AI

Commented by André Will-Laudien on September 30th, 2025 | 07:35 CEST

High-tech super boom! 1,000% no problem—here is more from D-Wave, NetraMark and Palantir!

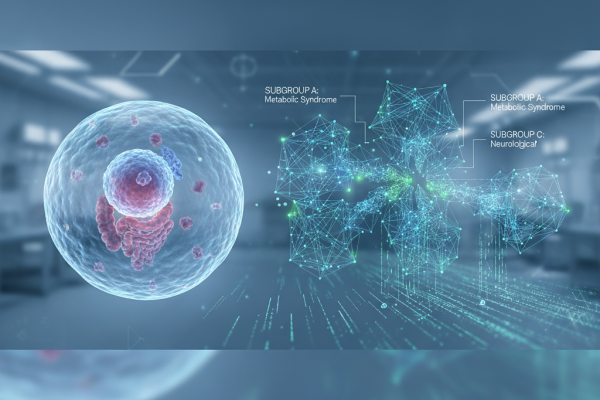

Artificial intelligence (AI) is currently revolutionizing drug development by analyzing enormous amounts of data in a very short time and making clinical trials much more targeted. Modern AI systems make it possible to select drug candidates with precision and predict the potential success of a therapy with a high degree of accuracy. Companies like NetraMark are already using these technologies profitably. Players such as D-Wave and Palantir are also among the pioneers of the new AI-driven economy and have seen their share prices rise by over 1,000%. Expectations for further growth are virtually limitless. The advent of quantum computer technology also marks the beginning of a new chapter in ultra-fast data processing. For forward-looking investors, this opens up attractive entry opportunities in dynamically expanding future markets. Those who bet on the right players early on can benefit from this change to an above-average extent.

ReadCommented by Stefan Feulner on September 29th, 2025 | 07:05 CEST

SAP, Aspermont, AppLovin – AI models with powerful upward momentum

The combination of big data and artificial intelligence is considered one of the biggest growth drivers of the coming decade. Companies that manage to efficiently collect and evaluate vast amounts of data and make it usable in real time not only gain competitive advantages but also redefine entire industries. Whether in healthcare, finance, commodities, or industry, those who use data intelligently can optimize processes, reduce costs, and develop entirely new business models. Investors should not underestimate this dynamic.

ReadCommented by Nico Popp on September 26th, 2025 | 07:30 CEST

AI is conquering increasingly more areas: SAP and Amazon are targeting small and mid-sized businesses, while NetraMark is winning over the biotech industry

Will AI become our new god? This question is currently being explored in depth by the German philosopher Markus Gabriel in a well-known German podcast. And although the question may cause unease for many, Gabriel's conclusions are ultimately anything but pessimistic. SAP and Amazon are also looking to the future with optimism: Together with OpenAI, they are now building an AI infrastructure in Germany. The goal: to enable public authorities and companies to use the latest AI tools in a legally compliant manner, without European data leaving the continent. The initiative demonstrates that AI will conquer many more areas in the coming years. One of these areas is medical research. The innovative company NetraMark is using its AI solution to deliver faster results and lower costs for future-focused projects, such as the fight against cancer.

ReadCommented by Nico Popp on September 23rd, 2025 | 07:10 CEST

The AI doctor in your pocket: PanGenomic Health, Bayer, CVS Health

Healthcare costs are a pressing political issue worldwide - in Germany, for example, debates are resurfacing over co-payments and the requirement to see a general practitioner first. This drives more people to self-medicate. The situation is even more extreme in the US: without mandatory insurance and facing extremely high healthcare costs, almost 9% of the population is uninsured, and around 33% is underinsured, leading many citizens to turn to alternative solutions. We examine business models related to increasing personal responsibility in healthcare, with a special focus on a smaller-cap stock.

ReadCommented by Fabian Lorenz on September 18th, 2025 | 07:25 CEST

Adidas to take over Puma? Evotec with insider buying! 50% upside potential with AI stock NetraMark!

Adidas and Puma caught in merger fever? A US investor brings the spectacular idea into play. Is it a means of exerting pressure on Puma's management or a real possibility? What do analysts say? Meanwhile, Evotec is sending a signal of confidence with fresh insider purchases. However, the stock is still digesting the recent revenue forecast downgrade. Could there be fresh momentum next week? In contrast, NetraMark shares offer a 50% return. For this to happen, however, the AI-driven drug development specialist must reach the analysts' price target. Operationally, there is much to be said for this, and in comparative tests, the Company has outperformed ChatGPT and DeepSeek.

ReadCommented by Stefan Feulner on September 16th, 2025 | 07:25 CEST

Broadcom, NetraMark, Adobe – The AI wave continues to roll inexorably forward

Artificial intelligence is more than just hype; it is becoming the central driver of innovation in our time. Whether in industry, medicine, mobility, or finance, this technology is changing processes, increasing efficiency and creating new business models in almost all sectors. Companies that embrace AI early on secure clear competitive advantages. At the same time, a future market with enormous potential is opening up for investors. However, despite the rosy outlook, stock picking is also required here, as many companies are significantly overvalued.

ReadCommented by Armin Schulz on September 16th, 2025 | 07:20 CEST

Building wealth with network effects and AI: How Palantir, MiMedia, and Alibaba are making investors rich

The global economy is being driven by a new type of company: scalable platform ecosystems with predictable, recurring revenues. They leverage network effects for exponential growth and are resilient to economic fluctuations. These disruptive business models, at the intersection of AI, data, and digital connectivity, generate steady cash flows and define the investment opportunities of tomorrow. Three companies that perfectly embody this strategy are Palantir, MiMedia Holdings and Alibaba.

ReadCommented by Armin Schulz on September 15th, 2025 | 07:25 CEST

Beyond FAANG, German tech companies such as SAP, Finexity and TeamViewer also offer potential for your portfolio

While US tech giants like Meta and Google dominate the headlines, other technology companies in Germany receive little attention. But here too, on the other side of the Atlantic, innovative companies with disruptive technologies and robust business models are shaping the future and offering unique opportunities for capital growth. Reason enough to take a closer look at three German companies: SAP, Finexity and TeamViewer. We analyze the strategic decisions and innovations that will shape the next investment success story.

ReadCommented by Armin Schulz on September 12th, 2025 | 07:05 CEST

Investing in the future of medicine: A look at Novo Nordisk, NetraMark Holdings and Evotec

AI is completely transforming the pharmaceutical industry. Modern algorithms sift through vast amounts of data, identify promising therapeutic approaches, and advance drug development at record speed. This increase in efficiency is an absolute game changer. Not only does it save billions, but it also significantly increases success rates and catapults agile companies to the forefront. While cumbersome large corporations laboriously digitize their research departments, disruptive start-ups with innovative AI platforms are shaking up the market. It is precisely this dynamic that presents unique opportunities for investors, if they know how to decipher them. Today, we take a closer look at Danish pharmaceutical giant Novo Nordisk, AI specialist NetraMark Holdings, and German research service provider Evotec.

ReadCommented by Armin Schulz on September 11th, 2025 | 07:15 CEST

The Hidden Champions of 2025: Puma, Sranan Gold and AMD – Where it might be worth getting in

As an investor, it is often wise to find hidden gems rather than buy expensive market leaders. While large corporations are often overvalued, undervalued small caps offer unique opportunities. Whether as turnaround candidates, commodity gems, or technology leaders, these specialized companies have the potential to dominate their niches and initiate a quiet catch-up rally. For savvy investors, this second tier is the real source of above-average returns. Three promising candidates that embody this profile are sporting goods manufacturer Puma, gold explorer Sranan Gold, and chip designer AMD. Let's take a look at their current situation.

Read