Sustainability

Commented by Armin Schulz on January 21st, 2026 | 09:35 CET

The winners of the Energy Transition 2.0: How Nordex, RE Royalties, and E.ON are now generating returns

The next stage of the energy transition is dawning. Success will no longer be determined by subsidies, but by economic pragmatism. While the government is artificially suppressing electricity prices with record billions, the systemic question is becoming more acute. The new focus is on cost efficiency and security of supply. But financing is also raising questions following the rise in interest rates. In this period of upheaval, three players are showing how decarbonization can succeed even without permanent subsidies: wind power pioneer Nordex, financing expert RE Royalties, and infrastructure giant E.ON.

ReadCommented by Fabian Lorenz on January 20th, 2026 | 07:15 CET

The dirty GOLD RISK! RZOLV Technologies with a billion-dollar opportunity and takeover fantasy!

With a price of around USD 4,600 per troy ounce, there is a gold rush atmosphere. But there is a risk that mine operators and authorities alike fear: cyanide. This highly toxic chemical is becoming key, especially for low-grade deposits that are now profitable again. It was also responsible for one of Europe's biggest environmental disasters. This is precisely where RZOLV Technologies comes into play. The Canadian company is working on a water-based, biodegradable leaching formulation that is intended to replace cyanide in existing plants – without expensive conversions and at low cost. The potential is enormous. If the upcoming industrial test is successful, the stock could move up to a new league and make RZOLV a hot takeover candidate.

ReadCommented by Nico Popp on January 16th, 2026 | 07:20 CET

Green Capital 2.0: How RE Royalties is closing the gap between Hannon Armstrong and Altius

The end of cheap money is forcing wind and solar park developers into a new reality: traditional banks are withdrawing from risk financing, but the investment pressure for the energy transition remains high. Specialized royalty financiers are stepping into this vacuum. While established players such as Hannon Armstrong and Altius Renewable Royalties already dominate this segment, the still largely undiscovered player RE Royalties now offers investors the opportunity to be at the beginning of a similar growth curve. The massive gap between developers' capital requirements and what banks have to offer is the ideal breeding ground for this business model.

ReadCommented by Nico Popp on January 16th, 2026 | 07:00 CET

Trash to gas: How A.H.T. Syngas, EQTEC, and 2G Energy are making companies self-sufficient

German industry is undergoing one of its toughest trials. The "trilemma" described by analysts - volatile energy prices, rising CO2 taxes, and the physical uncertainty of the power grids - has driven production costs to a level that poses a massive threat to competitiveness. While politicians debate hydrogen pipelines that will take years to complete, innovators are already creating a new reality: decentralized energy supply from waste materials. Three players are emerging in this booming sector, working together to solve the puzzle of energy self-sufficiency. While CHP market leader 2G Energy provides the hardware for a green future with its engines and British supplier EQTEC validates gasification technology worldwide, Germany's A.H.T. Syngas Technology closes the crucial gap for small and medium-sized enterprises. With compact plants, A.H.T. transforms industrial waste into the clean gas that keeps the engines running – regardless of Putin's war or price jumps on the Leipzig energy exchange EEX.

ReadCommented by Nico Popp on January 15th, 2026 | 07:25 CET

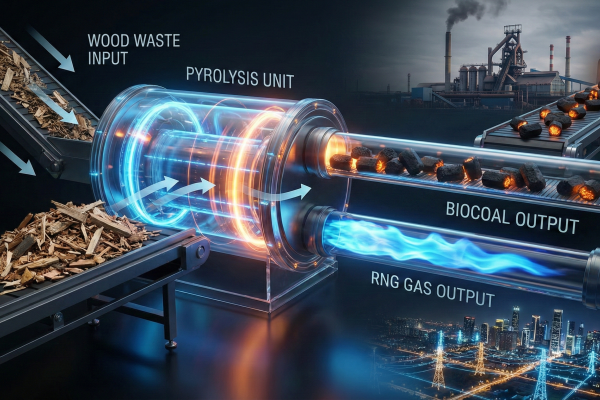

Double returns: How CHAR Technologies is closing the gap between ArcelorMittal's coal hunger and Montauk's gas profits

We are witnessing a historic turning point for global heavy industry. We are currently seeing not only a technological evolution, but also a fundamental revaluation of industrial assets, driven by two parallel megatrends: the decarbonization of primary steel production and the monetary revaluation of waste streams for energy security. While regulatory constraints are forcing steel giants such as ArcelorMittal to reinvent their blast furnaces, and specialists such as Montauk Renewables are demonstrating the enormous valuations possible in the renewable natural gas (RNG) market, CHAR Technologies is positioning itself at the intersection of these two worlds. With its proprietary high-temperature pyrolysis technology, the Canadian company provides the answer to both questions at once: it produces biochar for the steel industry and RNG for the energy grid – from a single waste source.

ReadCommented by André Will-Laudien on January 14th, 2026 | 07:40 CET

Price explosion ahead! Alibaba flexes its muscles, RE Royalties up 40%, and TeamViewer on the launch pad!

The markets are proving highly dynamic at the start of the year. Yesterday, the DAX climbed to a new all-time high of over 25,400 points. There have been minor corrections among the high-tech winners of 2025, but the focus is now shifting to small caps and old favorites, which can now take off unchallenged. Alibaba is making an impressive comeback in China, RE Royalties is off to a strong start with a 40% gain, and the much-maligned TeamViewer is finally posting a satisfactory quarter. How quickly will investors return here?

ReadCommented by Carsten Mainitz on January 13th, 2026 | 07:20 CET

Enormous growth ahead due to hunger for electricity: CHAR Technologies, Siemens Energy, and Nel – Who is in the lead?

Global electricity demand is exploding. What was once considered a stable, moderately growing market has been transformed by two powerful megatrends. AI applications, cloud infrastructures, and energy-intensive data centers are causing electricity demand to rise sharply. At the same time, decarbonization is putting increasing pressure on the economy and society. Many countries have committed to climate neutrality by 2050. This raises a key question for investors: Who can satisfy the growing demand for electricity in a reliable, affordable, and climate-neutral way?

ReadCommented by Armin Schulz on January 12th, 2026 | 07:10 CET

The license to mine: With RZOLV Technologies, Barrick Mining and Agnico Eagle could gain new scope - without cyanide

Gold mining has long relied on a single, highly toxic molecule: cyanide. Today, tightening regulations, rising ESG scrutiny, and increasingly complex ore bodies are challenging this long-standing industry standard. A paradigm shift is emerging in which access to clean extraction technology, rather than mere ownership of the metal, is becoming the decisive strategic lever. This change is casting innovative providers such as RZOLV Technologies and established mining giants such as Barrick Mining and Agnico Eagle in a new strategic light.

ReadCommented by Nico Popp on January 8th, 2026 | 07:10 CET

Gold rush without toxins: Why Newmont and Equinox are under pressure, and RZOLV Technologies could become the key stock of the new super cycle

Gold is back on the big stage. Driven by geopolitical hot spots, structural weakness in the US dollar, and the insatiable appetite of central banks, the precious metal is racing from one all-time high to the next. But while prices are rising, the situation for mine operators is deteriorating: dependence on highly toxic cyanide is becoming more and more of a problem. Environmental regulations are becoming stricter, approval procedures are dragging on for decades, and social resistance is blocking billion-dollar projects. The technology company RZOLV Technologies is positioning itself in this area of tension between record prices and ecological dead ends. While industry giants such as Newmont and Equinox Gold are looking for ways to secure their production in a sustainable manner, RZOLV is providing the long-awaited technological answer: gold extraction that does not require any toxic chemicals and thus has the potential to reshuffle the cards in global mining.

ReadCommented by André Will-Laudien on January 5th, 2026 | 07:30 CET

Double-digit start to 2026 for Plug Power, Nel ASA, CHAR Technologies, and thyssenkrupp nucera

Things are continuing as they ended in 2025: high volatility, challenging circumstances, and political upheaval. Now the guns are speaking again, because there is no peace in Ukraine after all, putting defense stocks back at the top of the shopping list. However, after years of decline, investors are now venturing back into the alternative energy sector. Since the hydrogen boom in 2021, the industry's protagonists have lost up to 90% of their share price value. So why not venture back into an area where money has not flowed for a long time? Biomass specialist CHAR Technologies is a newcomer on the scene. The rally started here in 2025 and is likely to continue. thyssenkrupp nucera is also worth a look. After being spun off from the Duisburg-based group, the lights appear to be green!

Read