Sustainability

Commented by Fabian Lorenz on January 5th, 2026 | 07:10 CET

Solar, wind & co. with a breakthrough in 2025: Is now the time to buy Nordex, JinkoSolar, or RE Royalties stock?

The science magazine "Science" has declared the global boom in renewable energy the "Breakthrough of the Year 2025." The industry is booming. But shares in the sector are struggling. One share that clearly has catch-up potential is RE Royalties. The financing company has a convincing, diversified business model, and its dividend yield currently stands at a sensational 16%. The stock should really be moving higher. 2025 was very volatile for JinkoSolar. A halving of the share price was followed by a doubling. What do analysts say? One of the clear high flyers of the sector in 2025 was Nordex. Will the rally continue?

ReadCommented by André Will-Laudien on January 2nd, 2026 | 07:15 CET

An unbelievable start to 2026: DAX record, WashTec leading the way, and BayWa, Mutares, and Steyr Motors gaining momentum

After a turbulent 2025, European investors are ending the year with solid portfolio gains. The EU confederation has decided to invest up to EUR 3 trillion in defense and to slowly increase the share of defense spending to 5% of GDP. These are huge investments in security, which at first glance will not affect consumers. In the long term, however, they are intended to create security and perhaps a new upward scenario for the ailing economy on the old continent. However, such massive spending will be largely debt-financed, as tax revenues alone are insufficient. This suggests that elevated inflation levels are likely to persist. Investors are therefore well advised to continue to reflect the positive outlook for global equities in their asset structure. The stock market is based on this paradox. High inflation means that the asset bubble will continue. Venezuela offers an extreme example - despite partial sovereign default and rampant inflation, its stock market rose more than 1,200%. Volatility will therefore remain a defining feature of markets, amplified by AI-driven trading models that increasingly anticipate human behavior. Against this backdrop, 2026 will demand strong nerves and disciplined stock selection. Best of luck navigating the year ahead.

ReadCommented by Carsten Mainitz on December 30th, 2025 | 07:20 CET

Electricity as a bottleneck for AI? Different energy sources, different approaches: American Atomics, Nordex, Siemens Energy – Who is ahead?

The electricity demand of rapidly growing AI data centers is enormous. The uninterrupted availability of energy, including infrastructure and pricing structures, is a decisive guideline for the future. Green energy from solar and wind is often presented in public debate as the means of choice, but it comes with significant drawbacks. Last year, the US corporate giant Microsoft demonstrated that radically different approaches are possible. To satisfy the power hunger of its AI data centers, Microsoft signed a 20-year contract with a domestic energy provider for the supply of nuclear power. This deal sent a remarkable signal and is emblematic of a new trend: nuclear energy. American Atomics, a newcomer to the stock market, stands out as an exciting investment in this area.

ReadCommented by André Will-Laudien on December 23rd, 2025 | 08:50 CET

Money printing presses unveiled in 2026! Where to invest now? TUI, RE Royalties, Lufthansa, and Airbus

In an inflationary environment, investors are looking for stability. What could be better suited than equity investments that pay high dividends and also follow sustainable principles? RE Royalties operates a successful business model that combines both ideas. The travel industry has also been trying to reduce its carbon footprint for years. How far have efforts to bring about a fundamental change come? TUI, Lufthansa, and Airbus showed decent returns in 2025. But what does the future hold?

ReadCommented by Stefan Feulner on December 23rd, 2025 | 07:30 CET

APA Corporation, NEO Battery Materials, JD.com – Sector rotation ahead

2025 will once again go down in history as a strong year for the stock market. This is particularly surprising from a German perspective, as the DAX, long considered an underperformer, even outperformed the leading US market with a gain of over 20%. However, anyone who believes that the coming year will be a simple continuation of this trend is likely to be disappointed. Many market observers expect prices to continue rising, buoyed by AI investments, fiscal tailwinds, and robust earnings. At the same time, however, the risks of unexpected turns are growing. High valuations, possible sector rotations, and underestimated asset classes could make 2026 a year in which flexibility is more important than blind optimism.

ReadCommented by Nico Popp on December 18th, 2025 | 07:00 CET

Dividend comeback: Why Mercedes-Benz and VW look outdated compared to RE Royalties' model

In a market phase in which interest rates have peaked, and tech stocks are ambitiously valued, investors are once again turning their attention to the oldest source of income in stock market history: dividends. But the hunt for the highest returns often turns out to be a dangerous undertaking, because a high percentage payout is usually not a sign of strength, but a warning signal for falling prices or structural problems. While German automotive giants Mercedes-Benz and Volkswagen attract investors with seemingly favorable valuations and generous returns, their business model is facing the most expensive transformation in history. In this environment, RE Royalties, a Canadian niche stock, is coming into focus. Its business model is specifically designed to generate stable cash flows from the megatrend of the energy transition without bearing the operational risks of an industrial group.

ReadCommented by André Will-Laudien on December 16th, 2025 | 07:20 CET

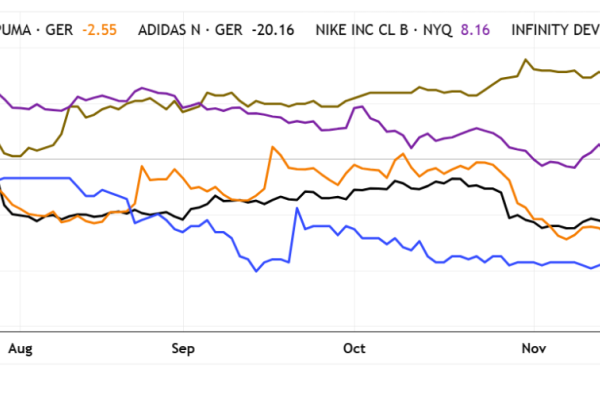

Impact investing, with super dividends into 2026 – Nike, RE Royalties, Adidas, Puma, and Infinity Development

Impact investing has become increasingly important in recent times as investors increasingly recognize that capital flows generate not only returns but also social and environmental impacts. In light of climate change, resource scarcity, and social imbalances, many market participants are no longer satisfied with using financial metrics alone as a benchmark. Regulatory authorities are promoting this development through stricter ESG requirements and greater transparency requirements for companies and financial products. At the same time, younger generations are demanding that their assets be consistent with their values and have a measurable positive impact. If you are looking for something, you will find suitable investments!

ReadCommented by Fabian Lorenz on December 8th, 2025 | 07:15 CET

RENK better than HENSOLDT? Risk at NOVO NORDISK! Billion-dollar opportunity with RZOLV Technologies!?

Is RENK's stock better than Hensoldt's? That is what analysts are saying. According to them, the transmission specialist is attractively valued at the current level. Hensoldt, on the other hand, is having problems converting its order backlog into revenue growth, leading to a significant reduction in its price target. In contrast, RZOLV Technologies shares have enormous upside potential. The Company aims to replace a toxic chemical used in gold extraction, thereby opening up a billion-dollar market. Development is nearly complete, and patents have been filed. In just a few months, RZOLV could become a hot takeover candidate. Meanwhile, takeovers currently appear to be a way for Novo Nordisk to replenish its drug pipeline, with the Danish company taking risks worth billions - Pfizer, take note.

ReadCommented by Nico Popp on December 8th, 2025 | 07:00 CET

True sustainability in the portfolio: JinkoSolar, Nordex, and the smart niche player RE Royalties

"Green" is no longer a mark of quality on the stock market, but rather a minimum requirement. However, those who mindlessly invest in anything with a solar panel or wind turbine in its logo will often have learned a costly lesson by 2025. The sector is becoming more differentiated: on the one hand, the industrial heavyweights are struggling with price wars and supply chains. On the other hand, specialized financiers are emerging who are closing precisely these gaps and often operating more profitably than the manufacturers themselves. Anyone seeking real returns must now make a clear selection: between mass-market players, turnaround candidates, and intelligent niche specialists.

ReadCommented by Armin Schulz on December 3rd, 2025 | 10:25 CET

The moat strategy promises success in your portfolio: An analysis of Palantir, RZOLV Technologies, and D-Wave Quantum

In today's stock market landscape, a sustainable competitive advantage determines exceptional returns. Real moats, whether through impenetrable software, new technologies, or revolutionary hardware, reliably shield sources of profit and regularly outperform the market. The search for such protective mechanisms leads to three pioneers who dominate their fields with technological supremacy: Palantir, RZOLV Technologies, and D-Wave Quantum.

Read