February 5th, 2026 | 08:25 CET

Almonty shares are skyrocketing! Novo Nordisk shares are plummeting! And what is Hensoldt doing?

Almonty shares gained over 17% on the Nasdaq on Tuesday. The largest Western tungsten producer is likely to benefit from the US government's build-up of strategic reserves of critical raw materials. In addition, analysts have significantly raised their price target and expect Almonty to achieve a net margin of around 50% in 2027. Novo Nordisk, on the other hand, plummeted by over 17% yesterday. The pharmaceutical company has once again shocked the stock market. It expects declining revenue and profits for the current year. And what about Hensoldt? The stock is treading water, but analysts see potential for price gains. In addition, the company has landed an order worth hundreds of millions of euros.

time to read: 5 minutes

|

Author:

Fabian Lorenz

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , NOVO NORDISK A/S | DK0062498333 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Almonty Industries: Soon to reach a 50% net margin?

Almonty's stock is simply unstoppable at the moment. On Tuesday alone, the price shot up by over 17% on the Nasdaq. The closing price of USD 13.39 was, of course, a new all-time high. There are good reasons for the rally and why it could go a lot further. These include US President Donald Trump's announcement that he wants to build up a national strategic reserve of critical minerals. Right at the start, USD 23 billion is to be made available for this purpose. The stockpile of rare earths, tungsten, and other raw materials is intended to protect US industrial companies from short-term supply shocks. It would also help reduce dependence on China for critical raw materials. As one of the few Western tungsten producers, Almonty is likely to benefit massively from this, especially as it plans to start operating its new mine in the US this year.

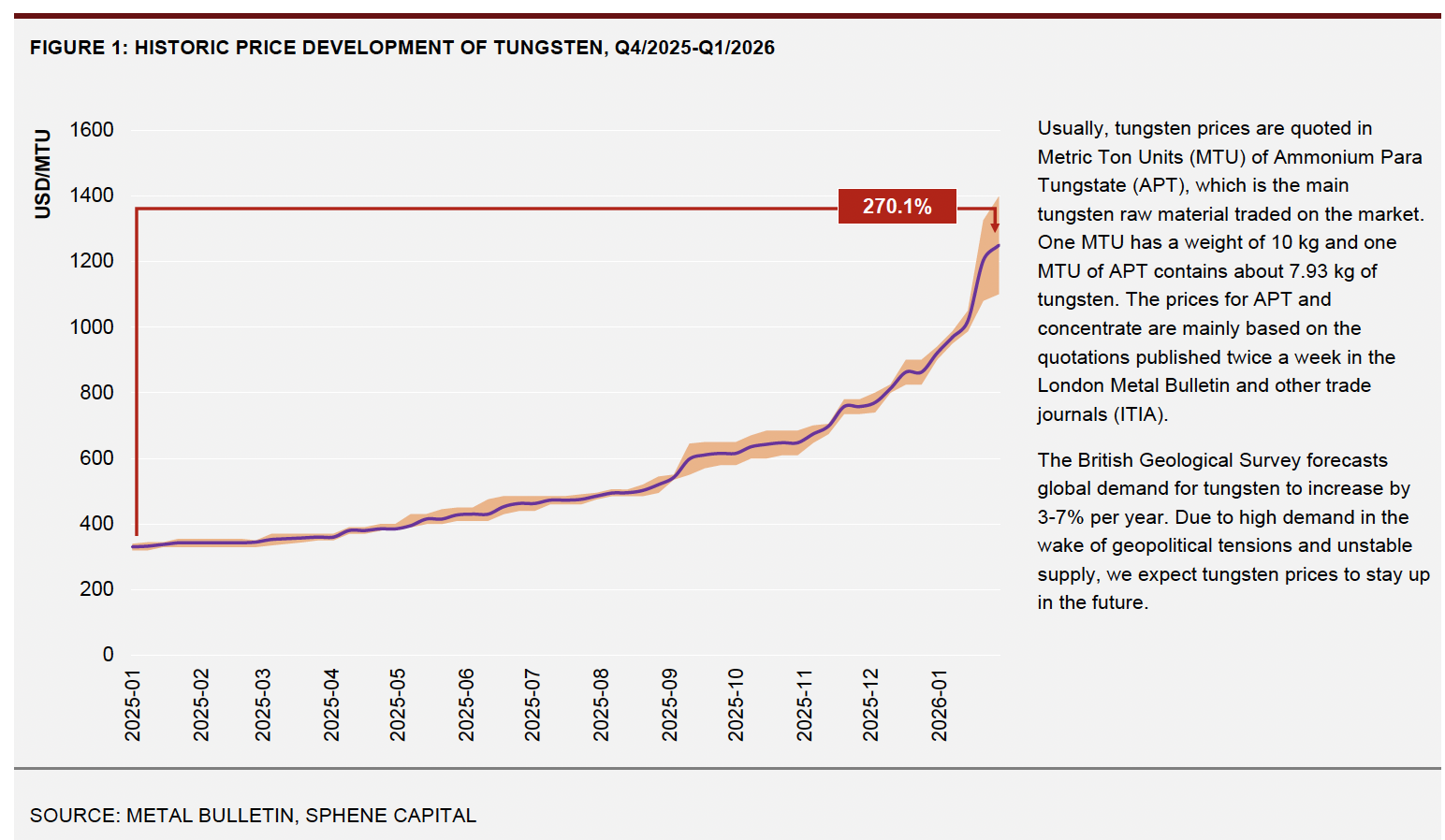

Sphene Capital has updated its study on Almonty. This was urgently needed, as the price of tungsten has developed very dynamically since the last update. Analysts point out that the price of tungsten exceeded the USD 1,000 per MTU APT mark for the first time in January 2026. Currently, around USD 1,250 per MTU must be paid. To put this into perspective, in January 2025, the price was still around USD 300. From the analysts' point of view, tungsten is practically irreplaceable in the defense industry – and probably in several other industries – due to its physical properties. This leads to low price elasticity of demand and disproportionate price increases, given the comparatively small and illiquid tungsten market.

Almonty will therefore earn a lot of money by ramping up its giant mine in South Korea. Sphene Capital expects Almonty to generate around CAD 200 million in revenue this year. By 2027, this figure is expected to rise to around CAD 530 million. Profit after tax is expected to skyrocket from CAD 68 million in the current year to CAD 263 million in 2027. This would give Almonty a net margin of around 50%.

Analysts have therefore raised their price target for Almonty shares from CAD 13.50 to CAD 20.10. Due to Tuesday's jump in the share price, the stock is already trading at CAD 17. Based on analysts' estimates, the P/E ratio for 2027 would still be below 20 even at a price of CAD 20. This means that even after the massive rally, the stock still does not appear to be expensive.

Note: For those who would like to learn more about the prospects for Almonty Industries firsthand, they can register for the International Investment Forum ii-forum.com on February 25, 2026. CEO Lewis Black will be presenting live.

Novo Nordisk shocks the stock market again

Price disaster at Novo Nordisk. Unfortunately, not for the first time.

In recent days and weeks, it actually looked as if the Danish pharmaceutical company's share price was recovering. But that came to an end on Tuesday evening.

After exchange rate-adjusted sales growth of 10% in 2025, the company, known for its weight loss injection, is expecting declining revenues for the current year, shocking the stock market. On an adjusted basis, the company is forecasting a decline in revenue and operating profit. Specifically, Novo Nordisk expects adjusted revenue growth of -5% to -13%. The decline in operating profit is also likely to be within this range. Investors had not anticipated this, given the new weight loss pill and the recently published positive study results for the Wegovy successor. Although Novo Nordisk points out that the reported figures are distorted by a special effect (release of discount provisions amounting to USD 4.2 billion in the US), this does little to reassure investors.

Novo Nordisk cites the factors feared by the stock market as the main reasons. Namely, headwinds in the world's most important pharmaceutical market. Lower prices are expected in the US. Competition is also increasing, and the reimbursement situation for obesity drugs is deteriorating. Internationally, Novo Nordisk expects sales volumes to rise, but prices to fall. At the same time, the Danish company plans to continue investing heavily in research and development.

Even the announced share buyback program cannot reassure investors. Novo Nordisk has announced that it will buy back its own shares worth up to DKK 15 billion in 2026. In an initial tranche, up to DKK 3.8 billion worth of own shares are to be acquired by May 4, 2026.

Hensoldt: Million-euro order

And what is Hensoldt actually doing? Things have quietened down for the former high-flyer. The share is currently trading at EUR 80, which is the same level as in March 2025. The all-time high of around EUR 117 was reached in October 2025.

Analysts currently see some upside potential. Jefferies recently confirmed its price target of EUR 90. However, this means that analysts only consider Hensoldt shares a "Hold". Within the defense sector, experts currently favor RENK and Rheinmetall. Deutsche Bank believes the defense electronics specialist's stock is worth EUR 101.

In terms of operations, a major order was recently announced. At the beginning of this week, Hensoldt received an order worth EUR 100 million as part of the German "European Sky Shield Initiative." The client is the German company Diehl Defence, the manufacturer of the IRIS-T SLM air defense system. This system uses Hensoldt's high-performance TRML-4D radar, which ensures the rapid detection and tracking of around 1,500 targets within a radius of up to 250 km. It is capable of quickly and reliably detecting, tracking, and classifying all types of air targets - cruise missiles, rockets, drones, and aircraft - for combat. The order volume also includes maintenance and training packages. As part of the ESSI initiative, HENSOLDT already has contracts for over 150 radars of various types.

Hensoldt manager Markus Rothmaier commented: "There is enormous pent-up demand in European air defense, and the threats posed by air attacks are more complex and varied than they were a few years ago. Digital technologies – keyword 'software-defined defense' – are increasingly enabling existing capabilities to be linked, software-based modernizations to be rolled out, and development cycles to be massively shortened. We are also working on this with our air defense radars, thereby increasing the efficiency and performance of our products."

German defense stocks appear to have lost some momentum currently. Hensoldt shares remain attractive, but there is no urgent need to buy them at present. Investors are currently focusing on critical raw materials. Almonty is the clear favorite when it comes to tungsten. The high-flyer is expanding its mine in Portugal, ramping up its mine in South Korea, and will start operations at its mine in the US this year. At current prices, this is a lucrative venture. At Novo Nordisk, on the other hand, the signs point to stormy weather. The outlook for the current year has once again shocked the stock market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.