November 21st, 2024 | 07:00 CET

Make Trump love hydrogen – why not? Nel, Plug Power, First Hydrogen, thyssenkrupp and nucera

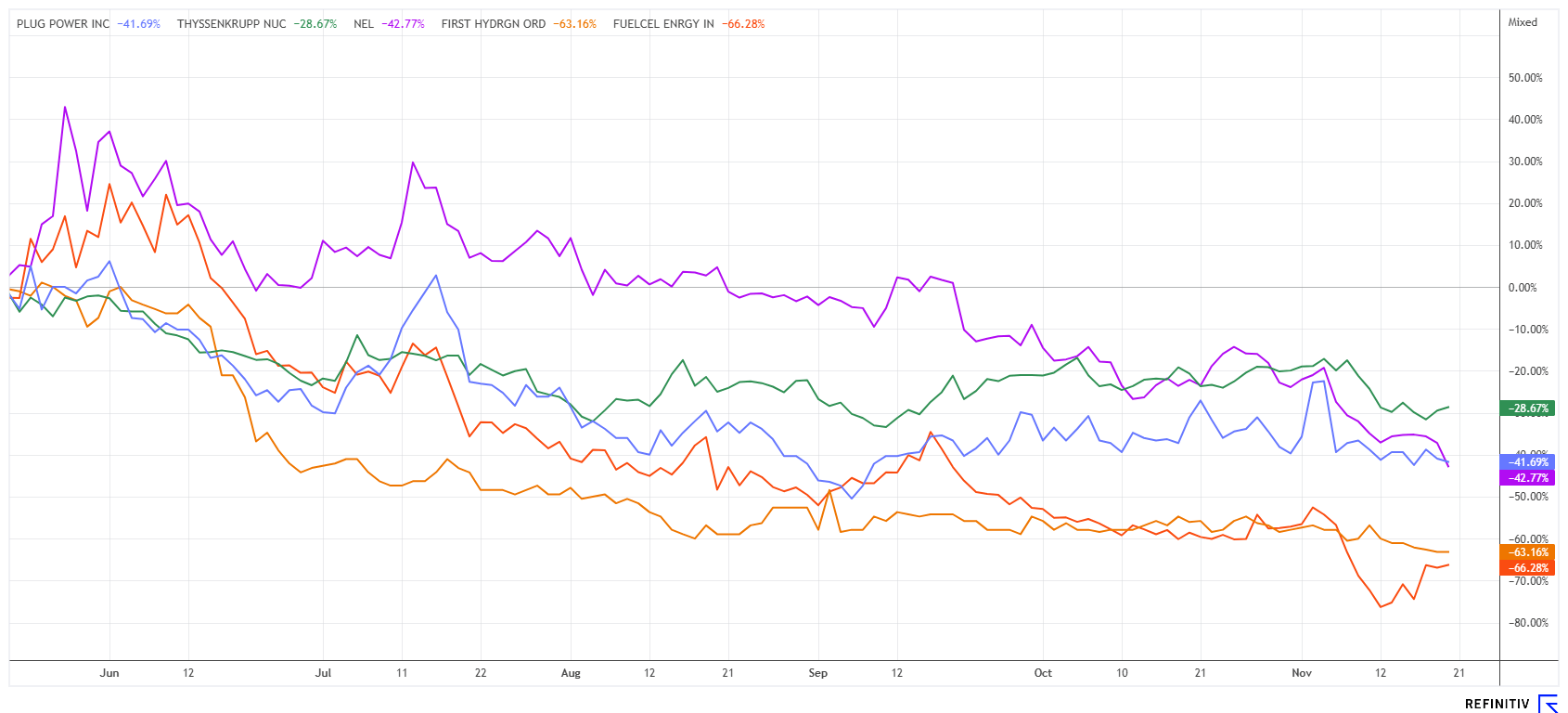

- Even though Trump ignores or denies climate change, he has an advisory team focused on the future of the US. After all, the Republican Party wants to continue to govern even after the Donald era. However, the current election result is weighing on the entire green tech sector, so investors should selectively take advantage of the current sell-off. After all, the technologies will not disappear but continue to develop in the background. Hydrogen propulsion systems still play a niche role but could become more important due to technological advances and infrastructure investments. Their future depends heavily on how effectively renewable hydrogen can be produced and made available and how costs develop compared to other zero-emission technologies. First Hydrogen is demonstrating how the logistics and transportation sector could develop under the EU's "Net Zero 2050" target! Sentiment is low, so investors should switch in time to benefit from the impending rebound.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , First Hydrogen Corp. | CA32057N1042 , THYSSENKRUPP AG O.N. | DE0007500001 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

First Hydrogen – Full speed ahead towards Europe

The Canadian hydrogen specialist First Hydrogen (FHYD) is on its path. After an extensive development period, a widely tested, sprinter-sized delivery van is now ready to revolutionize the logistics and transport industry. Hydrogen-powered vehicles (FCEVs) only emit water vapor, making them a clean alternative to fossil fuels. The production of green hydrogen is still energy-intensive and heavily dependent on the availability of renewable energy sources. That is why First Hydrogen plans to start with its first integrated production site in Quebec. The announcement followed the introduction of an FCEV demonstration program for North America and plans to build a 35-megawatt hydrogen production plant combined with an assembly plant in Shawinigan, where 25,000 zero-emission vehicles are expected to be produced annually. After the US election, the decision to focus on Europe has been confirmed as a good strategic decision. An office in Germany has already been opened.

CEO Balraj Mann commented: "Europe has shown a strong commitment to switching from fossil fuels to clean hydrogen. First Hydrogen is now bringing hydrogen-powered fuel cell vehicles to Germany; we were the first in the market with successful trials of various fleet operations in the UK." Extensive tests have already been successfully completed in Europe, and enquiries from various logistics providers have already been made. The European Commission has approved four waves of integrated EU hydrogen projects (IPCEI) in its "Net Zero 2050" future plan, and many companies like First Hydrogen will receive funding. FHYD shares are currently trading at around CAD 0.35 or EUR 0.24. Unfortunately, the negative industry trend since Donald Trump has also made itself felt here. However, the next hydrogen wave could already be lurking around the corner.

Nel ASA and Plug Power – Completely wiped out

Things could not have turned out worse for Plug Power and Nel ASA. Both companies have been suffering for months from tight public finances and investor restraint. Plug Power has already placed two capital increases on the market to finance its current business. Unfortunately, the Q3 figures were also worse than expected, and the share price fell back from USD 2.45 to USD 1.92 after the announcement. The New York-based electrolyser specialist was unable to recover from this crash. The PLUG share currently offers little incentive for renewed investment, but the technical resistance at around USD 2.50 to 2.75 should be kept in mind.

Yesterday, a stock market storm surrounded the Norwegian hydrogen pioneer Nel ASA. The stock fell to a new 5-year low of around EUR 0.27 for no apparent reason. In May, the stock was still trading at over EUR 0.75. Although Nel remains strong in the technology and production of electrolysers, for example, with the expansion of capacity in Norway and the US, the commercialization of these technologies continues to require significant investment. This leads to continued losses and a longer perspective on profitability. The analyst firm Jefferies downgraded its rating from "Hold" to "Underperform" and lowered its price target from NOK 5.50 to 3.00. Morgan Stanley is also moving down a notch and now expects only NOK 3.50 instead of NOK 9.00 over a 12-month horizon. At the moment, Nel ASA seems to be fighting a losing battle on all fronts.

thyssenkrupp and the stake in nucera – Is something in the offing?

Like a phoenix rising from the ashes, thyssenkrupp turned things around last week. Although the Q4 figures for the 2023/24 financial year were another disappointment, the current view seems to be that things cannot get much worse. Since the end of October, the stock has risen by around 25%, and yesterday, it just missed the EUR 4 mark. Thyssenkrupp wrote off around EUR 1 billion on the ailing steel business, and high restructuring costs weighed on the bottom line. The management team around CEO Miguel López is preparing for another year of transition due to the challenging environment, with Steel Europe and Marine Systems being the focus of attention. After financial investor Carlyle pulled out of the bidding process, thyssenkrupp is sticking to the idea of hiving off the marine division. According to the statement, a spin-off is now favored, but the division remains open to industrial partnerships. In addition, thyssenkrupp is continuing talks with the German government. The point is to get the state involved because the GreenSteel project is an invention of the Minister of Economic Affairs Habeck.

Things are going better at thyssenkrupp nucera. The Company had expected revenues of between EUR 820 and 900 million for the 2023/24 fiscal year. In an outlook, management confirmed that the fourth quarter developed positively. With improved order momentum, particularly in the chlor-alkali service business, the hydrogen division (AWE) even achieved new business at the previous year's level. Although EBIT was down year-on-year, it was slightly better than expected. The Company, majority-owned by thyssenkrupp, has not yet provided any specific figures. These are to be presented on December 17. At least thyssenkrupp nucera's share price has stabilised between EUR 8 and EUR 9 for some time. Keep both stocks on your watchlist. thyssenkrupp could break out technically at EUR 4.25 soon.

Donald Trump was a trigger for selling in the green tech sector. But Trump is not everything, especially from a global perspective. After a huge sell-off, the focus will eventually return to the best business models. In this regard, both thyssenkrupp nucera and First Hydrogen are already well on their way. The two darlings of the public, Nel ASA and Plug Power, continue to suffer from portfolio adjustments at the end of the year.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.