January 16th, 2025 | 07:00 CET

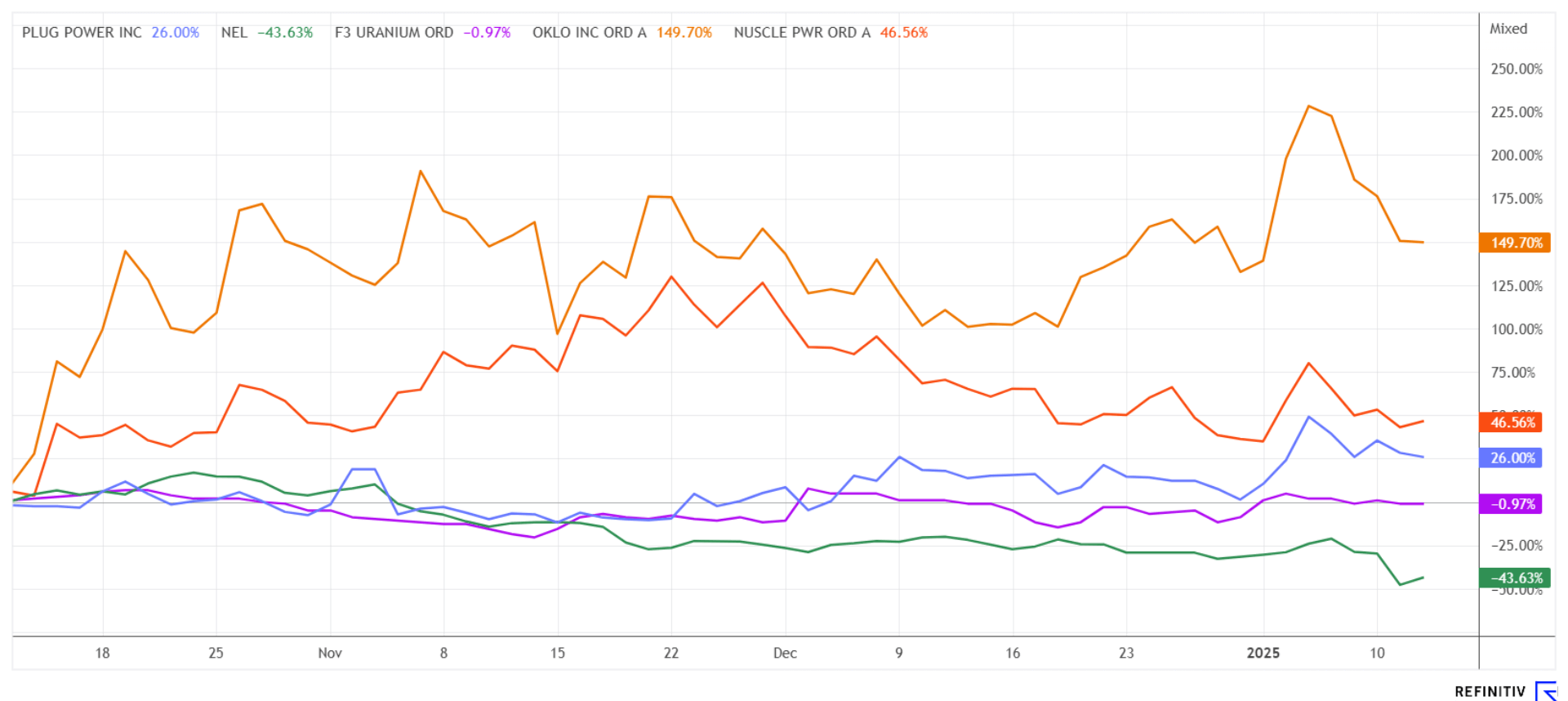

The energy year 2025! Uranium stocks such as Oklo, NuScale and F3 Uranium are in high demand, as are Nel ASA and Plug Power

In 2007, a pound of uranium occasionally cost more than USD 140 per pound before a long decline in prices began. With the outbreak of the Fukushima disaster in 2011, the mood against nuclear power reached its peak and forced the uranium price even below USD 50. Since the "NetZero" wave, however, it has been rising unchecked because, according to the World Energy Agency, nuclear power is now once again being classified as environmentally friendly compared to fossil fuels. Currently, 439 reactors are operational worldwide, with 64 under construction and 88 planned. Uranium demand is, therefore, set to rise by a good 30%, which is not a good sign for the hydrogen industry because this is where government investment is urgently needed. F3 Uranium has extensive concessions in the world's largest uranium mining district: the Athabasca Basin. The industry is preparing for the coming supply shortage with acquisitions and purchases. Good returns are on offer for risk-conscious investors.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

OKLO INC | US02156V1098 , NUSCALE POWER CORPORATION | US67079K1007 , F3 URANIUM CORP | CA30336Y1079 , NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

F3 Uranium – Abundant Resources

The global undersupply of the yellow raw material has taken hold in investors' minds. The spot price of around USD 74 serves as a benchmark here, though 80% of production is locked in fixed supply contracts. However, the large uranium deposits are slowly running out, and years of low prices deterred investment in new mines. This is now taking its toll, as the sector has been experiencing a structural deficit since around 2018. With the recent surge in energy and metal commodity prices, uranium is poised for a prolonged upward cycle in the coming years.

The Canadian company F3 Uranium is at the forefront of the abundant uranium deposits in the Athabasca Basin. The Athabasca Basin, located in the Canadian province of Saskatchewan and partly in Alberta, is one of the world's most important uranium mining areas. It is considered a source of high-grade uranium, which is central to global energy production and military purposes. It is no wonder that Western governments keep a close eye on the strategic resources in friendly jurisdictions.

The Company was incorporated in October 2013 as a wholly owned subsidiary of Fission Uranium. F3 Uranium is now in the process of developing the newly discovered high-grade JR zone on the PLN property in the western Athabasca Basin. This area in the state of Saskatchewan is on track to become the next major uranium zone and is home to thick deposits such as Triple R, Arrow, and Shea Creek. At the end of the year, a further CAD 8 million was raised through a private placement of so-called "federal flow-through" shares. Exploration work can, therefore, continue quickly in 2025. With a share price of CAD 0.255, the market value is just under CAD 132 million. Analysts at Red Cloud and SCP expect 12-month price targets of CAD 0.60 and CAD 0.75, respectively. This could quickly become a hot topic!

Oklo and NuScale – Small reactors under discussion

Crypto and artificial intelligence require large amounts of computing power and are driving up the energy consumption of high-tech devices. Companies like Microsoft operate massive data centres that continuously consume large amounts of energy. As a result, they are increasingly looking into purchasing their own smaller power plants. Small modular reactors (SMRs) can be connected in series due to their modular design and can thus reach any size. SMRs provide a stable and reliable source of energy, independent of weather conditions or fluctuations in renewable energies. This means that data centres can be operated in remote locations or regions with unstable grid conditions by providing a local, independent energy source. Companies like Microsoft could use SMRs as a high-profile opportunity to promote innovative technologies and modernize their own infrastructure for a sustainable future.

Some of these future projects are already listed on the US stock exchange NASDAQ, even though the US government is still in the midst of lengthy approval processes with the manufacturers. Scientists in the UK are still skeptical. Stephen Thomas, Professor of Energy Policy at the University of Greenwich, UK, commented: "Contrary to press reports suggesting that there are numerous orders for SMRs, the reality is that the first commercial order is still years away. There is not a single SMR design that has been approved by a credible nuclear regulatory authority." Examples of the stocks that have been hyped are Oklo Inc and NuScale Power Corp. The share prices of both companies have increased by several hundred per cent in the last six months and have reached market values of USD 3 to 6 billion. The topic is widely discussed, but there are no approved products yet. Caution at the platform edge – this will take much longer than many expect!

Nel ASA and Plug Power – The sell-off continues

Within the EU's "NetZero" efforts, hydrogen represents a renewable alternative to fossil fuels in the medium term, provided that it can be produced cost-effectively and greenly. However, since there is currently no unified political will for this alternative, the hydrogen sector has become one of the big losers of the last 3 years. Now, after price losses of more than 90% since the 2021 peak, many investors are wondering what will happen next.

One of the pioneers in the electrolyzer business is Nel ASA from Norway. While the Company has been struggling with a lack of major orders for some time, it is now also being forced to cut costs. In a surprise move, Nel announced yesterday that it is cutting costs at its main production site in Norway. **According to CEO Håkon Volldal, the market for renewable hydrogen production technologies has developed more slowly than anticipated by the industry in general and by Nel in particular. Production of alkaline electrolyzers will, therefore, be temporarily suspended. Additionally, one-fifth of full-time positions as of the end of September 2024 are set to be cut. The price of the Norwegian company's shares plunged to a new all-time low of NOK 2.10 or around EUR 0.18. Yesterday, there were initial recovery attempts, with the stock rising to around EUR 0.194. The share is only suitable for speculative investors.

The US counterpart, Plug Power, is doing somewhat better. Since the beginning of the year, the New York-based company's share price has conjured up a performance of plus 57% with prices up to EUR 3.30, before profit-taking pushed the price back down to EUR 2.76. For the current year, revenue is expected to increase by around 30% to USD 918 million, with a price-to-sales ratio of a moderate 3. In bull markets, this indicator has been known to reach 50. Due to the subdued operational outlook, most experts on the Refinitiv Eikon platform remain bearish for Plug and expect moderate price targets of around USD 3.00 for 2025. The likelihood of hydrogen taking off under Donald Trump's new administration seems highly improbable from today's perspective.

Global energy policy is developing differently than EU politicians in Brussels would like. While fossil fuels are being phased out in Europe, the new US President Donald Trump is rallying with the slogan "Drill, Baby Drill!". Alongside conventional power generation from oil and gas, nuclear power is also regaining centre stage as a so-called "NetZero" energy source. Investors looking to join the action should look beyond Europe, focusing particularly on North America, where the momentum is building.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.