February 12th, 2025 | 08:00 CET

Mega rally at First Phosphate, Renk, VW, and BYD with buy signals

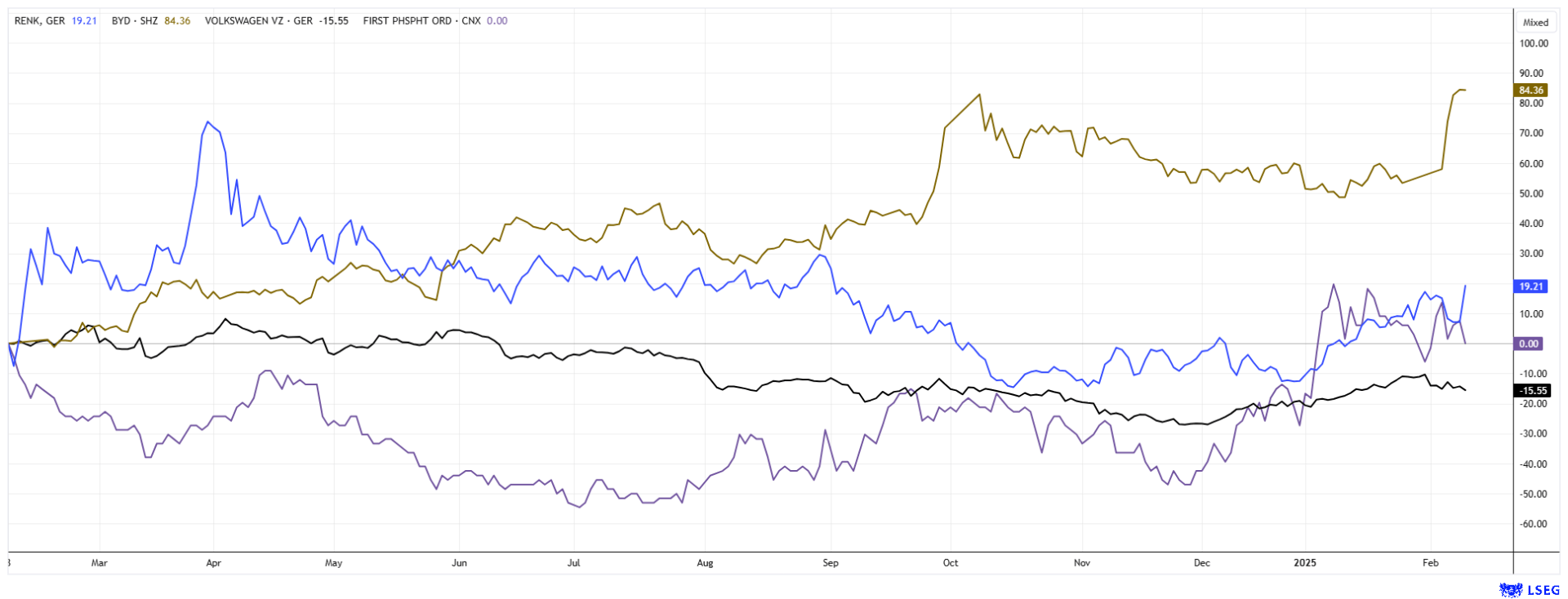

The stock markets continue to rise unabated. Those hoping for a correction will be disappointed. Yesterday, the DAX 40 index broke through the 22,000 mark, much faster than many had anticipated. Technology stocks SAP and Siemens remain the driving force, while on the NASDAQ, it is still the Magnificent 7 that is setting the tone. Selection is now key. We turn our attention to the upcoming battery materials supplier, First Phosphate, as well as stocks like Renk, VW, and BYD. While VW is in the middle of restructuring, BYD is continuing on its journey. The defense industry remains interesting, especially Renk. Where should one invest now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

FIRST PHOSPHATE CORP | CA33611D1033 , RENK AG O.N. | DE000RENK730 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

First Phosphate – 50% premium at the beginning of the year

Those wanting to master the energy transition need innovations in the field of batteries. Whether for e-mobility or the urgently needed energy storage, performance and endurance are required. Vehicles and stationary storage units must be charged and discharged in short cycles if they are to replace the base load capacity of a continuous energy source such as nuclear power. If the plans of the still-ruling traffic light government are to be followed, renewable energies such as wind, solar, and water are to close the production gap from the shutdown of nuclear reactors in the long term. Experts estimate the additional demand at around 2.5 million solar rooftops or about 5,000 wind turbines, as the hydropower sector appears to be already fully installed across Central Europe.

The Canadian company First Phosphate (PHOS) is focusing on this potential game changer and is betting on phosphate. The phosphate market is well known worldwide from the fertilizer industry, but in light of the energy transition, phosphate is primarily used to produce active cathode material for the lithium iron phosphate (LFP) battery industry. First Phosphate wants to extract this from its own mine in the long term, with the aim of positioning itself in the critical supply chains of Western high-tech producers. A resource estimate in the indicated and inferred category of around 15.5 million tons of phosphate (P2O5) has already been made for the Begin-Lamarche project. This could increase further with additional development. In January, First Phosphate published a preliminary economic assessment (PEA) of the project. This shows that the mine will generate an after-tax cash flow of CAD 700 million in the first three years alone. A discount rate of 8% results in a present value of CAD 1.59 billion. First Phosphate is valued at just under 53.2 million shares, or just CAD 18 million. No wonder the value has doubled in recent weeks with high turnover. In the current geopolitical environment and under the scope of Trump's industrial policy with a focus on North America, the ongoing revaluation is just the beginning.

Renk – A change in ownership Boosts the Company

The Augsburg-based specialist gearbox manufacturer surprises with a change in a major shareholding. The French-German defense company KNDS has become the largest shareholder through the exercise of an option. This involves around 18.3 million call options that have now been redeemed from the major shareholder, Triton. Previously, the investment company was Renk's largest shareholder with 33.5 million shares, well ahead of KNDS with 6.7 million. With the current package, KNDS's stake is now likely to grow to a blocking minority of 25.1%, although the authorities still have to approve the share purchase. The stock market now sees the synergy effects that could result from closer cooperation between the two defense companies. Market observers also expect higher revenues for Renk. The share price jumped by more than 10% to EUR 24.80 yesterday. As a result, the value is technically almost back at its breakout point from late January.

BYD versus VW – Success speaks for itself

With a total of seven new models, BYD has been pushing into European sales markets since the fall of 2024. This is not surprising, as the Chinese electric mobility provider has long since anchored all vertical production stages in its corporate structure with great strategic skill. By contrast, its largest European competitor, VW, is undergoing a tough restructuring. A total of 35,000 jobs are to be added by 2030, including 3 production sites. Volkswagen sold a total of around 238,200 electric vehicles (BEVs) across all group brands in the fourth quarter of 2024. Compared to the previous year's fourth quarter, the number fell by 0.5%. In 2024, a total of around 744,800 e-vehicles were sold, about 3.4% less than in the previous year. This marks the biggest contrast to BYD, which sold over 4 million electric vehicles. The stock has lost around 22% of its value in the last 12 months but has at least recovered from its lows of around EUR 80. The Wolfsburg-based company will present its figures on March 11, which may be the first positive surprise in several quarters. 14 out of 28 analysts on the LSEG platform are voting to "Buy", with a medium-term price target of EUR 114.80. But is that enough to persuade frightened investors to buy the stock again?

The success story of BYD is different. When it comes to e-mobility, the innovative manufacturers from the Middle Kingdom have already caught up with industry leader Tesla. At the same time, the market capitalization of the Chinese company has already outperformed that of the Wolfsburg-based company by 200%. Fundamentally, the market no longer believes that VW is particularly dynamic because, with a 2025 P/E ratio of 3.8, the value is at its lowest point in the last 20 years compared to its peer group. With a profit factor of 14.6, BYD can continue to rely on its strong growth. With a price of over EUR 41 and a performance of over 80% in the last 12 months, the value is only just below its all-time high from 2023. Turnaround speculators favor VW, while investors bet on further high growth at BYD.

Battery research is becoming a game changer in e-mobility. The explorer First Phosphate focuses on the supply chains in the high-tech industry and continues to make progress. VW is currently lagging behind the Chinese producer BYD but should be able to regain its footing in the course of 2025. The stock is a bargain. Renk remains on the buy list of defense investors.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.