HENSOLDT AG INH O.N.

Commented by André Will-Laudien on December 18th, 2025 | 08:00 CET

Silver boom and critical metals on the rise! Keep a close eye on Rheinmetall, Infineon, Hensoldt, and Antimony Resources

International conflicts and competition for physical silver are leading to increasing uncertainty surrounding critical metals. Since the defense industry and the high-tech sector are particularly dependent on intact supply chains, increased volatility is also measurable in these sectors. For risk-conscious investors, the time has come to scan their portfolios for potential risks and, after one of the best upward cycles of the last 20 years, to close one or two doors. We can help with the analysis.

ReadCommented by Fabian Lorenz on December 18th, 2025 | 07:10 CET

Drone defense and nearly 10% fixed interest! DroneShield, Hensoldt, Bitcoin Group, Nakiki

Is Germany now getting serious about drone defense? A new drone defense center was opened in Berlin yesterday, aiming to provide a nationwide overview of the situation and a coordinated response to drone incidents. DroneShield and Hensoldt are among the beneficiaries on the stock market when it comes to drones and their defense. Will the shares now receive new momentum? Bitcoin is not currently experiencing any momentum. However, this is actually a desirable scenario for Nakiki SE. The Company plans to buy Bitcoin in the coming months and become Germany's first pure play Bitcoin Treasury company. To this end, Nakiki is currently issuing a corporate bond. Investors can secure a fixed interest rate of almost 10% p.a. and diversify their portfolio. The CEO explains why the Bitcoin bond is interesting. In contrast, Bitcoin Group has missed the boat, and now short sellers are also getting involved.

ReadCommented by Fabian Lorenz on December 16th, 2025 | 07:00 CET

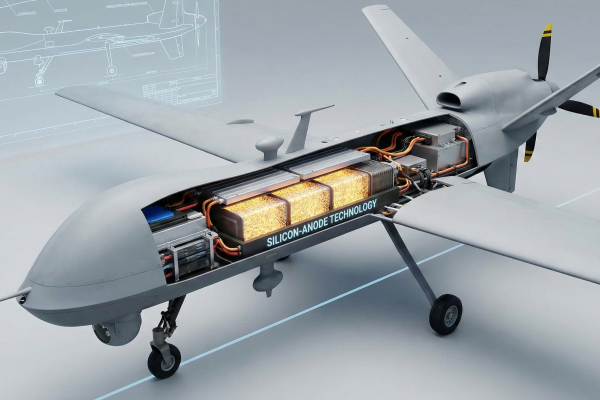

Great potential in the defense sector! RENK, Hensoldt, NEO Battery Materials

Milestone at NEO Battery Materials! With the lease of its new operational battery facility, NEO Battery is now ready to start commercializing its high-performance battery technology for defense, automotive and energy sectors. The new factory eliminates the need for time-consuming and costly construction. Orders and partnerships are also already in place. It is likely only a matter of time before batteries are also used in tanks. In Germany, RENK, for example, is developing drives for vehicles weighing up to 70 tons. Analysts consider the recent sell-off in defense stocks to be exaggerated. Their current favorite is Hensoldt. However, the sensor specialist is not recommended as a buy by all experts.

ReadCommented by Fabian Lorenz on December 10th, 2025 | 07:00 CET

Defense stocks are RISING! The US is leaving Europe on its own! Rheinmetall, Hensoldt, and Antimony Resources!

Investors are once again snapping up defense stocks. On the one hand, peace in Ukraine seems unlikely in the foreseeable future. On the other hand, Europe can no longer rely on the US. Rheinmetall and Hensoldt are therefore in high demand. The shares of both companies have gained ground in recent days and have received additional tailwind from orders. Defense companies such as Rheinmetall and Hensoldt would likely face major problems without antimony. Nevertheless, this critical metal is relatively unknown among investors. Here, too, China determines supply. This makes Antimony Resources interesting for investors. After strong share price gains, the stock has recently consolidated. This offers an entry opportunity before the first resource estimate is published shortly.

ReadCommented by Fabian Lorenz on December 8th, 2025 | 07:15 CET

RENK better than HENSOLDT? Risk at NOVO NORDISK! Billion-dollar opportunity with RZOLV Technologies!?

Is RENK's stock better than Hensoldt's? That is what analysts are saying. According to them, the transmission specialist is attractively valued at the current level. Hensoldt, on the other hand, is having problems converting its order backlog into revenue growth, leading to a significant reduction in its price target. In contrast, RZOLV Technologies shares have enormous upside potential. The Company aims to replace a toxic chemical used in gold extraction, thereby opening up a billion-dollar market. Development is nearly complete, and patents have been filed. In just a few months, RZOLV could become a hot takeover candidate. Meanwhile, takeovers currently appear to be a way for Novo Nordisk to replenish its drug pipeline, with the Danish company taking risks worth billions - Pfizer, take note.

ReadCommented by Nico Popp on December 8th, 2025 | 07:00 CET

Even in times of peace, these defense stocks have a future: NEO Battery Materials, Hensoldt, DroneShield

There is a lot at stake for Ukraine these days: Will there be a dictated peace, will the war continue, or is a long-term viable solution in sight after all? Some defense stocks have fallen in recent weeks. However, regardless of the current peace negotiations, it looks as if Europe in particular will have to invest heavily in military capabilities in the coming years. We explain why and present some exciting stocks.

ReadCommented by Carsten Mainitz on November 27th, 2025 | 07:05 CET

Everything is lining up! Take advantage of lower prices to enter Antimony Resources, RENK, and Hensoldt!

Is peace finally coming? Efforts to end the war between Russia and Ukraine have intensified significantly in recent days. But Russia remains the unknown factor. As a result, stock market volatility driven by shifting news or rumors is to be expected in the near future, especially for defense stocks. Setbacks offer investors opportunities to build up positions. In addition, special topics such as critical metals or raw materials that are indispensable for the defense industry and other key sectors remain attractive. This is where the undervalued Antimony Resources stands out.

ReadCommented by André Will-Laudien on November 24th, 2025 | 07:25 CET

Peace plan for Ukraine! Losses at Rheinmetall, RENK, and Hensoldt - Are Oklo and Kobo Resources already a buy?

The capital markets are caught in a political squeeze. The billion-dollar announcements for rearmament among NATO states had driven dream-like share price gains at Rheinmetall & Co., in some cases delivering annual returns of over 600%. With the latest publications hinting at potential peace options, however, those days now appear to be over. Investors are suddenly reassessing the overvaluation that has been evident for months and are taking profits. Rheinmetall, in particular, has been unable to reach its high of EUR 2,005 for quite some time. Further turbulence appears to be looming here. At Oklo and Kobo Resources, on the other hand, the correction phases seem to be nearing an end. We go into more detail below.

ReadCommented by Stefan Feulner on November 24th, 2025 | 07:05 CET

Rheinmetall, Hensoldt, Almonty Industries, MP Materials – Exaggerated reactions

Chip giant NVIDIA has delivered, once again exceeding analysts' forecasts. However, the stock market's celebrations were short-lived, with profit-taking across the board subsequently dominating the market. The overpriced AI sector is likely to face a prolonged period of consolidation. In other sectors, such as producers of critical raw materials, the current level could already be used as a long-term entry opportunity.

ReadCommented by Armin Schulz on November 17th, 2025 | 07:15 CET

How European Lithium, Hensoldt, and Volkswagen are overcoming the supply chain crisis and creating potential in their portfolios

The global tech and defense industries are under pressure. Dependence on critical raw materials from limited sources is becoming a strategic nightmare. Recent trade restrictions are driving up prices, jeopardizing supply chains, and forcing Europe to rethink its strategy quickly. At the same time, studies warn of an impending lithium shortage that could bring the electric vehicle boom to an abrupt end. The race for secure supply and technological sovereignty is in full swing – and at the same time offers historic opportunities. We therefore take a look at three companies that are directly active in these turbulent markets: European Lithium, Hensoldt, and Volkswagen.

Read