September 26th, 2025 | 08:20 CEST

Bitcoin at USD 250,000? Quantum computers conquer crypto – Favor D-Wave, Finexity and Alibaba now!

The financial markets are undergoing a profound transformation, with speed and computing power becoming decisive competitive advantages. High-performance computers have already revolutionized stock market trading by implementing complex strategies in milliseconds. At the same time, blockchain technology and crypto platforms are creating a new market that is benefiting massively from these technological developments. Whether in high-frequency trading, hedging digital assets, or building tokenized securities markets, the interplay of computing power and decentralized networks is opening up access to a whole new dimension of global financial flows. Which stocks offer opportunities?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

D-WAVE QUANTUM INC | US26740W1099 , FINEXITY AG | DE000A40ET88 , ALIBABA GR.HLDG SP.ADR 8 | US01609W1027

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

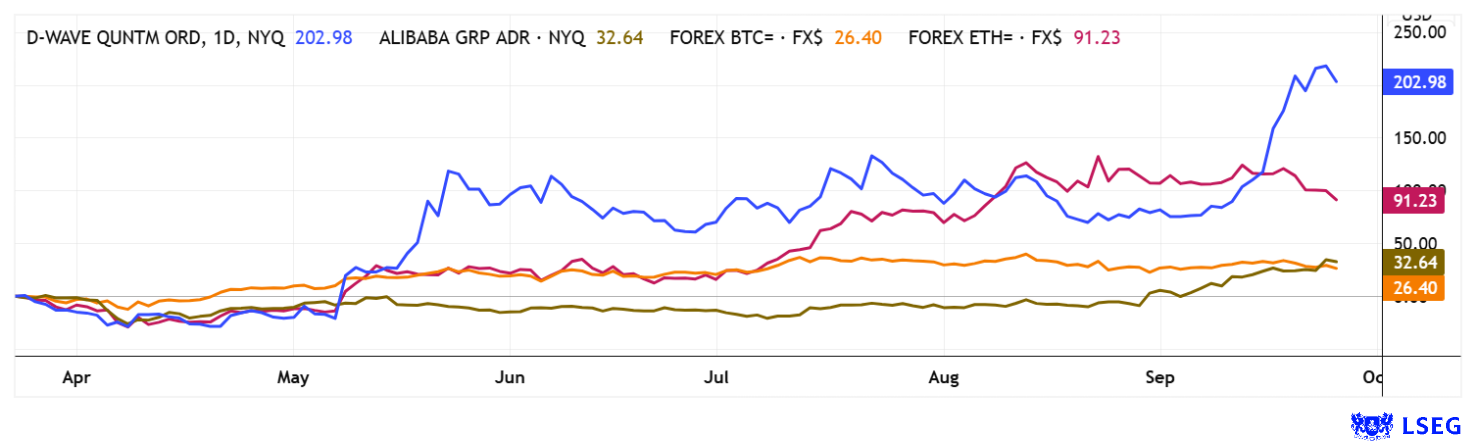

D-Wave – Access to quantum resources for Fintechs and digital assets

D-Wave Quantum shares are currently on a rollercoaster ride. In September, the stock doubled from EUR 12 to EUR 24, with some investment banks drastically raising their price targets in anticipation of steep growth. D-Wave is one of the pioneers in quantum computing and, with its focus on quantum annealing, is specifically targeting practical optimization solutions that are already commercially viable today. Unlike competitors such as IBM and Google, which are working on universal quantum computers, D-Wave is characterized by a clear market orientation. The goal is to perform complex calculations in the financial world, industry, and defense much faster.

This is becoming increasingly important in the crypto sector, as questions of encryption, liquidity optimization, and smart contract architecture are increasingly coming to the fore. With its "Leap Quantum Cloud" platform, D-Wave provides direct access to quantum resources, which also opens up new opportunities for smaller fintechs and crypto platforms. The discussion about post-quantum cryptography is generating additional attention, as D-Wave supports companies in building secure and future-proof structures. D-Wave is positioned on the NASDAQ as one of the few pure-play providers in quantum computing and is considered a promising growth stock. Experts see its strength in not relying on theoretical quantum supremacy, but rather addressing concrete, monetizable use cases. This positions D-Wave as a bridge builder at the interface between high-performance computing, quantum algorithms, and the dynamic future fields of blockchain and digital assets. But caution is advised! The future is being traded here, as the Company, which has almost no revenue, is valued at over EUR 8 billion.

Finexity AG – Strategic expansion and new market opportunities in the digital capital market

There are also interesting business models in the field of alternative capital markets in Germany. Hamburg-based Finexity AG is increasingly emerging as a key player in the European market for tokenized private market investments. Since its stock market debut on the m:access segment of the Munich Stock Exchange, the Company has been consistently expanding its capital market presence. Today, Finexity is one of the leading platforms for digital real asset investments, with over 250 listed securities and more than 84,000 registered investors. The Company continues to pursue its growth strategy through targeted acquisitions, technological scaling, and international expansion.

A key element of this development is the Company's recent market entry in Dubai, one of the world's most dynamic real estate markets. For the first time, a security regulated in Germany is giving private investors direct access to exclusive luxury real estate in the United Arab Emirates. The first step is the financing of a high-quality villa in the Al Barari district, which will be available for subscription from October 6, 2025. At the same time, professional fund structures are being created for institutional investors, with market launch planned for the first quarter of 2026. With this strategy, Finexity is establishing a new standard for international top assets in small denominations that are tradable, regulated, and fully digitized. The expansion comes at a favorable time in the market, as according to the Knight Frank Wealth Report, Dubai is one of the fastest-growing hotspots for wealthy private clients, while the Dubai International Financial Centre (DIFC) is establishing itself as a growing financial hub with over 30% more company registrations. This momentum supports the double-digit growth rates that have been seen for years in the premium and luxury segment of the real estate market.

CEO Paul Hülsmann sees the strategic addition as a decisive step for the global expansion of the issuance and trading business: Issuances in the double-digit million range are expected to follow as early as 2026, enabling targeted exposure to real estate in the UAE. At the same time, Finexity is preparing to set up a Multilateral Trading Facility (MTF) to evolve from an OTC model to a fully regulated real-time trading infrastructure. With the acquisition of Effecta GmbH as a regulatory umbrella, the integration of Swiss company Crowdli AG, and a stable shareholder base, Finexity is aligning for sustainable growth and long-term scalability. While major market players such as Deutsche Börse and Coinbase are still waiting to see how things develop, Finexity is using its agility and regulatory expertise to position itself as the leading infrastructure provider for digital real asset investments, across Europe and increasingly worldwide. With a current market capitalization of just EUR 56 million, the stock offers an attractive entry point.

Alibaba - Strong AI and cloud offensive drives share price

Alibaba launched an AI and cloud offensive in 2025, and the NASDAQ's resentment also seems to have evaporated. The share price has recovered from its previous lows of around USD 80 and has recently shown strong performance, rising by over 70% in the last 12 months. The Company is massively expanding its AI infrastructure, with planned investments of around 380 billion yuan (USD 53 billion) over three years, including its own language models and cloud applications. Alibaba Cloud is establishing itself as a serious competitor to Amazon Web Services in the Asian market. It is expanding globally with new data centers in Brazil, France, and the US, among other locations.

Alibaba is also pushing ahead with development projects in the field of quantum computing to take computing power for AI and blockchain applications to a new level in the future. This is particularly relevant for interfaces to crypto platforms, as quantum computing offers potential for optimizing transactions, security, and smart contracts. Alibaba is researching quantum algorithms and infrastructures in order to take a leading role in post-quantum cryptography in the long term. In the crypto market, Alibaba is also benefiting from the increasing use of tokenized assets and blockchain-based financial applications, which must operate with high computing capacity and security.

Despite positive growth prospects, regulatory uncertainties and geopolitical tensions between China and the US remain a drag on the stock's valuation. Nevertheless, analysts see opportunities, particularly in the strong growth of the cloud and AI business, which is considered a key pillar for the future. There are 38 positive analyst reports on the LSEG platform, but the average 12-month price target of USD 176 has already been reached. This rally seems to have been missed!

D-Wave, Alibaba, and Finexity AG represent three key future trends: quantum technology, digital platform economics, and tokenized capital markets. D-Wave is a speculative growth stock whose quantum computing technology opens up enormous application potential in AI, logistics, and cryptography. Despite regulatory risks, Alibaba remains a leading player in e-commerce and cloud business with a strong market position and global expansion. Finexity, in turn, democratizes access to alternative investments such as real estate or private equity through tokenized securities. A mix makes sense in the portfolio for risk management reasons.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.