Comments

Commented by Fabian Lorenz on November 28th, 2025 | 07:10 CET

A 100% price gain not enough? Barrick Mining, First Majestic Silver, and gold gem Kobo Resources!

Barrick Mining's share price has risen by over 100% in the current year. The consolidation of the gold price in recent weeks has had virtually no impact on the Company, and analysts see further upside potential. The Company is closing a billion-dollar deal, and the major problem within the group appears to have been resolved. Now, precious metal prices are rising again. This should also herald a return to prosperity for exploration companies. Kobo Resources is emerging as a hot takeover candidate. The gold explorer has reported high-grade results. A neighbor will be watching developments closely. And what is First Majestic Silver doing? The Company has divested itself of a stake.

ReadCommented by Armin Schulz on November 28th, 2025 | 07:05 CET

The comeback is here: How to capitalize on the hydrogen boom with Plug Power, First Hydrogen, and Nel ASA

After a steep decline, the hydrogen industry is on the verge of a spectacular turnaround. Global decarbonization targets and massive infrastructure programs, such as Germany's planned 9,000 km pipeline corridor, are catapulting the market for green hydrogen into a new phase of growth. These political impulses are now triggering an explosive comeback and creating an investment-friendly environment in which the once-ostracized pioneers can accelerate their operational profitability. Plug Power, First Hydrogen, and Nel ASA are seeking to capitalize on this upswing. We analyze the current situations.

ReadCommented by Carsten Mainitz on November 28th, 2025 | 07:00 CET

Attention! Major Updates from NEO Battery Materials, Xiaomi, and RWE

Geopolitics are once again dominating global headlines. A 28-point plan brokered by the United States aims to end the war between Russia and Ukraine and pave the way toward sustainable peace. Viewed soberly, an approaching end to the war puts pressure on defense stocks. One area that has gained significant importance due to the Ukraine conflict is drones. Battery technology is playing an increasingly important role here. However, the use of powerful batteries is also essential in many other areas, such as robotics. The still largely unknown NEO Battery Materials is delivering one positive update after another. How can investors benefit now?

ReadCommented by André Will-Laudien on November 28th, 2025 | 06:55 CET

New tax incentives for e-mobility in 2026 – The spark for BYD, Nio, Graphano Energy, and VW

The German government is planning to reintroduce an electric vehicle subsidy for private individuals. Currently, there are only purchase incentives for companies and tax advantages for purely electric company cars. In its coalition agreement, Berlin has now promised various purchase incentives for electric vehicles. This includes the reintroduction of an e-mobility bonus for private individuals. The government confirmed this plan at the German auto summit in early October. The plan is to support low- and middle-income households in making the transition to the new era of mobility. In addition to funds from the European Climate Social Fund, a further three billion euros will be available for this purpose until the end of 2029. The details of the subsidy have not yet been announced. Meanwhile, business with electric vehicles is still sluggish. Clearly, people are waiting for the new tax breaks. Which stocks are in focus?

ReadCommented by André Will-Laudien on November 27th, 2025 | 07:55 CET

Black Friday: DAX explodes, and biotech is back in vogue: Watch out for 100% gains at Bayer, Vidac Pharma, and Novo Nordisk

The stock market has managed to break out of its consolidation phase, and the upward trend is continuing toward the end of the year. There are signs of hope for the Leverkusen-based pharmaceutical company Bayer, and Vidac Pharma is moving into the primary segment of the Düsseldorf over-the-counter market. The well-known Novo Nordisk, whose share price has been destroyed, is experiencing its fourth sell-off in three months. Some analysts are now turning positive. Investors should now be aware that prices in the biotech sector have fallen so low that even minor news items are enough to cause prices to skyrocket. Especially during the year-end portfolio adjustments, prices often reach absurd levels. We help you navigate the thicket of valuations.

ReadCommented by André Will-Laudien on November 27th, 2025 | 07:20 CET

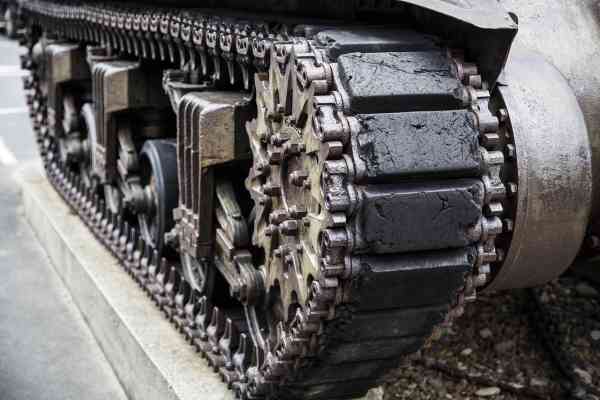

Black Week sales, Bitcoin flop, DAX steady – another interest rate cut? Almonty, Rheinmetall, thyssenkrupp, and TKMS

And up it goes again! It is the season of rising prices. After the widely expected autumn correction turned out to be very mild, many investors believe: That is it! True to the motto "Buy every dip!", they are piling back into the order books. Too few shares are available, so should investors continue buying at high prices? Caution is advised with some stocks. The euphoria surrounding the IPO of thyssenkrupp's marine subsidiary TKMS has completely evaporated, and investors in Düsseldorf-based defense group Rheinmetall are taking profits on a larger scale for the first time. After all, if the war in Ukraine ends, the rearmament cycle could slow down. We will guide you through the Advent bargain hunt!

ReadCommented by Fabian Lorenz on November 27th, 2025 | 07:15 CET

Plug Power poised for a 250% rally? Buy TKMS and Rio Tinto partner Aspermont shares?

Plug Power shares are not for the faint-hearted. This year, too, a spectacular rise was followed by a crash of over 50% within just a few weeks. But now, a positive analyst report is causing a stir. Is a gain of more than 250% really possible for the hydrogen specialist? Aspermont shares currently appear to be a real bargain. The figures for the fourth quarter were certainly convincing. And the business model, with its perhaps unique combination of artificial intelligence and raw materials, is only just getting started. And what is TKMS doing? The euphoria following the IPO has now faded. But analysts have now upgraded the stock and are recommending it as a "Buy".

ReadCommented by Armin Schulz on November 27th, 2025 | 07:10 CET

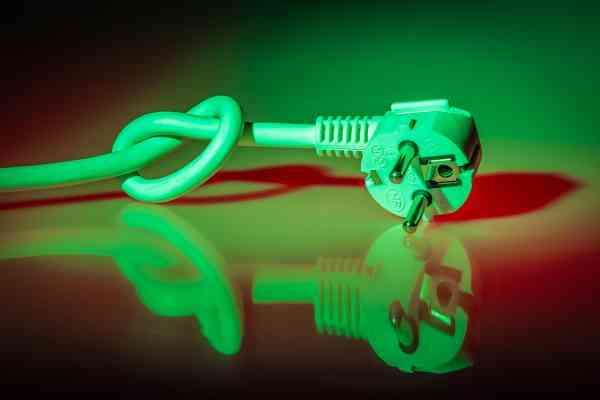

USD 2.4 trillion is being invested in the energy transition – How to benefit with Siemens Energy, RE Royalties, and Nordex

The global energy market is undergoing a fundamental transformation. With record investments of USD 2.4 trillion being made, it is no longer just about building plants. The real key to success lies in system integration - the intelligent networking of generation, storage, and stable grids. This development creates unique opportunities for companies that are central to shaping the new energy landscape. Three players stand out in particular: Siemens Energy, RE Royalties, and Nordex.

ReadCommented by Carsten Mainitz on November 27th, 2025 | 07:05 CET

Everything is lining up! Take advantage of lower prices to enter Antimony Resources, RENK, and Hensoldt!

Is peace finally coming? Efforts to end the war between Russia and Ukraine have intensified significantly in recent days. But Russia remains the unknown factor. As a result, stock market volatility driven by shifting news or rumors is to be expected in the near future, especially for defense stocks. Setbacks offer investors opportunities to build up positions. In addition, special topics such as critical metals or raw materials that are indispensable for the defense industry and other key sectors remain attractive. This is where the undervalued Antimony Resources stands out.

ReadCommented by Fabian Lorenz on November 27th, 2025 | 07:00 CET

REBOUND for Steyr shares! COLLAPSE at Nel and thyssenkrupp nucera! SCALING at dynaCERT?

Hydrogen will play an important role in the future. But companies like Nel and thyssenkrupp nucera are not generating sustainable profits despite high revenues. In contrast, dynaCERT's bridge technology is convincing more and more companies. The retrofit kit for diesel engines can be installed with little effort, helping to save fuel and reduce emissions. If the rollout is successful, a scalable business model could drive the share price. thyssenkrupp nucera has crashed. Why is the stock trading at an all-time low? Meanwhile, Steyr is in rebound mode. Analysts see even more potential in the stock of the specialty engine provider.

Read