January 14th, 2025 | 08:00 CET

THE VOLATILITY TRAP: Sell-off in Bitcoin, gold on the rise! Desert Gold, MicroStrategy, Lufthansa, and Nel ASA

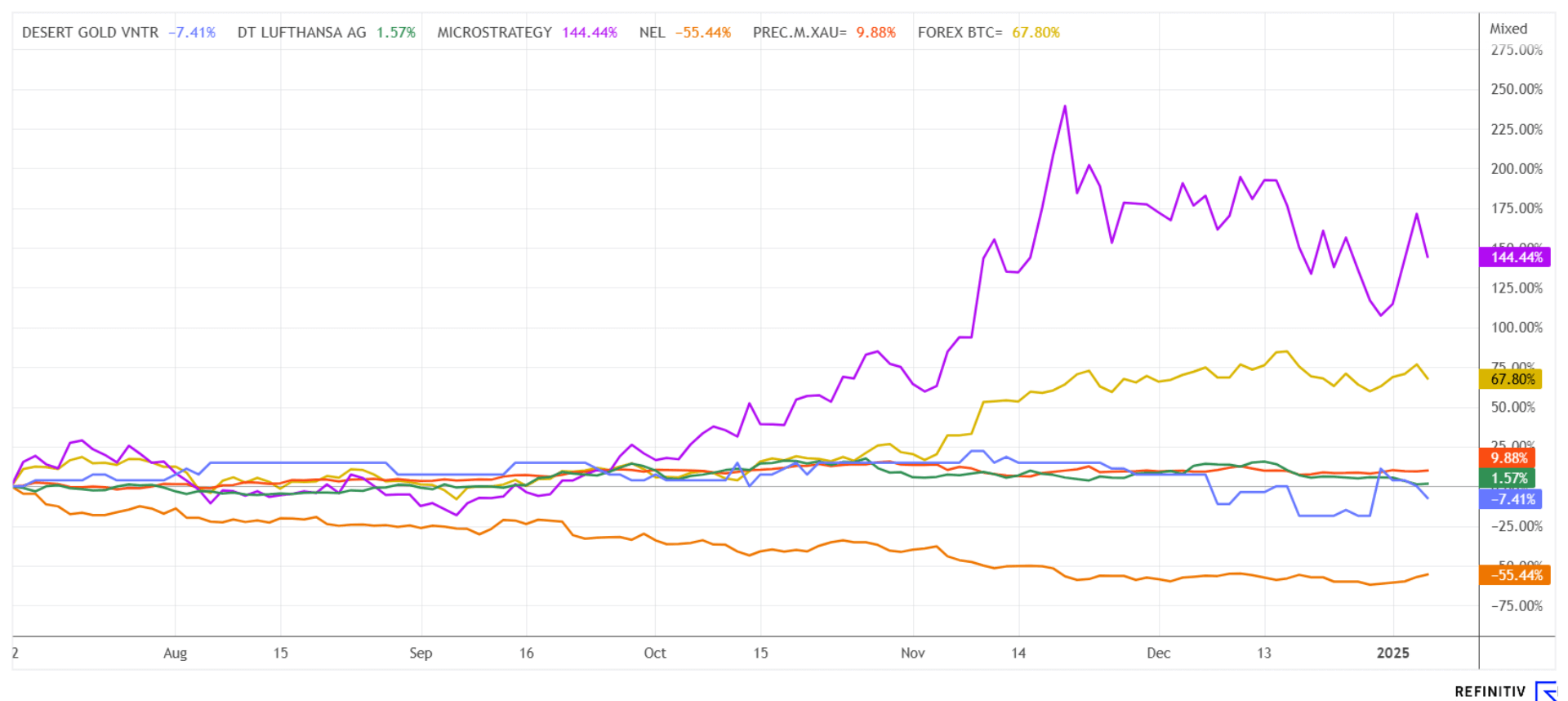

After a record year for equities in 2024, the new year is entering a challenging phase. Hopes of interest rate cuts look bleak, with inflation remaining too high. The mega rally in Bitcoin also needs to be deflated soon. This hits BTC collector MicroStrategy quite hard. Nel ASA, which had started the year on a hopeful note, now has to announce a production stoppage! Lufthansa, meanwhile, is working on acquiring the state-owned Italian airline ITA. Volatility is rising dangerously, signaling that a correction is due. These developments are positive for the safe haven of gold. The key now is consistent action!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DESERT GOLD VENTURES | CA25039N4084 , MICROSTRATEG.A NEW DL-001 | US5949724083 , LUFTHANSA AG VNA O.N. | DE0008232125 , NEL ASA NK-_20 | NO0010081235

Table of contents:

"[...] The processes in Namibia are predictable and the country itself is very safe. [...]" Heye Daun, President and CEO, Osino Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

MicroStrategy – Fundamentally completely overpriced

With a temporary 800% gain, MicroStrategy Inc. (MSTR) was certainly one of the most hyped stocks on the price board in 2024. The reason: the Company is taking out loans and issuing shares to buy more and more bitcoins on the market. What began as a self-fulfilling prophecy could turn into a balance sheet disaster if the BTC correction continues. As of last week, the premium in the MSTR share was almost 80% of the current net present value of the accumulated coins. After a high of over USD 108,000 in December, there is now a surprising correction in the new year to below USD 90,000. This means that the first support lines at USD 96,400 and USD 91,700 have been broken, and the chart is in real trouble for the time being. Yesterday, the MSTR price was already struggling with the USD 305 mark. CEO Michael Saylor had previously announced on the X platform that the Company had expanded its BTC holdings to 450,000 units. The crux of the matter is that MicroStrategy is valued at over USD 71 billion and is heavily in debt, but bitcoins are currently only worth USD 40 billion. Should the cryptocurrency continue to correct, MSTR shares are ripe for a decent correction! Long investors should keep an eye on the borrowing rates on the balance sheet. A casino at its finest!

Desert Gold – Takeover rumors are spreading

2025 could be a precious metal year because inflation has manifested itself, and the special expenses for armaments and other things are driving public debt to ever-new heights. In the second week of trading, the euro reached a new two-year low of 1.018 against the US dollar. At the same time, gold marked a multi-week high at USD 2,693, while silver was back towards USD 31. The US dollar thus remains in demand because, in contrast to the EU, the FED has made it clear that there are currently no prospects of interest rate cuts.

The focus is now returning to the explorers, also known as juniors. They do not have to make any major efforts at the moment because whoever sits on the right property automatically finds themselves in the crosshairs of larger producers. For several hundred years, Africa has been a continent of precious metals and raw materials. There is huge potential there in important metals and minerals. Traditionally, the connection to Western investors has been a guarantee for investments on the continent.

The Canadian explorer Desert Gold Ventures has had its sights set on the Senegal Mali Shear Zone (SMSZ) for several years. Here, 1.1 million ounces of gold have already been identified near surface. CEO Jared Scharf and his team of geologists are confident that they will soon be able to bring potential strategic partners on board. A pre-feasibility study is already in progress and the low-cost heap leach plant is expected to start up in 2025. This process allows near-surface gold mineralization to be mined at a cost of less than USD 700 per ounce. The Barani East and Gourbassi West gold deposits remain the focus of management's attention.

Currently, the surrounding environment in Mali seems particularly interesting. After all, the neighbours are none other than well-known names such as Barrick Gold, B2 Gold and Allied Gold. Allied Gold, for example, had recently spoken of wanting to consolidate some properties in Africa. If not now, then when? Desert Gold, with its SMSZ project, is therefore in pole position for a quick takeover deal. With a market capitalization of around CAD 16 million, Desert Gold is one of the most inexpensive explorers in relation to the available resources. The DAU stock price, starting at CAD 0.06, has clear upside potential for significant growth!

Nel ASA and Lufthansa – Two charts in sell-off

A striking sell-off is marking the values of Nel ASA and Lufthansa. While the Norwegian hydrogen pioneer has been struggling with a lack of major orders for some time, it is now facing the added pressure of having to cut costs. In yesterday's announcement, Nel is cutting costs at its leading production site in Norway. According to the management statement, the market for renewable hydrogen generation technologies has developed more slowly than the industry in general and Nel had expected. The production of alkaline electrolysers will therefore be temporarily suspended. One-fifth of the full-time positions are to be cut by the end of September 2024. Nel boss Håkon Volldal regrets the far-reaching changes in the Company. The share price of the crowd favourite falls to a new all-time low of NOK 2.11 or EUR 0.184. Wait and see - the Norwegian's cash situation could force a capital increase!

Lufthansa took the first step towards taking over the Italian state airline ITA yesterday. However, the timetable is questionable. According to the published figures, the crane line will initially take over a minority of 41% of the capital for a capital contribution of EUR 325 million. The complete integration of the Alitalia successor with around 100 aircraft and 5,000 employees has been contractually agreed with the government in Rome since May 2023. Lufthansa can then take over 90% of Italia Trasporto Aereo (ITA) in two further steps and later the rest if the business figures are right. ITA is expected to deliver the second-highest earnings contribution of all foreign subsidiaries after Swiss in the future. The share price remains on a downward trajectory at EUR 5.58 for the time being, only just above the 52-week low of EUR 5.38. It is worth waiting for a bottoming out; there is no need to rush at this point.

Now it is here, the long-awaited correction of the overheated stock markets. While high-tech stocks are losing some of their overvaluation, long-neglected stocks are coming into focus. The crowd favourite Nel ASA has come under severe pressure, and Lufthansa is also benefiting little from the ITA takeover. The gold explorer Desert Gold appears promising, as the yellow metal is set to reach new highs.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.