Batteries

Commented by Armin Schulz on December 15th, 2025 | 07:10 CET

The secret profit chain: From zinc ore to steel to premium electric vehicles with Pasinex Resources, thyssenkrupp, and NIO

Metals such as zinc are the invisible foundation of progress. As an indispensable corrosion protection for steel in car bodies and a beacon of hope for new battery generations, this metal connects traditional industry with the technological future. This strategic convergence opens up opportunities along the entire value chain – from raw material extraction to steel refining to the final electric product. Three companies embody this transformative development: Pasinex Resources, thyssenkrupp, and NIO.

ReadCommented by Carsten Mainitz on December 15th, 2025 | 06:00 CET

Attention! Brand new developments at Siemens Energy, NEO Battery Materials, and BYD!

Energy infrastructure, electromobility, innovative battery technologies, artificial intelligence, and robotics are investment themes that will remain exciting in the coming year. These megatrends are establishing themselves thanks to sustained high demand, which is reflected in rising share prices for industry representatives. Innovative battery storage systems are becoming increasingly important. New high-performance batteries store more energy, reduce charging times, and offer greater safety. One promising second-tier company that is often overlooked is Canadian battery specialist NEO Battery Materials. We highlight its potential and that of established players Siemens Energy and BYD.

ReadCommented by André Will-Laudien on December 10th, 2025 | 07:10 CET

E-mobility to hit the roof in 2026? BYD on the rise, Graphano Energy strong and Mercedes-Benz chart breakout!

The black-red federal government plans to launch a new subsidy program for electric vehicles and plug-in hybrids at the beginning of 2026. The support is primarily aimed at people with low or middle incomes to make it easier for them to switch to electric mobility. The basic subsidy is expected to be around EUR 3,000 and can increase to a maximum of EUR 4,000 with child supplements and a bonus for very low incomes. Only vehicles with a net list price not exceeding EUR 45,000 will be eligible for funding, which means that higher-priced models will remain outside the program. Both the purchase and leasing of purely electric passenger vehicles (BEVs) and, according to media reports to date, plug-in hybrids will be eligible for funding. At the same time, the existing motor vehicle tax exemption for fully electric vehicles is to be extended, but for a maximum of 10 years and with a horizon until the end of 2035. The pendulum is therefore swinging in favor of electric vehicle manufacturers and necessary suppliers. Now is the time to get started!

ReadCommented by Nico Popp on December 8th, 2025 | 07:00 CET

Even in times of peace, these defense stocks have a future: NEO Battery Materials, Hensoldt, DroneShield

There is a lot at stake for Ukraine these days: Will there be a dictated peace, will the war continue, or is a long-term viable solution in sight after all? Some defense stocks have fallen in recent weeks. However, regardless of the current peace negotiations, it looks as if Europe in particular will have to invest heavily in military capabilities in the coming years. We explain why and present some exciting stocks.

ReadCommented by Nico Popp on December 4th, 2025 | 06:55 CET

How suppliers like Aspermont, CATL, and Continental turn the world's complexity into profit

"During a gold rush, don't sell shovels - sell treasure maps." In a world driven by technological disruption, geopolitical tensions, and the trend toward decarbonization, investors need to think one step ahead. Often, it is not the end manufacturers who benefit most, but the specialized suppliers and service providers operating behind the scenes. They take the complexity off their customers' hands – whether it is building an electric vehicle, optimizing tyre compounds, or deciding where to build the next billion-dollar mine. Those who understand this principle will find exciting options on the stock market right now. We present three companies.

ReadCommented by Armin Schulz on December 3rd, 2025 | 06:55 CET

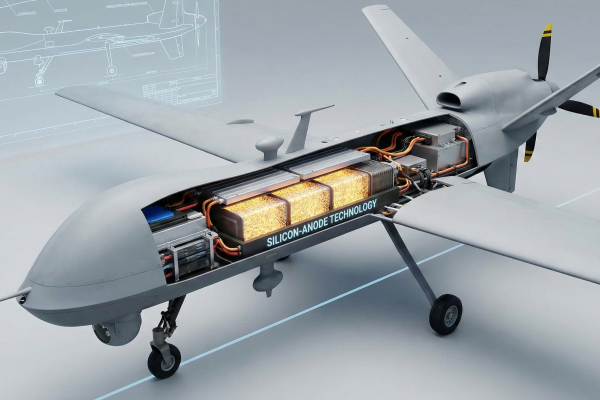

Benefit from the megatrends of electrification, AI, and security with BYD, NEO Battery Materials, and DroneShield

The next technological revolution is unfolding not only on the roads, but also in the air and in data centers. Outstanding high-performance batteries that offer more energy, faster charging times, and maximum safety are driving this development far beyond the automotive industry. They are fueling a race for the optimal cell chemistry and opening up great opportunities in future markets such as artificial intelligence, robotics, and defense. This momentum is strengthening electric vehicle market leader BYD, Canadian battery specialist NEO Battery Materials, and drone security expert DroneShield.

ReadCommented by Carsten Mainitz on November 28th, 2025 | 07:00 CET

Attention! Major Updates from NEO Battery Materials, Xiaomi, and RWE

Geopolitics are once again dominating global headlines. A 28-point plan brokered by the United States aims to end the war between Russia and Ukraine and pave the way toward sustainable peace. Viewed soberly, an approaching end to the war puts pressure on defense stocks. One area that has gained significant importance due to the Ukraine conflict is drones. Battery technology is playing an increasingly important role here. However, the use of powerful batteries is also essential in many other areas, such as robotics. The still largely unknown NEO Battery Materials is delivering one positive update after another. How can investors benefit now?

ReadCommented by André Will-Laudien on November 28th, 2025 | 06:55 CET

New tax incentives for e-mobility in 2026 – The spark for BYD, Nio, Graphano Energy, and VW

The German government is planning to reintroduce an electric vehicle subsidy for private individuals. Currently, there are only purchase incentives for companies and tax advantages for purely electric company cars. In its coalition agreement, Berlin has now promised various purchase incentives for electric vehicles. This includes the reintroduction of an e-mobility bonus for private individuals. The government confirmed this plan at the German auto summit in early October. The plan is to support low- and middle-income households in making the transition to the new era of mobility. In addition to funds from the European Climate Social Fund, a further three billion euros will be available for this purpose until the end of 2029. The details of the subsidy have not yet been announced. Meanwhile, business with electric vehicles is still sluggish. Clearly, people are waiting for the new tax breaks. Which stocks are in focus?

ReadCommented by André Will-Laudien on November 26th, 2025 | 06:55 CET

AI, Bitcoin, and e-mobility in the eye of the storm! Opportunities at BYD, NEO Battery Materials, and Strategy

It is not just the stock markets that are running at full throttle! On days when Nvidia reports its quarterly figures, investors' nerves are on edge, and global power infrastructures are pushed to their limits. That is because the whole world is watching the pioneer of AI infrastructure, which briefly crossed the USD 5 trillion valuation mark in October before slipping back toward USD 4.5 trillion. Since then, trading in AI-related stocks on the NASDAQ has been dominated by profit-taking. The one-way rally appears to be losing momentum, but then again, it has been around for three years now. Amid this consolidation, three stocks in AI, battery materials, and e-mobility are offering attractive entry points. Read on to discover where new opportunities may emerge.

ReadCommented by Armin Schulz on November 25th, 2025 | 07:40 CET

Mercedes-Benz searches, Graphano Energy finds, Siemens Energy uses: The three stocks for the next phase of energy storage

The global energy transition is heating up the market for critical raw materials. The spotlight is on a true jack-of-all-trades: graphite. Without it, lithium-ion batteries, which power electric vehicles and modern energy storage systems, simply would not work. But supply is lagging behind rapidly growing demand. This gap poses enormous challenges for supply chains. It is driving up prices, opening up exciting opportunities for companies – both those that source the raw materials and those that forge high-tech products from them. We therefore take a closer look at automotive giant Mercedes-Benz, raw materials expert Graphano Energy, and energy professional Siemens Energy.

Read