Comments

Commented by Nico Popp on December 8th, 2025 | 07:00 CET

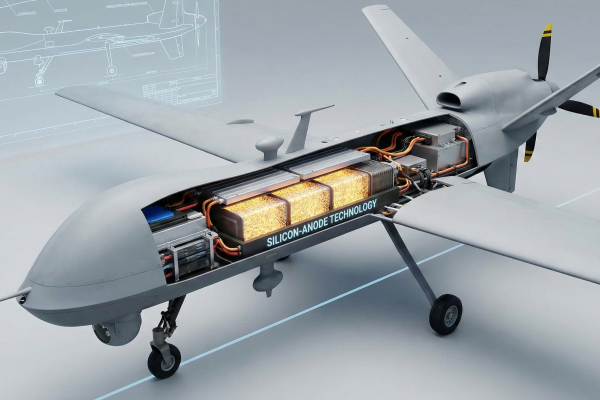

Even in times of peace, these defense stocks have a future: NEO Battery Materials, Hensoldt, DroneShield

There is a lot at stake for Ukraine these days: Will there be a dictated peace, will the war continue, or is a long-term viable solution in sight after all? Some defense stocks have fallen in recent weeks. However, regardless of the current peace negotiations, it looks as if Europe in particular will have to invest heavily in military capabilities in the coming years. We explain why and present some exciting stocks.

ReadCommented by Fabian Lorenz on December 8th, 2025 | 06:55 CET

Nearly 2,000% returns! Siemens Energy, Nel ASA, and First Hydrogen shares! Hydrogen or SMR nuclear power!

Siemens Energy shares are unstoppable. Analysts are enthusiastic about the DAX-listed company. The outlook for the coming years is bright, and a 2,000% return could soon be achieved. First Hydrogen shares have not yet benefited from the AI energy boom in the US. The Company aims to make SMR nuclear reactors more efficient and safer. In addition, North Americans are benefiting from the willingness of their governments to go full throttle on the issue. Full operational momentum, however, has been missing at Nel for quite some time. Revenue growth and order intake are not fueling any share price speculation. Can a new EU initiative give the hydrogen sector new momentum?

ReadCommented by Nico Popp on December 5th, 2025 | 07:00 CET

Siemens Energy, Deutsche Bank, Almonty: Why 2025 belonged to the tankers – and 2026 will be the year of the speedboats

There are years on the stock market that are remembered for decades. 2025 was one such year. It was the year the old economy made its comeback. Who would have thought 12 months ago that a former DAX turnaround candidate would outperform tech stocks? Or that a major German bank would suddenly be viewed as a highly attractive core investment? The scoreboard does not lie: the big tankers delivered. However, stock market history rarely repeats itself exactly. While many blue chips are now trading at high valuations and no longer offer much upside potential, experienced investors are already positioning themselves for the next cycle. A presentation at the International Investment Forum (IIF) on Wednesday provided a decisive clue as to where the momentum may shift in 2026.

ReadCommented by André Will-Laudien on December 5th, 2025 | 06:55 CET

Super Rally 2026 – Who will climb to the top of the yield Olympus? Nel ASA, Plug Power, RE Royalties, mutares, or Steyr?

At the end of the year, it makes sense to rethink some stories. After an exuberant boom year in 2025, selecting new "top performers" is becoming increasingly difficult. Defense appears to have run out of steam. Nvidia, a representative of the AI sector, has been hovering around USD 180 for the past three months, investors' favorite Palantir is settling in at the USD 170 mark, and even the flagship indices DAX and NASDAQ have been moving only up or down by around 1,000 points for weeks. Get out of stocks? That would be logical, but we know that selling only happens when the cannons start firing! We take a look at some stocks that caused quite a stir in 2025. What will happen next?

ReadCommented by Armin Schulz on December 4th, 2025 | 07:20 CET

Take advantage of the panic: Why buy Rheinmetall, Almonty Industries, and DroneShield now?

A sharp drop in share prices is shaking the defense industry. Triggered by short-term hopes for peace, the markets are ignoring the unchanged robust fundamentals: bulging order books and rising global defense budgets. This discrepancy opens up strategic entry opportunities. Three key companies, artillery and vehicle manufacturer Rheinmetall, critical raw materials supplier Almonty Industries, and drone defense specialist DroneShield, are in focus and stand to benefit from sustained demand.

ReadCommented by Nico Popp on December 4th, 2025 | 07:05 CET

Hype fades, substance remains: Why Bank of America, Commerzbank, and Nakiki are now winners

"The tide lifts all boats, but it is only at low tide that you can see who is swimming without swimming trunks." This stock market bon mot from Warren Buffett perfectly describes the current state of the crypto market. While Bitcoin is stabilizing after its volatile phase and reaching a new stage of maturity, speculative bubbles are bursting at the edges - the best example: American Bitcoin from the Trump universe. Investors increasingly understand that quality is what matters when it comes to blockchain. We present financial stocks with substance that also exude crypto fantasy.

ReadCommented by André Will-Laudien on December 4th, 2025 | 07:00 CET

Gold & silver with a record year – 100% in 2026 too? Barrick, Kobo Resources, First Majestic, and Endeavour Silver

Gold and silver remain the surprise of 2025. Despite many prophecies of doom, both precious metals have so far managed to hold on to their record highs of USD 4,350 and USD 58.50, respectively. After a brief correction at the end of last week, the highly volatile silver price quickly rose back to the USD 58.00 mark. Experts warn of an approaching pain threshold for short sellers and futures speculators. They had hoped to be able to close their uncovered positions at a favorable price before the approaching settlement date on November 28. Far from it, because on Friday, metals took off again. According to traders, it is currently almost impossible to procure sufficient quantities of physical silver to cover the many derivative transactions. This is leading to unusual behavior on the market. So where should investors pay close attention now?

ReadCommented by Nico Popp on December 4th, 2025 | 06:55 CET

How suppliers like Aspermont, CATL, and Continental turn the world's complexity into profit

"During a gold rush, don't sell shovels - sell treasure maps." In a world driven by technological disruption, geopolitical tensions, and the trend toward decarbonization, investors need to think one step ahead. Often, it is not the end manufacturers who benefit most, but the specialized suppliers and service providers operating behind the scenes. They take the complexity off their customers' hands – whether it is building an electric vehicle, optimizing tyre compounds, or deciding where to build the next billion-dollar mine. Those who understand this principle will find exciting options on the stock market right now. We present three companies.

ReadCommented by Armin Schulz on December 3rd, 2025 | 10:25 CET

The moat strategy promises success in your portfolio: An analysis of Palantir, RZOLV Technologies, and D-Wave Quantum

In today's stock market landscape, a sustainable competitive advantage determines exceptional returns. Real moats, whether through impenetrable software, new technologies, or revolutionary hardware, reliably shield sources of profit and regularly outperform the market. The search for such protective mechanisms leads to three pioneers who dominate their fields with technological supremacy: Palantir, RZOLV Technologies, and D-Wave Quantum.

ReadCommented by Fabian Lorenz on December 3rd, 2025 | 10:20 CET

US government strengthens Bayer! Almonty next? What is Novo Nordisk doing?

A bombshell at Bayer: The US government has officially sided with the Company. If the Supreme Court follows the recommendation, the Leverkusen-based company could largely put the glyphosate issue behind it as early as next year. Investors and analysts are enthusiastic. Almonty Industries is also in intensive discussions with the US government. CEO Lewis Black emphasized this in an interview with Fox Business. The Company plans to start mining tungsten, which is critical for defense and aerospace, among other things, in the US as early as next year. Since 2015, the US has been 100% dependent on imports. Analysts see 40% upside potential. Novo Nordisk shares are currently looking for a bottom. To reduce its dependence on Ozempic, the Danes have concluded a billion-dollar deal.

Read