September 2nd, 2025 | 07:20 CEST

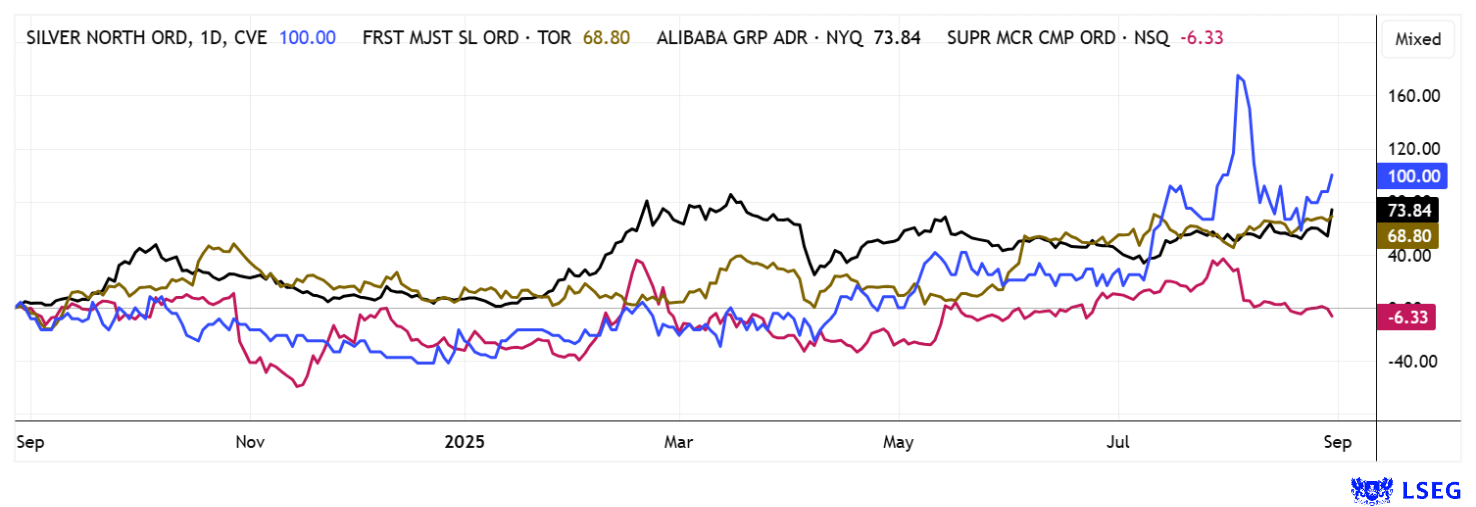

Silver above USD 40 – These are the 100% winners! Silver North, First Majestic, SMCI, and Alibaba!

Metal commodities are showing remarkable strength, with silver leading the way. In recent years, silver has evolved from being just a pure precious metal into an indispensable commodity for modern technologies. The metal plays a key role in electronics, batteries, and solar cells. A prime example is the year 2024, when an estimated 220 million ounces of silver were consumed in photovoltaics alone, more than twice as much as in 2021. This sharp increase in demand means that global supply can no longer meet demand, which is reflected in declining inventories on the futures exchanges. Consumers are alarmed, and mining companies now need a new strategy to bring more material to market. Speculators are now investing in the most promising projects – here is an example from the Yukon. The time to get on board is now!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

SILVER NORTH RESOURCES LTD | CA8280611010 , FIRST MAJESTIC SILVER | CA32076V1031 , SUPER MICRO COMPUT.DL-_01 | US86800U1043 , ALIBABA GR.HLDG SP.ADR 8 | US01609W1027

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Silver explosion: Scarce supply meets booming industry

Silver has sent a strong signal with its recent surge, demonstrating once again that it is no longer just gold's little brother. With a 40% price increase over the last twelve months, it has clearly outperformed gold. The reasons lie in the tight supply situation, as there are only around 240 active silver mines worldwide, compared to more than 1,300 gold mines. Added to this is the rapidly growing demand. The solar sector and electromobility in particular are driving demand. Electric vehicles contain significantly more silver than combustion engines, with 25 to 80 grams. It is used in switches, relays, inverter modules, and battery management systems. With the increasing digitalization of vehicles, consumption is likely to rise further. According to the Silver Institute, demand in the transport sector could even double by 2030. There are also other areas of application in semiconductors and medical technology. Physical stocks on the futures markets are currently falling dramatically, exacerbating the supply deficit. Silver is thus well on its way to establishing itself as a strategic metal of the future. For investors, explorers and developers offer the greatest leverage, as even small price movements can lead to significant gains.

First Majestic Silver – On the rise after the integration of Cerro Los Gatos

Producer First Majestic Silver was able to take advantage of the current dynamic environment and recorded revenue growth of 94% to around USD 264 million in Q2 2025, a new quarterly record. Silver production, calculated in equivalents, rose by 48% to 7.9 million ounces. In addition to a strong EBITDA of just under USD 120 million, the Company achieved a net profit of USD 56.6 million and holds a liquidity reserve of over USD 510 million. First Majestic was able to further optimize its production and successfully advance the integration of the Cerro Los Gatos mine, which promises future cost savings and synergies. The current annual performance of almost 50% reflects a resurgence of the producer, even though the political situation in Mexico must continue to be closely monitored. The share is currently trading at CAD 12.57 and was once close to CAD 20, but analysts on the LSEG platform only see a 12-month average price target of around CAD 14. This will certainly need to be recalculated soon!

Silver North – Silver boom in the Yukon region sets new standards

The Yukon region of North America presents a promising picture for silver investors with the Tim and Haldane projects from Silver North Resources (SNAG). The Haldane project, adjacent to the well-known Hecla Mining area, is considered underexplored but hosts silver grades of up to 300 grams per ton. The Tim property, easily accessible and close to Coeur Mining's Silvertip mine, shows anomalous silver-lead-zinc values and is considered promising for carbonate replacement deposits (CRD). Coeur Mining conducted an initial drilling program at Tim in 2024 and can secure up to 80% under the option agreement.

Silver North has now completed the exploration program for the Veronica project, part of the GDR project adjacent to Tim, which is supported by the Yukon government. The eight-day survey included soil sampling, mapping, and manual trenching. Initial findings of galena and assay samples indicate promising CRD-style mineralization similar to that of the Silvertip mine 16 km to the southwest. These results reflect the potential for significant deposits to be discovered in this new zone for the first time. Assay results are expected in October and could mark a significant advance for the area. In addition to Haldane and Tim, Silver North also owns the GDR project and plans further strategic acquisitions in favorable jurisdictions.With the support of partners such as Coeur Mining, which contribute further expertise and financial resources, Silver North could grow into a significant silver producer in the vast Yukon and British Columbia area in the long term. The combination of high-grade silver projects, active partnerships, and a dynamic exploration program underscores Silver North's strong growth potential and makes the stock particularly attractive in this dynamic environment with a market value of only CAD 13 million.

Alibaba and SMCI – Fallen far, but promising

As high-tech stocks, Alibaba and Super Micro Computer (SMCI) are part of the current cloud megatrend and depend on stable supply chains in the strategic metals sector. So far in 2025, both companies have exhibited distinct price trends and business prospects. Following years of regulatory uncertainty and geopolitical tensions in China, Alibaba has experienced a robust counter-movement, recovering by around 55% since the beginning of 2025. The Company reported a jump in earnings from USD 1.39 to USD 2.57 per share in the last quarter, along with a significant improvement in its operating margin, driven by rising cloud and e-commerce revenues. Alibaba is currently investing billions to expand its cloud business. Analysts on the LSEG platform are divided: many see the potential in Alibaba Cloud as AWS's strongest competitor in Asia, but warn of ongoing political risks. The average price target is USD 151.50, which is only around 7% potential after the jump to over USD 140 at the beginning of the week. Investors should keep an eye on the uncertainties in China and Alibaba's ongoing transformation.

SMCI in 2025 is also demonstrating very strong operational momentum, with a focus on server solutions and high-performance components, particularly for cloud data centers and AI applications. SMCI is benefiting from strong demand for high-performance data center solutions and reported impressive growth rates of 47% in revenue and an even more substantial increase in order intake for the 2024/25 fiscal year (ended June 30). The stock has underperformed many traditional tech stocks over the past 12 months. Nevertheless, management forecasts for the new fiscal year remain optimistic, especially with regard to international expansion plans. SMCI shares suffered a slump last week due to repeated indications of internal accounting problems. This issue had already caused SMCI to lose around 60% of its share price in 2024. Despite a 2025/26 P/E ratio of only 16.5, the stock is highly volatile – caution is advised!

Precious metals are starting the challenging stock market month of September with strong gains. Gold has technically managed to regain the USD 3,400 mark, while silver has broken through the USD 40 mark. For explorer Silver North, the Veronica zone offers excellent prospects for another significant silver discovery in an emerging district. Producer First Majestic is also performing well. Meanwhile, tech stocks Alibaba and SMCI are showing mixed results.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.