BASF SE NA O.N.

Commented by Nico Popp on November 12th, 2021 | 11:57 CET

BASF, Royal Helium, Linde: This market is at the very beginning

Industrial gases are in demand - and expensive. Even gases such as Helium are not immune to price increases. Chemical giant BASF calls the noble gas valuable in a press release and, together with Linde, presented a process that can be used to extract Helium from natural gas production. In other regions, the extraction of Helium, which is used in medical devices and chip production, even succeeds independently of by-products - given the long-term dwindling production of fossil fuels, this is becoming increasingly important. We present three stocks.

ReadCommented by Stefan Feulner on November 1st, 2021 | 12:30 CET

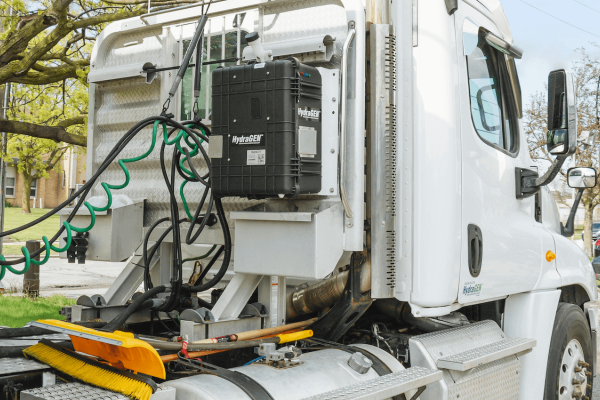

BASF, dynaCERT, Nikola - These shares will be exciting

From today until November 12, all eyes are on the UN Climate Change Conference COP26 in Glasgow. Nothing less than the future of our planet and a trend reversal towards a climate-neutral economy are at stake. At the top of the agenda is the commitment of countries to reduce emissions. A company that has received little attention in the recent past is waiting in the wings with its patented technology and could soon take off. Be prepared.

ReadCommented by Nico Popp on October 28th, 2021 | 13:20 CEST

BASF, Memiontec, JinkoSolar: Rich returns with green shares

Chemistry is everything. It is not just since the bestseller "Chemistry for Breakfast" by scientist and YouTuber Mai Thi Nguyen-Kim that people have known how comprehensively chemistry can explain our world. There is also a lot of chemistry involved in future technology, such as filter systems for water or solar panels. We present three stocks and assess their values. We start with one of the best-known chemical stocks, followed by smaller shares with no less interesting business models.

ReadCommented by André Will-Laudien on October 13th, 2021 | 13:23 CEST

BASF, Almonty Industries, Millennial Lithium, BYD - All sold out?

Anyone who can offer scarce raw materials today is in a fortunate position as far as business prospects are concerned. In particular, metals and battery raw materials are in high demand and have become a bone of contention in globalization. That is because many critical metals are majority-owned by China, meaning that the regime decides on potential allocations to foreign countries. Admittedly, the Middle Kingdom wants to stay in business with the West, so long-term contracts exist. Nevertheless, the domestic industry is naturally given preferential treatment; we can only hope for political stability and incremental improvements in the West. Who are the interesting players in the tight commodity market?

ReadCommented by André Will-Laudien on September 17th, 2021 | 11:23 CEST

NEL, Royal Helium, Linde, BASF - This is where it gets highly explosive!

How will the energy transition play out in Europe? With hydrogen is one way. It is costly to produce if you look at the issue sustainably. The raw material itself is seen as an alternative building block of a green future and, according to experts, could become one of the most important energy sources in the coming decades. The water element is available in abundance, but what is lacking is a truly environmentally friendly way to convert it back into hydrogen and oxygen. Even under the best conditions, green hydrogen costs about 10 times as much to produce as Russian natural gas, which also burns fairly cleanly overall. What is next for this sector?

ReadCommented by Stefan Feulner on September 6th, 2021 | 14:25 CEST

BASF, Desert Gold, Moderna, BioNTech - Keep going, keep going!

The Delta variant is teaching the markets to be afraid. After the economy was humming in the past two quarters, disillusionment is now slowly setting in. The unexpectedly weak labor market data in the US in August demonstrated this. Outside of agriculture, only 235,000 new jobs were created compared with the forecast of 728,000 new jobs. Thus, the market's fear of an end to loose monetary policy and possible interest rate hikes should also be off the table.

ReadCommented by André Will-Laudien on August 12th, 2021 | 11:25 CEST

BASF, Meta Materials, IBU-Tec, SGL Carbon - Materials that dreams are made of!

Whether e-mobility, aircraft technology or renewable energies - there are inherent scarcities and political implications in many high-tech materials essential for the German economy and future and resource-efficient technologies. Their production and further processing cost a lot of precious energy, and not all environmental or health impacts have been clarified. Mining companies and processing industries are therefore required to observe sustainability principles and not just implement them on paper. Some companies take a proactive approach to this issue, while others must first be forced into line politically. We take a look at some of the protagonists.

ReadCommented by Stefan Feulner on July 29th, 2021 | 11:08 CEST

JinkoSolar, Carnavale Resources, BASF - Beware of shortages!

The change from fossil fuels to renewable energy sources due to climate change means that raw materials such as copper, lithium and nickel are increasingly in demand. The increasing demand due to new economic sectors such as wind power, electromobility or photovoltaics is offset by an extremely scarce supply. The result is sharply rising prices and an expected shortage in the coming years. In addition, the trade conflict with China is visibly worsening the shortage. The primary beneficiaries of this dilemma are commodity producers who can at least partially cover the supply deficit outside the Middle Kingdom.

ReadCommented by Stefan Feulner on July 12th, 2021 | 13:36 CEST

NIO, Kainantu Resources, BASF - Bright prospects

The first half of the 2021 stock market year is over, and the stock market indices continue to march from high to high. While some market participants were hoping for a stronger correction after the Corona rally, they have been disappointed so far. The FED has now laid the foundation for further rising prices. It sees the rising inflation, which is currently at 5% in the USA, as temporary. In favor of growth, interest rates will remain at historic lows for the time being. In addition, the bond-buying program of the monetary guardians continues unabated - a feast for the stock markets.

ReadCommented by Stefan Feulner on July 7th, 2021 | 14:25 CEST

Infineon, Desert Gold, BASF - Prepared for the future

The energy turnaround and the achievement of climate neutrality are back in the news as the Corona pandemic fades. Politicians around the world are supporting with billions in subsidies. But the industry is under pressure. Climate neutrality requires the introduction of new production technologies in many sectors, and in areas such as basic materials, the conversion of entire production lines. On the other hand, competitiveness should not suffer in this historic transformation.

Read