December 3rd, 2025 | 10:20 CET

US government strengthens Bayer! Almonty next? What is Novo Nordisk doing?

A bombshell at Bayer: The US government has officially sided with the Company. If the Supreme Court follows the recommendation, the Leverkusen-based company could largely put the glyphosate issue behind it as early as next year. Investors and analysts are enthusiastic. Almonty Industries is also in intensive discussions with the US government. CEO Lewis Black emphasized this in an interview with Fox Business. The Company plans to start mining tungsten, which is critical for defense and aerospace, among other things, in the US as early as next year. Since 2015, the US has been 100% dependent on imports. Analysts see 40% upside potential. Novo Nordisk shares are currently looking for a bottom. To reduce its dependence on Ozempic, the Danes have concluded a billion-dollar deal.

time to read: 4 minutes

|

Author:

Fabian Lorenz

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , ALMONTY INDUSTRIES INC. | CA0203987072 , NOVO NORDISK A/S | DK0062498333

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Bayer: Sensational news in the US

Bayer is experiencing unexpected relief in the ongoing dispute over glyphosate. The US government has officially sided with the Company. The government's top litigator before the Supreme Court, the highest US court, is recommending that a key Monsanto case be accepted and that Bayer be followed on key points. At its core, the issue is whether federal law, under which the pesticide Roundup was approved, takes precedence over stricter warning requirements in individual states. The US government argues that a label approved by the federal government should not be "tightened" retrospectively by liability lawsuits brought by the states. For Bayer, which has faced more than 67,000 lawsuits since it acquired Monsanto in 2018, paid over USD 10 billion in settlements and set aside further billions in provisions, a clear affirmation of the primacy of federal law could be a turning point.

Political backing increases the chances that the Supreme Court will even accept the case for a ruling. If successful, a precedent-setting ruling could massively limit or completely prevent future damage claims. Bayer hopes this will make the legal risk more calculable and significantly reduce the expensive special charges related to glyphosate by the end of 2026.

Investors snapped up Bayer shares yesterday in response to the news. The stock shot up more than 13% to over EUR 34. Analysts also expressed positive views. DZ Bank raised its price target from EUR 36 to EUR 41 and recommends buying. The DAX-listed company has cleared an important hurdle in the battle against the glyphosate lawsuits. If the Supreme Court follows the US government's recommendation, this would be a decisive victory for Bayer, and the litigation risks would be massively reduced.

Almonty Industries: Talks with the US government

The Bayer case shows how good relations with the US government can drive a share price. Will this soon also be the case for Almonty Industries? Last week, Almonty CEO Lewis Black emphasized in an interview with Fox Business that the Company was in intensive talks with Washington. In line with this, the tungsten producer recently acquired a promising tungsten project in the US state of Montana and plans to bring it into production as early as next year. This would mark the first time tungsten has been produced in the US since 2015. It is actually unbelievable that this has not been the case in recent weeks. After all, tungsten is a critical raw material and essential for defense, aerospace, and technology. But at least the US government has not only recognized the shortcomings in rare earths and critical metals such as tungsten, but is also working hard to change this. One would wish for such determination in Europe as well.

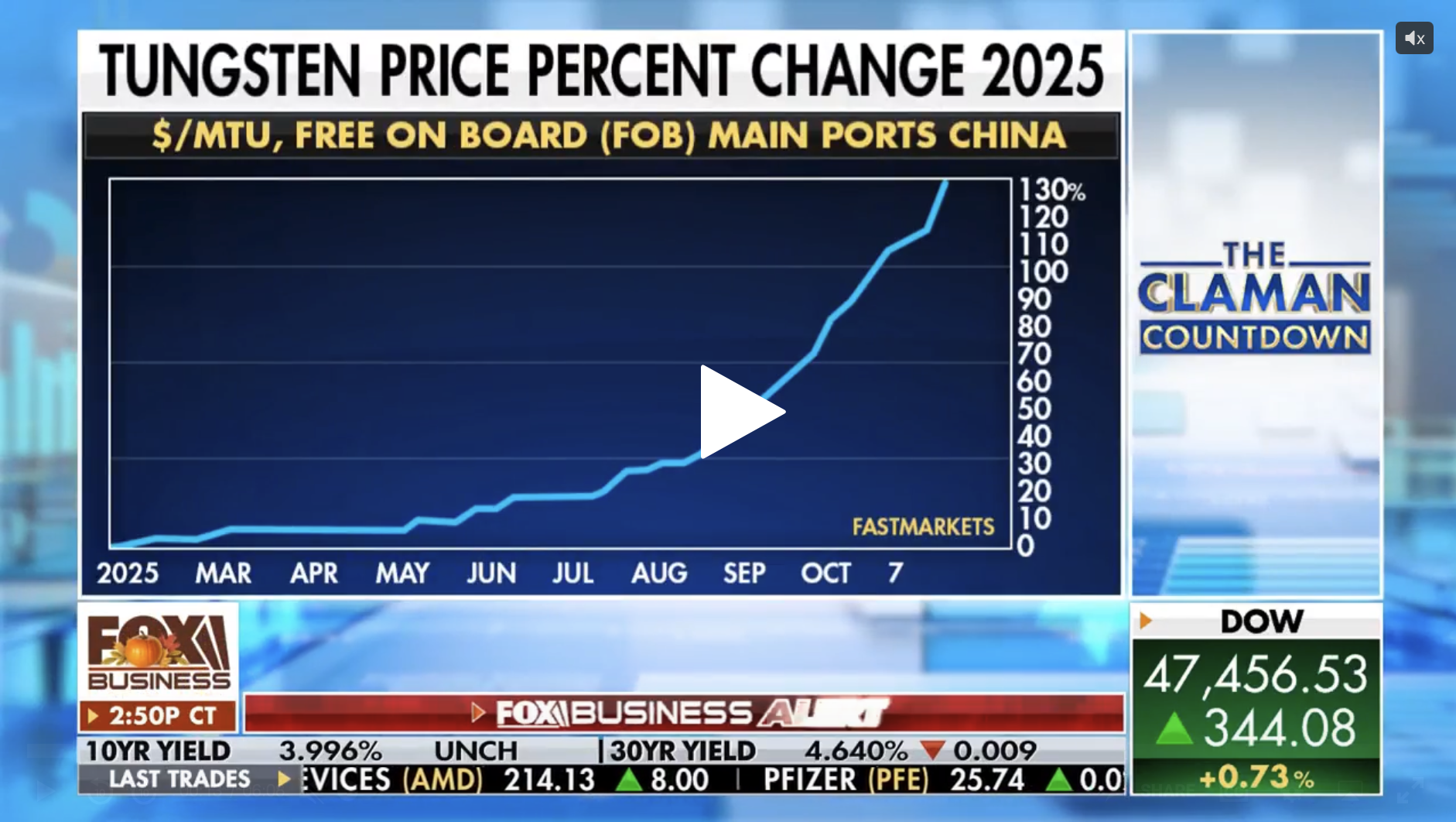

The Fox interview also touched on the price of tungsten, which has more than doubled in the current year. This is well above the level that analysts use in their studies of Almonty shares. Most recently, Germany's Sphene Capital recommended Almonty shares as a "Buy". The target price for the shares, which are also actively traded on German stock exchanges, was raised from CAD 8.40 to CAD 13.50, representing upside potential of over 40%.

Sphene analysts expect Almonty to increase its revenue from CAD 31.4 million in the current year to over CAD 400 million by 2027. By then, EBITDA is expected to be CAD 194.1 million and net income CAD 147.9 million. The price drivers are clear: Almonty is currently commissioning the largest tungsten mine outside China in South Korea. Customers in the West are desperately waiting for suppliers outside China. This is because there have been repeated supply restrictions or stoppages in recent months. And then, of course, there is the new US mine. In Montana alone, 140,000 MTUs are to be mined annually in the future.

Against this backdrop, Almonty shares appear to be anything but expensive.

Novo Nordisk invests billions

And what about problem child Novo Nordisk? The shares of the Company, known for its weight-loss injection Ozempic, have fallen sharply. The stock is currently trying to find a bottom at EUR 40.

Most recently, the purchase and licensing of the complementary drug Zaltenibart from Omeros was completed. The monoclonal antibody is considered a potential "best-in-class" candidate for diseases caused by dysregulation of the alternative complement pathway. Zaltenibart specifically blocks the enzyme MASP-3, the most important and most upstream activator of this signaling pathway, and is thus intended to address a range of complement-mediated diseases, including paroxysmal nocturnal hemoglobinuria (PNH) and various rare kidney diseases such as IgA nephropathy, C3 glomerulopathy, and atypical hemolytic uremic syndrome. One advantage of this mechanism of action is that a significant portion of the immune response and infection defense is preserved. This is not the case with C3 or C5 inhibitors. On this basis, Novo Nordisk intends to develop Zaltenibart into a differentiated treatment option for rare blood and kidney diseases, thereby further strengthening its position in this specialized segment.

Novo Nordisk is paying Omeros up to USD 2.1 billion for this. Of this, USD 240 million has already been paid upfront, and USD 340 million will be paid to Omeros in the short term.

The announcement is not expected to contribute to significant price increases for Novo Nordisk in the short term. However, it shows that the group is attempting to diversify its portfolio.

The current weakness in Almonty's share price could represent an attractive entry opportunity for investors with a bit of patience. Analysts are convinced of the tungsten producer's potential, and the raw material is in high demand worldwide. Ozempic currently appears to be more popular than Novo shares. However, this may change again. The support of the US government is a real coup for Bayer. Perhaps the Company will actually be able to resolve the issue next year.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.