October 23rd, 2024 | 07:45 CEST

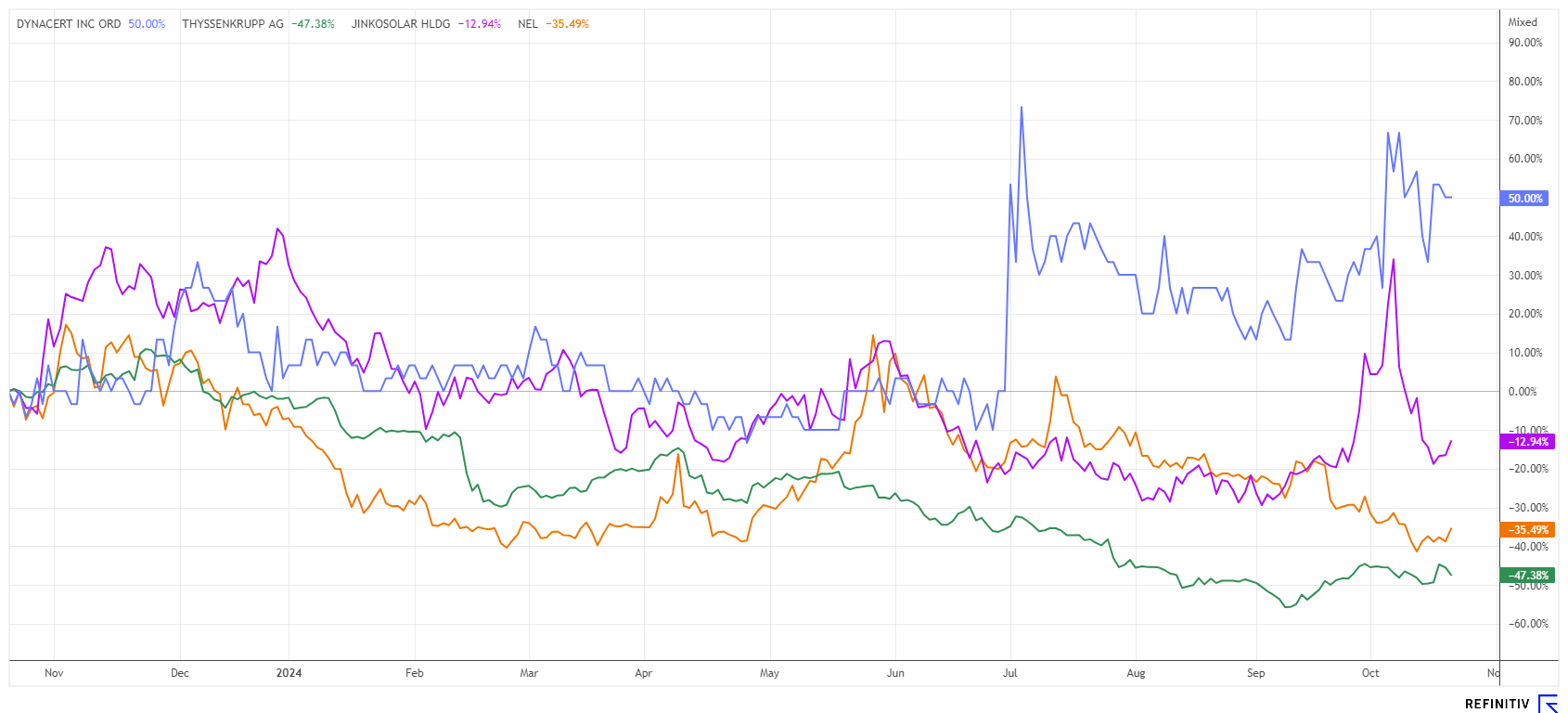

The next gold rush with silver! dynaCERT and JinkoSolar remain winners, caution with Nel and thyssenkrupp

If things continue this way, gold and silver are set to become the top performers of 2024. Excluding popular technology stocks like Nvidia, the Nasdaq 100 index is currently up 32% in Euro terms. Precious metals have recently outperformed this return. Gold prices have increased by almost 40%, while silver prices have risen by nearly 50%. Commodity experts attribute the new rally to the strong increase in money supply by central banks and the persistently high inflation. Silver is expected to see an even stronger appreciation, as the widely observed gold-silver ratio is at historically high levels of 80, whereas in regular times, it should be around 50. With a gold price of USD 3,000 in 2025, silver could theoretically advance to USD 60. LME physical silver inventories are at a 20-year low. In our peer group of stocks, there are clear candidates for a rapid doubling.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DYNACERT INC. | CA26780A1084 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007 , NEL ASA NK-_20 | NO0010081235 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

JinkoSolar – Now it is Germany's turn

The stock of Chinese solar panel expert JinkoSolar is down more than 25% for the year, making it one of the year's losers. Persistent pressure on margins, falling export figures, and a struggling domestic real estate market are causing trouble for the Company. In Q2, total output delivered rose by 36% to 25.3 megawatts, but sales fell by almost 22% to USD 3.3 billion. The gross margin in the reporting period was a weak 11.1%, compared to 15.6% in the same period of the previous year. The bottom line was a minus of USD 156.6 million, and the operating margin plunged to negative 4.6%. "Due to the global oversupply, the sector is facing consolidation," summarized Frank Niendorf, Head of Europe.

However, the market leader continues to focus on Germany. The Company plans to carry out a capital market placement in the near future. The technology subsidiary Jiangxi Jinko intends to offer shares on the Frankfurt Stock Exchange. Including a greenshoe option, a total of around 1 billion shares with a nominal value of 1.0 yuan in the form of Global Depositary Receipts (GDRs) are expected to be offered. Each GDR represents ten ordinary shares of Jiangxi Jinko's original shares, which are currently only listed in Asia. Approvals from the Shanghai Stock Exchange, the Frankfurt Stock Exchange, and the German Federal Financial Supervisory Authority are still pending. In the long term, Jiangxi Jinko is an interesting growth stock, and this move will also provide fresh capital for the parent company.

dynaCERT – In Pole Position with VERRA

The Canadian company dynaCERT is a technology supplier for the transportation industry across all segments. With the company's in-house hydrogen add-on units under the name HydraGEN™, diesel combustion processes can be optimized to such an extent that, depending on the type of use, fuel savings of between 8 and 15% can be achieved. In addition, the soot and nitrogen oxide levels are reduced, so the exhaust gases are cleaner. The technology is particularly suitable for public transport companies, logistics fleets, and mining companies to achieve ESG guidelines and reduce the CO2 footprint of entire fleets.

After a long run-up, the important certification by VERRA finally took place at the beginning of October. HydraGEN™ technology is now a recognized process and part of the VERRA organization's range of applications. What sounds highly scientific is of inestimable value for dynaCERT because now customers with a comparatively low entry of about CAD 6,000 per vehicle can be offered an environmental solution that not only provides significant fuel savings but also generates tradable emission certificates. Large-scale carbon reductions are an important topic for the future, particularly for fleet operators, mines and public transport. What needs to be considered now are the new orders that will soon be invoiced. Several deals are expected to be finalized in 2024.

The DYA share price jumped by over 40% at the beginning of October. The Company is now also an ESG-relevant and heavily traded company in Germany, with trading volumes of over 2 million shares on some days. With a market capitalization of more than CAD 100 million and the long-awaited certification, there is now also an incentive for institutional investors to add the stock to their portfolios. The big upswing in the share price is still to come!

Nel ASA and thyssenkrupp – Ongoing problems create pressure

Not all stocks can look back on a good year of investment despite booming markets. The two industrial and technology specialists, Nel ASA and thyssenkrupp, are suffering from exceptional charges. In the case of Nel ASA, it is the never-ending operational pressures. The last quarter, for example, again fell short of analysts' expectations, with only 2 of 21 analysts on the Refinitiv Eikon platform now issuing a "Buy" recommendation. The median 12-month price target is NOK 5.00. With the current price at NOK 4.45, the potential is obviously limited.

The situation is not significantly better for the Duisburg-based steel and technology giant thyssenkrupp. In September, the share price fell to a 5-year low of EUR 2.76. Analysts do not expect the big rebound in the figures until 2025. Then earnings per share are expected to rise again to EUR 0.77. With prices of around EUR 3.25, the current P/E ratio is a low 4.5. A spin-off of the marine division could also be an exciting prospect, as business here is booming due to increasing orders in the armaments sector. Certainly, some investors have already speculated on such an event, as the price was able to shoot up by a further 20% within four weeks. With a market capitalization of EUR 2.16 billion, the German industrial pearl is dramatically undervalued because the restructuring is already well advanced. Collecting in the range of EUR 2.90 to 3.30 makes sense, but the next technical resistance is already lurking at EUR 3.50.

The stock markets are currently celebrating a series of interest rate cuts, which are on the cards due to slightly lower inflation figures and a declining economy. Geopolitical uncertainties have become more of a buying argument, as they are boosting certain sectors of the economy. In terms of stock selection, there are opportunities in the high-tech, defense and energy sectors. Our selection group is benefiting from the current trends, with dynaCERT, in particular, appearing to be well positioned.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.