September 22nd, 2025 | 07:10 CEST

Takeovers in the chip sector – Gold is unstoppable! Intel, AMD, Infineon, and Sranan Gold

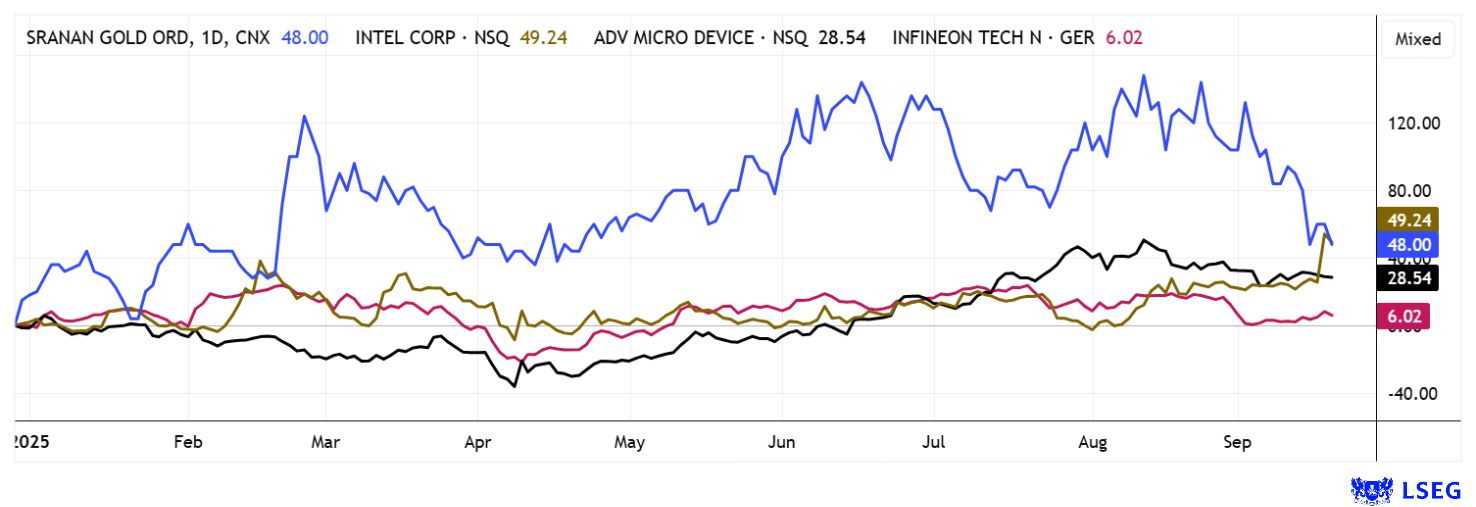

The stock market is booming, and strategic partnerships are nothing unusual. Then last week came the bombshell: the world's largest chip designer, Nvidia, is investing billions in its rival Intel. The two semiconductor companies announced that Nvidia will acquire Intel shares worth USD 5 billion. They also plan to jointly develop chips for PCs and data centers in the field of artificial intelligence. That adds more fuel to the already overheated NASDAQ rally. A rate cut by the Fed on Wednesday also catapulted precious metals upwards. Gold touched the USD 3,700 mark, while silver broke through the next barrier at USD 43. The bull market continues, and as usual, it is high-tech stocks and gold stocks like Sranan Gold that are leading the way. Here is an important update.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

INTEL CORP. DL-_001 | US4581401001 , INFINEON TECH.AG NA O.N. | DE0006231004 , SRANAN GOLD CORP | CA85238C1086 , ADVANCED MIC.DEV. DL-_01 | US0079031078

Table of contents:

"[...] We can make a big increase in value with little capital. [...]" David Mason, Managing Director, CEO, NewPeak Metals Ltd.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Intel – Nvidia makes a surprise entry

Boom – is a merger in the making? Nvidia's current billion-dollar investment in Intel is causing a stir in the chip industry. Following surprisingly strong quarterly figures and a shift toward AI, Intel is now forming a strategic alliance with Nvidia that has the potential to shape the next era of computing. Nvidia is investing USD 5 billion and will hold a stake of just under 5% in Intel, strengthening the technological and financial basis for joint innovations in AI and data center solutions. Together, the partners plan to develop new high-end chips for PCs and data centers, and the integration of Nvidia's AI expertise into Intel's x86 technology will result in products with unique selling points in the long term. Intel's share price jump of over 25% last week highlights the market potential of this historic partnership, which could benefit both sides and the entire AI ecosystem. Analyst sentiment is overwhelmingly positive. While Nvidia is very much in focus on the LSEG platform with a 2027 P/E ratio of 27.5 and annual growth of over 25%, Intel may now actually have ended its two-year bottoming out between USD 18 and USD 24. Current analyst estimates are not yet updated, but Intel's 2027 P/E ratio of 24 could fall further once new forecasts reflecting the Nvidia partnership are factored in. Very interesting!

AMD and Infineon – The entire sector is in focus

In the current environment, a wide range of opportunities are opening up for chip manufacturers AMD and Infineon. AMD is impressing with double-digit revenue growth, which is attributable to its success in the PC, server, and gaming segments. In particular, the expansion of its portfolio into the promising AI, embedded, and data center areas is giving AMD a strong market position for the coming quarters. The fabless model provides a high degree of financial flexibility, but there is a strong dependence on TSMC as a manufacturing partner. Geopolitical risks and capacity bottlenecks in particular could have a negative impact. The market valuation remains ambitious at USD 260 billion, driven by high expectations for further AI-driven growth. High cyclicality and price wars with Nvidia are also weighing on earnings visibility. At over USD 200, the share price had already peaked in March 2024. However, with prices around USD 157 and the announced savings, the 2027 P/E ratio falls back to a moderate 21. Interesting!

As an integrated semiconductor manufacturer, Infineon focuses particularly on electromobility, the energy transition, and industrial applications, from which the group is benefiting above average in the current boom in electric vehicles and renewable energy. The Green Industrial Power and Power & Sensor Systems divisions in particular contributed to stable and high-margin growth. The automotive business was recently further strengthened through acquisitions. Economic dependence and high political uncertainty are slowing down the price momentum, compounded by high export requirements and trade restrictions, which are weighing on margins. There are, therefore, a number of reasons why the market capitalization of EUR 43 billion lags far behind its US competitors. While the boom in high-end chips and AI is fueling imagination, the structural demand for sensors, power semiconductors, and safety-related automotive components tends to point to volatile ups and downs in downstream industries during the economic cycle. With its current positioning, Infineon is much more cyclical than the US giants. Investors should therefore weigh AMD's dynamic growth potential against Infineon's cyclical positioning. Overall, AMD remains the more speculative AI player with greater innovation leverage. A corresponding weighting of the two stocks in the portfolio smooths out the result.

Sranan Gold – Strong drilling results from Suriname

Away from high tech, toward precious metals! An exciting investment opportunity in the gold sector is currently opening up in Suriname, South America. While the country's economy is heavily dependent on gold mining, Canadian exploration company Sranan Gold is working intensively on several properties there. With the 29,000-hectare Tapanahony project, the Company holds one of the most promising exploration areas in the country. Previous prospectors had already identified potential for over 15 million ounces of gold here. CEO Oscar Louzada, who has been active in Suriname for more than twelve years, aims to build on the success in the Guiana Shield with Tapanahony. Initial samples taken by Sranan from shafts recently opened by local miners yielded peak values of up to 76.6 grams per ton.

Recent work has revealed additional high-grade results from trenches along the Randy trend of the project. One five-meter section averaged 8.9 g/t gold, extending the known mineralization. It occurs within northeast-trending shear zones within intrusive rocks and volcanic sequences. These structures are complex, indicating strong gold potential. Initial drill results from the Randy's Pit target area have now been announced.

One drill hole intersected 11.5 meters at 3.64 g/t gold in weathered saprolite rock. This drill hole is located 300 meters north of previous high-grade samples of up to 76.6 g/t gold. Iamgold had already reported similar values in the same zone in 2012. This indicates a gold-bearing corridor 500 meters long in near-surface rock. Dr. Dennis LaPoint, Vice President of Exploration, emphasizes that this is only the beginning and that further drilling will clarify the depth, orientation, and geological controls of the trend. Future drilling and trenching will also reveal how Randy's Pit is connected to the deposits located further north.

Overall, the results demonstrate that Sranan Gold is currently bringing a significant gold system to life at the Tapanahony Project. The Company is pursuing a methodical approach that combines prospecting, drilling, and analysis. Each new sample contributes to a better understanding of the geological context. For investors, this means a lot of potential for surprises in the coming months, which could catapult SRAN shares to new heights. Currently, consolidation prices below CAD 0.40 are tempting new investors to enter the market. Speculative investors continue to buy!

The capital markets continue to celebrate. The ubiquitous megatrend of AI has given chip stocks a particular boost in recent weeks, as they provide the necessary infrastructure for urgently needed mainframe computer systems. Since expectations of interest rate cuts in the US have intensified, there has been no stopping precious metals either. Sranan Gold shares have benefited significantly from this. The rally is likely to continue!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.