May 30th, 2023 | 09:00 CEST

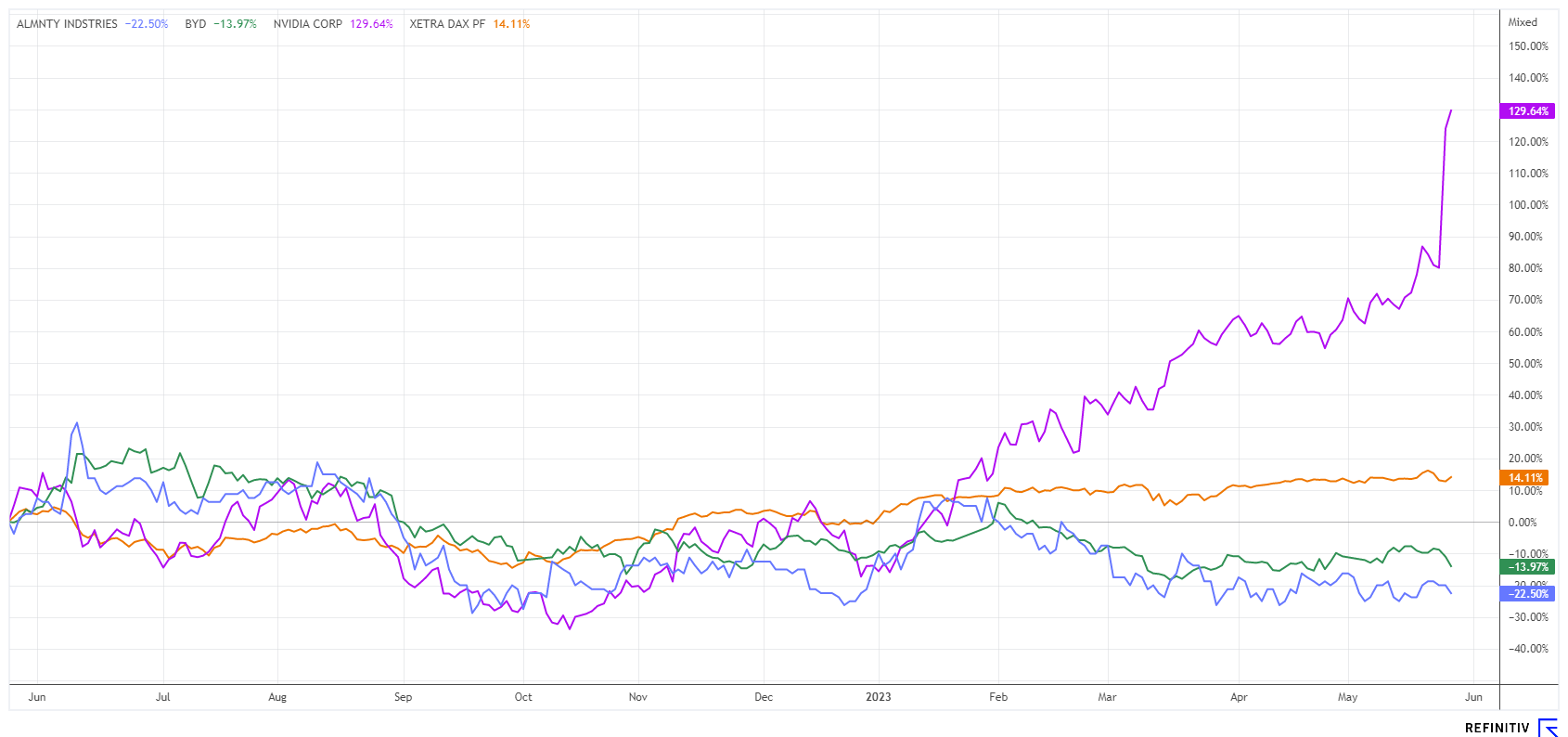

ChatGPT, Artificial Intelligence and E-Mobility! BYD, Almonty Industries, Nvidia - 100% performance with strategic metals!

Those aiming to accelerate artificial intelligence, e-mobility, or the energy transition need access to critical metals. The EU and the USA have the extraction of domestic resources on the agenda in order to become independent of the raw materials giants China and Russia. Long approval phases, too little exploration and a lack of investment capital have made this problematic over the last 10 years. Now a law is being prepared to secure the supply of raw materials in the EU. Resourceful investors can position themselves early on.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , ALMONTY INDUSTRIES INC. | CA0203981034 , NVIDIA CORP. DL-_001 | US67066G1040

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Almonty Industries - Tungsten production in Spain to start in 2023

The industry ministers of the 27 EU member states recently met in Brussels to discuss the supply of critical raw materials to the EU. The declared goal of the Swedish EU Presidency on this issue is to reach a common position before the summer. This was the attitude that Ebba Busch, the minister responsible for industry, demanded of her counterparts at the beginning of the discussion on the new CRMA raw materials law. The aim is to reduce the EU's dependence on China and other countries for raw materials essential for ecological and digital transformation.

Canadian explorer and producer Almonty Industries (AII) has already fully focused on the critical tungsten market with its properties in Spain, Portugal and South Korea. Tungsten is a lustrous white metal of medium hardness, high density and strength and has the highest melting point of all chemical elements at 3422°C. This makes tungsten essential in the production of over 1,000 high-tech applications in the fields of energy systems, IT and defence. More than 70 % of the world market is currently supplied from China. The next megatrend will come when tungsten oxide is used in newer battery technologies.

The flotation technology successfully developed by Almonty in South Korea will now be used in the current year in the currently closed Los Santos mine in Spain. More than 800,000 metric tonnes of tungsten oxide are to be extracted from tailings there. According to a recently published report, the average grade is about 0.14%, and the investment costs for the recovery plant are expected to be a manageable USD 1.3 million. In parallel, the Sangdong super site in South Korea is being developed. The current price of Almonty shares (AII) in Canada is a low CAD 0.62, putting the market valuation at CAD 141 million. In an update from Sphene Capital, a 12-month price target of CAD 1.69 is calculated based on current cash flow estimates, putting over 170% potential in the room.

Nvidia - AI fantasy creates 200 billion in value in a week

In 1993, Jensen Huang was one of the founders of Nvidia. After 13 more years, the current Nvidia CEO made his company's chips programmable and focused on the gaming market. Since then, the Californians have been considered the market leader in the field of graphics cards and Superchips. What investors likely only realized last week: Nvidia is now the technology leader in high-speed processors required for artificial intelligence (AI) applications such as the prominent ChatGPT. Fast database queries and internet searching must be done in milliseconds, which requires powerful computer hardware. Nvidia has acquired this knowledge in the booming gaming market and is also at the forefront of solutions for autonomous driving, where fast object recognition is crucial. ChatGPT has been trained with 10,000 Nvidia graphics processing units (GPUs) clustered in a Microsoft supercomputer. Shortly after its introduction in the fall of 2022, it became a new megatrend.

"What Nvidia is to AI is almost what Intel was to PCs," says Dan Hutcheson, an analyst at TechInsights. According to a recent report by CB Insights, Nvidia now occupies about 95% of the GPU market for machine learning. The AI chips, which are also sold in data centre systems, cost about USD 10,000 each on average, with the most powerful versions costing significantly more. A good opportunity for the IT company from Santa Clara. 48 Analysts on the Refinitiv Eikon platform see a medium price target of USD 442, and the British bank HSBC even USD 600. Well then!

BYD - The European rollout shifts into the next gear

That Chinese carmaker BYD has big ambitions should be well known by now. The strength of the innovative group has grown over the last few years as they created their own technology ecosystem. "Build Your Dreams" manufactures its own essential components such as batteries, sensors and chips; in-house production is significantly cheaper than procurement from many competitors and allows margins to rise accordingly.

In its home market, the technology group is already a force to be reckoned with, and now the management is setting its sights on the international markets. The pace is fast. VW and Tesla could already be outstripped in the Middle Kingdom. The new EU headquarters are in the Netherlands, and the first sales partners are already in Germany, the UK, Norway and Hungary. The Europe-wide rollout should be completed in 2025 at the latest. But now, the competitive landscape for European carmakers will change significantly because BYD is, on average, 25% cheaper.

After a strong run in recent months, the carmaker's shares suffered a 10% setback last week. However, the 30 experts on the Refinitiv Eikon platform consistently come to positive assessments with an average 12-month price target of CNY 356 - 44% above the current quotation of CNY 247. Conclusion: The BYD share is well positioned among the competition, but with a 2023 P/E ratio of 24.2, it is not cheaply valued, even after the correction.

Energy transition and Artificial Intelligence are the breeding grounds for the current megatrends. Rare metals play a crucial role in this. Almonty Industries is ramping up its production and thus remains promising. BYD and Nvidia are future-oriented standard stocks for any growth portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.