July 12th, 2023 | 07:50 CEST

Prime Day at Amazon! Nvidia, Defense Metals, Infineon - No Artificial Intelligence without metals!

US Treasury Secretary Janet Yellen has concluded her four-day trip to China. The conclusion of the visit is quite positive on both sides, even if Yellen openly admits differences between the two world powers. Relations between Washington and Beijing have deteriorated significantly in recent years over trade and human rights issues, dealings with Taiwan, and a host of other issues. However, the supply situation of strategic raw materials remains an important issue. We examine buying opportunities in the high-tech sector.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

AMAZON.COM INC. DL-_01 | US0231351067 , NVIDIA CORP. DL-_001 | US67066G1040 , DEFENSE METALS CORP. | CA2446331035 , INFINEON TECH.AG NA O.N. | DE0006231004

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Amazon - Graphics cards from Nvidia remain the rage

Whether computer games, mining or big data applications such as artificial intelligence - they all need infinite computing power. In the process, it is, above all, the graphics card that is stressed because the quality of the chips installed determines the computer's speed in complicated computing operations and elaborate graphics. Graphics cards for modern PCs are sometimes costly but at least somewhat cheaper on Amazon's Prime Day. High-end graphics cards are usually quite large and expensive solutions, but mud textures and pixel mush are a thing of the past. 40% of all sales made on Amazon yesterday and today are high-tech items - here, Amazon is humming just like the manufacturer Nvidia.

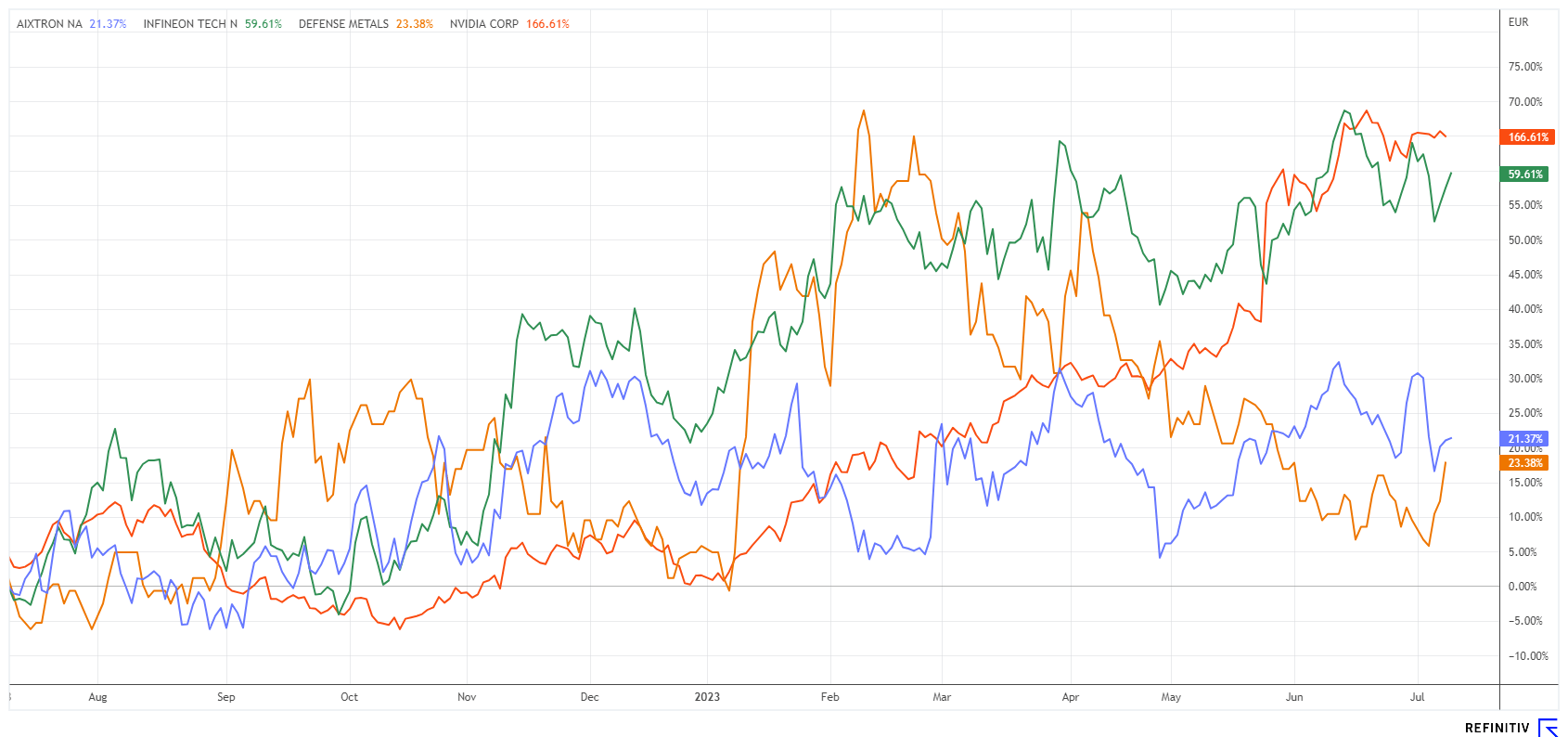

For technology stocks on the NASDAQ, things could not be going better at the moment. After a slump at the beginning of the year, the NDX is now up a whopping 27%. Nvidia has rallied 180% in just 6 months, culminating in a slight consolidation in early July. The stock is buoyed by ongoing AI speculation and now trades at a 2024 P/E ratio of 54. Amazon, on the other hand, has been slow to recover from the December sellout to EUR 78 and at least briefly reached the EUR 120 mark again. Here, too, the P/E ratio is a hefty 49. Both stocks are no bargains but really en vogue.

Defense Metals - No high-tech without strategic metals

Today, an important part in shaping the future is played by technology companies, which set the knowledge trends for us humans via their achievements. Almost every consumer is thus dependent on Microsoft, Google, Samsung or Apple. Ultimately, with its gigantic cloud service business, Amazon is also a major player in a highly dynamic sector. Access to strategic metals is also important for energy renewal, which consists of turning away from fossil fuels. Here, the West should not depend entirely on its relationship with China. So the development of new properties is more than warranted. For rare earth metals, China is currently calling the shots, while Western deposits remain scarce.

British Columbia-based exploration company Defense Metals (DEFN) owns the Wicheeda Rare Earth Project and is considered one of the future producers. A feasibility study is already underway, making it just in time to benefit from the expected commodity supercycle. The 4,262-hectare Wicheeda project is considered particularly promising to supply the needs of Western industrialized nations. Pilot hydrometallurgical plant testing was recently completed. The results are expected to yield up to 25,000 tons of REO production, which could account for about 10% of global production in the future. The investment is estimated at USD 640 million, which puts the break-even period from the start of production at about 5 years. Starting in 2025, this is within reach.

The DEFN share is currently trading at CAD 0.23, with 256 million shares outstanding this results in a market value of approximately CAD 59 million. The stock could experience a sudden surge if a larger investor with strategic interest enters the picture.

Infineon - No negative impact from China's export restrictions

The Infineon share has so far been able to participate very well in the great wave of euphoria on the NASDAQ. With power-saving chips and components for e-mobility, the Company is brilliantly positioned. However, despite its strong position in the semiconductor industry, Infineon faces new challenges and risks. One of the main issues is the high volatility and uncertainty in the semiconductor industry caused by factors such as price pressure, technological change and geopolitical tensions. In addition, Infineon is heavily dependent on the automotive industry, which has faced several challenges in recent years.

China's announced export restrictions on gallium and germanium are not expected to limit Infineon Technologies' production greatly. "Currently, we do not see any major impact on material supply that would affect our production capacity," said a spokesperson for the German chipmaker to Wall Street. The announced export controls were not highly specified. In addition, the Munich-based company is pursuing a multi-sourcing strategy that includes suppliers from different regions of the world.

Infineon's financial performance has shown mixed results in recent years. While the Company has delivered strong results in some quarters, it has suffered from difficult market conditions in other periods. At a price of EUR 36.50, the stock is valued at a low P/E ratio of 14. According to Refinitiv Eikon, 26 analysts assess the stock, of which 21 conclude "Buy" with an average price target of EUR 48.15, indicating a potential upside of over 30% for the German technology company.

The high-tech industry depends on effective supply chains. While companies can take steps to manage their own supply chains, it is the responsibility of policymakers to provide the overarching framework. This is no easy feat in times of geopolitical conflict. A cautious investor diversifies across different stocks, giving the portfolio enough time to develop.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.