October 17th, 2024 | 08:15 CEST

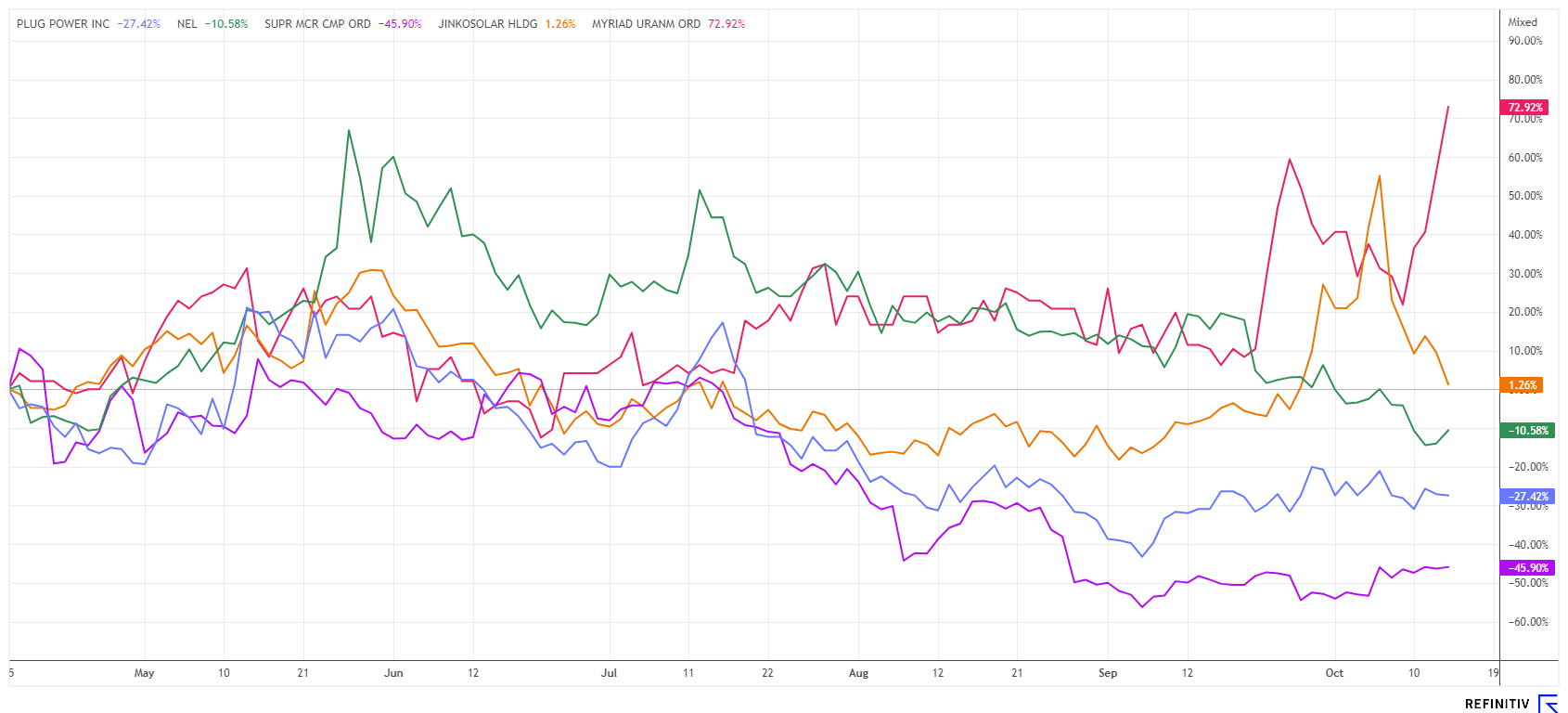

The next 200% uranium rally – will there be takeovers soon? Myriad Uranium, Nel, Plug Power, SMCI and JinkoSolar

Somehow, international energy policy has become very complicated for investors. The EU's "Net Zero" plans cannot be achieved solely by expanding renewable energies. Countries with a less pronounced green ideology, like Germany, have rediscovered nuclear power, which was once banned. China, Russia and India even want to double their capacities. Germany's neighboring countries like France, Sweden, the Czech Republic, Poland and Great Britain intend to connect more than 50 new reactors to the grid over the next 10 years. All this suggests a lack of unity in Brussels and raises the question of how to manage the global energy supply for growing populations. For investors, the starting signal in uranium has long since been given. What should dynamic investors look out for now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

MYRIAD URANIUM CORP | CA62857Y1097 , NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Myriad Uranium – Uranium from Wyoming

The coup in Niger prompted the Canadian uranium explorer Myriad to withdraw from Africa. A wise decision, as the expert for strategic metals is now focusing on the most promising uranium deposits in the US. In a sensational 75% deal, Myriad gained access to an already extensively explored area called Copper Mountain. Historically, Union Pacific invested CAD 117 million in development expenditures in this region during the 1970s. However, the project was abandoned due to low uranium prices and the 1979 nuclear incident at Harrisburg.

However, the signs have now changed drastically: from 2025, the world energy supply will be confronted with a major uranium deficit. Due to geopolitical tensions between East and West, the industrialized countries should not place their hopes on an endless supply from Kazakhstan. Nuclear energy operators are, therefore, looking for secure jurisdictions to secure their supply chains, which have become scarce worldwide. Union Pacific drilled about 2,000 holes in the 1970s, discovered 7 historic uranium deposits, and even developed a mine plan. The U3O8 resources identified at that time are now estimated at about 65 million pounds, which offers potential for the industrial-scale production of fissile uranium.

CEO Thomas Lamb wants to conduct further drilling in the coming months because he suspects modern methods will reveal a significantly larger resource. Investors currently seem to love the story, as the Myriad share price has jumped by a full 50% in the last 4 weeks. Nevertheless, the Company, with around 58.5 million shares, is only valued at around CAD 23 million. The valuation scope can, therefore, still expand significantly after the upcoming drilling. The day before yesterday, on October 15, Myriad Uranium CEO Thomas Lamb presented to a broad audience at the 12th International Investment Forum. With current uranium prices around USD 83 and possible scarcity above the USD 125 mark, Myriad's journey could accelerate significantly. Time to accumulate!

Plug Power and Nel ASA – The sell-off is not over yet

When it comes to future energies, hydrogen is on the radar of those who see "Net Zero" on the horizon. Hardly any other industry has suffered more on the stock market; since the highs of 2021, valuations have fallen by around 90%. The international protagonists Plug Power, and Nel ASA have been suffering from declining orders and a decreasing willingness to invest for years. In the current environment, nuclear energy is once again surging ahead internationally, while hydrogen is increasingly falling by the wayside.

Currently, the necessary public-sector orders are failing due to the high level of household debt. Even Berlin lacks strategic decision-making quality and entrepreneurial vision in all the recently proclaimed investment projects. The considerable development costs for innovative H2 technologies and very difficult refinancing are leading to a shrinking supply of liquidity in the companies, which inevitably puts further pressure on prices. The industry is now pinning its hopes on Democrat Kamala Harris, as she seems willing to continue her predecessor, Joe Biden's climate investments.

The Norwegian hydrogen pioneer Nel ASA recently reported a promising cooperation with the Italian company Saipem. But even that only lifted the share briefly into positive territory. The figures were released yesterday, and the share price fell by a further 10%. Nel increased its quarterly revenue from NOK 303 to 366 million, but the much-publicized new orders more than halved to NOK 161 million. This increases the operational pressure because the EBITDA plunged to NOK -90 million. The Norwegians estimate the cash balance at NOK 1.9 billion, compared to almost NOK 3.8 billion last year, but CEO Håkon Volldal still sees no reason to raise new funds. This is a cautious outlook and not a good sign for growth, which the stock market had actually anticipated for hydrogen. Still in the depths of disappointment is the 10 times larger US competitor Plug Power. Although there is encouraging news here about a 3 GW electrolyser order in Australia, investors should wait for the third-quarter figures on November 7 as a precaution. That is because the enigmatic CEO Andy Marsh is not so particular about fulfilling previous announcements.

JinkoSolar and SMCI – A possible turnaround is pending

Things can go very differently for well-known public stocks. We have often reported on JinkoSolar and Super Micro Computer (SMCI). The Chinese market leader for solar panels has been severely punished this year. The stock slid from around EUR 34 to EUR 15. With the China boom of the last three weeks, it then rose again above EUR 20. Jinko has just landed a huge supply contract for a 3 GW plant in Saudi Arabia. The Q3 figures on October 25 should, therefore, be extremely exciting. A positive surprise would have marked a successful turnaround.

Due to negative comments from a short seller, the SMCI share price has plummeted despite the share split. The investor darling lost a full 70% of its value between March and September. However, positive comments are now on the increase again, and yesterday, there was a top announcement in this regard. The specialist in cooling systems, AI and cloud services announced the introduction of a new storage system optimized for artificial intelligence workloads. The system integrates the state-of-the-art NVIDIA BlueField-3 data processing units (DPUs) to improve performance for AI training, inference and high-performance computing (HPC). Supermicro presented with NVIDIA yesterday at the OCP Global Conference in San Jose. The stock has already risen significantly in the last few days. Here, too, investors should regain confidence because, at some point, the short seller will have to cover again.

The energy question remains a major mystery within Europe. The use of fossil fuels is not very transparent, but the shift of many towards nuclear energy is understandable. After all, a total of 56 nuclear power plants are operated west of the Rhine. And Germany is one of the largest customers of this low-cost electricity. As a result, good opportunities are again emerging for investors in the uranium sector. Here, Myriad could become a top pick with its Copper Mountain project.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.