February 27th, 2025 | 15:25 CET

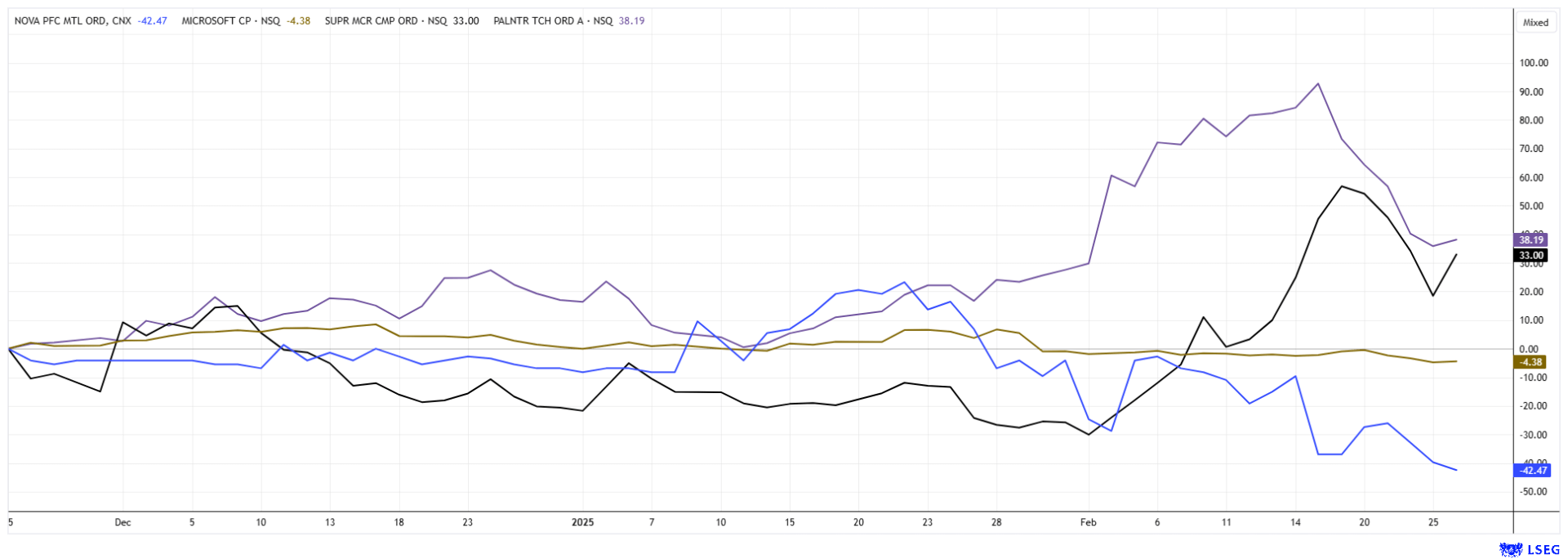

NASDAQ rally continues! Now betting on AI with SMCI, Palantir, Nova Pacific Metals, and Microsoft

After a brief consolidation, the rally is continuing, but volatility is increasing. Alongside armaments, the topic of artificial intelligence (AI) remains a key driver of investor imagination. AI has rapidly advanced in recent years and is now an integral part of many areas of daily life. From personalized recommendations on streaming platforms to voice assistants and autonomous vehicles, AI technologies are already shaping numerous industries and parts of societal life. Particularly in the areas of healthcare, finance, manufacturing, and mobility, AI is opening up innovative solutions that increase efficiency and create new opportunities. Some companies are calling the shots. We offer a selective insight.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SUPER MICRO COMPUT.DL-_01 | US86800U1043 , PALANTIR TECHNOLOGIES INC | US69608A1088 , NOVA PACIFIC METALS CORP | CA66979J1066 , MICROSOFT DL-_00000625 | US5949181045

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Super Micro Computer – Resurrected

Since the extensive correction to around USD 20, the high-tech stock Super Micro Computer has recovered quite well. In the meantime, the Californian company has provided its balance sheet data and hired a new auditor, and the stock market is regaining confidence. Now, analysts are once again looking at the Nvidia partner through their fundamental glasses, and yesterday, the Company was once again able to exceed analysts' expectations. SMCI already delivered its quarterly figures on February 11. With an EPS of USD 0.51, the Company stayed within expectations. Experts on the LSEG platform expect earnings per share of USD 2.62 by the end of the fiscal year. This puts the current P/E ratio at 19.5 – a drop in the ocean compared to Nvidia's valuation. Due to the inconsistencies in the financial figures, many analysts have recently revised their estimates. Only 4 out of 12 experts now recommend the share as a "Buy". The weighted 12-month price target is USD 48.80, which is exactly yesterday's price. Flip a coin!

Nova Pacific Minerals – Strategic metals more important than ever

Critical metals play a central role in the development and production of artificial intelligence (AI) and high-tech applications. Western industrialized nations, in particular, depend on elements such as copper, nickel, rare earths, cobalt and lithium, which are essential for high-performance chips, battery storage, and sensors. The dependence on global supply chains, especially from China, represents a significant strategic risk. With Donald Trump's new term of office, securing these raw materials is increasingly becoming the focus of US policy to ensure technological competitiveness and national security. Even today, Western industrialized countries are working to make their supply of critical metals more independent by diversifying sources and recycling strategies. The US and Canada have been heavily dependent on imports and are seeking to diversify their raw material supply and increase the number of domestic mining operations to reduce geopolitical risks.

Nova Pacific Metals is a Canadian exploration company focused on the Lara Volcanogenic Massive Sulfide (Lara VMS) Project on Vancouver Island. This brownfield development project has a significant historical resource rich in critical and precious metals and is located at a site with excellent infrastructure. Nova Pacific's forward-looking strategy includes confirmation and infill drilling, completion of an updated mineral resource estimate (MRE), and, prospectively, the preparation of a pre-feasibility study.

Yesterday, the Company published promising results from surface exposures in the Anita zone, a strategic expansion of the flagship Lara Project. Higher copper grades of up to 4.77% were encountered at Anita compared to the Lara deposit, with gold and silver grades of 0.02 to 3.28 g/t AU and 2.41 to 610 g/t AG respectively, with associated base metals, broadly similar to the Coronation Zone grades. CEO J. Malcolm Bell explains: "The sample results from the Anita Zone, which is part of the western extension of the Lara deposit, are very encouraging as they confirm similar results to those obtained by Falconbridge in the 1980s. Further work will be carried out this spring and summer before a drilling program is proposed." So it should remain exciting.

NVPC stock has initiated a small round of consolidation after jumping a good 10% to CAD 0.47. Risk-conscious investors can now build up further positions in the CAD 0.20 to 0.23 corridor. The medium-term prospects in the critical metals market are excellent.

Palantir and Microsoft – Two blockbusters in the big data sector

Opinions are divided when it comes to Palantir. While insiders continue to happily sell off shares, demand on the stock market remains strong after a 25% correction. According to SEC filings, CTO Shyam Sankar sold 375,000 Palantir shares worth around USD 38 million on February 20, and Alex Karp has also pulled several billion dollars from the market. However, Sankar still holds nearly 1.5 million shares directly and indirectly, so the pressure could continue for a while. The stock has been fluctuating significantly after muted fourth-quarter results. Analysts on the LSEG platform estimate an average 12-month price target of USD 93.20. Only 6 out of 24 experts would still enter at the current level of USD 89. A glimmer of hope: The stock is technically supported in the USD 86 to USD 89 range. The risk only arises if it drops below this level with high volume.

According to the latest figures, Palantir partner Microsoft continues to grow solidly at around 10% per annum. Uncertainties about future investments in AI have caused the share price to correct by over USD 50 since December. For the high-tech blockbuster, there are over 50 "Buy" recommendations on the LSEG platform, which, on average, condense into a price target of USD 502. Nevertheless, investors should exercise caution. MSFT shares have not generated a return in a year. Technically, the current formation could also be interpreted as a long-term double-top reversal. But who wants to turn negative in the midst of the greatest euphoria? A stop at around USD 375 serves as a lifesaver for the valuable porcelain box.

With advances in machine learning and neural networks, future AI systems could become even more autonomous, intelligent, and adaptable. This raises both opportunities and challenges, with the debate in society focusing in particular on ethical questions and the responsible use of AI. Investors should, therefore, proceed selectively. Palantir and SMCI are analytically expensive, while Microsoft offers the long-term stability of a global market leader. Nova Pacific Metals remains interesting from a speculative point of view due to its extensive critical metals resources.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.