November 5th, 2024 | 07:30 CET

The tension is rising! Quarterly figures from BioNTech and Evotec – Doubling potential for BioNxt, Grenke and SMCI

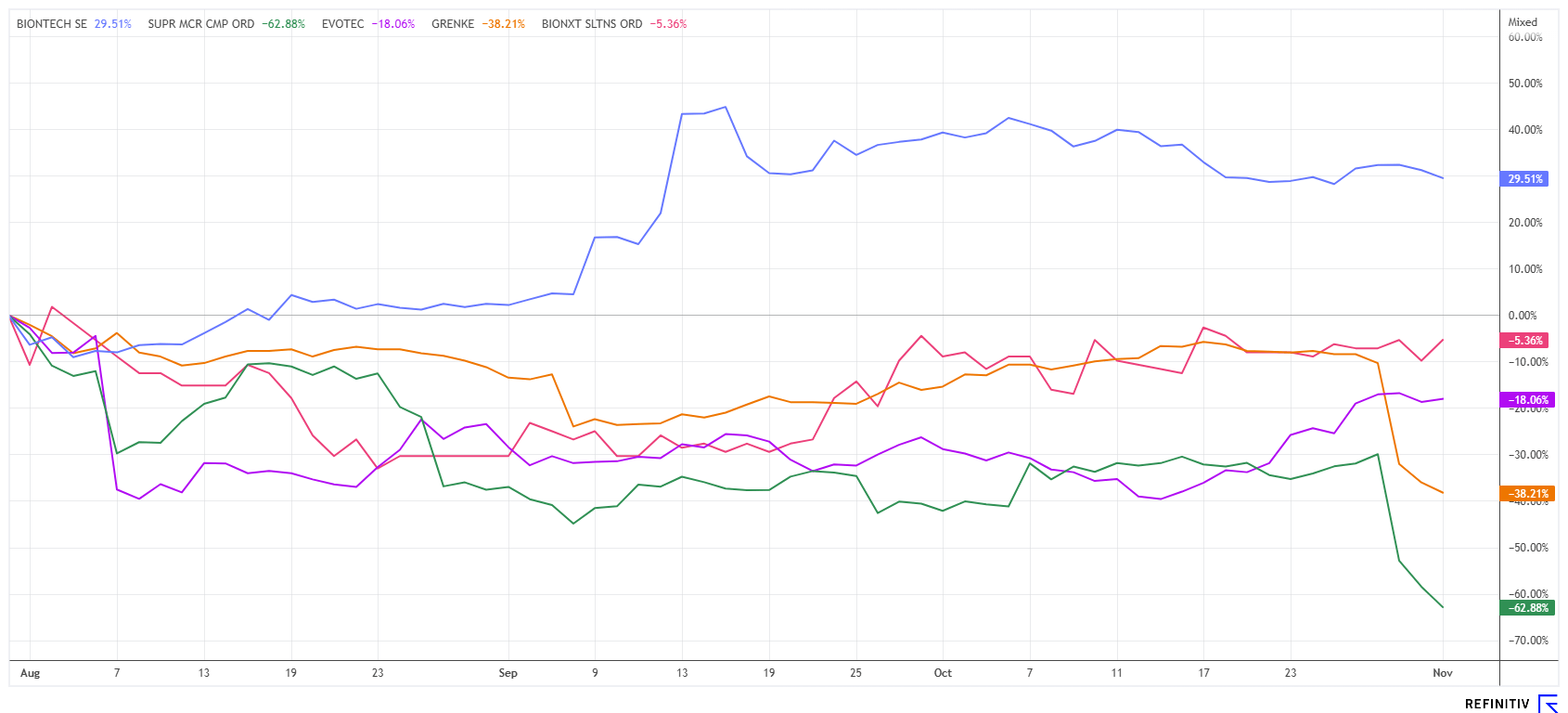

The reporting season has just started, and the first profit warnings are already here. Grenke warns of increasing provisions, Super Micro Computer is keen to submit figures, but the auditor has resigned. There is good news, however, from Evotec, BioNTech, and BioNxt, with their bottoming phases seemingly behind them. In an environment of falling interest rates, biotech stocks could now appear in a new light. Currently, everyone is looking west because the world's largest economic power is electing a new president. Once the uncertainty clears, markets may continue their positive trend. We have some interesting investment ideas in store.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

Bionxt Solutions Inc. | CA0909741062 , GRENKE AG NA O.N. | DE000A161N30 , SUPER MICRO COMPUT.DL-_01 | US86800U1043 , EVOTEC SE INH O.N. | DE0005664809 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec and BioNTech – The quarterly figures are imminent

Investors eagerly await Evotec's Q3 earnings report, set to be released on Wednesday. The Hamburg-based biotech company's stock is already gaining momentum. Yesterday, shares started the morning at EUR 7.15, but by noon the technical resistance at EUR 7.75 was already history and even the EUR 8.00 mark was briefly overcome. This reporting event is highly anticipated, as investors are particularly interested in statements from the new CEO, Christian Wojczewski, regarding the Company's future direction, especially in light of recent strategic shifts following the departure of former CEO Dr. Lanthaler.

At BioNTech, the figures were delivered yesterday after the close of trading. However, due to our editorial deadline, we do not yet have the official press release. Here, too, investors are likely to pay close attention to insights from the leadership team, as progress on cancer medications, information on the delivery of the new COVID-19 vaccines, and, last but not least, more detailed explanations on the new AI activities in London are expected. With EUR 17.5 billion remaining in the treasury, the Mainz-based company still has significant capital for research and development. Analysts are expecting a quarterly loss of around EUR 1.53. Exciting!

BioNxt Solutions – Autoimmune diseases on the agenda

After bottoming out between EUR 0.11 and EUR 0.15, trading volumes at the Canadian biotech company BioNxt have recently increased noticeably again. BioNxt focuses on next-generation drug formulations and delivery systems. In addition, the Company develops diagnostic screening tests and the production and evaluation of new pharmaceutical active ingredients. In recent months, research has focused primarily on transdermal and orally dissolvable preparations. The European Patent Office gave the green light for the intellectual property rights applied for by BioNxt in September 2024. Now, a series of patents are being filed in over 40 destinations to provide IP protection for international marketing. The current patent series covers the sublingual administration of cancer drugs for the treatment of autoimmune neurodegenerative diseases.

The lead development program of BioNxt in its portfolio for autoimmune neurodegenerative diseases is the Company's sublingual cladribine product for the treatment of multiple sclerosis (MS). Cladribine tablets are currently approved in more than 75 countries, including by the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA). According to Merck, they generated annual sales of over USD 1 billion in 2023. Cladribine tablets are approved for several indications, in particular for highly active forms of relapsing-remitting MS. MS represents the largest market segment for the sale of cladribine, as there are approximately 2.3 million people worldwide living with the disease. According to Market.us, the global market for multiple sclerosis drugs is expected to reach USD 41 billion by 2033. The developers at BioNxt believe that the in-house cladribine product offers a significant advantage over tablet forms for patients suffering from dysphagia (difficulty swallowing). In Germany, the value continued its recent recovery movement yesterday with a premium of more than 10%. At the beginning of 2024, the value traded as high as EUR 0.50. With further progress reports, it should quickly move back in this direction.

Super Micro Computer and Grenke AG – Is there hope after the sell-off?

We would like to draw attention to two other stocks on our watch list. The AI-focused partner of Nvidia, Super Micro Computer (SMCI), has seen a significant decline over the past few months. First, there was a negative research report from a hedge fund, and later, management reported delays in submitting regulatory filings to the SEC. Now, it has been announced that their auditor has resigned. The year's high of EUR 112 per share has receded into the distance at just under EUR 24, and investors are wondering whether the setbacks are a buy signal or an urgent sell signal. After all, the auditor is none other than Ernst & Young. Stock market players remember Wirecard! CEO Liang emphasizes that everything is fine, but past experiences run too deep. SMCI is currently only for speculators comfortable with a casino-style gamble.

German Grenke AG also issued a profit warning last week. The Company now expects a net profit of between EUR 68 and 76 million in fiscal year 2024, down from between EUR 95 and 115 million. The reason for this is the continuously increasing number of insolvencies, especially in the core markets of France, Spain, and Germany. As a result, the figure for claims settlement and risk provision increased from EUR 26.7 million in Q1 and EUR 28.3 million in Q2 to EUR 37.8 million in the past quarter. On a positive note, the forecast for new business in fiscal 2025 remains unchanged at between EUR 3.0 and 3.2 billion. Anyone who now senses an opportunity to buy would be best advised to wait until November 14, when CEO Sebastian Hirsch presents more precise data and formulates his outlook for 2025.

The stock market is on hold due to the upcoming US election. However, after November 6, trading volumes will likely rise sharply again. Also of interest are the quarterly earnings reports from BioNTech, Evotec, SMCI, and Grenke. BioNxt has already delivered positive news, establishing a technical support level that suggests a rally ahead. Biotech stocks could emerge as next year's market stars, driven by potentially lower interest rates.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.