Comments

Commented by André Will-Laudien on January 5th, 2024 | 08:30 CET

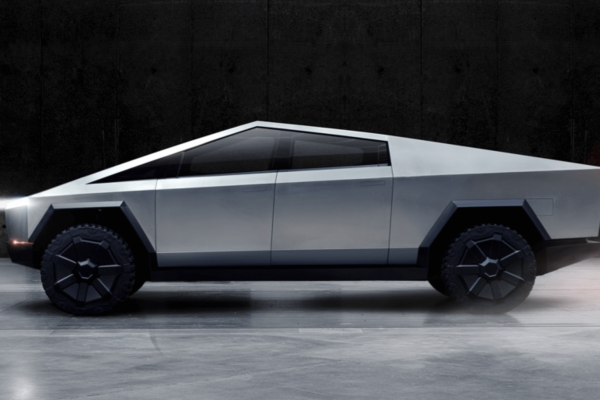

Berlin abolishes the eco-bonus, so what now for e-mobility? Plug Power, Prospera Energy, VW and Porsche in focus

Investors who bet on green energy in 2023 took a big hit. Contrary to many forecasts for the future, the wind and hydrogen sector has yet to show any sustained positive development. Government budgets are simply insufficient to promote these still unprofitable forms of energy. Private investors want to see returns on their investments. State-of-the-art combustion technologies will likely remain available for years because they are efficient and work in all weather conditions. Those who experienced their electric vehicle running out of power on December 1, 2023, at minus 10 degrees with 1 meter of fresh snow can attest to the challenges. We look at titles that carry the essence of fossil energy approaches in their soul.

ReadCommented by Juliane Zielonka on January 4th, 2024 | 08:00 CET

Focus on individual stocks: Why Saturn Oil + Gas, Siemens Energy, and JinkoSolar are scoring points in the energy poker game

Global demand for oil and gas is rising steadily, especially in high-growth economies. Saturn Oil & Gas is a Canadian company that is positioning itself as a promising investment in the energy sector. The Company is currently successfully producing light oil in Saskatchewan and has also completed horizontal drilling in Alberta. It also pursues a conservative accounting policy. Siemens Energy is in the focus of investors after a more than 50% drop in shares between June and November 2023. The damaged wind turbines from the Siemens Gamesa deal require a clear strategy from CEO Christian Bruch. Analysts are divided. While Morgan Stanley is optimistic about the development, Barclays lowers the price target. In an uncertain market environment for renewable energies, a differentiated view of individual values is crucial for investors. China is positioning itself not only as one of the leading industrialized oil and gas countries but also as a pioneer in the renewable energy sector. JinkoSolar, a Chinese company, is benefiting from its financial stability and the rising global demand for solar energy. Find out here which stock scores best.

ReadCommented by Armin Schulz on January 4th, 2024 | 07:45 CET

Almonty Industries, Volkswagen, Rheinmetall: Which share will take off in 2024?

The new year has barely begun, and investors are looking for the winning stocks for the coming year. Investors should keep an eye on the critical raw material tungsten, which Almonty Industries produces. There is significant dependence on China and Russia in this sector. The areas of application are diverse and range from electric cars, which Volkswagen builds, to medical products, metal alloys, industrial applications, electronic devices and the defense industry, where Rheinmetall operates. In times of increasing conflicts and escalating trade disputes between the US and China, essential resources such as tungsten are increasingly coming to the fore. We look at which of the three shares could take off in 2024.

ReadCommented by Fabian Lorenz on January 4th, 2024 | 07:30 CET

Price rockets 2024? Bayer, Siemens Energy and dynaCERT

Analysts expect Siemens Energy shares to gain 50% in the new year. But have the problems from 2023 really been dealt with? There are doubters, and their price targets are significantly lower. Bayer has also had a challenging year. The share was one of the weakest DAX stocks in 2023. Will 2024 bring new momentum? At least 2023 ended with an important stage victory. But analysts remain skeptical. There are reasons for a pleasing share price performance in 2024 at dynaCERT. The hydrogen company has three hot irons in the fire and landed numerous orders in 2023. Sales should now pick up, and the share should break out of its sideways trend.

ReadCommented by André Will-Laudien on January 4th, 2024 | 07:15 CET

This is where the music plays: Top values wanted for 2024! Mercedes, Globex Mining, BYD, and NIO to the inspection!

It was a challenging year for the otherwise popular automotive stocks. Berlin and Brussels no longer want combustion engines, but consumers do. Then, to top it off, the environmental bonus was also cut at Christmas. The traffic light coalition believes that e-mobility should now sell itself. Far from it, say the experts: combustion engines still account for 97% of road vehicles. Those in office are governing for minorities, as there has long been a lack of scientific facts and a lack of tact. But well, customers are voting with their feet, turning new vehicles into shelf warmers and buying their beloved diesel SUVs through the used car market. This market could even flourish over the next few years and demand scarcity premiums. Where are the opportunities for investors?

ReadCommented by Fabian Lorenz on January 3rd, 2024 | 07:20 CET

100% share price increase in a few days! Plug Power, BYD and Defense Metals shares

Within just a few days, the Defense Metals share price more than doubled shortly before Christmas. Even if the price level of the developer of a rare earths project in Canada could not be fully maintained, the share is entering 2024 with new momentum. Important data is due soon. If these are also positive, the current valuation of around CAD 50 million could be a real bargain. Plug Power is not a bargain despite the massive drop in the share price. The hydrogen specialist needs to grow and accelerate its path to break even. The e-commerce giant Amazon should help with this. BYD can only dream of doing big business in the US so far. The market is closed to Chinese e-car manufacturers. Is it justified?

ReadCommented by Armin Schulz on January 3rd, 2024 | 07:10 CET

Bayer, Defence Therapeutics, Pfizer - Buckle up for the rebound

As the end of the year approaches, the savvy equity investor begins to optimize their equity portfolio for tax purposes. During this time, investors are particularly keen to review their investments and make strategic adjustments to minimize the tax burden. This approach, often referred to as "tax-loss harvesting" or "loss offsetting", involves the clever realization of losses in order to reduce capital gains tax due on profits made in the same year. This means that shares that have not performed so well over the course of the year are often sold off again in December. In the new year, the selling pressure disappears, and the shares can start their rebound. Today, we are looking at three potential candidates.

ReadCommented by André Will-Laudien on January 3rd, 2024 | 07:00 CET

Donald Trump turns 2024 into a false start - This is where the action is: TUI, Lufthansa, Desert Gold and Alibaba

"If I do not become president, the stock market is in for a bigger crash than the Great Depression of 1929," proclaimed Donald Trump, the former president and Republican aspirant, at the end of the year. The assessment makes for amusing and entertaining reading and contains an important message. The economy is sluggish, war is raging in many places, and inflation is galloping. Why are stocks still trading near their all-time highs? It is the interest rate fantasy because between 4 and 7 interest rate cuts by the ECB and the Fed are expected in 2024. This will allow countries to continue their bloated and debt-financed budgets, but it will not create prosperity in the long run. Despite Trump's gloomy forecast, we look at some interesting turnaround stocks.

ReadCommented by Armin Schulz on January 2nd, 2024 | 08:00 CET

BYD, a pioneer in electromobility: Can First Hydrogen and Plug Power follow suit with hydrogen?

The future of mobility is increasingly environmentally conscious and innovative: now that electric cars have firmly established themselves on the market, hydrogen propulsion is emerging as a promising candidate for a green transportation revolution. Driven by the increased use of renewable energies, we are seeing growing potential for the production of green hydrogen. It is in the spotlight of current energy strategies and could come into its own, particularly in areas of mobility where electric batteries are reaching their limits. We look at the top dog of electromobility and two companies that focus on hydrogen.

ReadCommented by André Will-Laudien on January 2nd, 2024 | 07:10 CET

Returns beckon here: The Biotech favorites for 2024! BioNTech, Pfizer, Cardiol Therapeutics and MorphoSys in focus

The past year was a disaster for investors in the Biotech sector - no golden check as often seen before. Despite all the gloom, the key indicator, the Nasdaq Biotechnology Index (NBI), has managed an annual gain of around 7% since the end of October, thanks to a fabulous 15% upswing. The index was temporarily down 12%. High capital costs made it difficult for research-based companies to refinance, and it is only now, with falling inflation rates, that interest rate hopes are reviving. The 10-year yield in the US fell by more than 100 basis points from 4.98% to 3.84% in a short space of time. Now, the industry senses a positive outlook again. At the end of the year, the positive environment helped some Biotech stocks shake off the negative trend and initiate a turnaround. Which stocks should we focus on?

Read