BASF SE NA O.N.

Commented by Nico Popp on May 16th, 2022 | 12:48 CEST

Future Tech check: BASF, Meta Materials, BYD, Rock Tech Lithium

What will drive share prices in the future is more uncertain than ever. The sword of Damocles of the recession is currently hovering over many future topics. But should long-term investors be driven by fear of recession? On the contrary! Now is the best time to consider investments for the future. The good thing is that thorough due diligence can pay off twice over. First, it increases the chances of hitting the bull's eye, and second, the prices may even suit investors. We take a closer look at three shares!

ReadCommented by Juliane Zielonka on May 10th, 2022 | 12:38 CEST

Biotech stocks: Defence Therapeutics, BioNTech, BASF - Advantage through platform technology

Large corporations such as BASF were previously considered safe portfolio investments. But the war in Ukraine is throwing a spanner in the works. Force majeure, such as war, can cause deals to fall through without the responsibility of the companies involved. How should investors react now? Which portfolio strategy can keep up with the high volatility of the markets? Newcomers like BioNTech face oversupply and have to accept shortages. A focus on emerging markets seems to be the solution for their growth strategy. But there are subtle differences in the vaccines business, as Defence Therapeutics proves.

ReadCommented by André Will-Laudien on May 10th, 2022 | 11:54 CEST

GreenTech stocks are on the rise! Buy now: BASF, Meta Materials, Nordex, Siemens Energy

The distortions on the capital markets can hardly be topped at the moment. The nickel price has risen by 300%, only to drop by 70% again. And all this in only 48 hours. There are countless examples in the current stock market environment that are historically unparalleled. In just 2 months, the Bund Future fell from 178 to 151, a loss of 16% in the 10-year Bund. In parallel, the capital market interest rate rose from minus 0.45% to a whopping plus 1.15%. So interest rates are back, inflation is spreading, and supply deficits continue to fuel the underlying stagflation scenario! One major trend should bounce back after the end of the many corrections: GreenTech! Here is a selection of interesting stocks.

ReadCommented by Nico Popp on May 4th, 2022 | 13:05 CEST

Attention, special situation! BASF, Barsele Minerals, Amazon

Old Economy? Tech stocks? Or special situations? Investors find different ways to stay invested during difficult market phases. It is not for nothing that the motto "Time in the market beats timing in the market" exists. Nevertheless, it makes sense right now to increase the equity quota only selectively. We will outline which stocks could be considered for this using three companies as examples.

ReadCommented by Stefan Feulner on May 3rd, 2022 | 13:01 CEST

BASF, Meta Materials, NIO - New opportunities through the correction

Whether the old stock market rule "Sell in May and go away" still applies this year is at least doubtful. The DAX and S&P 500 benchmark indices have lost more than 10% since the beginning of the year. The Nasdaq technology segment was hit harder, losing more than 20%. Concerns about further interest rate hikes, the threat of stagflation and uncertainties regarding the Ukraine conflict are causing investors to go on a buyers' strike in some cases. Nevertheless, there are good long-term, anticyclical entry opportunities at current levels.

ReadCommented by André Will-Laudien on April 29th, 2022 | 12:20 CEST

BASF, Standard Lithium, Almonty Industries, BYD - Industrial shares in focus: Now it matters!

Poland and Bulgaria no longer receive gas from Russia because they cannot pay in hard rubles. Feat: No one has larger stocks of this exotic currency because until now, all energy deliveries could be paid for in foreign currency. The situation has reached a new level of escalation between the Russian government and resource-hungry Central Europe. With further arms deliveries, this political issue will become even more acute. We look at existing dependencies and the dangers for German industrial stocks.

ReadCommented by Nico Popp on April 20th, 2022 | 10:29 CEST

The million-dollar opportunity: Valneva, Edgemont Gold, BASF

No one can see into the future. But investors can estimate which topics will move share prices in the near future. There is not always a connection between what is important and what is played out in the media. Issues such as climate change are timeless but disappear from the front pages from time to time. It is currently a similar situation with the pandemic. We dare to take a look into the future and ask what could move prices this summer.

ReadCommented by André Will-Laudien on April 15th, 2022 | 12:14 CEST

Barrick Gold, Barsele Minerals, BASF - Investing in scarcity: 3 B-shares with potential

The risks on the capital markets are increasing, as can be seen in the volatility indices. They were around 18 before the invasion of Ukraine and rose to over 35 by mid-March. The volatility index measures the range of fluctuation expected by the futures markets in the coming months. If we follow this indication, we could still be in for a tough summer. Possibly significantly lower again but, with the desired political easing, also a little upward similarly. However, investors need to be aware of the exploding inflation, the tight commodity markets and the supply chain problem. These are ongoing issues that will not pass anytime soon. The following values could provide some stability.

ReadCommented by Nico Popp on April 13th, 2022 | 18:02 CEST

A crisis here, an opportunity there: BASF, Almonty, Plug Power

Quarterly figures and many upcoming annual general meetings will bring to light what has been somewhat abstractly clear for weeks: many industrial companies are in serious danger. Yesterday it became known that the Russian army is said to have sprayed an unknown substance over Mariupol. If it was poison gas, the West would be forced to react. It cannot be ruled out that oil from Russia will be the next to be hit. Just how dependent companies like BASF are on Russian energy recently became clear. We examine three stocks and their opportunities and risks in this market phase.

ReadCommented by Carsten Mainitz on April 11th, 2022 | 19:08 CEST

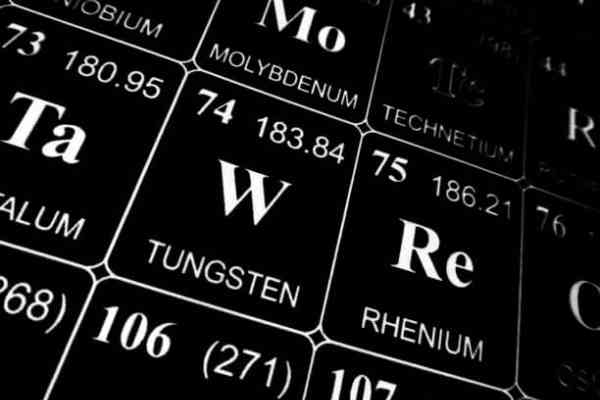

BASF, Meta Materials, Varta - A huge new market is emerging here!

Science fiction or soon a reality? Metamaterials are artificial materials with specific optical, magnetic or electrical properties that do not exist in nature. These tiny innovative materials can be used in a wide variety of ways. A well-known example is stealth technology. Metamaterials can change the refractive index of light and thus guide the light around an object. The industry is still some way from mass production, but experts estimate that will soon change. As early as 2030, the market is expected to be worth USD 11 billion, with a strong upward trend.

Read