Comments

Commented by Fabian Lorenz on November 24th, 2023 | 13:00 CET

100% upside potential with hydrogen! Siemens Energy, thyssenkrupp and dynaCERT instead of Nel?

Is there about to be a changing of the guard in the hydrogen sector? There are significant doubts that the previous investor favorites, Nel and Plug Power, will get their losses under control. Who could be the new favorites? Siemens Energy and BASF are working on a production plant for CO2-free hydrogen. The partners are now receiving funding from the federal government and the state of Rhineland-Palatinate. dynaCERT is having its technology tested under the toughest conditions. The hydrogen and emissions reduction specialist is equipping a team for the Dakar Classic Rally. Could 2024 bring revenue growth? thyssenkrupp nucera shows that you can also earn money with hydrogen. Analysts see almost 100% share price potential.

ReadCommented by Juliane Zielonka on November 24th, 2023 | 07:00 CET

Renewable energies - which market environment currently offers the best investment opportunities for Altech Advanced Materials, Plug Power and Siemens Energy

Wind, hydrogen, electric batteries - in this article today, you can find out which renewable energy technology offers an exciting investment case for investors. Altech Advanced Materials AG is to build a battery plant in Germany, focusing on innovative anode technology that can increase the performance of batteries by around 30%. According to CEO Marsh, Plug Power has strong fundamentals, but is the market environment in the US and Europe ready for green hydrogen? In recent months, Siemens Energy experienced challenges in the wind sector, especially with the acquired wind energy company Siemens Gamesa, which still requires repair measures. Which market environment now offers good investment opportunities in renewables?

ReadCommented by Fabian Lorenz on November 23rd, 2023 | 07:40 CET

Buy now? Morphosys, Siemens Energy and Desert Gold share

What do renewable energies, biotech and gold have in common? Shares from these sectors have predominantly experienced significant losses in 2023. Morphosys, Siemens Energy and Desert Gold are examples of this. However, the underperformers in the current year are often among the top performers in the upcoming year. Can this apply to these three shares? In the case of Morphosys, the latest study data has been confusing, and the share has given back its gains of the year. Analysts are now expressing their views. Siemens Energy has lost over 30% of its value due to operational problems, and the price targets of the experts vary widely. Explorer Desert Gold has been quiet recently. Is it the calm before a price jump? In any case, the share is anything but expensive.

ReadCommented by André Will-Laudien on November 23rd, 2023 | 07:30 CET

Getting in now? Hydrogen - The analysis: Nel and Plug Power sold off, rebound at dynaCERT!

It was like a crash. The hype sector hydrogen experienced one of the most significant sell-offs in recent stock market history with a complete reversal to the downside. Parallel to otherwise bullish markets, losses of 70 to 90% were not uncommon. The rationale behind this is understandable and frustrating at the same time: green-oriented governments around the world are trying to accelerate the climate transition but often have the wrong targets in mind due to their lack of expertise. Hydrogen is just a selectively applicable technology and not a solution for global energy supply. Studies show that only the complete, green production of H2 makes any economic sense. Investors have long since seen through the game, and politicians may have to fail before the necessary insight comes. Nevertheless, there are some opportunities for sensible hydrogen applications. We delve into the topic and put current models to the test.

ReadCommented by Juliane Zielonka on November 23rd, 2023 | 07:20 CET

Saturn Oil + Gas, Rheinmetall, Bayer - Energy, Defense, Healthcare: Where short-term returns await

In Germany, the federal government put its spending on hold, a day after the Federal Constitutional Court ruled that the reallocation of EUR 60 billion of unused debt from the pandemic era to the Energy and Climate Fund was unlawful. Europe's largest economy is shrinking due to rising energy prices and trade tensions. At the same time, North America, with stable oil companies such as Saturn Oil & Gas, presents an attractive investment opportunity for investors. Rheinmetall is experiencing a target price high of EUR 370 and flirting with long-term prospects in the US. At the same time, Bayer grapples with legal challenges and the failure of the blood thinner 'asundexian'. We look at where an investment may be worthwhile now.

ReadCommented by Stefan Feulner on November 23rd, 2023 | 07:10 CET

Significant events at TeamViewer, Power Nickel and Nordex

Global stock markets continue to head north and find themselves in the midst of a year-end rally despite the uncertainties in geopolitics. This rally is likely fueled by the ongoing easing on the interest rate front. The DAX, Germany's leading index, remains close to the critical 16,000-point mark. In addition, technology companies that have corrected sharply in recent months will likely face a sharp wave of recovery.

ReadCommented by André Will-Laudien on November 22nd, 2023 | 07:30 CET

Black Week in the energy sector: Short hydrogen - Long oil! Shell, BP, Prospera Energy, and Plug Power under the microscope

It sounds ambitious! To completely restructure Europe's energy supply, the European Union would need to invest a good EUR 300 billion in alternative energy sources, infrastructure and raw material supply contracts by 2030. As of 2021, Germany alone was importing 45% of its fossil fuels from Russia, which had been a valued partner until then. After the start of the war in Ukraine, this long-standing business partner was removed from the list. However, this also means that the very cheap sources are no longer accessible for Central Europe. Therefore, electricity, heating and mobility prices will remain high while public coffers are empty. Shareholders who bet on Greentech have to endure a crash in the hydrogen sector while fossil fuels are experiencing a renaissance. Where are the medium-term opportunities?

ReadCommented by Fabian Lorenz on November 22nd, 2023 | 07:20 CET

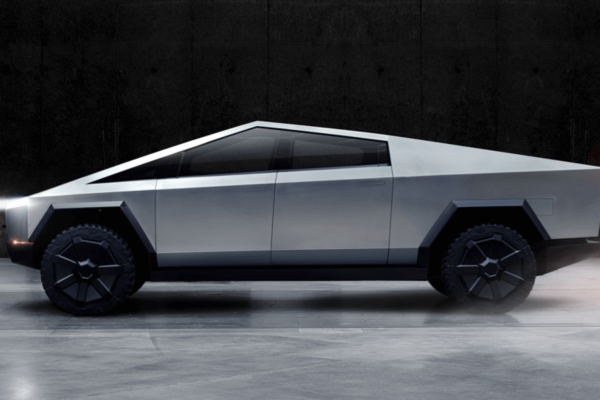

BYD with "Tesla killer", JinkoSolar with sales record, and Klimat X Developments with milestone payment

BYD is currently bursting with energy. The Chinese company is rushing from one sales record to the next. To ensure this continues in the coming year, BYD has unveiled two new "Tesla killers". The mid-range SUVs are designed to make life difficult for the Model Y. For those without a climate-neutral business model, CO2 certificates can be purchased from Klimat X Developments. The Company has just received a milestone payment. When will the shares of the innovative company benefit? JinkoSolar shareholders also need to be patient at the moment. The share is not taking off despite the solar group doing well operationally. While the Chinese have reason to celebrate, another competitor disappoints once again.

ReadCommented by Armin Schulz on November 22nd, 2023 | 07:10 CET

Siemens Energy, Almonty Industries, BASF - Rebound underway, where is it worth getting in?

At the end of October, the mood among investors was gloomy. Many indices were under pressure and had lost more than 10% of their value. Since October 28, the mood has changed, and the markets have rallied significantly. One of the reasons is undoubtedly the Fed's interest rate pause. After three weeks on the upswing, the indices are approaching new highs. Nevertheless, there are still stocks that have not yet been able to benefit from the upward trend. We have picked out three interesting stocks that offer plenty of long-term potential.

ReadCommented by Stefan Feulner on November 22nd, 2023 | 07:00 CET

Bayer, Cardiol Therapeutics, K+S AG - Clear opportunities after bottoming out

Shareholders of the chemical and pharmaceutical company Bayer suffered a black Monday following the discontinuation of a Phase III trial. As a result, Bayer shares fell to their lowest level since 2009. In contrast, there is optimism among other companies for a strong rebound. The biotech sector, in particular, seems to have bottomed out. There is a long-term opportunity for outperformance here, especially with second-tier companies.

Read