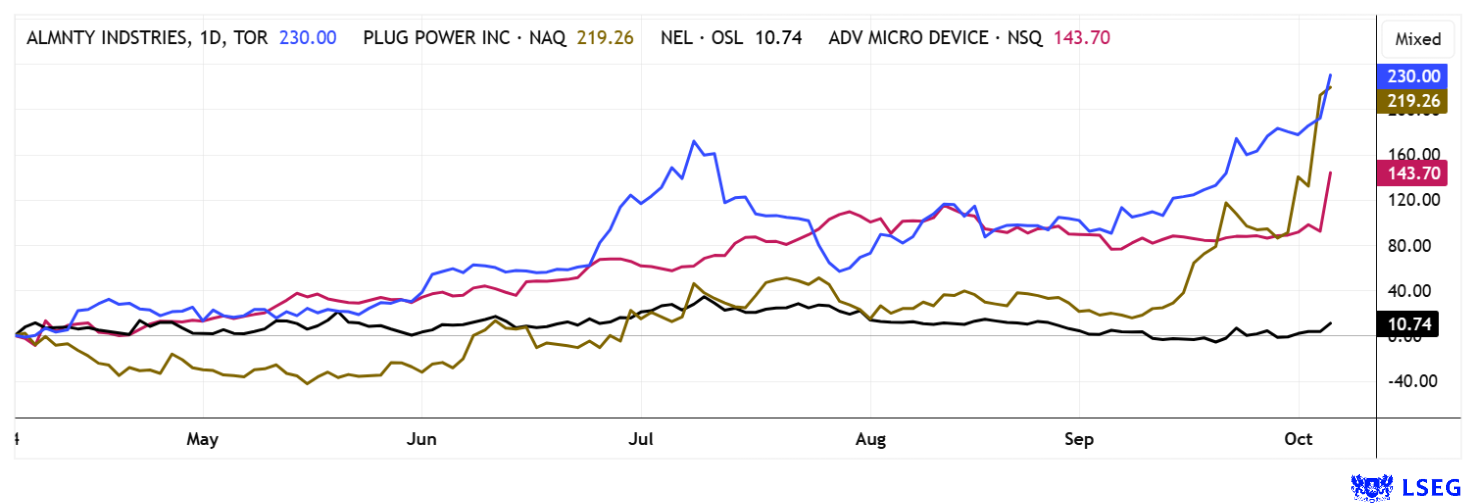

The financial markets are in a bullish mood. But not all stocks are performing like Almonty Industries, where the surge is driven purely by fundamental revaluation. After the gold rush in 2020/2021, hydrogen stocks underwent a prolonged 95% correction. For US industry leader Plug Power, this meant a sell-off from over USD 12 to a low of USD 0.75. In May, the correction came to an end, and the stock skyrocketed to over USD 4.75 yesterday – a fivefold increase in just four months. Nel ASA has followed a similar path, with a 15% turnaround from the bottom yesterday. These extreme movements are evidence of very high market liquidity. AMD surprised with a deal with OpenAI - fueling a 25% jump. The helium balloon keeps rising. Here is an overview of the action.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , PLUG POWER INC. DL-_01 | US72919P2020 , NEL ASA NK-_20 | NO0010081235 , ADVANCED MIC.DEV. DL-_01 | US0079031078

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Almonty Industries – Something is brewing here

At the start of the week, Almonty Industries is once again on a steep upward trajectory. At USD 7.18, the stock reached a new all-time high in New York, to the amazement of many traders. The movement is no coincidence: critical raw materials such as tungsten have evolved from simple industrial materials to strategic factors that determine prices, supply chains, and geopolitical power relations. Secure access is essential for defense, high-tech, and the energy transition. Global supply remains tight: while demand from the defense and cleantech sectors is growing, reserves in Europe and the US are shrinking. China dominates around 90% of processing and has driven prices up by over 50% since 2023.

At tomorrow's virtual 16th International Investment Forum at 4 pm CET, CEO Lewis Black will provide an update on the strategic development at Almonty Industries. Register here.

Against this backdrop, Almonty Industries' Sangdong project in South Korea is gaining strategic importance. The revival of the historic tungsten mine is expected to strengthen Western supply chains and reduce dependence on China. At the same time, Almonty is advancing a drilling program at the nearby molybdenum project to secure additional resources. The reactivated mine has high-grade deposits with an expected life of over 100 years. Production is initially expected to reach around 640,000 tons of ore per year and later increase to 1.2 million tons. With an ore grade of 0.45%, it is well above the global average. State-of-the-art safety systems, AI-supported monitoring, and efficient processing facilities increase safety and recovery rates to up to 85%. Environmental measures, including water treatment and sustainable backfilling, are fully integrated.

Sangdong is thus becoming a central pillar of South Korea's raw material supply and an important supplier for partner countries such as the US and Europe. Training programs ensure a supply of skilled workers, and a long-term pricing strategy protects the business from market fluctuations. Almonty is thus positioning itself as an indispensable partner for Western industrial and defense strategies. After a brief consolidation, the stock is exploding again, and yesterday's high of over USD 7 or CAD 10 is likely just another stop along the way. Stock up!

Listen to the latest assessment from CEO Lewis Black, who has been steadily steering the Company forward for several years.

https://youtu.be/3F6bC9RQabQ?si=tB1P_HLSi2WRfZkt

Plug Power – From sell-off to top of the class

Plug Power shares are back! Thanks to positive analyst opinions and important project milestones. H.C. Wainwright recently raised its price target from USD 3 to USD 7, citing rising electricity prices, which are now also making green hydrogen more attractive. In addition, the successful delivery of a 10-megawatt electrolyser to the Portuguese group Galp strengthens confidence in the Company's technical implementation capabilities. Analyst Amit Dayal now expects long-term revenue of USD 11 billion by 2035, which is still 10 years away. This is very ambitious, as according to the LSEG analysis platform, the USD 1 billion revenue hurdle will not be reached until 2027. Analysts calculate that the break-even point will be reached in 2029. Therefore, caution is advised: the price-to-sales ratio has quadrupled in no time, and high short interest is also providing additional momentum in the wake of positive news. Experts such as Jefferies and Morgan Stanley are urging caution, pointing to high capital requirements, possible project delays, and still uncertain market dynamics. Plug Power is still not profitable and relies on external financing. The technical trading corridor of USD 2.50 to USD 5.00 is therefore likely to be penetrated for some time to come!

Nel Asa – Is this just a follow-up stock?

Without any operational news, but with decent tailwind from Plug Power, Nel ASA peaked yesterday at EUR 0.223, up from EUR 0.195. This represents a 14% gain for the Norwegian hydrogen pioneer. In recent quarters, the Company has tended to row back. It will therefore be interesting to see whether yesterday's technical movement will be sold off again. Fundamentally, Nel ASA is now exactly at its 12-month average price target of NOK 2.42. Analysts will have to recalculate on October 29 when the third quarter figures are published. Perhaps the Norwegians will surprise us positively. Exciting!**

AMD – Celebration mood due to OpenAI deal

Advanced Micro Devices (AMD) also rose explosively yesterday, up 25%. The Company announced a long-term partnership with OpenAI. The collaboration will focus on expanding AI infrastructure, with OpenAI using several generations of AMD GPUs, starting with the MI450 in 2026. The agreement could generate billions in additional revenue for AMD. In addition, OpenAI is coming on board as an investor and will receive an option on up to 160 million shares, representing about 10% of the Company. The investment is contingent on milestones such as the development of up to six gigawatts of computing power and certain price targets. Analysts have mixed views on the deal: Wedbush is positive about the expected AI revenues in 2026, while Vital Knowledge warns of unclear profitability and high cash burn figures at OpenAI. The contract underscores AMD's ambition not to cede the field to Nvidia in AI GPUs without a fight. Whether the rally will continue sustainably will likely be determined by the Q3 reporting date on November 4. Here, a new management outlook for 2026 and subsequent years is anticipated. The all-time high of USD 226 is currently within reach. The AI wheel continues to turn upward!

The stock market takes, the stock market gives. After five tough years for commodities, strategic metals are finally showing their strength. High-tech stocks are also continuing to perform well. For bold investors, momentum is key, while cautious investors steadily adjust their stop-loss levels. As the saying goes: "The trend is your friend!" and "The last one turns off the lights!"

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.