November 27th, 2025 | 07:55 CET

Black Friday: DAX explodes, and biotech is back in vogue: Watch out for 100% gains at Bayer, Vidac Pharma, and Novo Nordisk

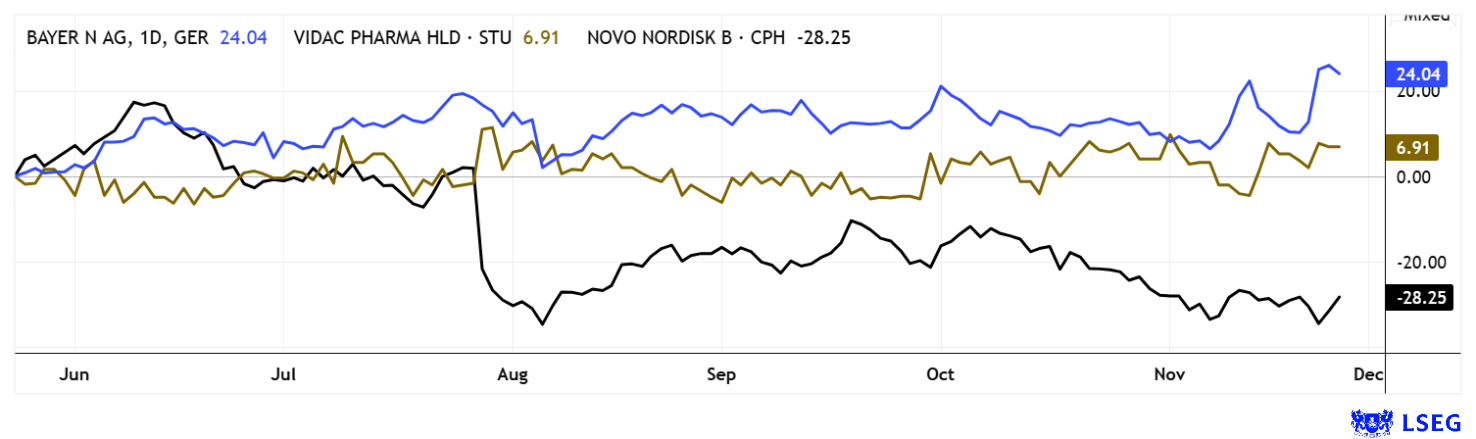

The stock market has managed to break out of its consolidation phase, and the upward trend is continuing toward the end of the year. There are signs of hope for the Leverkusen-based pharmaceutical company Bayer, and Vidac Pharma is moving into the primary segment of the Düsseldorf over-the-counter market. The well-known Novo Nordisk, whose share price has been destroyed, is experiencing its fourth sell-off in three months. Some analysts are now turning positive. Investors should now be aware that prices in the biotech sector have fallen so low that even minor news items are enough to cause prices to skyrocket. Especially during the year-end portfolio adjustments, prices often reach absurd levels. We help you navigate the thicket of valuations.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , NOVO NORDISK A/S | DK0062498333

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer – Asundexian significantly reduces stroke risk

More good news from Leverkusen! Pharmaceutical giant Bayer saw its share price jump to over EUR 30 at the beginning of the week after the Company presented positive results for its experimental anticoagulant. The Company announced that Asundexian had met its primary efficacy and safety endpoints in the pivotal Phase III OCEANIC-STROKE trial. The drug significantly reduced the risk of recurrent ischemic stroke in patients treated after a non-cardioembolic ischemic stroke or high-risk TIA. Both patient groups also received standard therapy with antiplatelet agents. According to Bayer, there was no increased risk of major bleeding according to the criteria of the International Society on Thrombosis and Haemostasis (ISTH). This success could be groundbreaking for stroke treatment!

The success of the study is a milestone for the Leverkusen-based Company after the project suffered a severe setback at the end of 2023. At that time, Asundexian had failed in a clinical phase in patients with atrial fibrillation and an increased risk of stroke, which led to a sharp drop in the share price. Now, the new data set is raising hopes again for future approval of the drug. Bayer announced that it would begin discussions with health authorities worldwide about possible marketing authorization applications. The detailed study data will be presented at a scientific conference in the near future.

After many years of pessimism, the average 12-month price target of analysts on the LSEG platform has gradually increased from EUR 23.50 to EUR 29.70. Seven out of 22 experts now recommend buying the stock, whereas six months ago, no one wanted to touch it. If the stock now manages to break through the EUR 30 to EUR 33 mark, the EUR 40 mark is within reach. If the experts are correct in their expected earnings per share of EUR 4.73 for 2026, the stock is currently trading at a P/E ratio of 6.5. The hard times for shareholders appear to be over, and the Company is now heading for new shores!

Vidac Pharma – The strategic course has now been set

Vidac Pharma continues to expand its position as one of the most innovative developers of metabolic cancer therapies. The Company, founded in 2012 by Prof. Max Herzberg, is currently attracting attention in several areas. First, the renowned US Patent and Trademark Office (USPTO) has granted a comprehensive patent for a new class of HK2-splitting agents. With this now protected technological approach, Vidac Pharma is placing tumor metabolism at the center of therapeutic strategies. The patented compounds selectively target HK2-expressing cancers - tumors that are highly dependent on the enzyme hexokinase-2, which plays a central role in their survival. By interfering with this metabolic axis, the aim is to reverse the so-called Warburg effect, forcing cancer cells back into a near-normal cellular state while making them more vulnerable to attack by the immune system. The platform is based on the same scientific concept that underlies the two promising drug candidates VDA-1275 and VDA-1102 (Tuvatexib).

The research firm Sphene Capital recently confirmed its "Buy" recommendation for the oncology pioneer's stock with a price target of EUR 4.20 over a 36-month horizon. Sphene points to the blockbuster potential inherent in the current drug developments. Once the first partnerships or out-licensing agreements are in place, initial cash flows will reach the Company and can quickly translate into scaling revenues. CEO Dr. Max Herzberg describes the significance of the latest developments as follows: "We are proud that a high-caliber group of analysts such as Sphene Capital recognizes the importance of our technology for our future market positioning based on their understanding of it. Their continued confidence underscores the clear focus of our program as we move toward Phase 3 trials."

Vidac Pharma has applied to list its shares on the primary market of the Düsseldorf Stock Exchange's open market as of December 1, 2025. As part of this inclusion, founder and major shareholder Dr. Max Herzberg plans to sell 50,000 shares in a one-day public offering exclusively in Germany. The order will be placed as a limit sell order with a minimum price of EUR 0.50 per share. The shares can be purchased through regular trading channels on the Düsseldorf Stock Exchange. The Company considers this step an important milestone in strengthening its market presence, transparency, and shareholder base. With a market capitalization of around EUR 26 million, Vidac is a curiosity among biotech stocks, as a Phase 3 study is not far off. Comparable peer group companies on the NASDAQ are trading at a multiple. Continue to invest with confidence!

Founder and CEO Dr. Max Herzberg will be presenting for the first time at the International Investment Forum on December 3. He will be introducing his company and its future prospects to a large audience at 2:30 p.m. Click here to register.

Novo Nordisk – Was that the sell-off?

Hard to believe! Danish pharmaceutical company Novo Nordisk has come through one of its most difficult periods of adjustment. It is still not 100% certain that the four-wave downward trend will actually come to a halt. However, a historically high number of shares have been traded in the last four weeks, which could be a clear indication of capitulation. Novo has now achieved another study success with its new weight loss drug Amycretin. In a Phase 2 clinical trial, patients with type 2 diabetes lost up to 14.5% of their weight within 36 weeks. The study tested the once-weekly subcutaneous injection and oral versions of Amycretin against a placebo in 448 people with type 2 diabetes. Novo Nordisk's share price rose significantly, gaining 15% on a weekly basis. Could this be a new starting point? Analysts on the LSEG platform expect 33% potential over the next 12 months. Speculative investors are entering the zone between EUR 39 and EUR 43, with a 2027 P/E ratio of 11.5 and a dividend yield of around 4%!

The biotech sector is gaining momentum again. In recent weeks, several stocks such as Bayer, Evotec, and Novo Nordisk have begun to recover from their recent lows. Looking ahead to the new stock market year 2026, investors are expected to readjust their portfolios and swap well-performing tech stocks for lagging life science investments. With selective accumulation across our peer group, we are well-positioned for such a potential sector shift.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.