December 23rd, 2024 | 08:10 CET

New elections in 2025 – A tailwind for electric mobility: VW, Mercedes, ARI Motors, BYD and Stellantis

The traffic light is history, and new elections will be held on February 23. If the current polls are to be believed, a centre-right coalition could emerge. A 180-degree turn in economic policy would be needed for Germany as a business location to stop the exodus of industry abroad. However, this requires signs of a consistent refocusing on burning issues. Citizens are burdened with high price increases, and e-mobility urgently needs new incentives. International investors have long since turned their backs on European markets and are investing primarily in the US. The very low valuations in this country, which have rarely been observed over a longer period of time, offer hope. There is a good chance of a noticeable turnaround in the automotive sector in particular.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VOLKSWAGEN AG VZO O.N. | DE0007664039 , MERCEDES-BENZ GROUP AG | DE0007100000 , ARI MOTORS INDUSTRIES SE | DE000A3D6Q45 , BYD CO. LTD H YC 1 | CNE100000296 , STELLANTIS NV | NL00150001Q9

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Volkswagen and BMW – From crisis to new strength

The German automotive market is unsettled. While foreign manufacturers are entering the market with a great deal of innovative strength, Volkswagen and BMW are currently struggling. Global deliveries by VW are expected to fall to around 9 million vehicles in 2024, down from 10.9 million in 2019. Now, shortly before Christmas, the unions and management have agreed on a number of points. At the core of the VW brand, the group's trouble spot is that a good 35,000 jobs are to be cut in a socially responsible manner by 2030. That is around a third of the VW brand's workforce in Germany. At the same time, production capacity at domestic plants will be reduced by 734,000 units. This will reduce significant overcapacity, but there will be no plant closures and no redundancies. The job guarantee that has existed since 1994 and that the board had cancelled in the autumn will be reinstated and remain in place until the end of 2030.

BMW recorded a dramatic drop in profits in 2024, triggered by weakening business in China. However, outgoing supervisory board chairman Reithofer sees the Far East as the best place to reverse this trend: "With the New Class, we will also be very competitive in China. Technologically, we are taking a big leap forward," the 68-year-old told Manager Magazin. In addition to the electric drive with battery, he considers the on-board electrical system and the operating concept to be crucial in this regard. The new model series is to be on par with the competition from China in terms of technology and also competitive in terms of costs. At EUR 88 and EUR 76, respectively, VW and BMW shares have technically rebounded from their lows, making a rebound now likely. Both stocks are currently at historic lows in analytical terms, with 2025 P/E ratios of 3.8 and 5.9, respectively. A significant price recovery is to be expected in 2025.

BYD and Stellantis – The battle for Europe has begun

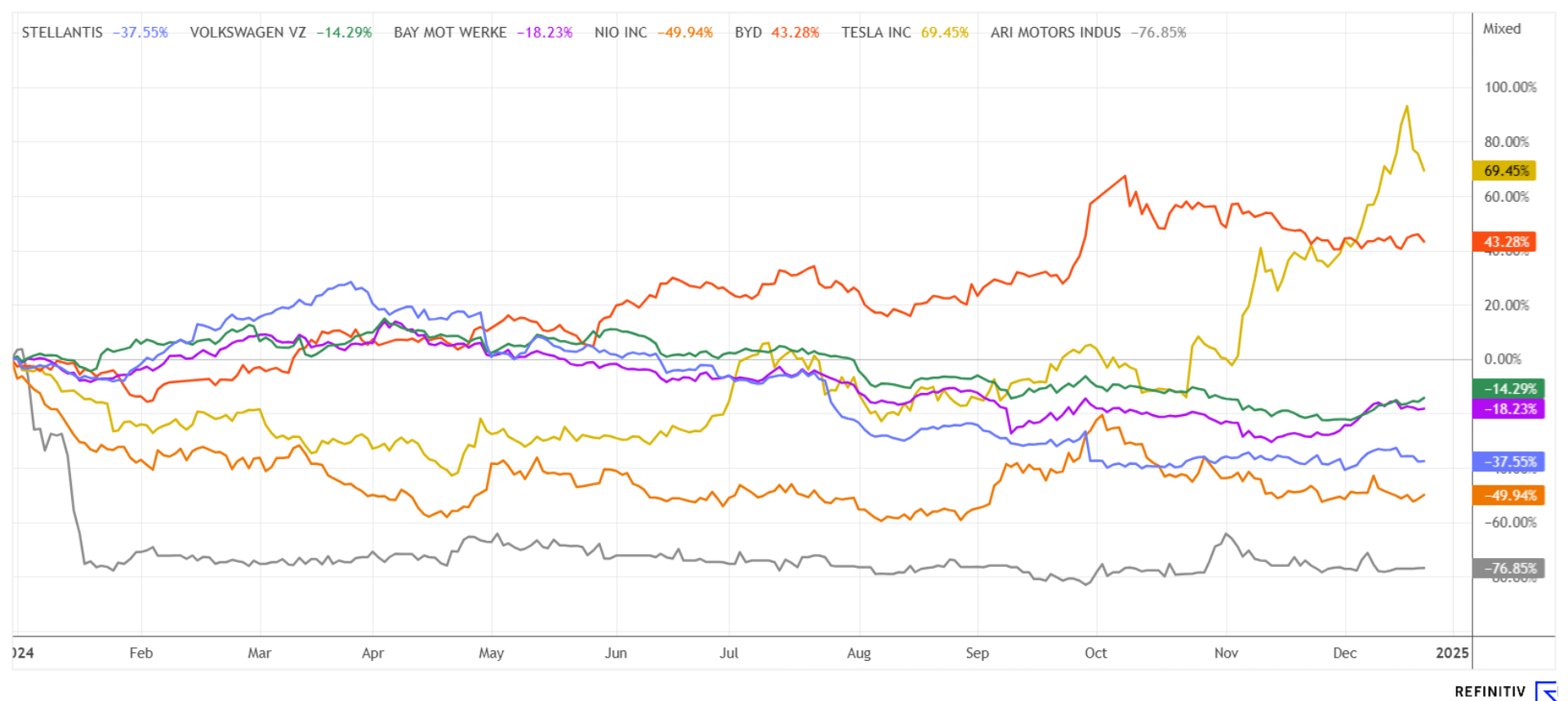

While Germany is currently living out its self-inflicted locational disadvantages, foreign manufacturers such as BYD and Tesla are stepping up a gear. There has hardly been a year in recent stock market history in which such a high valuation gap could be observed within a sector. The Texan e-mobility pioneer Tesla, with a market capitalization of USD 1.35 trillion USD and a 2024 P/E ratio of 175, the Texan e-mobility pioneer Tesla is now valued higher than all the remaining carmakers combined. A look at the charts of the key players makes this clear. Tesla benefits from Donald Trump's re-election, gaining almost 70% over a 12-month period, while BYD, the industry's second-place finisher, gains 43%.

Experts disagree on the future of the automotive sector. While Donald Trump is taking on all of his trading partners with his 'America First' policy, BYD is going down the route of its own EU production in Hungary. Due to the sharp rise in prices in recent years, German carmakers are looking at a shrinking domestic market. Added to this is the lasting uncertainty among consumers with regard to e-mobility. However, American manufacturers will have just as hard a time in the EU because there is a threat of counter-tariffs if Trump makes good on his threats. The big winner could be China, which has recently been able to gain a foothold in Europe in terms of both technology and price, and has greatly expanded its presence.

Analysts on the Refinitiv Eikon platform are somewhat skeptical about the future of the sector. Tesla is an anomaly, with 24 "Buy" recommendations out of 54 opinions. Interestingly, the average price target of USD 279 is around 50% below the current price. There are at least 10 "Buy" ratings for Stellantis, investment banks love BYD, with 31 "Buy" recommendations pointing to a price target of CNY 364 compared to a current price of around CNY 276. While Stellantis has a low P/E ratio of 4.8 for 2025, BYD investors are paying 16 times earnings.

ARI Motors Industries SE – With full order books into 2025

Remaining in the e-mobility sector, we turn our attention to a specialist for electric vehicles in everyday use. ARI Motors Industries from Thuringia has been less on the radar but no less successful. Starting as a pure assembler of Chinese components, the Company has expanded its product range to include vans. With their electric alternatives, the Thuringia-based company is fully in line with the trend because public authorities, institutions, property management companies, sports clubs, home care providers and other last-mile service providers, in particular, need cost-effective and economical e-mobiles in order to withstand the EU's 'ESG pressure' from a regulatory point of view. Currently, ARI vehicles are mainly offered through the in-house online store and distributed through word-of-mouth by satisfied customers, which is already having a very positive effect on sales. ARI Motors is continuously working on further developing its vehicle range. The range has grown from two vehicle variants to over 50 different versions in order to meet the diverse requirements of the market.

Managing Director Thomas Kuwatsch commented: "2024 was a year for us that, despite difficult economic conditions and geopolitical uncertainties, brought some important highlights and successes. Because especially in times of crisis, many buyers appreciate the good price-performance ratio of our vehicles, so we can look forward to a stable order intake. Thanks to reliability, good service, and the seriousness of our framework agreements, we were able to secure larger order quantities. For 2025, we expect sales of up to 500 vehicles due to the weak economy, provided the trend toward large-volume orders continues and the economy recovers.."

At just EUR 3.9 million, the market capitalization of the Thuringian company is remarkably low for the development achieved so far, especially since the innovative manufacturer wants to more than double its revenue to EUR 8.4 million in the current year. News on the Company's performance in 2024 and an updated outlook will be provided at the Annual General Meeting in Borna on January 17, 2025. Very exciting!

From an investor's perspective, BYD and Tesla's shares were blockbusters in 2024. There is much to suggest that there will soon be a rotation within the automotive sector. That is because turnaround investors are already lurking at VW, BMW, and Stellantis. ARI Motors, on the other hand, could surprise positively in 2025 because its order books are full. Risk-conscious investors are now entering at the low levels. Diversification across several pillars makes sense and lowers portfolio risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.