November 10th, 2025 | 07:00 CET

Takeover fever! BYD is amazed, Graphano celebrates, and Lyft buys FreeNow from Mercedes and BMW!

If the electric vehicle market wants to overtake combustion engines, further advances in battery technology are still needed. Consumers need to be convinced, which means that economic realities should be at the forefront of their purchasing decisions. Major innovations require high-performance materials, including graphite, which is a key component of modern lithium-ion batteries. Graphite contributes to a greater range, higher energy density, and improved safety. At the same time, innovative approaches to silicon anodes and novel cathode materials are ensuring more efficient and cost-effective production processes. With the steady expansion of charging infrastructure, range anxiety among consumers is diminishing, further boosting the adoption of e-mobility. This highly dynamic innovation environment thus opens up attractive prospects for both technology developers and investors, as the industry is changing rapidly.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , Graphano Energy Ltd. | CA38867G2053 , MERCEDES-BENZ GROUP AG | DE0007100000 , BAY.MOTOREN WERKE AG ST | DE0005190003

Table of contents:

"[...] Silumina Anodes® is a ceramic-coated graphite/silicon anode composite material that we plan to produce in Schwarze Pumpe, Saxony. Here, we aim to supply manufacturers of batteries for e-cars with an application-ready drop-in technology that is low-cost, high-performance and safe. [...]" Uwe Ahrens, Direktor, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD – The luxury brand Yangwang is launched

BYD is now launching its next coup in the e-mobility storm. In order to compete in the upper segment, the Company is now preparing to launch the luxury brand Yangwang for the European market. Founded in 2023, Yangwang focuses on the luxury electric vehicle segment. Yangwang aims to compete even in the ultra-luxury segment with established brands such as Bentley, Rolls-Royce, and Porsche. The Chinese powerhouse is relying on a combination of advanced technology, power, and self-assured luxury. All vehicles will be equipped with state-of-the-art electric drives, such as the Yangwang U8, a luxury SUV that can achieve power ratings of up to 1,200 hp and accelerates from 0 to 100 km/h in approximately 3.6 seconds. The vehicle range includes sporty sedans such as the Yangwang U7 and supercars such as the U9 or the U9 Xtreme, which can be built with up to 3,000 hp and have even set a world speed record in recent tests. Fully electronic, there are advanced driver assistance systems with multiple cameras, radar, and LiDAR sensors to support semi-autonomous driving.

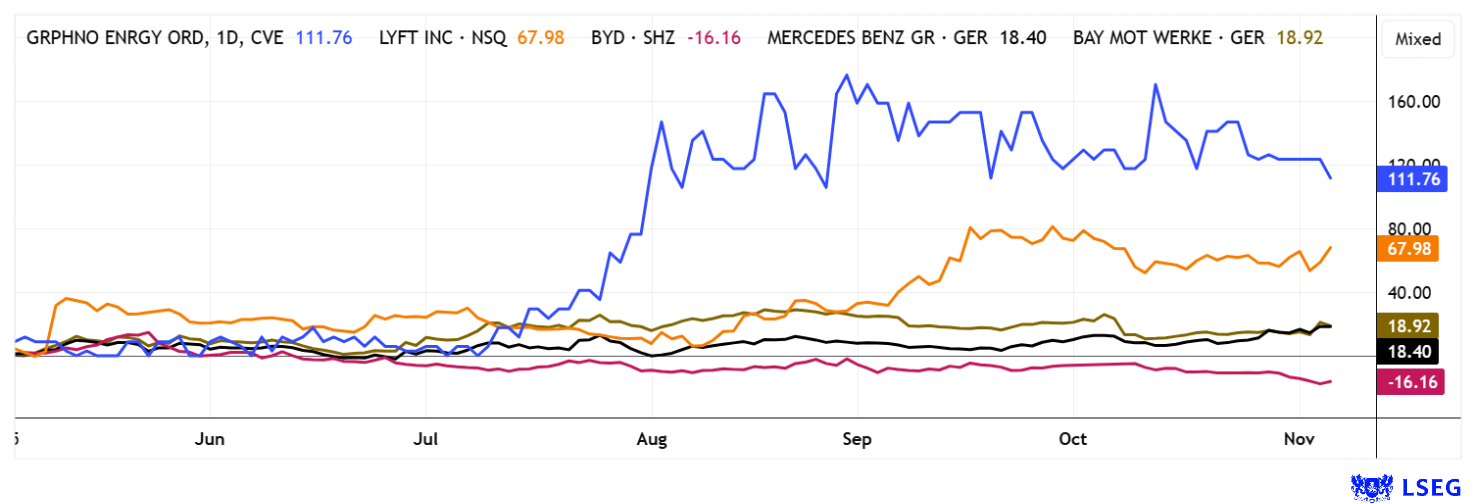

In their home market of China, Yangwang vehicles are already very expensive, with an entry-level price equivalent to EUR 120,000, and a price well above EUR 200,000 is expected for the EU. BYD is positioning Yangwang as a technological showcase for its electric mobility expertise, with the brand set to be launched in Europe as early as 2026. It remains to be seen whether it will immediately gain a foothold in this segment, as consumers who spend more than EUR 200,000 have so far tended to opt for combustion-engine cars with a real "man's engine." BYD shares, on the other hand, have been a real tragedy over the last 12 months. The stock is currently in the red, but in terms of valuation, the 2026 P/E ratio has now reached a low of 11.1. Exciting!

Graphano Energy drives Québec's battery raw materials offensive

Those building batteries need access to graphite. One of the up-and-coming developers of graphite resources with a strong project pipeline in Québec, Canada, is Graphano Energy. The Company is positioning itself as a new key supplier for the raw material-hungry battery and energy storage industry, which is increasingly dependent on secure, local sources of critical raw materials. The focus is on the flagship Lac Aux Bouleaux ("LAB") project, located in close proximity to Northern Graphite's Lac des Îles Mine, currently Canada's only active graphite mine. A cooperation agreement for the joint use of the processing facility at Northern Graphite opens up potentially significant cost advantages for Graphano as it transitions into production. In addition, the Company benefits from tax incentives from the province of Québec, which specifically promotes investment in strategic raw materials. With the Standard Mine project, Graphano has a second, already advanced deposit with positive resource figures and encouraging metallurgical results. An updated resource estimate is expected later this year, while the feasibility study is planned for 2026. North America needs more active sites to meet its industrial demand, and Graphano is poised to deliver.

The recently discovered Black Pearl property has been added to the portfolio. Initial drill results confirmed near-surface, high-grade graphite mineralization with peak values of 11.33% Cg over 8.61 m and 17.9% Cg in channel samples over 9 m. As a result, the Company was able to further extend the zones along several conductive trends and identify additional high-grade intersections. The results are consistent with the established deposits in the Lac-des-Îles region and underscore the district potential of the entire Black Pearl Zone. According to CEO Dr. Luisa Moreno, the results validate the geological model and mark an important milestone on the path to resource expansion. The Black Pearl property comprises 84 claims covering 4,149 hectares and remains largely unexplored outside the current drill zones. Together with Standard Mine, which has indicated resources of 950,000 tonnes at 6.27% Cg and inferred resources of 980,000 tonnes at 7.16% Cg, this creates a contiguous, large-scale graphite project area of regional significance. Graphano is thus positioning itself at the heart of an emerging commodity corridor that combines clean energy, infrastructure, and skilled labor.

Graphite remains an indispensable component of lithium-ion batteries, which form the foundation of the global energy transition. With new battery production starting up in Europe and North America, Graphano's development schedule coincides precisely with the industrial turning point. Graphano shares (ticker symbol: GEL) are tradable in Canada and Germany. With a market capitalization of only around CAD 3.3 million and consistently positive exploration results, the Company offers considerable upside potential. The early bird catches the worm!

Mercedes and BMW – Lyft buys mobility subsidiary FreeNow

The industry is in turmoil, as surveys show that only 36% of young people still rely on individual mobility and are more inclined toward innovative sharing and pooling concepts in the future. This is where Uber's competitor Lyft comes into the picture. With the EUR 175 million purchase of the FreeNow activities of Mercedes-Benz and BMW, the San Francisco-based short-distance ride provider is making the leap into Germany. The acquisition doubles Lyft's addressable market size to over 300 billion private short trips per year, narrowing the gap with Uber and opening up access to the affluent German middle class. Lyft is focusing on driverless vehicles in the long term, but in the short term, the aim is to forge new partnerships with local taxi companies, authorities, and fleet operators in several European countries.

For BMW and Mercedes, the sale meant that they could focus on their core business and more easily implement efficiency improvements after their hopes of playing a leading role in the global mobility market with FreeNow had not been fulfilled. Lyft plans to migrate the digital platform to its own technology by the end of 2026 and aims to merge the brands in the medium term. Lyft and FreeNow are working closely together to leverage synergies and develop new features for passengers and drivers. For the much-maligned German automotive stocks, it is time for their in-house expertise to return to the spotlight. At this price level, investors receive dividends of 6 to 7% from Mercedes-Benz and BMW, and, given the estimated 2026 P/E ratios of 5.5 to 7.2, they cannot really go wrong. But who knows what will happen in Germany.

The automotive sector fluctuates with the innovative strength of battery technology. Sales of electric vehicles have recently picked up again, with some states revising their tax incentives. Mobility providers like Uber and Lyft are demonstrating that transportation can also be completely rethought. Sharing models are particularly popular among younger generations and will force the industry to come up with new concepts for the future. For investors, this makes the sector particularly exciting, with Graphano Energy positioned at the forefront as a key supplier of raw materials for battery technology.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.