January 21st, 2025 | 07:00 CET

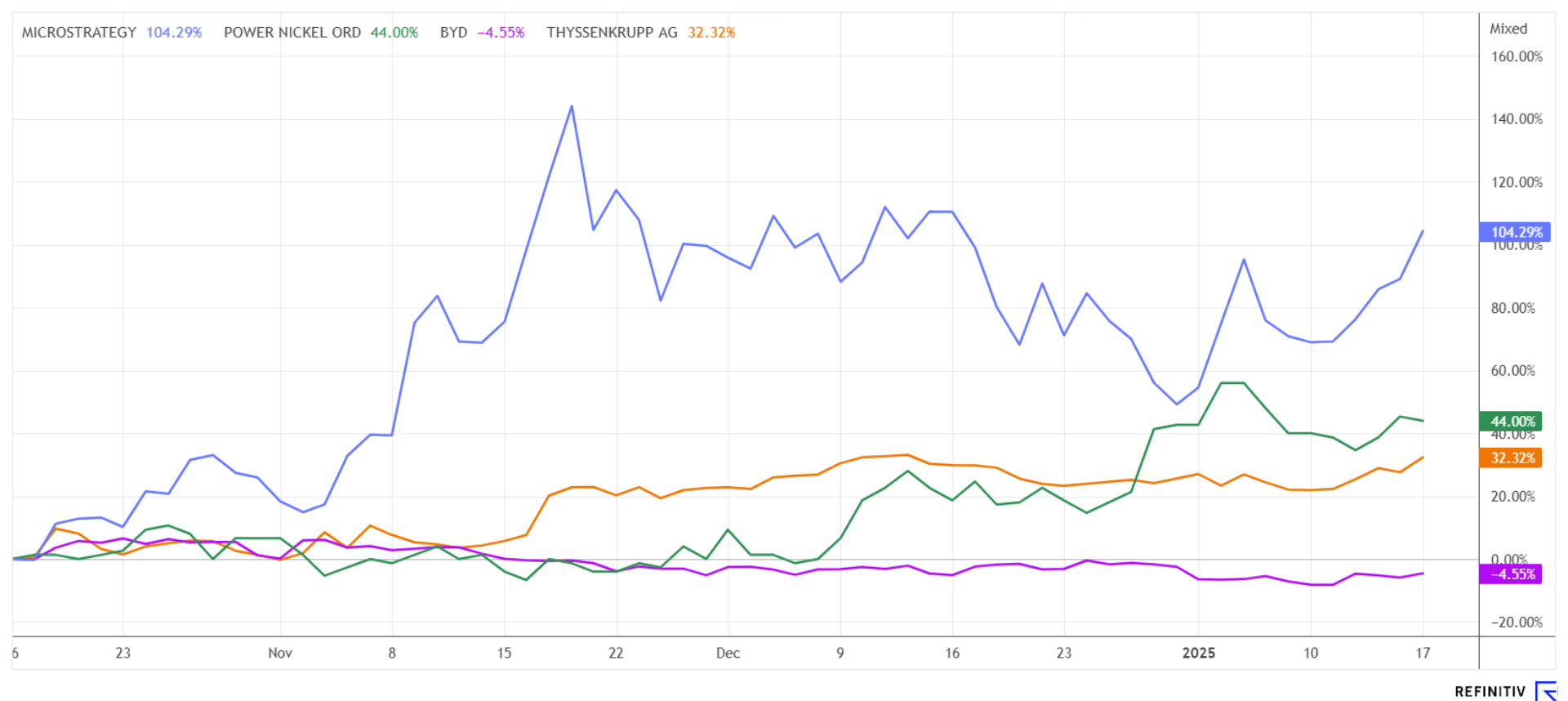

The stock market boom continues – Power Nickel, BYD, Bitcoin, and MicroStrategy are soaring, and thyssenkrupp is turning a corner!

The stock market started the new year at full speed. Chart analysts see the DAX reaching 21,500 points as early as January! Yesterday, the stock markets in the US were closed for Martin Luther King Day, but Donald Trump was sworn in again as the 47th President. Storm clouds are currently a rarity, and corrections have been limited to just a few hours. Investors have to keep pace with this speed to achieve returns. Stagnation or even setbacks are seen only in Germany's GDP, which has declined for the second consecutive year. However, this is no obstacle for higher stock market valuations. Here is a selection of stocks that continue to cause a stir!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

Power Nickel Inc. | CA7393011092 , BYD CO. LTD H YC 1 | CNE100000296 , BITCOIN GROUP SE O.N. | DE000A1TNV91 , MICROSTRATEG.A NEW DL-001 | US5949724083 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] China has become the manufacturing capital of the World, and because of its infrastructure, expertise and capabilities, Silkroad Nickel has strategically positioned itself to partner with Chinese companies in the Stainless Steel and EV industries [...]" Jerre Foo, Corporate Development Executive, Silkroad Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

MicroStrategy – With Bitcoin to Mars

Donald Trump's crypto-friendly stance has brought new excitement to the emerging asset class. Once dismissed as a dangerous gamble, banks and investment firms have now made a U-turn and are investing heavily. What typically takes years to achieve in returns for traditional assets is being accomplished within months. MicroStrategy (MSTR) is at the forefront of the Bitcoin movement with its investment philosophy. With a temporary 800% gain in just 12 months, MSTR shares were one of the most hyped stocks on the stock exchange in 2024. The Company is taking out loans and issuing shares to buy more and more Bitcoin from the market.

CEO Michael Saylor intends to expand the authorized class A common shares from 330 million to 10.3 billion to facilitate the Company's extensive Bitcoin acquisitions. About 47% of the voting rights are still controlled by him as founder. If the plans go through, the total number of outstanding shares will increase by a factor of about thirty. In recent months, the Company has made ten consecutive weekly purchases, almost doubling its Bitcoin holdings to over USD 44 billion. Analysts are optimistic that shareholders will approve the increase, which will be voted on January 21. What is ignored in this business model is that the BTC price could also fall at times, as demonstrated last week, with a 15% drop within 48 hours. MicroStrategy is valued at just under USD 97 billion and is heavily in debt, but the Bitcoins are currently only worth USD 48 billion. The hefty premium presents extreme price risks for the MSTR share. However, the community tends to fuel the hype with continuous inflows of fresh money. Pure casino!

Power Nickel – An excellent start to the new year

The Power Nickel share gained a sensational 20% in January, far outperforming the junior mining sector. The work on the NISK project has shown a very high increase in value. Power Nickel (PNPN) operates in Quebec, one of the best mining jurisdictions in North America. With the demonstrated degrees of mineralization, the Company offers many perspectives for overcoming the scarcity of critical metals in the future. In an environment of great geopolitical instability, industrial producers are seeking a secure supply of strategic metals. The approximately 196 million shares issued now have a market value of over CAD 200 million. Last week, geologist Ken Williamson was appointed Vice President of Exploration.

Now, in the new year 2025, preparations are underway for the long-awaited spin-out of the Golden Ivan assets and certain Chilean projects under the name Chilean Metals. On November 27, 2024, the Company received a final order from the Supreme Court of British Columbia approving the arrangement. At the end of January, the steps will be implemented, with one new PNPN share and 0.05 shares in the Company to be spun off for each old PNPN share. Outstanding options and warrants will also be adjusted. The transaction and its background are explained in detail on the Company's website and in two videos. Follow this (https://www.prnewswire.com/news-releases/letter-to-the-shareholders-of-power-nickel-inc-302352836.html text: link).

The implementation of all measures is expected for the end of January/beginning of February. Interest in Power Nickel has been very high for weeks, with a daily turnover of around 500,000 shares. It is expected that development work on the project will continue very quickly after the share transformation is completed. The story is running!

BYD – Delivering to the EU via Hungary

Automakers are urgently dependent on battery metals of all kinds. The dynamic Chinese company Build Your Dreams (BYD) is particularly striking in this regard. Due to high government subsidies, the Company has been subjected to punitive tariffs by the EU, but production in Hungary is set to begin by the end of 2025, which would eliminate the tariff issue. BYD left its competitors far behind last year and recently even lapped the e-pioneer, Tesla. Thanks to a strong December, BYD is now almost on par with electric pioneer Tesla in terms of deliveries of pure electric vehicles. A total of 1.78 million vehicles were sold in 2024, despite the economy in its home country of China falling to a 10-year low. According to the latest forecasts, revenue is expected to exceed the USD 100 billion mark for the first time. BYD will report exact figures on March 26. The BYD share is currently consolidating at a high level with prices around EUR 33. In 2024, the stock gained more than 40%. This upward revaluation is likely to continue in the current year.

thyssenkrupp – Stabilized above EUR 4

The thyssenkrupp share has gained an impressive 50% since September 2024. The restructuring was finalized in the autumn, and now the management is looking ahead. Of the current 27,000 jobs in the steel sector, only 16,000 are to remain. By the end of 2030, 5,000 jobs in production and administration are to be cut and a further 6,000 are to be eliminated through outsourcing or business sales. These measures are being driven by weak demand, prompting the Company to significantly reduce its steel capacity from the current 11.5 million tons per year to between 8.7 and 9.0 million tons.

The shipbuilding division of thyssenkrupp, TKMS, is gaining attention with an investment of around EUR 220 million at the Wismar shipyard site. The state-of-the-art 212CD submarines are to be built there. The German armed forces will receive six submarines, with NATO partner Norway expected to receive a further six. For TKMS, the corresponding advance payments are anticipated to positively affect cash flow in the current year. A solution for TKMS has been sought for years. Now, due to NATO's rearmament, there are new orders, proving to be a boon for thyssenkrupp. Although negotiations with private equity firm Carlyle fell through last year, other interested parties, including Deutz, Rheinmetall, and rival shipbuilder Lürssen-Werft, are reportedly in talks for TKMS. This should continue to fuel the thyssenkrupp share price. We initially highlighted the stock at EUR 3.20 and recommend staying invested.

The battle for critical raw materials is entering a new round under Donald Trump. Yesterday, Trump was sworn in as the 47th President and the world now awaits his first executive orders, which are expected to be issued swiftly from the Oval Office. This is a high-stakes game for high-tech and industrial investors because the stock markets have been booming since Trump's re-election. Selection remains key!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.