NEL ASA NK-_20

Commented by André Will-Laudien on June 6th, 2025 | 07:10 CEST

Greentech is now exploding – a 300% comeback for hydrogen? nucera, dynaCERT, Plug Power, and Nel ASA

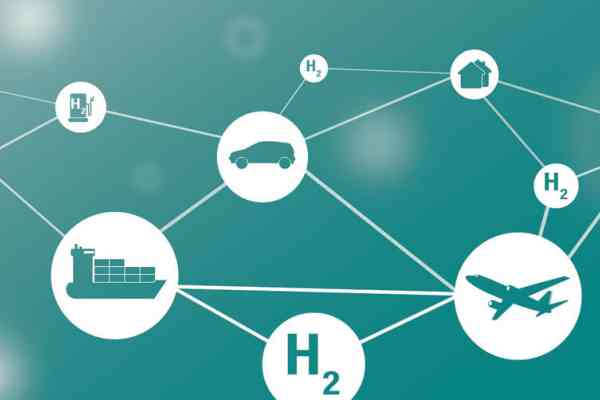

Although the US administration under Donald Trump does not think much of climate change, the outlook for the hydrogen sector is improving all the time. This is because it is no longer the US setting the tone but Europe and Asia. Global efforts to make local transport cleaner and more sustainable are now also reaching the transport, logistics, and mining industries. There is still enormous potential for improvement here in terms of reducing climate-damaging emissions. Innovative technologies such as those developed by dynaCERT are now well-known in the market. Therefore, decision-makers in public office will no longer be able to avoid discussing these issues if they want to remain in their positions in the coming years. The public pressure to combat negative climate change globally is increasing. Forward-looking investors should start positioning themselves now.

ReadCommented by Fabian Lorenz on May 30th, 2025 | 07:00 CEST

D-Wave shares with insider alert! Nel and Samsung step on the gas! Walmart partner MiMedia makes a big splash!

Insider alert at D-Wave Quantum. Numerous executives have sold shares in recent weeks, taking advantage of the quantum highflyer's record levels to take profits. Should investors do the same? There was positive news at MiMedia. On Wednesday, the cloud hidden gem announced a new partnership with a smartphone manufacturer. Is the stock now heading for a new all-time high? In any case, the valuation appears attractive. At Nel, new major shareholder Samsung is increasingly taking the reins. In addition to the change in the board of directors, a joint product was presented. Will the struggling hydrogen play manage a turnaround?

ReadCommented by André Will-Laudien on May 26th, 2025 | 07:05 CEST

Tariffs, nuclear energy, and climate policy! Trump sets the pace for Nel ASA, First Hydrogen, Plug Power, and Oklo

The world is undergoing a 180-degree turn. Nuclear energy, which was demonized until 2022, is now experiencing an astonishing renaissance, and green seems to be redefined. Under Donald Trump, the US aims to expand the use of nuclear energy significantly, and the US president signed all the necessary decrees last week. Trump said that the United States intends to become "a real power" in the nuclear industry again by quadrupling its nuclear power production after his tour of the Middle East. Oil prices thus approached the critical USD 60 mark again, and hydrogen stocks experienced another sell-off. However, one problem is becoming apparent: 30-year bonds are now yielding over 5%. Stock market traders are now focusing on nuclear business models and uranium stocks. Where are the opportunities and risks?

ReadCommented by Fabian Lorenz on May 13th, 2025 | 07:15 CEST

Stocks are taking off! Nel, RENK, Walmart partner MiMedia! Is the tariff chaos coming to an end?

Will MiMedia's stock break through resistance and shoot to a new all-time high? The chances are good, as the cloud insider tip has navigated the tariff chaos of recent weeks surprisingly well. Now, the Company is set to scale up in Latin America with retail giant Walmart. With gross margins of 80% and above, the upside is substantial. Could new momentum come from the CEO soon? Things are already heating up at Renk - tomorrow's update will be crucial. Can the high-flyer's order backlog and outlook convince investors? Analysts remain cautious, and the potential downside for the stock should not be underestimated. And what is Nel doing? For shareholders, it is a rollercoaster once again. An order cancellation is followed by new hopes that the EU might completely cut off the Russian gas tap.

ReadCommented by Armin Schulz on May 12th, 2025 | 07:00 CEST

From the valley of tears to hypergrowth? Nel ASA, dynaCERT, and Plug Power in the crosshairs

Does the future of the energy sector lie in hydrogen? After a decade of hype and disillusionment, 2025 is shaping up to be a turning point. Hydrogen is set to flow through Germany's new core grid for the first time, while global megaprojects drive the decarbonization of everything from steelworks to aircraft. The market could grow by 12% annually until 2030, fueled by billions in government funding, industry alliances, and innovative storage solutions. But can hydrogen make the leap from the lab to mass application? In this key phase, three players are stepping into the spotlight: Nel ASA, dynaCERT, and Plug Power.

ReadCommented by Stefan Feulner on May 5th, 2025 | 07:05 CEST

Nel ASA, First Hydrogen, BYD – Warren Buffett steps down and significant rebound opportunities

The bombshell dropped over the weekend! The Oracle of Omaha is stepping down and passing the baton. With cash reserves of USD 347.7 billion, Berkshire Hathaway's rejuvenated management is entering a new era. In addition to this breaking news, the past trading week saw a flurry of quarterly figures. Several companies in the renewable energy sector once again failed to meet expectations. However, there are opportunities for a rebound, albeit at significantly reduced levels.

ReadCommented by Fabian Lorenz on May 1st, 2025 | 07:10 CEST

A bombshell at Nel ASA! Buying opportunity for Bayer and Defence Therapeutics shares?

A bombshell at Nel ASA. The hydrogen specialist has reported its first quarter results: revenue and order intake are down, while the Company is sliding deep into the red. Will new major shareholder Samsung bring about a turnaround? Defence Therapeutics is a hot rebound candidate with takeover speculation. The biotech company is consistently pushing ahead with the monetization of its technology and has found a strong partner. The decline in the share price in recent months offers opportunities. A lot of negative news is certainly already priced into Bayer's share price, but is that enough to buy the stock? Yes, according to analysts.

ReadCommented by Fabian Lorenz on April 28th, 2025 | 07:00 CEST

Over 300% upside potential for cleantech stocks: Will dynaCERT finally outshine Nel, Plug Power, and Co.?

Analysts believe that dynaCERT shares are currently undervalued by more than 300%. The Company is on the verge of a breakthrough with its technology for reducing fuel consumption and emissions in diesel engines. Revenue is expected to multiply in the current year, with the trend continuing to rise sharply. Industry sentiment for cleantech and renewable energy stocks has also improved noticeably in recent weeks. This is because it is not only in Germany that the price of CO₂ is becoming a key lever for climate protection. dynaCERT helps companies save CO₂ and generate revenue through the sale of certificates. Perhaps Rheinmetall, KNDS, and Co. will follow suit in the future?

ReadCommented by Fabian Lorenz on April 17th, 2025 | 08:15 CEST

Billions for defense and hydrogen: RENK, Nel ASA, and dynaCERT – Profiteer or "dead cat"?

In the coming years, billions will be invested in defense, hydrogen, and energy efficiency in Germany alone. The grand coalition has committed itself to this in the coalition agreement. The CO2 price is set to play a central role in climate protection. dynaCERT is expected to benefit from this, as the cleantech company's retrofit kits for diesel engines reduce CO₂ emissions. Analysts see multiple potential for the share. How quickly such a multiplication can happen has been recently demonstrated by RENK's share price. Despite hitting record highs, analysts recommend buying. And what is behind the price jump at Nel ASA? New hope, or are the Norwegians just a "dead cat bounce"?

ReadCommented by Fabian Lorenz on April 8th, 2025 | 07:00 CEST

Winners in the tariff quake: Renk, Nel ASA, Almonty – China attacks US defense industry

The tariff quake on the stock markets continued yesterday. For companies like Nike and the German automotive industry, the extent of the consequences is still unclear. However, there may also be winners. Tungsten producer Almonty emphasized yesterday that its defense-critical raw material is exempt from tariffs. In addition, China is tightening its controls on the export of critical raw materials. This makes Almonty shares even more attractive. Is a NASDAQ listing the next surprise? The effects of the tariffs are also likely to be manageable for RENK. The transmission manufacturer for tanks and other military vehicles has excellent business prospects here in Europe. The share was again recommended as a "Buy". Hydrogen could also benefit, as it helps diversify Europe's energy supply. Can Nel ASA benefit from this? A study shows that more investment in electrolysis capacity is needed in Europe.

Read