HENSOLDT AG INH O.N.

Commented by Fabian Lorenz on October 9th, 2025 | 07:20 CEST

GOLD RUSH to USD 5,000? DEFENSE STOCKS set for a billion-dollar contract! Barrick Mining, Hensoldt and Kobo Resources!

While the US government shutdown drags on, the rush for tangible assets persists. The pace at which gold and silver prices are climbing is almost alarming. On the stock market, AI and defense remain key drivers. With surprising ease, the price of gold has broken through the USD 4,000 mark - could USD 5,000 be next? Barrick Mining is also continuing its rally, while those looking for undiscovered gems amid this hype should take a closer look at Kobo Resources. The junior explorer could soon become a potential takeover target. In the defense sector, the capital market is waiting for major orders. One such order could now come from the German government. Hensoldt stands among the likely beneficiaries.

ReadCommented by André Will-Laudien on October 8th, 2025 | 06:55 CEST

Drone warfare and armament – Caution with Rheinmetall, Hensoldt, and thyssenkrupp, but 150% upside with Antimony Resources

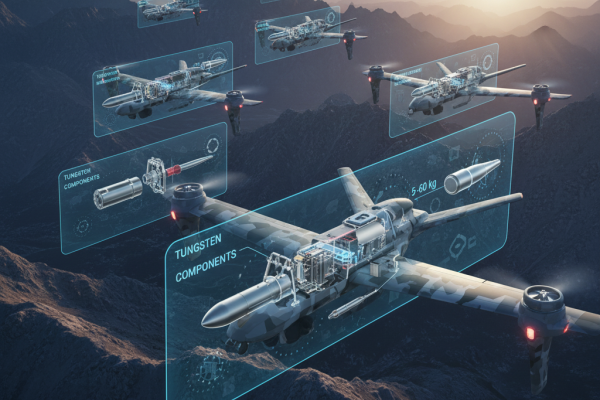

Recent geopolitical events impressively highlight the critical need for strategic metals. While tungsten producer Almonty has surged by over 1,000%, risk-aware investors are now turning their attention to Antimony Resources. With properties that are indispensable for ammunition, electronics, and protection systems, antimony is emerging as a key strategic metal for modern defense and high-tech industries. The heavy reliance of Western nations on a few producing countries, such as China, is increasingly bringing security of supply into the focus of geopolitical debates. Without a stable supply chain, there is a risk of bottlenecks that threaten not only defense capabilities but also technological sovereignty. Investors and industry players are therefore increasingly seeking alternative sources and recycling solutions to meet rising demand in a sustainable manner. Meanwhile, defense stocks are currently consolidating at a high level. Is the rally now entering its final phase?

ReadCommented by André Will-Laudien on October 6th, 2025 | 07:10 CEST

Defense first, then sell – Now it is time to load up on critical raw materials! Globex Mining, Hensoldt and RENK

Daily madness on the capital markets. While foreign drones circle over NATO territory conducting espionage, politicians in Brussels feel compelled to increase defense budgets once again. Even Ursula von der Leyen feels the pressure to act at the Denmark summit: "We must invest in real-time space surveillance so that no troop movements go unnoticed. We must heed the call of our Baltic friends and establish a drone defense system. This is not an abstract ambition – it is the basis of credible defense!" This is the next boost for the defense industry, and for the raw materials stock Globex Mining, things are really taking off now! We highlight which stock could become the next big gainer.

ReadCommented by Fabian Lorenz on October 3rd, 2025 | 07:10 CEST

Drone wall for Europe! Almonty, DroneShield, and Hensoldt – Defense stocks taking off again!

The past few weeks have shown that Europe has been asleep at the wheel on drone defense. In Denmark, Poland, and Germany, these small aircraft are almost impossible to detect, and when they are, current countermeasures are inefficient and costly. At the EU summit in Copenhagen, Danish Prime Minister Mette Frederiksen warned of the "most serious threat since World War II" and called for urgent investment. Billions must now flow into radar systems, jammers, and interception technologies. This is electrifying defense stocks. Almonty, at the beginning of the value chain, supplies tungsten, a critical material also used in drones and missiles. Hensoldt, with its expertise in detection systems, is investing heavily in new solutions. Can DroneShield justify its billion-dollar valuation?

ReadCommented by Nico Popp on October 2nd, 2025 | 07:05 CEST

What billions for space mean for drones: Volatus Aerospace, Hensoldt, Airbus

Things are happening in Germany! The federal government recently approved comprehensive investments in space. Experts agree that Germany is on a par with the US when it comes to space research. While partners across the Atlantic usually act faster and on a larger scale, Germany is now set to take a bolder approach: a hefty EUR 35 billion is to be invested in space security. This move positions Germany as a space power, leaving even the French and British in the dust. We take a look at what these investments mean and why the commitment to space should be seen as part of the bigger picture.

ReadCommented by André Will-Laudien on September 30th, 2025 | 07:10 CEST

Gold boom boosts critical metals! Another 100% with Power Metallic, BYD, Hensoldt and RENK

The geopolitical situation continues to escalate, but the stock markets continue to boom! Trade conflicts, sanctions, and military tensions dominate the headlines, but behind the front lines of a new Cold War, another competition has long been raging: the battle for access to critical metals. Without copper, lithium, nickel, cobalt, or rare earths, not only would the e-mobility revolution come to a standstill, but defense technologies, digitalization, and the energy transition would also grind to a halt. Supply chains are coming under increasing pressure from geopolitical power games, and the battle for resources is becoming a key strategic factor in a multipolar world order. For Western industrialized nations, security of supply is becoming a matter of survival, and for investors, this is creating new opportunities. Anyone looking for tomorrow's winners today should keep a close eye on the global raw materials poker game.

ReadCommented by André Will-Laudien on September 26th, 2025 | 07:25 CEST

Shooting down Russian drones and fighter jets? NATO keeps its focus on Rheinmetall, Almonty and Hensoldt!

On the financial markets, Russian provocations involving jet and drone overflights are primarily perceived as a security risk. Such actions increase political instability and often trigger a flight to safe havens such as gold, government bonds, or the US dollar. At the same time, defense stocks and companies in the security sector tend to benefit, as investors anticipate rising defense spending in Europe and within NATO. For the broader equity market, the increased risk often translates into higher volatility and temporary price setbacks. In the long term, such threat scenarios are factored into risk premiums and valuation models, leading to more selective capital allocation in security-related sectors. Here are a few ideas.

ReadCommented by Nico Popp on September 16th, 2025 | 07:15 CEST

Defense industry expands – New growth drivers: Hensoldt, Almonty and Rheinmetall

An industry once largely overlooked by the public is now dominating the headlines. On Monday, it was announced that Rheinmetall will acquire the Marine Division of the Bremen-based Lürssen Group. This includes the Blohm + Voss shipyards, the Norderwerft shipyard in Hamburg, the Peene shipyard, and the Neue Jadewerft shipyard in Wilhelmshaven. This move underscores how the defense industry is venturing into new domains. Meanwhile, tensions between Russia and NATO continue to escalate. The drones that flew over Poland last week are considered by experts to be a serious provocation. In this context, we take a closer look at three high-flyers in the defense industry and highlight where investors may find the greatest opportunities.

ReadCommented by Fabian Lorenz on September 10th, 2025 | 07:20 CEST

Evotec downgraded! Out of Hensoldt? Into Pure Hydrogen?

Out of Hensoldt and into Rheinmetall? That is what analysts are suggesting—at least indirectly. Valuation is becoming a headache. How do other experts view the share's performance? In contrast, an exciting buying opportunity seems to be developing at Pure Hydrogen. With their openness to technology, the Australian company is clearly striking the right chord with customers. Once again, they have managed to win over a client in the US – the world's largest commercial vehicle market. Heavy commercial vehicles with fuel cell drives are scheduled for delivery before the end of this year. The stock is unlikely to remain this cheap for long. At Evotec, on the other hand, the MDAX downgrade is weighing heavily, with the stock trading close to its multi-year low. Analysts see almost 100% upside potential, but investors are not responding.

ReadCommented by André Will-Laudien on September 10th, 2025 | 07:00 CEST

Will Trump's tariffs be stopped by the courts? Gold and silver on the rise – Deutz, Desert Gold, Renk, and Hensoldt in focus

A US appeals court has declared most of Trump's tariffs unlawful under the International Emergency Economic Powers Act (IEEPA) of 1977. This law allows the president to take economic measures against foreign countries in the event of a declared national emergency. However, no such national emergency currently exists. Instead, the US economy is growing at a moderate pace, while benefiting from the energy supply emergencies in Europe and further defense support for Ukraine. The US is no longer simply giving these goods away; instead, it now provides loans or sells them to allied countries. This creates significant uncertainty in the markets, which in turn is fueling defense stocks as well as gold and silver. New highs were reached at USD 3,640 for gold and USD 41.5 for silver. Where do the opportunities lie for investors?

Read