ecommerce

Commented by Fabian Lorenz on October 8th, 2025 | 07:15 CEST

More than 50% upside potential! Zalando, thyssenkrupp, and stock market newcomer Finexity!

What is happening at thyssenkrupp? After the marine division (TKMS) drove the share price up this year with its defense fantasies, the planned IPO now appears to be stalling. Meanwhile, the steel division is once again dominating the headlines. Finexity, on the other hand, has successfully made the leap onto the trading floor. The next step is to attract greater investor attention. Those who get in early could profit, as the Company's growth prospects are excellent. Recently, Finexity announced plans for international expansion, targeting one of the most dynamic real estate markets in the world. In contrast, Zalando is facing strikes. When will the stock react? According to analysts, it might not. Yet they still see up to 50% upside potential.

ReadCommented by Fabian Lorenz on October 1st, 2025 | 07:20 CEST

1,000% not enough for D-Wave? 70% price potential for Zalando! Will Walmart partner MiMedia's stock now take off?

After a meteoric 1,000% rise in just 12 months, D-Wave Quantum shares continue to attract attention. Analysts are significantly raising their price targets - is the next short squeeze already looming? Meanwhile, bargain hunters should take a closer look at MiMedia. The Walmart partner's shares have halved since July, yet the Company is making strong progress in expanding its cloud platform. A rebound of up to 100% back to its previous high is possible. And in Europe, Zalando is back on investors' radar. Analysts see up to 70% upside potential, while the chart is also looking more favorable again. However, the weak consumer climate continues to weigh on business sentiment.

ReadCommented by André Will-Laudien on September 26th, 2025 | 08:20 CEST

Bitcoin at USD 250,000? Quantum computers conquer crypto – Favor D-Wave, Finexity and Alibaba now!

The financial markets are undergoing a profound transformation, with speed and computing power becoming decisive competitive advantages. High-performance computers have already revolutionized stock market trading by implementing complex strategies in milliseconds. At the same time, blockchain technology and crypto platforms are creating a new market that is benefiting massively from these technological developments. Whether in high-frequency trading, hedging digital assets, or building tokenized securities markets, the interplay of computing power and decentralized networks is opening up access to a whole new dimension of global financial flows. Which stocks offer opportunities?

ReadCommented by Armin Schulz on September 16th, 2025 | 07:20 CEST

Building wealth with network effects and AI: How Palantir, MiMedia, and Alibaba are making investors rich

The global economy is being driven by a new type of company: scalable platform ecosystems with predictable, recurring revenues. They leverage network effects for exponential growth and are resilient to economic fluctuations. These disruptive business models, at the intersection of AI, data, and digital connectivity, generate steady cash flows and define the investment opportunities of tomorrow. Three companies that perfectly embody this strategy are Palantir, MiMedia Holdings and Alibaba.

ReadCommented by Fabian Lorenz on September 16th, 2025 | 07:10 CEST

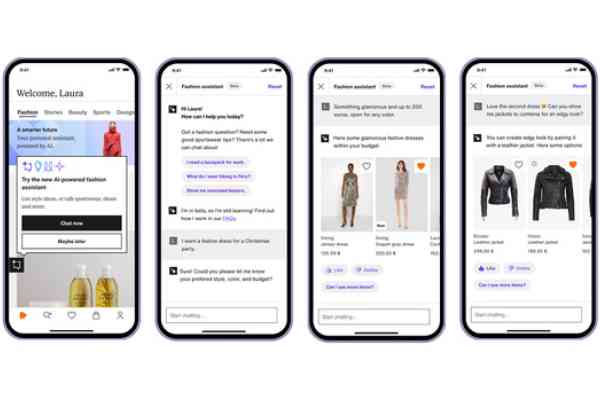

OPPORTUNITY for 100% returns and a short squeeze! D-Wave Quantum, Zalando and Rio Tinto partner Aspermont

While traditional AI stocks like Nvidia, Palantir and Oracle are becoming increasingly overheated, investors are now turning their attention to second- and third-tier companies. These are companies that are poised to benefit from the adoption of AI technologies. One example is the hot stock Aspermont. The Australian company holds a massive trove of data on the global resources industry. The latest bombshell: a partnership with mining giant Rio Tinto, which is paying for access to and processing of Aspermont's valuable data. The stock has not yet reacted. At Zalando, analysts see upside potential of up to 100%. The e-commerce group could also benefit from AI advancements. And then, of course, there is quantum computing, seen as a potential challenger to AI. Could investor favorite D-Wave be on the verge of a short squeeze?

ReadCommented by André Will-Laudien on September 2nd, 2025 | 07:20 CEST

Silver above USD 40 – These are the 100% winners! Silver North, First Majestic, SMCI, and Alibaba!

Metal commodities are showing remarkable strength, with silver leading the way. In recent years, silver has evolved from being just a pure precious metal into an indispensable commodity for modern technologies. The metal plays a key role in electronics, batteries, and solar cells. A prime example is the year 2024, when an estimated 220 million ounces of silver were consumed in photovoltaics alone, more than twice as much as in 2021. This sharp increase in demand means that global supply can no longer meet demand, which is reflected in declining inventories on the futures exchanges. Consumers are alarmed, and mining companies now need a new strategy to bring more material to market. Speculators are now investing in the most promising projects – here is an example from the Yukon. The time to get on board is now!

ReadCommented by Stefan Feulner on August 19th, 2025 | 07:20 CEST

JD.com, NetraMark, Palantir – Opportunities in the second tier

The extremely high valuations of the big players in artificial intelligence are a thorn in the side of many analysts. The sharp rise in share prices of Nvidia and Palantir, the latter of which has already reached dot-com status with a current price-to-earnings ratio of no less than 242, means that a healthy consolidation is long overdue. In contrast, AI companies from the second and third tier are standing out, whose potential has so far been largely overlooked by investors.

ReadCommented by Fabian Lorenz on August 13th, 2025 | 07:10 CEST

BUY RECOMMENDATIONS and strong figures! Zalando, IONOS, TeamViewer, and naoo

Strong figures for IONOS! The Company is one of the beneficiaries of the planned development of a German and European AI and internet infrastructure. The latest business figures and the upward revision of the forecast were convincing and sent the share price to a new all-time high. Do analysts see even more upside potential? Social media also needs a European alternative. This is exactly what naoo offers. The stock is still flying under the radar of many investors. Analysts see potential for a multiple increase. And what are the established German tech companies Zalando and TeamViewer doing? Zalando's figures were not well received. The price targets are falling. There are positive voices at TeamViewer.

ReadCommented by André Will-Laudien on August 5th, 2025 | 07:25 CEST

Correction over? The next doublers could be Puma and Veganz, while Nike and Adidas remain under pressure!

After the DAX fell 700 points in just 24 hours, investors are wondering whether last week's correction is already over. Over 60% of all S&P 500 companies have already reported their mid-year results, but the figures have not been enough to push the index higher across the board. This gives pause for thought and suggests that the correction is set to continue. While things are going well for plant-based nutrition specialist Veganz, sports consumers are coming under increasing pressure. US tariffs are becoming a problem for Adidas in the highly competitive sneaker market, and things are also looking tight for the popular Puma models. Nike could benefit from this, but its shares are costly. Who will be able to perform better in the slow summer months?

ReadCommented by Nico Popp on August 4th, 2025 | 07:00 CEST

Is this the buying opportunity of the year? Amazon, Bank of America, Almonty Industries

Correction and comeback – on the stock market, this sequence is not always guaranteed. Sometimes a correction is also just the beginning of the end. This is especially true when business models lack substance and visions for the future burst like soap bubbles. However, corrections are often followed by spectacular comebacks that propel stocks into entirely new realms. We show that even stock market veterans like Amazon and Bank of America have tested the nerves of shareholders in the past, and draw parallels with the recent developments at tungsten producer Almonty Industries. Here, too, there are many indications that, in retrospect, the past few days are nothing more than a minor blip on the chart. History has shown that, ultimately, the facts are what truly matter.

Read