December 17th, 2024 | 07:45 CET

Vote of confidence: What is the future of high-tech and crypto? SMCI, Myriad Uranium, MicroStrategy and Palantir in focus

Yesterday, Chancellor Scholz asked the Bundestag for a confidence vote. There were 394 no votes for a continuation of the federal government, thus paving the way for elections in February 2025. How will energy policy, in particular, change? CDU rival Merz wants to tackle the issue by including all available sources. Does that mean a return to nuclear energy? The situation in Germany is dramatic. After the shutdown of seven large power plants in 2024, a new term is making the rounds: 'dark doldrums'. The term describes periods when there is hardly any wind, and the sun does not provide any energy either. The remaining fossil fuel power plants are running at full capacity, fuelled by coal, oil and gas. Internationally, nuclear power has long been recognised as a central energy source, even under the 'NetZero' framework, and the development of new technologies is advancing. What should investors pay particular attention to now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

SUPER MICRO COMPUT.DL-_01 | US86800U1043 , MYRIAD URANIUM CORP | CA62857Y1097 , MICROSTRATEG.A NEW DL-001 | US5949724083 , PALANTIR TECHNOLOGIES INC | US69608A1088

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Super Micro Computer and Nvidia – Artificial intelligence needs electricity

The global energy supply must meet the increasing demands of the booming high-tech and crypto sectors. The electricity consumption caused by the use of artificial intelligence (AI) is considerable and growing rapidly. Extrapolated to millions of queries daily, this quickly adds up to a high gigawatt range. According to recent studies, the worldwide electricity consumption of AI systems will increase to 130 to 150 terawatt-hours annually by 2027. This corresponds to the energy needs of countries such as Belgium or Argentina. Although modern data centres and more efficient processors could reduce the burden, the exponential growth of the new technologies eclipses all demands on new infrastructure.

In this context, the technologies of Nvidia and Super Micro Computer are important. The specialist for ultra-fast chip architectures has already reached record highs before its stock split and is currently consolidating approximately 15% below the last highs. Nevertheless, the return over the last 12 months is over 180%. In contrast, the share price of industry competitor Super Micro Computer (SMCI) fluctuated significantly due to some uncertainties in the balance sheet, which were further fuelled by a negative report from the short seller Hindenburg Research. After the resignation of the auditor Ernst & Young, management quickly arranged for BDO to replace them, and internal investigations were unable to uncover any inconsistencies. The SEC has now given SMCI until February 25 to provide the missing quarterly reports. However, SMCI will be removed from the NASDAQ 100 index at the December settlement due to the decline in market capitalization. A capital increase is also pending, which is again weighing on sentiment. On the Refinitiv Eikon platform, only two experts still have a "Buy" rating. The risk currently seems very high and only acceptable for speculators.

Myriad Uranium – The Mega-Project in Wyoming

Regarding energy supply, industrialized nations are increasingly considering the use of nuclear energy. The financing of the necessary infrastructure should even be co-designed by the private sector. Well-known high-tech giants have already commented on this topic. For example, Microsoft started an evaluation in 2023 to determine whether data centres for Microsoft Cloud and Artificial Intelligence could be powered by Small Modular Reactors (SMRs) or microreactors. This could create a new demand component for the uranium market. By 2030, supply is expected to show a deficit of around 40%. New mining complexes are therefore needed, and the West must also ensure that it can free itself from dependence on Russia and Kazakhstan.

The Canadian uranium explorer Myriad Uranium is focusing on the 'Copper Mountain' property in Wyoming, which has already been historically explored by Union Pacific. At that time, however, uranium prices were at rock bottom, so the high-grade project was not pursued further. CEO Thomas Lamb considers it a stroke of luck to be working as an option partner with Rush Rare on the further development of the project. The maiden drilling program in the Canning area has now been completed, and the results confirm and exceed the historical figures in the Canning deposit area. The focus is now on deeper mineralization zones. Next year, work will be extended to other zones such as Midnight, Knob, Bonanza, and Mint.

Myriad shares have been trading very actively in recent days between CAD 0.42 and CAD 0.50, and a capital increase at CAD 0.40 with a volume of CAD 2.98 million was successfully closed last week. Investor interest is so strong that the stock is now also listed on Tradegate in Germany, alongside Stuttgart and Frankfurt. The Myriad share could, as it did in 2024, become a uranium high-flyer in the portfolio next year!**

Palantir and MicroStrategy – Guaranteed profits in 2025?

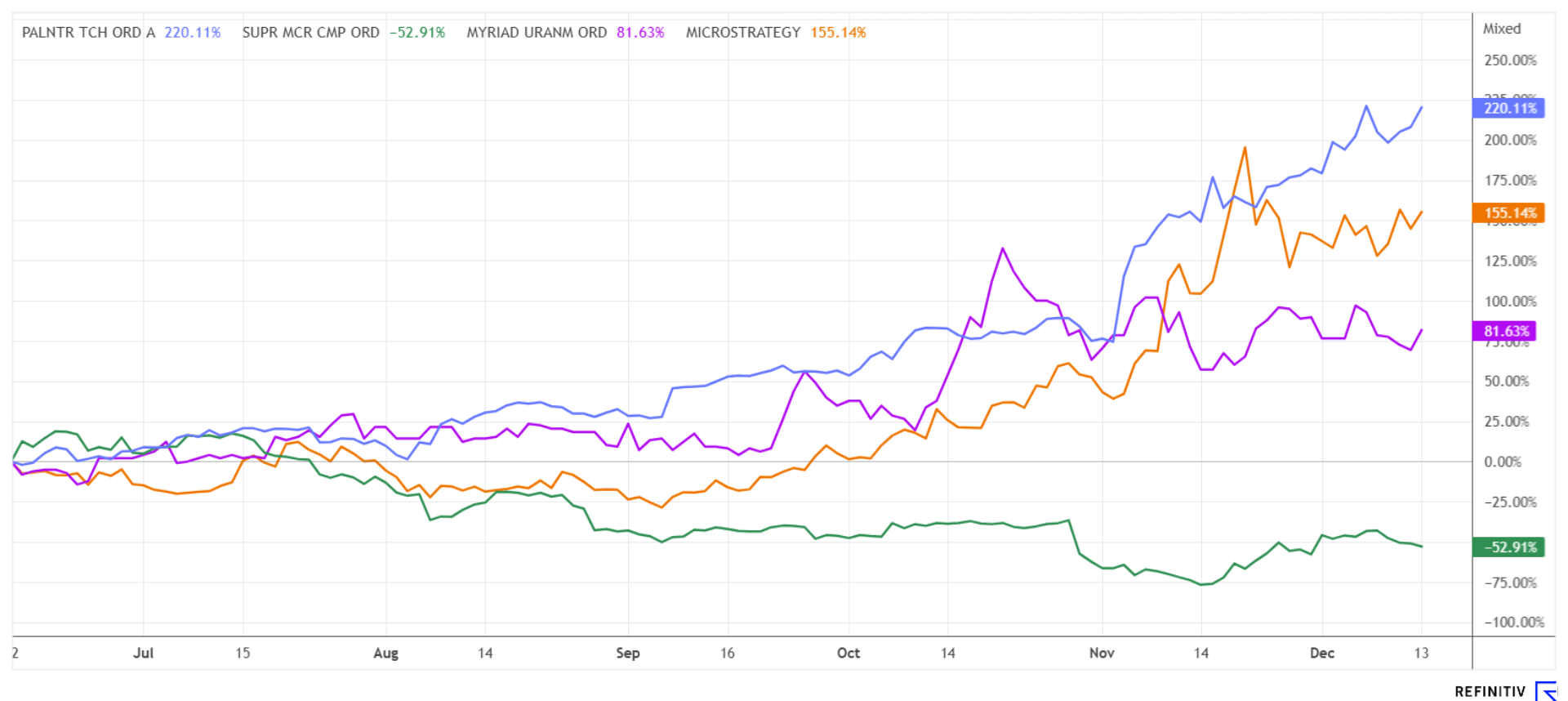

After 340 and 550% price gains, critical investors are naturally entitled to ask whether 2025 will be as successful for Palantir Technologies and MicroStrategy as the last 12 months. Key factors will be the remaining fundamental outlook, as well as the technical situation and momentum. Yesterday, the highly-watched NASDAQ reached a new annual high of 22,028 points. The urge to buy technology stocks seems unbroken because fund managers, in particular, want to be able to show many strongly rising stocks in their annual reports to attract fresh investment capital in the new year.

This is not to say that valuation should be ignored because, ultimately, investment decisions made today should also survive the first quarter. When it comes to Palantir Technologies, we cannot ignore the strong growth drivers such as Big Data analytics and AI software for public institutions. Demand is high, with revenue jumps of over 20% per annum being a consensus estimate. With a share price of USD 75, the software company from Denver has now reached a market capitalization of USD 173 billion, which corresponds to 62 times revenue for 2024 and a P/E ratio of 340, assuming the earnings per share end up in the target corridor of USD 0.21 to 0.23 per share. It seems that the PLTR share price already factors in the assumed figures for 2030.

The Bitcoin miracle company MicroStrategy is also on an unchecked upward trajectory. The business strategy of the high-tech company from Virginia is to take on debt in favour of expanding its Bitcoin holdings. The current collection comprises 439,000 BTCs, which, at a price of USD 106,000 per unit, amounts to a trading portfolio of approximately USD 46.5 billion. However, the 'crypto fund' is valued at double that amount on the stock exchange, at USD 96 billion. The explosive potential of MSTR shares, therefore, lies in the further price development of Bitcoin. For investors who seek a casino-like feeling in crypto, there is arguably no better option.

While Germany is struggling with an energy shortage, the 'dark doldrums', and a difficult economic situation, international high-tech companies are showing a renewed super rally at the end of the year. Those who were not sufficiently invested in the NASDAQ this year are missing out on important returns. Myriad Uranium also performed very strongly, with the prospect of a major future uranium producer in the US. Further revaluations are therefore to be expected.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.