December 18th, 2025 | 08:00 CET

Silver boom and critical metals on the rise! Keep a close eye on Rheinmetall, Infineon, Hensoldt, and Antimony Resources

International conflicts and competition for physical silver are leading to increasing uncertainty surrounding critical metals. Since the defense industry and the high-tech sector are particularly dependent on intact supply chains, increased volatility is also measurable in these sectors. For risk-conscious investors, the time has come to scan their portfolios for potential risks and, after one of the best upward cycles of the last 20 years, to close one or two doors. We can help with the analysis.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , INFINEON TECH.AG NA O.N. | DE0006231004 , HENSOLDT AG INH O.N. | DE000HAG0005 , ANTIMONY RESOURCES CORP | CA0369271014

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall – It could go even lower!

After a long upswing that began in February 2022 at around EUR 95, Rheinmetall reached a temporary all-time high of around EUR 2,005 in October 2025. In fact, only Infineon shares have seen a twentyfold increase in DAX value in history. In the financial crisis year of 2008, the chip stock fell to EUR 0.60 after reaching prices of around EUR 95 shortly after its IPO in 2000. After that, it rose sharply again with the help of a financial investor. Only those who are familiar with the long-term charts can still remember this movement. Infineon has undergone an astonishing development since 2008 and is now one of the most highly regarded chip and high-tech stocks in Europe.

In the case of Rheinmetall, it makes sense to look at the valuation achieved after the initial 2,000% upward movement. This is because orders from NATO and other countries are likely already included in the current prices. With a market capitalization of EUR 72 billion, the expected 2025 revenue of EUR 12.5 billion is valued at a factor of 6. As a result, the stock is also trading at a P/E ratio of over 50. The outlook for 2027 is somewhat more conciliatory: here, the estimated P/E ratio falls to 23.5 with revenues around EUR 10 billion higher. What is technically striking is that peace negotiations in Ukraine are damaging the current high valuation. So anyone who has not yet invested can confidently wait until lower levels are reached. After all, it can be expected that Rheinmetall has already brought all interested parties on board and that most investors are sitting on high profits. From a purely technical perspective, both the 200-day and 100-day lines have recently been breached, and momentum is clearly pointing downwards. Those who rely on fundamental analysis can find 19 out of 23 experts on the LSEG platform who set an average price target of EUR 2,215. With a stock market price of EUR 1,530, that is now 50% upside potential again. So which view will prove to be correct? We will stay on the ball.

Antimony Resources – Caught between supply, politics, and technology

Despite a somewhat more relaxed tone recently in China's export restrictions on strategic metals as a result of political deals with Donald Trump, the structural pressure to act remains high in the West. Dependence on a few producing countries is increasingly perceived as a strategic risk, which is why establishing reliable sources of raw materials is becoming increasingly important. Antimony is particularly in focus here, as it is not only essential for defense, electronics, and modern batteries, but is also virtually irreplaceable and has a permanent structural supply deficit worldwide. The situation is further exacerbated by the fact that large parts of global antimony production come from geopolitically unstable regions such as China, Russia, and Tajikistan. To make matters worse, many mines are technically outdated, which will further reduce supply in the long term. Against this backdrop, Western exploration projects are increasingly attracting the attention of dynamic investors.

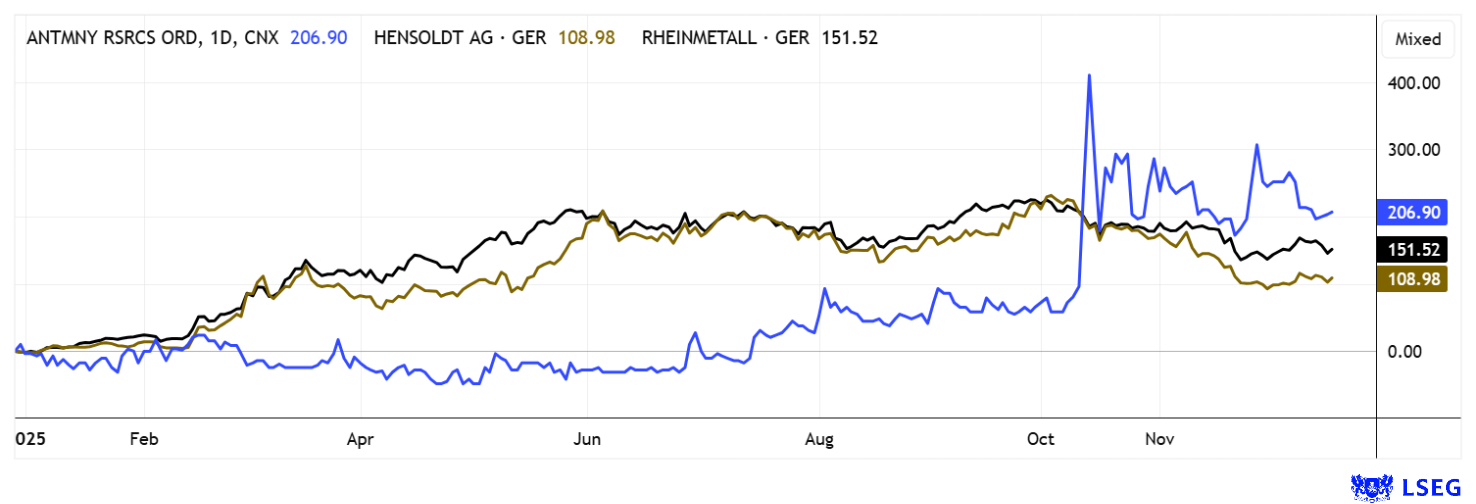

The latest surge in attention has been directed at Canadian exploration company Antimony Resources, whose share price has tripled since October. The rapid price increase of around 200% within a few trading days may have come as a surprise even to management, but it underscores the growing interest in the antimony sector as a whole. With the high-grade Bald Hill project in New Brunswick, the Company is addressing a critical market. Canada offers decisive long-term location advantages such as political stability, excellent infrastructure, and year-round exploration opportunities. The first drilling campaign already delivered convincing results with stibnite mineralization in the majority of the drill holes and peak grades of nearly 15% antimony over several meters. These results not only confirmed historical estimates but also provided the basis for a significant expansion of the exploration program.

With the NI 43-101-compliant report, Antimony Resources was able to nearly double the already known potential and report a significantly larger tonnage range. Management sees its assumptions increasingly confirmed and is aiming for an initial resource estimate in the first quarter of 2026. In November, the Company strengthened its capital base by raising CAD 10 million at CAD 0.45. This price level now forms the starting point for the next rally, which could begin at any time with the announcement of a resource. This is because the market capitalization of the 71.8 million shares issued is still a manageable CAD 32 million. Time is of the essence!

Hensoldt – 20% correction and what next?

Hensoldt has recently experienced a somewhat more severe decline. The stock peaked at EUR 117.60 in October and reached levels around EUR 68 last week. With a recovery to EUR 71.50, the valuation based on earnings (P/E ratio) for 2025 and 2026 has at least fallen to 44 and 36, respectively. In recent articles, we pointed out the overvaluation of defense stocks, and in the case of Hensoldt, our assessment was spot on. The LSEG platform also offers useful information. Only 4 out of 15 analysts are still giving the stock a thumbs up. However, due to the high momentum of recent months, the average expected 12-month target price is still around EUR 89.50, which represents a good 25% potential for the next reporting period. Things will get exciting on February 26, when Hensoldt is expected to report a 75% increase in earnings to EUR 1.62 per share, according to consensus estimates. Given a 3.3x revenue valuation based on 2025, the figures should be a little higher to justify the still high share prices. Technically, a correction target of around EUR 54 can also be identified, which could quickly materialize in the event of a surprise ceasefire in Ukraine.

Increasing geopolitical turmoil has made security and control over critical raw materials a central factor in modern investment strategies. At the same time, the possibility of peace hangs over traditional defense stocks like the Sword of Damocles, as signs of détente could lead to devaluations at any time. Antimony Resources is benefiting from the growing importance of strategic metals, which are indispensable for both defense and high-tech products. Dynamic investors should aim for broad diversification across the entire security and commodity complex and always keep an eye on their stops.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.