September 1st, 2025 | 08:50 CEST

This is where the action is! Plug Power has turned around, Pure Hydrogen, nucera, and Nel ASA with top news!

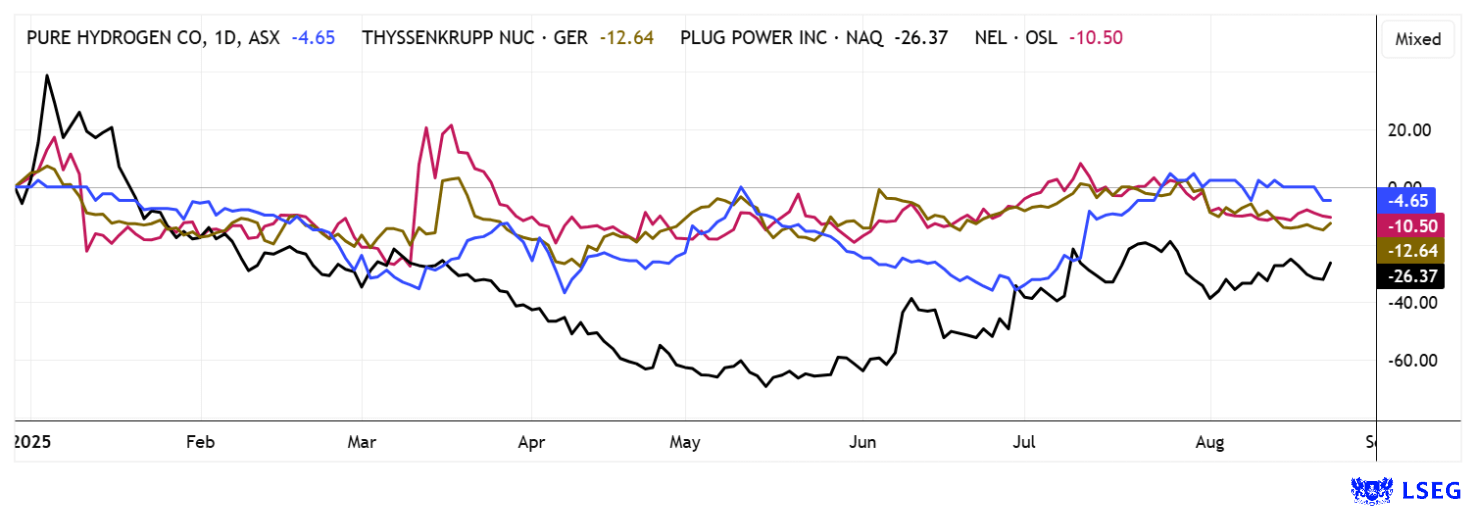

The capital markets are speculating on a US interest rate cut in September. With high inflation and government debt, this is not causing much fiscal enthusiasm, but at least more liquidity is flowing into the markets after the current summer slump. For those paying attention right now, there are opportunities to pick up stocks at bargain prices, but caution is warranted: trading volumes are thinner than usual. Turnaround speculators and medium-term investors should take another look at the hydrogen sector. Many things are changing for the better here, and there are some interesting new additions. We are examining Plug Power, Nel ASA, thyssenkrupp nucera, and Australian hydrogen specialist Pure Hydrogen. The Company is currently expanding successfully into the US, with other continents likely to follow. Where are the opportunities for investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001 , NEL ASA NK-_20 | NO0010081235 , PURE HYDROGEN CORPORATION LIMITED | AU0000138190 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

thyssenkrupp nucera – Not a good quarter

A look at thyssenkrupp nucera reveals a market environment that remains challenging. Although the Company is technically and strategically impressive with its large-scale electrolysis plants and cooperation with investors such as thyssenkrupp and De Nora, it faces considerable headwinds in the hydrogen segment (gH2). Order intake in the third quarter fell by 77% year-on-year to just EUR 63 million. There was a particularly drastic decline of 94% to EUR 13 million in the promising gH2 segment. Group-wide revenue declined by 22% to EUR 184 million, with the hydrogen segment at EUR 103 million (-23%) and the chlor-alkali (CA) segment at EUR 81 million (-21%). Nevertheless, the Company continues to grow on a nine-month basis: Revenues rose by 9% to EUR 663 million, with the gH2 segment generating EUR 377 million and the CA segment EUR 286 million. EBIT was exactly at the break-even point in the quarter, and over the nine-month period, EBIT remained positive at EUR 4 million. Free cash flow climbed to a positive EUR 15 million on a nine-month basis, meaning that a cash surplus was generated after all!

The balance sheet remains robust, with net cash of around EUR 660 million; however, analysts are urging caution, particularly regarding the development of the order backlog. Despite stable forecasts for the year as a whole (sales range of EUR 850–920 million, EBIT between EUR -7 and +7 million), the situation remains precarious as large new orders are still not forthcoming. Analysts believe that meeting the consensus expectations for 2026 and 2027 will be challenging. Berenberg recently lowered its price target to EUR 10 and is maintaining its "Hold" recommendation. The Company's presentation at the Hamburg Investor Days was received with mixed reactions. At EUR 9.20, the share price remains below the important EUR 10 mark for the time being.

Pure Hydrogen – Entering a new energy world

In a world that demands stable and clean energy sources, Pure Hydrogen is pursuing a path of consistent innovation. The Australian company specializes in the production of emission-free hydrogen and is developing three promising technologies: green hydrogen from renewable sources, turquoise hydrogen from methane pyrolysis with permanent carbon sequestration, and the new category of "emerald hydrogen," which is currently being tested in pilot projects. Studies already show that hydrogen solutions can often be implemented more quickly and cost-effectively than a purely electric transformation. Pure Hydrogen not only thinks in terms of visions, but also puts them into practice. In addition to developing hydrogen-powered commercial vehicles, generators, and mobile refueling solutions, the Company is collaborating with partners such as Botswana H2 and Botala Energy in Africa.

In Australia, gas exploration in the Cooper Basin is creating a strategic foundation that will provide at least 25 years of production security, an ideal bridge on the road to the hydrogen economy. Pure Hydrogen is now also setting its sights on the important US market. An initial agreement has been signed with Riverview International, one of California's leading commercial vehicle dealers. A hydrogen-powered garbage truck will be delivered and used locally as a demonstration vehicle for potential customers. With a vehicle price of around AUD 600,000 and a presentation at North America's largest trade fair for clean commercial vehicles (ACT Expo 2025), Pure is laying the foundation for potential fleet orders, opening the door to a billion-dollar market.

To accelerate its expansion, Pure Hydrogen secured fresh capital last week: AUD 1 million was raised at AUD 0.085 per share, approximately 17% below the recent trading price. In addition, there are attractive option rights at a ratio of 1:2 with an exercise price of AUD 0.15. Notably, there was strong insider participation, with company directors investing around AUD 75,000 of their own funds. A total of 11.76 million new shares and 5.88 million warrants with a three-year term will be issued. These funds will not only be used to deliver new vehicles, but also to accelerate expansion efforts in both Australia and the US. Pure Hydrogen's share price has already doubled since March and is currently consolidating somewhat, offering new investors an attractive opportunity to get in below AUD 0.10. Time to buy!

Plug Power and Nel ASA – Things are about to get exciting

It is always worth taking a look at the old hydrogen protagonists. Plug Power and Nel ASA have been two leading hydrogen companies since 2020, which, after a 90% drop in their share prices by the end of 2024, are now presenting very different developments. Plug Power increased its revenue by 21% to USD 174 million in Q2 2025, exceeding analysts' expectations. The electrolyzer business tripled year-on-year to USD 45 million, and more than 230 MW of GenEco projects are now being implemented worldwide. Despite continuing high losses, Plug aims to move into profit for the first time in the fourth quarter. Order intake remains solid, supporting long-term growth targets, despite analysts' continued expectation of a loss for 2025. The stock has recently fluctuated sharply between USD 1.40 and USD 1.70, with analysts on the LSEG platform forecasting a price potential of up to USD 2.35 for the full year - a good 45% premium to Friday's closing price. But caution: Investors need strong nerves—prices here can swing up and down by the minute!

In contrast, Nel ASA suffered a massive slump in order intake (-74%) and revenue (-48%) in Q2. Revenues from customer contracts fell to NOK 174 million, while EBITDA and net income slipped further into the red. This was due to delayed final decisions by some customers on major projects and production problems in the Alkaline segment. In contrast, the PEM segment achieved record sales, generating approximately NOK 290 million in order intake—a small ray of hope in a challenging market environment. The order backlog remains solid at NOK 1.46 billion, the balance sheet is robust, and the Company is planning further cost reductions. Restructuring, staff cuts, and site closures are on the agenda. LSEG analysts expect an average price of NOK 2.48, only slightly above the current level of NOK 2.30. Over a 12-month period, this implies a further price decline of 57%. Uh oh – we can only hope for the best!

The hydrogen sector is showing its first signs of life. While Plug Power is still selling shares from its capital increase on the market, thyssenkrupp nucera and Nel ASA are suffering from very sparse public procurement. There had been high hopes for the EU Green Deal in particular. Nevertheless, alternative energy producers such as Pure Hydrogen are back in demand. Speculators and long-term investors should put H2 stocks back on their watch list, because in addition to short-term gains, there are also interesting long-term technical formations on the horizon.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.