April 2nd, 2025 | 09:05 CEST

Tesla is out; SMRs are in! Green hydrogen in focus at nucera, Nel ASA, Plug Power, First Hydrogen, and Oklo

Even if Donald Trump denies climate change, the international community still has hydrogen and alternative energies on the agenda. Within the new US administration, nuclear projects have been under discussion for several months, alongside an emphasis on fossil fuels. Small modular reactors (SMRs) are being discussed in this context. They can be planned and put into operation in a much shorter time and are highly flexible in their applications. In the US, Oklo is moving forward in this area, and the Canadian company First Hydrogen is also in the starting blocks to roll out its innovative solutions. This means that green hydrogen remains in focus. Which stocks are coming to the fore?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001 , NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , First Hydrogen Corp. | CA32057N1042 , OKLO RESOURCES LTD. | AU000000OKU1

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

thyssenkrupp nucera – The international player

The hydrogen spin-off of the thyssenkrupp group, nucera, is driving forward major international projects and is already generating revenue. However, since the IPO last year, the operational situation has not improved significantly. Despite a 27% increase in revenues to EUR 262 million in the second quarter of 2024/25, EBIT rose only from EUR 2 million to EUR 8 million, leaving net profit per share at EUR 0.07. Growth was achieved primarily through an improved gross margin in the green hydrogen segment. At the same time, regulatory uncertainties and high startup costs caused difficulties for the entire sector. Order intake fell sharply by 46% to EUR 95 million, which came as a surprise.

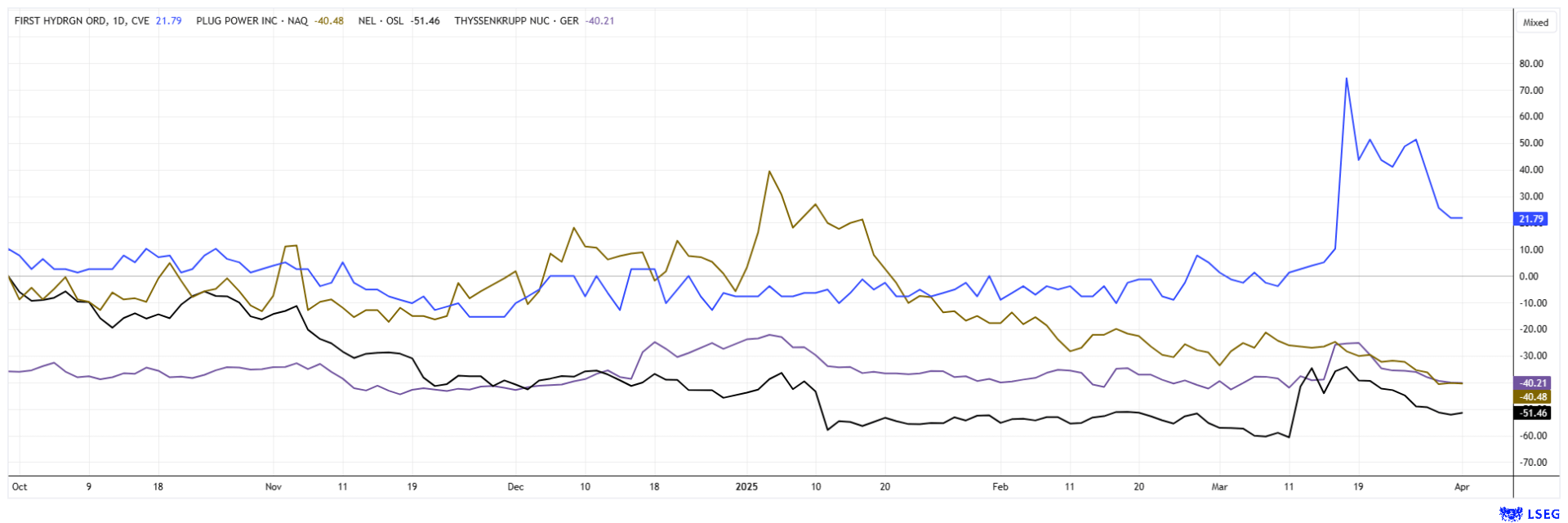

nucera is significantly involved in major international projects, such as in Neom in Saudi Arabia. The US company Air Products has commissioned thyssenkrupp Uhde Chlorine Engineers to supply an electrolysis plant with an output of more than two gigawatts. The hydrogen produced there will be synthesized into climate-neutral ammonia, which will be exported exclusively by Air Products to the global market. Commissioning is planned for 2026. For the current fiscal year 2024/2025, thyssenkrupp nucera expects revenues of between EUR 850 and 950 million. EBIT is expected to range between minus EUR 30 and 5 million, depending on the implementation of existing orders. A rapid rise in the share price in March can be attributed to the "special fund" that was decided. With prices around EUR 8.70 and a market capitalization of EUR 1.15 billion, nucera is currently the heaviest listed hydrogen share. An investment does not seem compelling at the moment.

First Hydrogen and Oklo – Small reactors are on the way

In addition to various alternative energies, nuclear power and hydrogen are also coming back into investors' focus with regard to the hoped-for climate change. Combining both technologies innovatively and using "clean" nuclear power to create flexible hydrogen supplies is clever. This so-called transmitter technology makes sense for many applications, especially where there is no adequate grid supply or climatic conditions that make a self-sufficient supply necessary. So-called small modular reactors (SMRs) are being closely examined in the US. According to the International Atomic Energy Agency (IAEA), SMR plants will help reduce greenhouse gas emissions in the future as a reliable and affordable source of energy. The unique properties of SMRs in terms of efficiency, flexibility, and cost-effectiveness can enable the technology to play a key role in the clean energy transition. According to the IAEA, 84 such reactors are currently under development or construction in 18 countries worldwide.

The high-tech corporations from Silicon Valley are leading the way. With billions in investments, they want to cover their gigantic power consumption in the large data centers with their own small reactors. In the US, Oklo Inc. has already pushed ahead, but the figures of the Santa Clara-based nuclear startup are still negative. With no revenue yet, Oklo reported a net loss of USD 0.74 per share for 2024, compared with a USD 0.47 loss the year before. Despite the challenges, the Company has filed a license application with the US Nuclear Regulatory Commission (NRC) to build its Aurora power plant at Idaho National Laboratory. Things are moving here, but the stock is clearly overvalued!

Also, Canadian innovator First Hydrogen (FHYD) aims to be the first to supply customers in the Montreal-Québec City region with clean, green hydrogen as a fuel over the next few years using the "Hydrogen-as-a-Service" model. As a first mover, the Company plans to install the new SMRs in areas where grid power is limited or non-existent to produce storable hydrogen for fueling stations. To this end, First Hydrogen has now launched a subsidiary called First Nuclear. By using SMRs, First Nuclear ensures a stable, cost-effective and efficient process for the production of green hydrogen, thus meeting the growing global demand for clean energy solutions.

The research institute IDTechEx expects that the installation rate of SMRs will increase significantly in response to the climate crisis and that the global market could reach a volume of around USD 72 billion by 2033. First Hydrogen is clearly in a pole position in Canada to implement local "NetZero" targets, which could soon set a precedent nationwide. FHYD shares have doubled from CAD 0.35 to CAD 0.70 following the latest events. Profit-taking has now occurred in this range. With prices around CAD 0.48 and a valuation of around CAD 35 million, risk-conscious investors are once again being given the chance to get in on the action for the long term. Collect!

Nel ASA and Plug Power – Challenges Persist

In the transition to 2025, the growth markets had high expectations for the dramatically collapsed hydrogen stocks, which lost as much as 95% at their peak. With some operational improvements, orders from the US and Scotland, and the successful spin-off of its fueling station division, Nel ASA was finally able to gain 50% again in March. The recovery was also supported by the German "special fund", which earmarks EUR 100 billion for climate protection projects. Additionally, securing Samsung E&A as an international partner through a capital increase was a major boost. However, investors quickly took advantage of the positive sentiment to sell off Nel shares. The value fell back from EUR 0.32 to EUR 0.22 and is now only just above the 5-year low of EUR 0.166. Wait and see!

The first quarter was disappointing for the US hydrogen industry leader Plug Power. At the beginning of the year, the public title shot up from USD 2.20 to USD 3.40, but by the end of the quarter, the price had landed at USD 1.30. The reasons? Poor annual figures for 2024, empty coffers, and a large capital increase at market prices. The current share price development reflects the Company's difficult fundamental situation. The PLUG share is only suitable for casino fans!

US President Donald Trump has done the stock market a disservice so far in 2025. Interest rates are rising sharply, as is debt. Growth stocks are suffering from the worsening conditions for future investments. At least there are some bright spots in the investment universe. In the small nuclear power sector, Oklo and First Hydrogen stand out with innovative approaches. Investors should diversify their portfolios broadly to reduce overall risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.