May 26th, 2025 | 07:05 CEST

Tariffs, nuclear energy, and climate policy! Trump sets the pace for Nel ASA, First Hydrogen, Plug Power, and Oklo

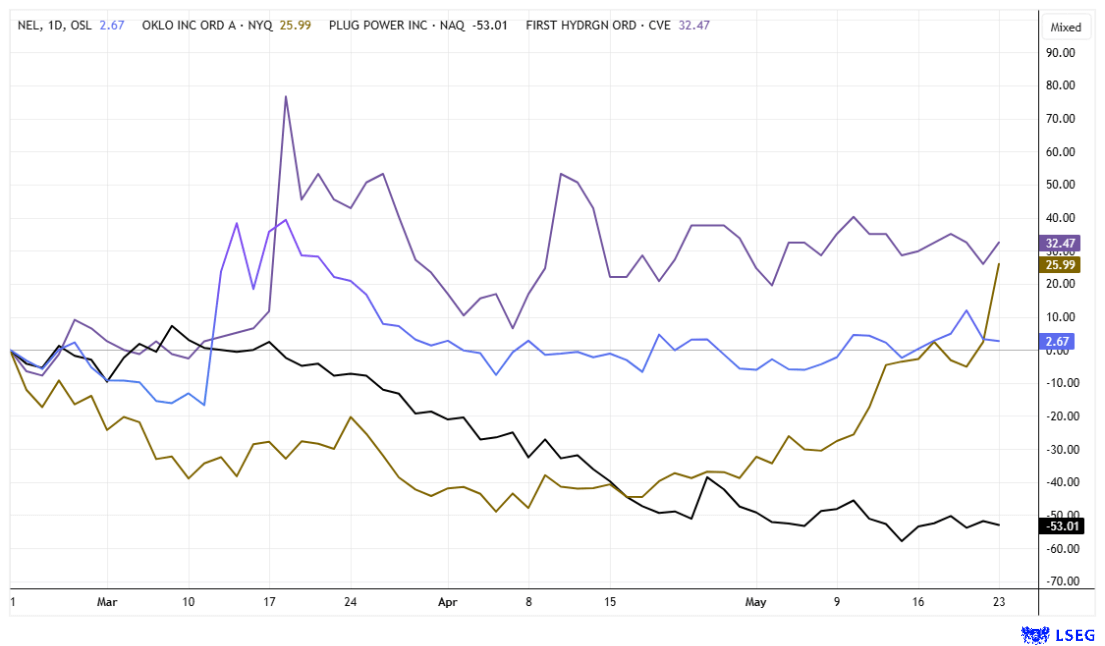

The world is undergoing a 180-degree turn. Nuclear energy, which was demonized until 2022, is now experiencing an astonishing renaissance, and green seems to be redefined. Under Donald Trump, the US aims to expand the use of nuclear energy significantly, and the US president signed all the necessary decrees last week. Trump said that the United States intends to become "a real power" in the nuclear industry again by quadrupling its nuclear power production after his tour of the Middle East. Oil prices thus approached the critical USD 60 mark again, and hydrogen stocks experienced another sell-off. However, one problem is becoming apparent: 30-year bonds are now yielding over 5%. Stock market traders are now focusing on nuclear business models and uranium stocks. Where are the opportunities and risks?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , First Hydrogen Corp. | CA32057N1042 , PLUG POWER INC. DL-_01 | US72919P2020 , OKLO INC | US02156V1098

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Plug Power – The US ends the climate debate

The hydrogen sector remains a problem child for international stock markets. Even though there are a few showcase projects from climate-oriented governments, demand among electrolysis experts remains weak. US President Trump's decision to withdraw from the Paris Climate Agreement and stay away from future climate summits is considered groundbreaking. However, the US is still the largest emitter of greenhouse gases on the planet, ahead of China. This is a real slap in the face for countries that are pushing ahead with climate protection out of solidarity and concern for future generations. No wonder the two best-known hydrogen stocks, Nel ASA and Plug Power, are struggling to get back on their feet. Over a three-year period, the stocks have lost 84% and 96%, respectively. There is unlikely to be any investor who is still in the black in the medium term. Nevertheless, the stocks remain a popular plaything for traders, as trading liquidity is very high and intermittent news is always good for a 20% hype. Profitability is a distant prospect for both companies, so poor figures are to be expected as the norm, which will trigger further capital measures. Plug Power has already done this twice and is planning a third round. There are no longer any buy recommendations for Nel ASA on the LSEG platform, but at least 6 out of 24 experts are still giving Plug Power the thumbs up. Investors should exercise caution.

First Hydrogen – Converting nuclear energy into hydrogen

Canadian innovator First Hydrogen (FHYD) is proving to be very visionary. To establish its "Hydrogen-as-a-Service" strategy in Canada, a subsidiary called "First Nuclear Corp." was launched in March. The focus is on small modular reactors (SMRs), which can be connected in series in any number to generate the desired output. First Nuclear plans to install the new SMRs in areas with limited or unavailable grid power to produce storable hydrogen for filling stations.

In the new economic nomenclature, hydrogen produced from nuclear power is referred to as pink or yellow. The classification of this form of hydrogen is currently under discussion in the EU. Some member states, such as France, the Czech Republic, and Poland, are in favor of recognizing nuclear energy as a sustainable energy source, while others, including Germany, are more cautious. Initial studies on the environmental balance of hydrogen from nuclear energy show that it does not cause any direct CO₂ emissions during operation. However, there are concerns about total life cycle emissions, which arise primarily during the construction, operation, and, ultimately, the disposal of old fuel rods. The EU plans to decide on the final classification by 2028. On May 21, Sweden passed a law providing financing for a new generation of nuclear reactors, including SMRs. By 2035, four large reactors or equivalent SMRs with a total capacity of around 5,000 MW are to be built to secure the country's energy supply and achieve climate targets.

The International Energy Agency (IEA) predicts that global nuclear power capacity will increase by a total of 25% from 395 GW in 2024 to 494 GW by 2035, with SMRs making a significant contribution. First Hydrogen is on the right track here, as its solutions offer local climate protection benefits and make a lot of sense simply because of Canada's size. The FHYD share is currently being revived at around CAD 0.50, as consolidation was needed after doubling in March. In the medium term, especially with a view to the post-Trump era, First Hydrogen could be a top pick among climate-friendly investments. Now is, therefore, the time to get in at a favorable price!

Oklo Inc. – 100% increase in 3 weeks

Not too long ago, we took a closer look at nuclear startup Oklo Inc. Between February and the end of April, significant sales at the loss-making Santa Clara-based company caused its share price to fall from USD 55 to USD 20. As a reminder, the balance sheet for 2024 shows zero revenue and a net loss of USD 0.74 per share. This is not necessarily a bad thing for a company that invests heavily, as profits may only materialize in years to come if the strategy pays off in the medium term. As confirmed by the US president's statements on Friday, the field of small modular reactors (SMRs) is firmly in the sights of the US government, which aims to quadruple its nuclear power production in the coming decades.

On average, US reactors are now 42 years old and urgently need to be overhauled or completely replaced, which will cost the US administration billions. According to a recent report by GlobeNewswire, the global SMR market is expected to reach a volume of USD 40 to 50 billion per year by 2035. North America is driving innovation, while the Asia-Pacific region and Russia are seeing equally strong expansion. The main drivers of these efforts are net-zero ambitions, energy security, and the opportunity to replace fossil fuel power plants with facilities with a lower carbon footprint. High-tech companies are providing investment capital to create new energy capacity, as their data centers consume billions of kilowatt hours. Oklo shares experienced a rapid renaissance following Donald Trump's recent decrees, temporarily reaching close to their February highs. However, momentum slowed somewhat in late trading, closing at USD 48.50, which was exactly in line with the target price set by analysts on the LSEG platform. Much euphoria and a new nuclear hype are on the horizon!

US President Donald Trump delivers daily surprises for the capital markets. At the end of last week, there were two: 50% tariffs now threaten the EU, and in his own country, the construction of nuclear power plants is being pushed forward. The uranium is to come from the US itself. Nuclear stocks and uranium stocks were in demand, while hydrogen stocks continued to struggle. First Hydrogen is taking a long view and aims to create a hydrogen ecosystem with the help of nuclear energy. This green vision clearly extends beyond Donald Trump's term in office. FHYD shares are still available at a bargain price!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.