February 4th, 2026 | 07:00 CET

The bomb has dropped! Gold from 5,600 to 4,600 and now back again? Crazy times with Barrick Mining, DRC Gold, and Strategy

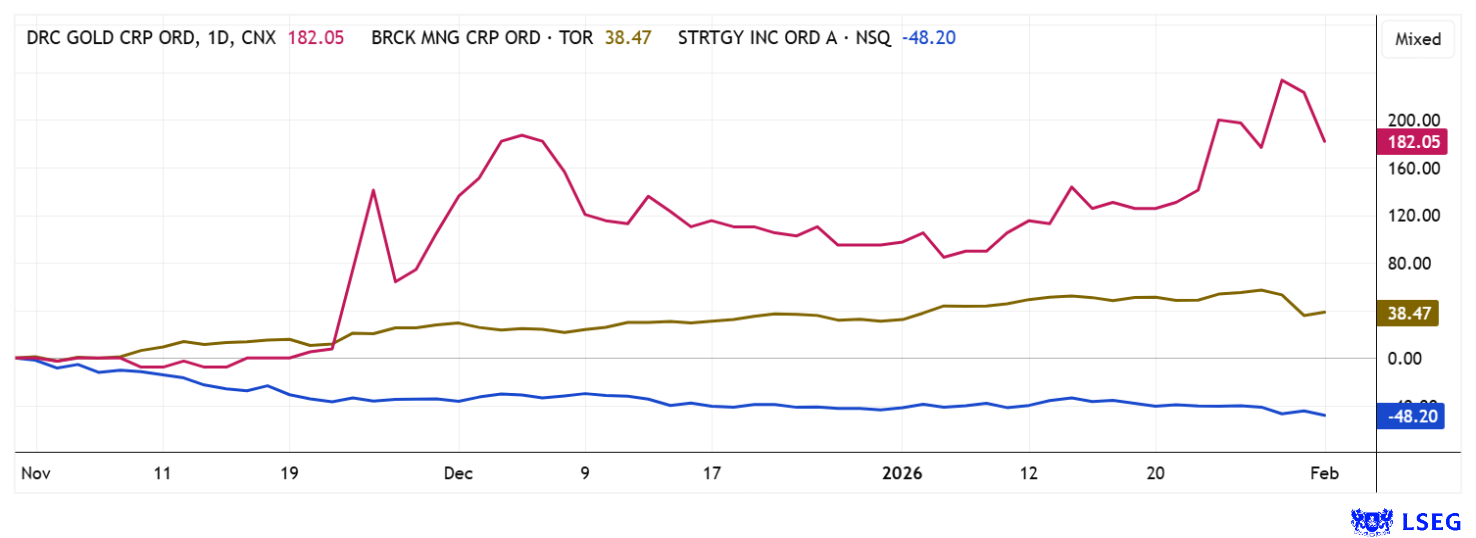

BANG! Investors could not react fast enough as gold and silver prices plunged last Friday. There were many explanations for this sell-off: derivative positions of major banks, which had really hurt during the steep upward trend of recent weeks. Then a few speculators jumped in, hoping to grab a slice of the pie. And finally, a dash of panic. Silver collapsed by a full 40% from USD 122 to USD 72, while gold corrected by around USD 1,000, or 20%, down to USD 4,600. At the start of the week, a slight stabilization is now visible, but volatility remains. The environment is still fragile. Gold stocks like Barrick Mining and DRC Gold are feeling the impact. Looking beyond the metals to Bitcoin, one loser comes into focus: Strategy, Michael Saylor's BTC asset management company. How will the mess continue?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BARRICK MINING CORPORATION | CA06849F1080 , DRC GOLD CORP. | CA23347H1064 , STRATEGY INC | US5949724083

Table of contents:

"[...] The transaction offers benefits to all parties: Shareholders now have three promising projects in their portfolio. [...]" Bradley Rourke, President, CEO and Director, Scottie Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Barrick Mining – The giant remains unimpressed

Those were quite shocking minutes and high-turnover hours. On Friday, investors dumped their Barrick Mining shares, which had risen by more than 100%, onto the market in a near-panic. What began as a derivatives event continued at the end of the day as a sell-off of mining stocks. Barrick Mining fell by a full 20% on that day, from EUR 44 to below EUR 36. Anyone who was unsettled by this downturn will certainly no longer be on board when the Q4 figures are expected tomorrow, February 5. But that will be quite exciting: analysts will have to process the enormous quarterly increases of the gold producers into a complete annual perspective. Earnings per share of CAD 1.2152 are currently expected for Q4 2025, and in 2026, this figure is expected to rise rapidly to between CAD 1.33 and CAD 1.40 per share. This is no surprise, as the company is currently operating with all-in sustaining costs (AISC) of USD 1,460 to USD 1,560 per ounce. Depending on the spot price and the ounce sold, the Canadians currently earn approximately USD 2,700 to USD 3,900 per ounce of gold mined. With an expected annual production of approximately 4.15 million ounces, this would result in a cash flow of at least USD 13.2 billion. Taking the valuation of USD 77 billion as a benchmark, Barrick Mining is trading at 5.8 times cash flow, assuming the gold price remains at these levels. This is by no means expensive, especially since the 2026 P/E ratio has fallen from 17 to 12.5 in the last two quarters! Profits from gold and copper production are therefore rising faster than the share price. The planned spin-off of the North American assets provides additional upside potential! In our opinion, the share price could double again by the end of the year in this environment.

DRC Gold – New name and a clear focus on gold

Even in the broad landscape of precious metal stocks, real gems can be found! DRC Gold, formerly AJN Resources, implemented significant structural and strategic steps at the start of the year to usher in the next phase of growth. A successfully placed financing at CAD 0.15 per unit raised approximately CAD 0.55 million gross, which will now be used specifically for due diligence work and the further development of core projects. The accompanying name change underscores the clear focus on gold and is intended to sharpen perception in the capital market without changing the underlying strategy. The focus remains on Africa, a continent with high geological attractiveness but comparatively little competition for promising projects.

The key value driver is the planned acquisition of a 55% majority stake in the Giro Gold project in the Democratic Republic of Congo, located in the renowned Kilo Moto greenstone belt. The immediate proximity to the Kibali mine, one of Africa's most productive gold mines, points to significant regional upside potential. Historical resources at the Kebigada and Douze Match deposits already indicate a multi-million-ounce gold deposit, which will be further confirmed by future drilling programs. In addition, DRC Gold is pursuing a second strategic axis in Ethiopia with majority interests in the Dabel and Okote projects. Okote in particular is already well advanced due to extensive historical drilling, attractive gold grades, and clearly defined shear zones. Ongoing mapping, sampling, and preparation of a new drilling program aim to further refine the geological model and identify additional resource potential. The geological structures show a continuity typical of orogenic gold deposits, which increases the prospects of success for further exploration.

With experienced geologist Klaus Eckhof at the helm, the company benefits from in-depth expertise in Africa and a robust network in politics and the commodities sector. The significant rise in the share price since its low at the beginning of 2025 signals growing market confidence, even against the backdrop of a sharp rise in the price of gold. Based on its current market capitalization of approximately CAD 33 million, DRC Gold appears attractively valued given its project portfolio and regional diversification. Buy!

Strategy – The concept is not working

Those involved in the crypto market are following a Bitcoin price that has fallen sharply since its October high of around USD 122,000. This is least likely to please CEO and founder Michael Saylor, head of Strategy, formerly MicroStrategy. The flamboyant visionary has accumulated around 713,000 Bitcoin through his company holding through the end of January 2026; the calculated cost price after the latest purchases is around USD 76,000 per Bitcoin. How close is that? In yesterday's morning trading, this mark was tested several times until a slight recovery to USD 77,700 was recorded. The crux of the matter: Strategy Group's total external debt consists mainly of several unsecured, convertible bonds with a cumulative nominal volume of around USD 8.2 billion maturing in 2028/30. These notes were used primarily to finance BTC purchases, in addition to recurring share placements via ATM programs. It will now be interesting to see how the company reacts if Bitcoin weakens significantly again. Chartists see prices of up to USD 50,000 as possible, although there are also long-term visionaries who are predicting a target range of USD 150,000 to USD 250,000. **It will be exciting to see how this plays out! Due to major investor concerns, Strategy is now trading at a 10% discount to its Bitcoin holdings, with an annual loss of 65%. A ride on the volcano!

The stock market is merciless. First, silver and gold surge upward with triple-digit returns, then a brutal sell-off puts a quarter's profits at risk. Fortunately, the sell-off could be slowed down and silver recovered from USD 72 to USD 88. Gold is also stabilizing in the USD 4,900 range. Whether Bitcoin guru Michael Saylor will "survive" the storm remains to be seen! Much is still up in the air here. Investors are quickly realizing that diversification and stop prices are the guardians of the china cabinet!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.