December 5th, 2025 | 06:55 CET

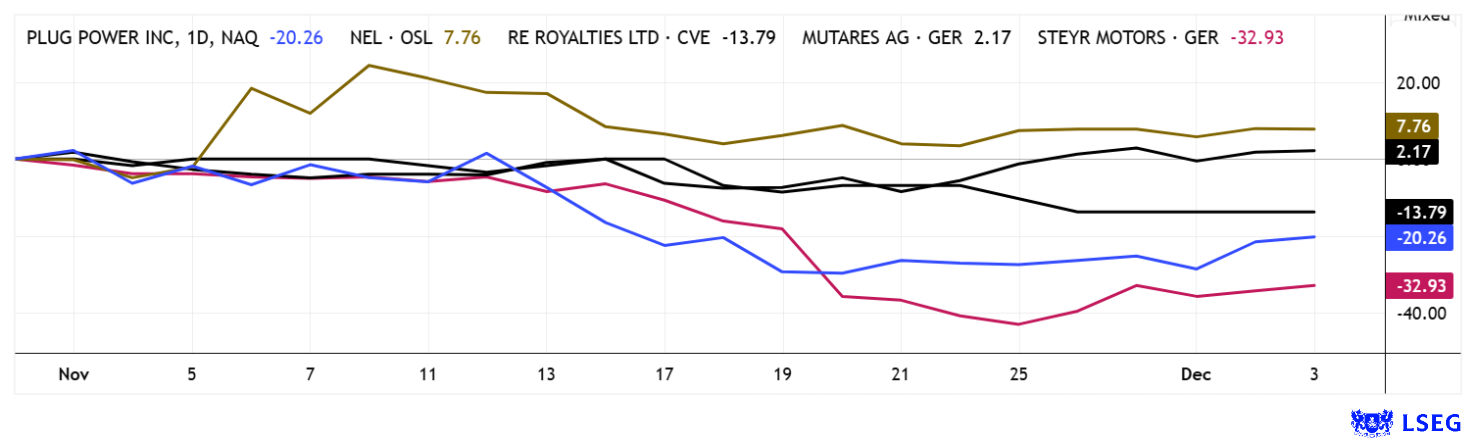

Super Rally 2026 – Who will climb to the top of the yield Olympus? Nel ASA, Plug Power, RE Royalties, mutares, or Steyr?

At the end of the year, it makes sense to rethink some stories. After an exuberant boom year in 2025, selecting new "top performers" is becoming increasingly difficult. Defense appears to have run out of steam. Nvidia, a representative of the AI sector, has been hovering around USD 180 for the past three months, investors' favorite Palantir is settling in at the USD 170 mark, and even the flagship indices DAX and NASDAQ have been moving only up or down by around 1,000 points for weeks. Get out of stocks? That would be logical, but we know that selling only happens when the cannons start firing! We take a look at some stocks that caused quite a stir in 2025. What will happen next?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , RE ROYALTIES LTD | CA75527Q1081 , MUTARES KGAA NA O.N. | DE000A2NB650 , STEYR MOTORS AG | AT0000A3FW25

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Plug Power – Ready for Take-Off

Hydrogen! A much-hyped topic during the coronavirus pandemic and under the German traffic light coalition government. The entire sector has not progressed beyond the level of declarations of intent, as production costs were too high for the private sector. However, after three years of consolidation and share price declines of over 90%, international sentiment seems to be slowly turning. The pioneer is the US industry leader, Plug Power. There have been three billion-dollar capital increases at a low level, and the financing of ongoing projects appears to be secured. At Nel ASA, the latest quarterly figures were once again sobering, but EU officials in Brussels have at least already set the course. The European Clean Hydrogen Alliance (ECHA) was launched as a platform to accelerate the large-scale introduction of clean hydrogen technologies by 2030. Over 1,400 stakeholders from industry, research, and politics are involved. According to Nel's management, the Company is actively working on "next-generation" systems. According to its own plans, a new, more efficient, and cost-effective "alkaline" electrolysis system is already planned for 2026, with significantly reduced energy consumption and lower capital expenditure (CAPEX). Nel's share price dipped five times to the EUR 0.18 mark and is now at least defending the EUR 0.20 mark. Analysts on the LSEG platform are not yet entirely convinced by Nel, favoring Plug Power instead, with price targets of USD 2.75 – a 30% premium on the last traded price. Technical indicators currently show good upward momentum, but what is missing is the right initial spark. Speculators are now logging in at the low level!

RE Royalties – On the road to success with green returns

With a market capitalization of only CAD 10 million, the shares of green finance company RE Royalties are still largely flying under the radar. This does not really do justice to the underlying theme, as sustainable investments now account for around 18% of global assets under management. Sophisticated ESG strategies recorded inflows of more than USD 150 billion in 2024, with North America accounting for around 40% of the green finance segment and Europe for a good 45%, while Asian markets are continuously expanding their share from currently around 12%. In addition, regulatory harmonization is increasing worldwide, institutional investors are increasingly introducing minimum ESG quotas for sustainable investments, and technological advances, such as in battery storage, are enabling new financing models.

Against this backdrop, Canadian project financier RE Royalties Ltd. stands out in particular. The Company is adapting a licensing model familiar from the raw materials sector for the promotion and implementation of wind, solar, and hydroelectric power projects, as well as storage solutions. Instead of building infrastructure itself, RE Royalties provides capital and receives contractually defined interest payments and long-term revenue shares in return. This is an innovative approach, as it generates recurring cash flows without requiring the developers of green projects to give up equity stakes. Investors in such models benefit twice: if the concept works, they receive good royalty income; if everything takes a little longer than expected, agreed interest and repayment rules apply. It is also noteworthy that this model stabilizes the capital structure of project operators and that risks from construction and operation largely remain with the developer, which offers investors much greater predictability.

RE Royalties sees itself as a provider of a model that combines economic stability with environmental impact. RE Royalties offers its own investors in the stock a continuous distribution mechanism: typically, CAD 0.01 per share is paid out quarterly, resulting in an annual dividend of CAD 0.04 since 2020. This generates an unusually high return of 16% per annum for investors. RE Royalties has demonstrated its outstanding expertise in this financing business in 130 projects to date. Broad regional diversification provides a certain degree of protection against volatile energy prices. Regulatory changes can also be easily absorbed. With this setup, RE Royalties is one of our top picks for the coming year, 2026. The stock can is currently trading at around CAD 0.25!**

CEO Bernard Tan explains his plans for the coming months in an interview with IIF presenter Lyndsay Malchuk.

https://www.youtube.com/watch?v=sKWA0kb1A_s

Steyr Motors – mutares posts a gain of CAD 170 million

When the investment company mutares acquired the predecessor companies of Steyr Motors AG at the end of 2022, no one knew that a few years later, a defense story would emerge from the deal. In the midst of the emerging defense hype in 2024, Steyr Motors AG, which had just been listed on the stock exchange, was given a little defense fantasy, and the previously inconspicuous stock soared higher and higher until March 2025, ultimately reaching a vertical short squeeze movement of EUR 420. However, this price was only valid for a few minutes, after which it went steeply south again. Between March and November, it then fluctuated rather unspectacularly in the range of EUR 65 to EUR 27. mutares had sold 21% of its shares at the IPO and then completely divested itself of Steyr over the last few months. In total, the Munich-based investment company generated gross proceeds of EUR 170 million. One could say it was in the right place at the right time. Steyr Motors is now back in the spotlight of NuWays analysts, who consider the current market capitalization of EUR 165 million to be far too low in their initial study. The Company supplies special engines for selected defense applications, among other things. Its customers include Thales, KNDS, and Rheinmetall. Generous orders from NATO countries have already increased the order backlog to EUR 300 million, and internationalization toward the US and Asia is also said to be on the agenda. Analysts expect average revenue growth of 37% in the coming years, with the EBIT margin rising from the current level of around 14% to up to 21% by 2028.The rating is "Buy" with a 12-month price target of EUR 59. With prices around EUR 30, that is a smooth doubling. Exciting!

**In-depth analysis of stock market movements depends on numerous factors. During extended downward phases, analysts pay particular attention to steadily declining trading volumes. The bottom line is simple. If the market continues to fall for months, "all" those willing to sell will have slowly sold off their holdings. Revenue will continue to decline, and the stock will virtually dry up. If positive news then emerges, the rebound can be explosive.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.