Batteries

Commented by Stefan Feulner on December 23rd, 2025 | 07:30 CET

APA Corporation, NEO Battery Materials, JD.com – Sector rotation ahead

2025 will once again go down in history as a strong year for the stock market. This is particularly surprising from a German perspective, as the DAX, long considered an underperformer, even outperformed the leading US market with a gain of over 20%. However, anyone who believes that the coming year will be a simple continuation of this trend is likely to be disappointed. Many market observers expect prices to continue rising, buoyed by AI investments, fiscal tailwinds, and robust earnings. At the same time, however, the risks of unexpected turns are growing. High valuations, possible sector rotations, and underestimated asset classes could make 2026 a year in which flexibility is more important than blind optimism.

ReadCommented by Nico Popp on December 23rd, 2025 | 07:00 CET

Nickel sulfides: The formula for profitability – why Power Metallic Mines is hot on the heels of Talon Metals and Magna

The nickel market is currently undergoing a split that offers investors clear guidance: while countless projects are failing due to low ore grades, skyrocketing energy costs, or politically unstable locations, a small group of winners is emerging. The formula for success is high-grade sulfide deposits in North America. Companies such as Talon Metals, which became known through a supply deal with Tesla, and Magna Mining in Canada's historic Sudbury Basin have proven that this geological constellation is the key to profitability. Power Metallic Mines is following in their footsteps. With its NISK project in Quebec, the Company has the geological ingredients of the two companies mentioned above, but is trading at a significant discount on the stock market, reflecting the past rather than the potential confirmed by drilling and the entry of several mining billionaires.

ReadCommented by André Will-Laudien on December 22nd, 2025 | 06:55 CET

Will 2026 start with another surge? We evaluate BYD, NEO Battery Materials, and DroneShield

In December, many market participants start thinking about the next investment period – in this case, the year 2026. The 2025 investment year was one of the best periods of the past 20 years for both the DAX and the NASDAQ, with gains of 18.7% and 20.8%, respectively. Even the Trump tariff crash in April was offset entirely within just two weeks. The drivers of the upswing remain the US administration's policy, which is perceived as "supportive," as well as ongoing geopolitical conflicts and still tolerable interest rates between 2.7% (Bund) and 4.0% (USD Treasury) in the ten-year range. For the coming year, some experts expect another wave of inflation, high commodity prices, and rising energy costs. These are all factors that could once again stifle the economic upturn and bring additional volatility to the markets. And let's not forget: AI and defense seem to be at their peak — so who will lead the next revaluation of the stock markets?

ReadCommented by Armin Schulz on December 22nd, 2025 | 06:00 CET

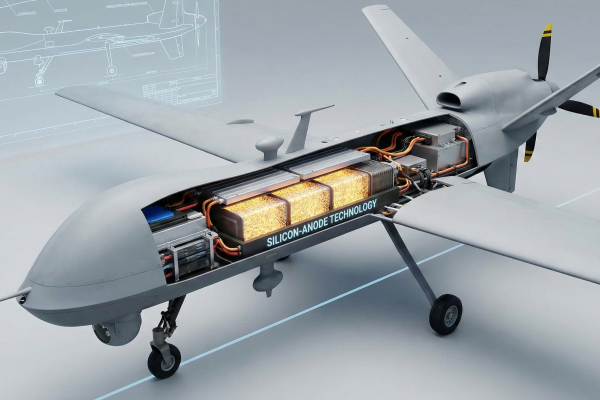

The key to billions in profits: High-performance batteries in the spotlight at NEO Battery Materials, Volkswagen, and DroneShield

While sluggish economic data currently dominates, disruptive technologies are unleashing enormous profit potential. Artificial intelligence, electromobility, and new safety requirements are fueling demand for specialized high-performance batteries. These key components are driving not only autonomous vehicles, but also AI infrastructures, robotics, and drone systems, generating growth markets worth billions. We analyse NEO Battery Materials, a manufacturer of high-performance batteries, electric vehicle manufacturer Volkswagen, and drone specialist DroneShield.

ReadCommented by Armin Schulz on December 16th, 2025 | 07:05 CET

The trio for the raw materials revolution: Why you should invest in European Lithium, Standard Lithium, and Lynas Rare Earths

The global hunt for the critical raw materials of the 21st century is on. Driven by rapid electrification and geopolitical upheaval, demand for lithium and rare earths is exploding, while supply is struggling. This fundamental discrepancy is creating a historic market imbalance and catapulting companies that can close strategic supply gaps into the spotlight. Three companies in particular are coming to the fore, whose stories are directly interwoven with the biggest megatrends of our time: European Lithium, Standard Lithium, and Lynas Rare Earths.

ReadCommented by Fabian Lorenz on December 16th, 2025 | 07:00 CET

Great potential in the defense sector! RENK, Hensoldt, NEO Battery Materials

Milestone at NEO Battery Materials! With the lease of its new operational battery facility, NEO Battery is now ready to start commercializing its high-performance battery technology for defense, automotive and energy sectors. The new factory eliminates the need for time-consuming and costly construction. Orders and partnerships are also already in place. It is likely only a matter of time before batteries are also used in tanks. In Germany, RENK, for example, is developing drives for vehicles weighing up to 70 tons. Analysts consider the recent sell-off in defense stocks to be exaggerated. Their current favorite is Hensoldt. However, the sensor specialist is not recommended as a buy by all experts.

ReadCommented by Armin Schulz on December 15th, 2025 | 07:10 CET

The secret profit chain: From zinc ore to steel to premium electric vehicles with Pasinex Resources, thyssenkrupp, and NIO

Metals such as zinc are the invisible foundation of progress. As an indispensable corrosion protection for steel in car bodies and a beacon of hope for new battery generations, this metal connects traditional industry with the technological future. This strategic convergence opens up opportunities along the entire value chain – from raw material extraction to steel refining to the final electric product. Three companies embody this transformative development: Pasinex Resources, thyssenkrupp, and NIO.

ReadCommented by Carsten Mainitz on December 15th, 2025 | 06:00 CET

Attention! Brand new developments at Siemens Energy, NEO Battery Materials, and BYD!

Energy infrastructure, electromobility, innovative battery technologies, artificial intelligence, and robotics are investment themes that will remain exciting in the coming year. These megatrends are establishing themselves thanks to sustained high demand, which is reflected in rising share prices for industry representatives. Innovative battery storage systems are becoming increasingly important. New high-performance batteries store more energy, reduce charging times, and offer greater safety. One promising second-tier company that is often overlooked is Canadian battery specialist NEO Battery Materials. We highlight its potential and that of established players Siemens Energy and BYD.

ReadCommented by André Will-Laudien on December 10th, 2025 | 07:10 CET

E-mobility to hit the roof in 2026? BYD on the rise, Graphano Energy strong and Mercedes-Benz chart breakout!

The black-red federal government plans to launch a new subsidy program for electric vehicles and plug-in hybrids at the beginning of 2026. The support is primarily aimed at people with low or middle incomes to make it easier for them to switch to electric mobility. The basic subsidy is expected to be around EUR 3,000 and can increase to a maximum of EUR 4,000 with child supplements and a bonus for very low incomes. Only vehicles with a net list price not exceeding EUR 45,000 will be eligible for funding, which means that higher-priced models will remain outside the program. Both the purchase and leasing of purely electric passenger vehicles (BEVs) and, according to media reports to date, plug-in hybrids will be eligible for funding. At the same time, the existing motor vehicle tax exemption for fully electric vehicles is to be extended, but for a maximum of 10 years and with a horizon until the end of 2035. The pendulum is therefore swinging in favor of electric vehicle manufacturers and necessary suppliers. Now is the time to get started!

ReadCommented by Nico Popp on December 8th, 2025 | 07:00 CET

Even in times of peace, these defense stocks have a future: NEO Battery Materials, Hensoldt, DroneShield

There is a lot at stake for Ukraine these days: Will there be a dictated peace, will the war continue, or is a long-term viable solution in sight after all? Some defense stocks have fallen in recent weeks. However, regardless of the current peace negotiations, it looks as if Europe in particular will have to invest heavily in military capabilities in the coming years. We explain why and present some exciting stocks.

Read