Batteries

Commented by Fabian Lorenz on October 30th, 2025 | 07:20 CET

CAUTION with Nel ASA! TAILWIND for Standard Lithium and Graphano Energy shares!

Exercise caution with Nel ASA. The Norwegian company's quarterly results yesterday caused disillusionment - there are no signs of growth. And one figure in particular should set alarm bells ringing for shareholders. On the other hand, there is strong momentum for electric mobility. While debates about the phase-out of combustion engines continue in Germany, sales of electric and hybrid vehicles are rising – both globally and in Germany! Industry's challenge is that the value chain for battery technology remains firmly in Chinese hands. Companies like Standard Lithium and Graphano Energy aim to provide raw materials from the West.

ReadCommented by Armin Schulz on October 29th, 2025 | 07:20 CET

Get in now: How DroneShield, NEO Battery Materials, and Hensoldt are benefiting from exploding defense budgets

The drone revolution is fundamentally changing warfare and driving defense spending to unprecedented heights. This technological turning point is opening up unique investment opportunities. Analysts are already talking about a supercycle in this area. Those who invest now in the key technologies of tomorrow can benefit from this structural megatrend. Three specialized companies that embody this opportunity are in the spotlight: DroneShield, NEO Battery Materials, and Hensoldt.

ReadCommented by Armin Schulz on October 29th, 2025 | 07:10 CET

In the China-commodities chess game: Power Metallic Mines as a beneficiary, BYD facing tariffs, Volkswagen on the defensive

China's new lithium export controls are creating clear winners and losers. While mining companies such as Power Metallic Mines are benefiting from the restrictive measures and rising commodity prices, other companies are facing immediate challenges. Chinese electric vehicle pioneer BYD must arm itself against trade policy countermeasures and tariffs abroad, but is fundamentally resilient thanks to its integrated supply chains. The situation is quite different for German automotive giant Volkswagen, which faces significant supply risks and is struggling to secure its battery supply and chips.

ReadCommented by Fabian Lorenz on October 28th, 2025 | 07:35 CET

DroneShield, TKMS, NEO Battery Materials! MULTIPLIERS AND NEW DISCOVERIES!

Drones, robotics, and defense are currently fueling a rush on stocks like DroneShield and TKMS. NEO Battery Materials is still a hidden gem. The Company develops advanced batteries that last longer and charge faster – ideal for drones, robots, and electric vehicles. Early orders show that commercialization has begun. When will NEO shares react? DroneShield recently impressed with a revenue increase of over 1,000%. Soon, the really big orders could be secured. TKMS, meanwhile, celebrated a successful stock market debut. Now the focus is on the Company's development. Will the next major order come from India?

ReadCommented by Nico Popp on October 28th, 2025 | 07:05 CET

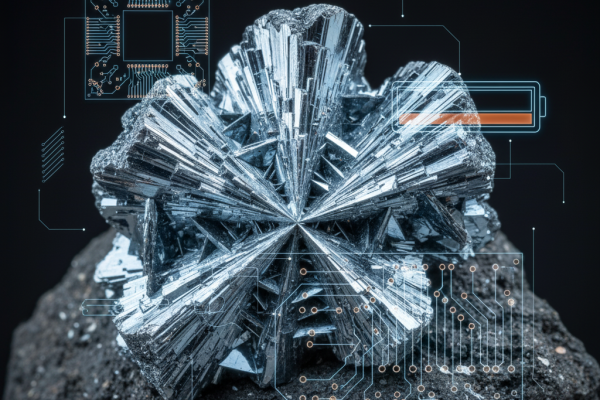

Antimony remains scarce and in demand: EnerSys, Aurubis, Antimony Resources

Antimony is a semi-metal with a silvery sheen, primarily used in lead-acid batteries, flame retardants, electronics, and military technology. In recent months, China has severely restricted its antimony exports. According to estimates, China produced around 60% of the world's antimony in 2024, followed by Tajikistan. China's dominance is heightening supply fears: as Reuters reported in June this year, US battery manufacturers are already referring to a "national emergency." This is reason enough to take a closer look at the supply chain in the West and examine the role of Antimony Resources, which recently attracted attention in the stock market.

ReadCommented by Nico Popp on October 23rd, 2025 | 07:30 CEST

Battery metals before the hype? Battery clusters are emerging in Québec: Northern Graphite, Graphano Energy, and General Motors

Graphite is a crucial material for battery anodes. Natural graphite, in particular, is in high demand and scores with its unique properties. As China tightens export restrictions on raw materials and focuses on supplying finished batteries, Western automakers like General Motors are growing increasingly concerned about supply security. At the same time, innovation is needed to remain competitive against low-cost Chinese producers. Currently, there is only one operating graphite mine in all of Canada, despite the material's strategic importance. We explain the background and introduce a potential beneficiary that has so far flown under the radar of many investors.

ReadCommented by Nico Popp on October 23rd, 2025 | 07:20 CEST

Next DRONE BOOST ahead: NEO Battery Materials, Kratos Defense, AeroVironment

Drones have become indispensable in modern warfare. That much is now clear. NATO and EU countries are therefore pooling considerable resources for unmanned systems: this year, NATO allies decided to increase defense spending to a total of 5% of economic output. Germany alone announced that it would invest EUR 10 billion in drones of all kinds in the coming years. These massive investments underscore that there is no way around drones. To ensure the supply of high-performance drones, battery technology is increasingly coming into focus. China dominates this field and has recently restricted military exports. The up-and-coming Canadian company NEO Battery Materials is closing the gap.

ReadCommented by Nico Popp on October 23rd, 2025 | 07:10 CEST

This raw materials latecomer scores with quality: Power Metallic Mines, Albemarle, Ford

Stagnation looms! After the Dutch government replaced the Chinese CEO at chip manufacturer Nexperia, chip deliveries from China to the EU have come to a halt - production stoppages are now a real threat. The supply of critical raw materials is also anything but secure today. China is tightening the reins not only on semiconductors and rare earths. Beyond strict export controls or outright bans, industry insiders report that a multitude of bureaucratic hurdles are making day-to-day operations increasingly difficult. We take a look at how Western mining and industrial companies are adapting to this new environment and explain why Power Metallic Mines has recently moved into the spotlight for many investors.

ReadCommented by André Will-Laudien on October 22nd, 2025 | 06:55 CEST

NEO Battery Materials – Batteries as the key to technological sovereignty

The situation sounds challenging! The global energy transition and the rise of autonomous systems are driving demand for high-performance batteries to historic highs. However, the dependence of Western industries on Chinese supply chains remains a geopolitical risk factor of the first order. In this tense environment, NEO Battery Materials Ltd. (NBM) is positioning itself as North America's hope for the development of cost-efficient, silicon-enhanced lithium-ion batteries. One of the newcomer's great strengths is its combination of modern and efficient materials science, cell architecture, and process optimization into an integrated solution. The focus is on establishing an independent value chain in North America. Time is of the essence, and the barrier to entry is high! Why are investors and producers lining up now?

ReadCommented by Stefan Feulner on October 21st, 2025 | 07:05 CEST

NEO Battery Materials is igniting the battery revolution in the West!

Drones, robotics, and e-mobility increasingly demand batteries with greater range, faster charging times, and lower costs. At the same time, the security of Chinese supply chains is deteriorating. This is precisely where NEO Battery Materials comes into play. With its silicon anodes (NBMSiDE®), the Company promises up to 70% higher energy density at over 60% lower production costs, while simultaneously establishing a Western supply chain suitable for defense applications. Recent orders and purchase agreements indicate that commercialization is now gaining strong momentum.

Read