Bionxt Solutions Inc.

Commented by Fabian Lorenz on September 16th, 2025 | 07:00 CEST

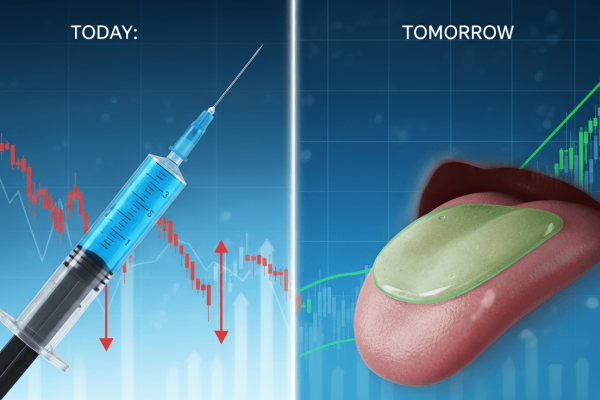

Hot Stock shakes up Big Pharma! BioNxt Solutions aims to replace Ozempic weight loss injection!

BioNxt is currently shaking up Big Pharma. The announcement that it plans to replace the Ozempic weight loss injection with an oral dissolvable film is once again fueling speculation about the share price. Just like in the multiple sclerosis space, the Company aims to disrupt a billion-dollar obesity market. Further exciting operational news is expected in the coming months. Key patents are already in place. With a market capitalization of around CAD 100 million, the Canadian-German life sciences company is far from expensive – even for Big Pharma. The major corporations will undoubtedly be watching BioNxt's development very closely in the coming months. Until then, the stock is likely to trade significantly higher.

ReadCommented by Nico Popp on September 15th, 2025 | 07:15 CEST

No more diet injections! Innovations in weight loss drugs: BioNxt Solutions, Merck & Co., Novo Nordisk

As recently reported by the United Nations Children's Fund (UNICEF), for the first time, more children worldwide are obese than underweight. While this is a great success in the fight against hunger, it also poses new risks. Severe overweight in childhood leads to obesity and associated diseases in adulthood, such as cardiovascular problems and diabetes. The treatment of overweight and diabetes in children is therefore likely to play an even more significant role in the future. GLP-1 receptor agonists have been popular for several years now in the form of modern weight loss injections. With patents expiring soon, experts anticipate substantial further growth and development in this rapidly expanding market. We explain who could benefit and what the future holds for modern diet medications.

ReadCommented by Armin Schulz on September 11th, 2025 | 07:10 CEST

Forget weight loss injections! BioNxt Solutions is unsettling Big Pharma, but could become an important partner

There is a catch with weight loss injections: they are injections. Studies show that adherence to treatment drops dramatically after one year. What if the blockbuster drug could simply be dissolved under the tongue? That is precisely what BioNxt Solutions is working on. With its patented dissolvable film technology, the Canadian-German biotech company not only aims to revolutionize obesity therapy but also make strides in multiple sclerosis treatment. The approach could transform entire markets.

ReadCommented by Fabian Lorenz on September 9th, 2025 | 07:20 CEST

Takeover candidate! Novo Nordisk and Eli Lilly eyeing BioNxt Solutions

A portfolio rocket for the coming weeks? The shares of BioNxt Solutions are certainly worth a closer look. There was no sign of a summer slump at this company - quite the opposite, as one major announcement followed another, and the newsflow continues into September. The Canadian-German life sciences company specializes in innovative drug delivery technologies. The latest bombshell: BioNxt aims to replace the Ozempic weight-loss injection with a tablet-like oral form of administration. This move opens the door to another billion-dollar market and positions the Company as a takeover candidate. Novo Nordisk, Eli Lilly, and others are engaged in fierce competition and are hungry for innovations – like those developed by BioNxt. The stock remains attractively priced.

ReadCommented by Nico Popp on September 4th, 2025 | 07:05 CEST

What comes after the weight loss injection? How does BioNxt intend to outperform Eli Lilly and Novo Nordisk?

The weight loss injection is all the rage. Not only are celebrities shedding significant pounds with it, but many people in our own circles are also losing weight effortlessly thanks to modern GLP-1 receptor agonists. Many patients report that they simply do not feel hungry anymore. This is already having an impact on the restaurant industry in the US – people are ordering more salads and splitting desserts. With Wegovy and similar drugs, one to two teaspoons of tiramisu is enough. But this billion-dollar market is far from reaching all patients. What groundbreaking developments in modern weight loss drugs are already in the pipeline, and how can investors benefit?

ReadCommented by Stefan Feulner on September 2nd, 2025 | 07:10 CEST

Bayer, BioNxt Solutions, FamiCord AG – Undiscovered gems with strong growth potential

While artificial intelligence has been dominating the headlines for months and tech stocks are reaching record valuations, the biotech sector is leading a shadowy existence on the stock markets. Investors are shying away from the often complex and risky business models, with many stocks trading well below their all-time highs. However, while the spotlight is on AI, significant developments are taking place in the background: clinical trials are reaching key milestones, new therapeutic approaches, such as cell and gene therapies, are advancing, and partnerships with big pharma have increased substantially in recent years.

ReadCommented by Armin Schulz on August 28th, 2025 | 07:15 CEST

The BioNxt Solutions formula: How a simple idea can turn into a billion-dollar business – Without high risk

In the pharmaceutical industry, promising active ingredients often fail due to a simple problem, such as administration. Canadian biotech company BioNxt Solutions has taken on precisely this challenge. With a smart platform for oral dissolvable films and patches, the Vancouver-based innovator could not only make life easier for patients but also open up a lucrative growth opportunity for investors. We took a closer look at the promising technology behind it.

ReadCommented by Fabian Lorenz on August 25th, 2025 | 07:25 CEST

A bombshell for takeover candidates! 100% share BioNxt Solutions leaves BioNTech and Co. behind!

BioNxt shares have finally taken off. At the beginning of July, we last pointed out the opportunities offered by the Canadian-German life sciences company. Since then, the share price has risen by almost 100%, outperforming both the biotech index and investor favorites like BioNTech. However, this is likely to be just the beginning. In a conversation with the editorial team, management hinted at a strong news flow in the coming months. The Company is working flat out on its next-generation platforms to revolutionize drug delivery. For example, syringes and tablets are to be replaced by dissolvable films and transdermal patches. This not only makes BioNxt a prime acquisition candidate, but with a market capitalization of just CAD 100 million, the Company still appears to be anything but expensive.

ReadCommented by Armin Schulz on August 21st, 2025 | 07:10 CEST

Overvaluations in pharma and biotech reduced – Novo Nordisk, BioNxt Solutions, and Bayer are NOW in focus

Following the drastic market correction since the waning of the COVID-19 pandemic, the pharma and biotech sectors now offer more rationalized valuations and real opportunities. Instead of speculative hype, solid pipelines, clinical results, and disruptive technologies are what count today. Artificial intelligence is revolutionizing drug development, accelerating processes, and creating measurable competitive advantages. This new reality makes companies that are mastering their digital transformation particularly promising candidates. However, it is important to take a close look at each company. That is why we are examining three exciting companies today where there is a lot going on: Novo Nordisk, BioNxt Solutions, and Bayer.

ReadCommented by Nico Popp on August 11th, 2025 | 07:15 CEST

Platform strategies are shaking up the biotech market: BioNxt, Thermo Fisher Scientific, Evotec

In biotech, the all-or-nothing principle no longer applies. Instead of offering just one product, the platform economy is becoming the norm in the development of tomorrow's active ingredients. What does this mean? Companies are working together, sharing their technology, and thereby reducing their dependence on individual projects. Since each player can focus on its core competencies, new active ingredients are brought to market faster, and even innovations in niche areas can gain significant traction thanks to strong partners. We explain what platform economics means in the biotech sector and how investors can benefit from it.

Read