January 24th, 2025 | 08:15 CET

Top performers wanted! Nel ASA, First Nordic Metals, thyssenkrupp and Agnico-Eagle

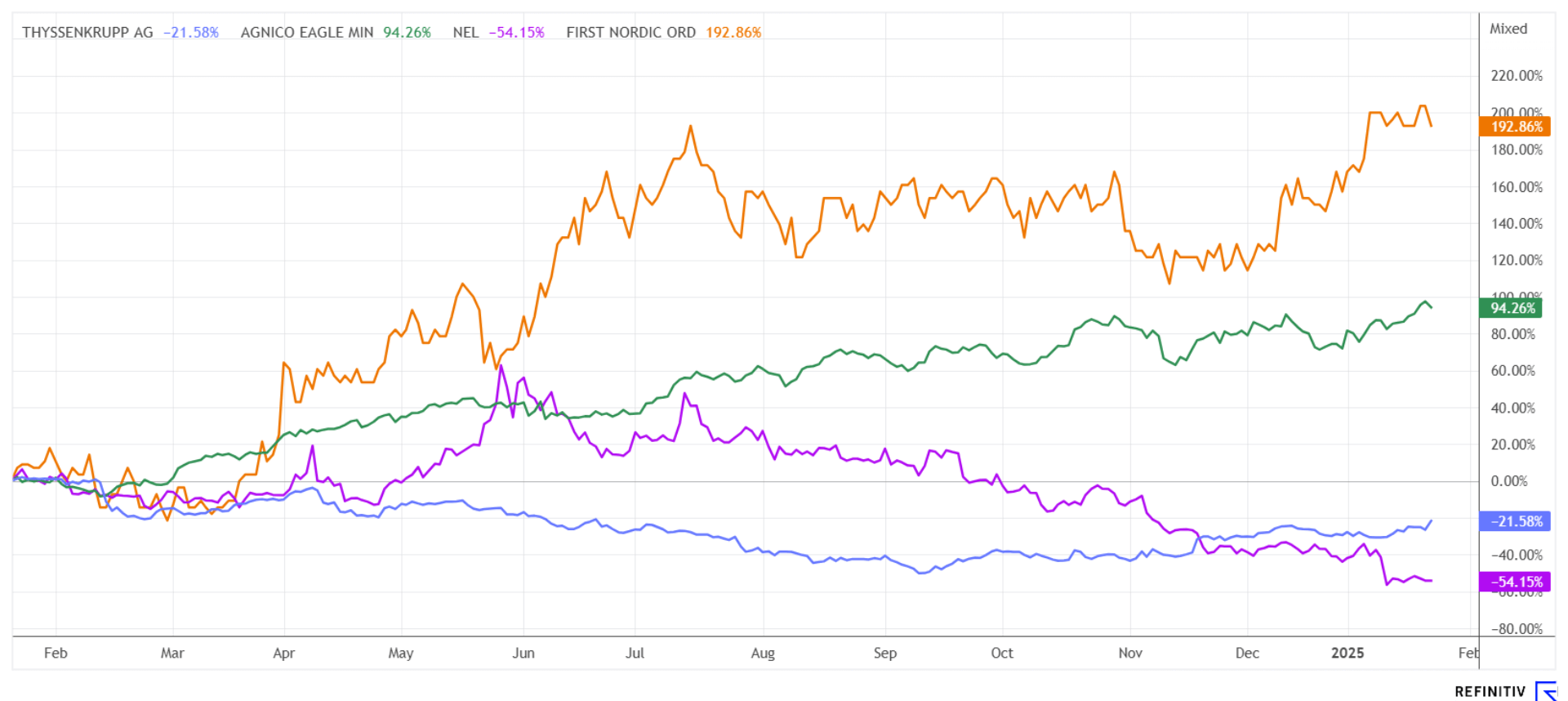

With rising inflation since 2021, the price of gold has also risen significantly. Over the last 20 years, resourceful investors have always been able to compensate for the loss of purchasing power with an average return of a good 8.5% per year. The crux of the matter is that one could not trade the ups and downs in precious metals because only long-term holders can look back on gold prices around USD 500 in 2005. Today, 20 years later, new highs of USD 2,788 have already been reached. Agnico-Eagle is one of the most successful mines in the world, with its shares almost doubling in the last 12 months. Things have been going equally well for Agnico's partner, the explorer First Nordic Metals. A closer analysis reveals even more ideas for boosting your portfolio.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , FIRST NORDIC METALS CORP | CA33583M1077 , THYSSENKRUPP AG O.N. | DE0007500001 , AGNICO EAGLE MINES LTD. | CA0084741085

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Agnico-Eagle – A top performer in gold

Geopolitical tensions, war, inflation, unresponsive politicians, escalating national debt, and a general loss of confidence, have triggered a run on precious metals in 2024. A troy ounce of gold thus reached a high of USD 2,790, while silver even scraped the USD 35 mark twice. Prices that have not been seen in years. In times of economic uncertainty or rising inflation, investors are looking for ways to protect and diversify their assets. Precious metals such as gold, silver, platinum, and palladium have been considered safe havens for centuries and retain their value even in times of crisis.

The internationally active mining group made history in 2024. With a share price increase of a good 70%, the highly profitable miner outshone all its competitors. Agnico Eagle is a leading gold company that impresses with a combination of strategic growth, risk minimization, and efficiency. Most of its mines are located in stable regions such as Canada, Finland, and Australia, minimizing the political and regulatory risks that can often arise in other countries. The acquisition of Kirkland Lake Gold and the complete acquisition of the Malartic complex have significantly increased production capacity and the resource base. Compared to other major gold producers, Agnico Eagle has lower all-in sustaining costs (AISC). In addition to increasing production, the Company is investing in exploration projects that will secure future resources and promote long-term growth.

With a dividend yield of over 3%, Agnico Eagle offers a rare balance of growth and stable distributions, making it highly attractive to investors over the long term. However, quality comes at a price: With a stock price of USD 88 and a market capitalization of USD 44.5 billion, investors are currently paying around 3.7 times revenue and a P/E ratio of 18 for 2025. The key advantage over the overheated high-tech stocks is that with current metal prices, there are more upside surprises than profit warnings.

First Nordic Metals – Sweden and Finland in focus

Not far from Agnico's properties in Sweden, we come across the Canadian explorer First Nordic Metals (FNM), which emerged from Barsele Minerals. The main projects are located in the mining region of Västerbottens Län in northern Sweden, 600 km north of Stockholm, and cover a total area of 104,000 hectares with a total length of about 100 km. The flagship Barsele project is located at the western end of the Proterozoic Skellefte trend, a prolific belt of volcanogenic massive sulfide deposits that overlaps with the "Gold Line" in northern Sweden. Both polymetallic deposits and intrusive-hosted gold intersections are present in this region. This project has been organized in a joint venture structure, with Agnico-Eagle holding 55% and FNM 45% for some time. It covers an area of almost 25,000 hectares, 165,000 meters have been drilled so far, and Agnico provided USD 55 million in financing. Agnico can earn an additional 15% interest in this prospective project upon completion of a pre-feasibility study. To date, the Avan, Central and Skiräsen zones have been explored, with gold mineralization found at outstanding grades of 3.5 to 133 grams per tonne of rock. A 2019 resource estimate already showed 324,000 indicated and over 2 million inferred ounces of gold. This is to be significantly expanded.

The new management under President Adam Cegielski and CEO Taj Singh suspects much larger mineralizations in the unexplored zones. In this context, the Gold Line Belt is often compared to the similar structures of the 200 million ounce Abitibi area in Canada. The advantage in Scandinavia: in Sweden, electricity prices are only around 3 cents per kWh, enabling sustainable production costs (AISC) of around USD 1,550 per ounce of gold. The Company's 263 million shares are 58% owned by institutional investors and insiders, providing significant stability. In addition, Agnico holds an 11% stake, which could increase in the future. What has not yet been included in the valuation at a market value of almost CAD 110 million are the projects in Paubäcken, Storjuktan, and Klippen. On top of that comes the huge Oijärvi project in Finland, which has only been explored to a depth of 215 meters. There is also a resource estimate of 1.1 million indicated and 1.6 million inferred gold equivalent ounces here. It is no wonder that First Nordic's stock has already seen a decent appreciation in 2024. Adam Cegielski is confident that the re-rating has only just begun. The Company currently has CAD 12 million in its coffers and, in addition to the listing in Canada and Germany, also reported in December that it would be listed on Nasdaq North in Sweden in Q1-2025. Things are moving forward in leaps and bounds here – extremely interesting!

Nel ASA and thyssenkrupp – This is where things could get interesting in 2025

Regardless of the operational problems at Nel ASA and thyssenkrupp, it could be interesting for both stocks from a chart perspective in the first quarter of 2025. Nel ASA had to announce operational cutbacks and job cuts last week, as the Norwegian electrolyser pioneer was unable to attract enough public-sector orders. The share price reached a five-year low of NOK 2.10, or the equivalent of EUR 0.18, and is currently trying to stabilize. Market capitalization has plummeted to EUR 315 million, which is only one-twentieth of the 2021 valuation. The 2024 annual figures are expected on February 26. After that, the share price should be watched closely; perhaps there will be no new lows, and the story will turn.

At thyssenkrupp, the restructuring of the steel division is in full swing. However, there is plenty of potential for the Company. A look at the shipbuilding sector at thyssenkrupp Marine Systems (TKMS) suggests that major orders from the NATO area can be expected following corporate investments of around EUR 220 million. The state-of-the-art 212CD submarines are to be built at the Wismar site. Both the German armed forces and NATO partner Norway will receive the coveted models. The TKMS division is now in the spotlight, as a solution for the profit center has been sought for years. With the NATO orders, takeover rumors could soon be looming again. Negotiations with financial investor Carlyle failed last year, but there are said to be other interested parties for TKMS, such as Deutz, Rheinmetall, and competitor Lürssen-Werft. We have had the stock on our radar since EUR 3.20, and yesterday, it managed to break through the important resistance level of EUR 4.30. The consensus estimate of analysts on the Refinitiv Eikon platform is a high EUR 7.20. Continue to add to your position!

High inflation is making the precious metals sector shine again. In Scandinavia, new gold projects are emerging at a rapid pace, with Agnico and First Nordic Metals among the players. Those speculating on turnaround stocks should keep an eye on Nel ASA and thyssenkrupp.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.