June 24th, 2024 | 07:15 CEST

IPOs, Takeovers and Mergers - Here we go again! Varta, Altech Advanced Materials, Nel ASA, and Cavendish

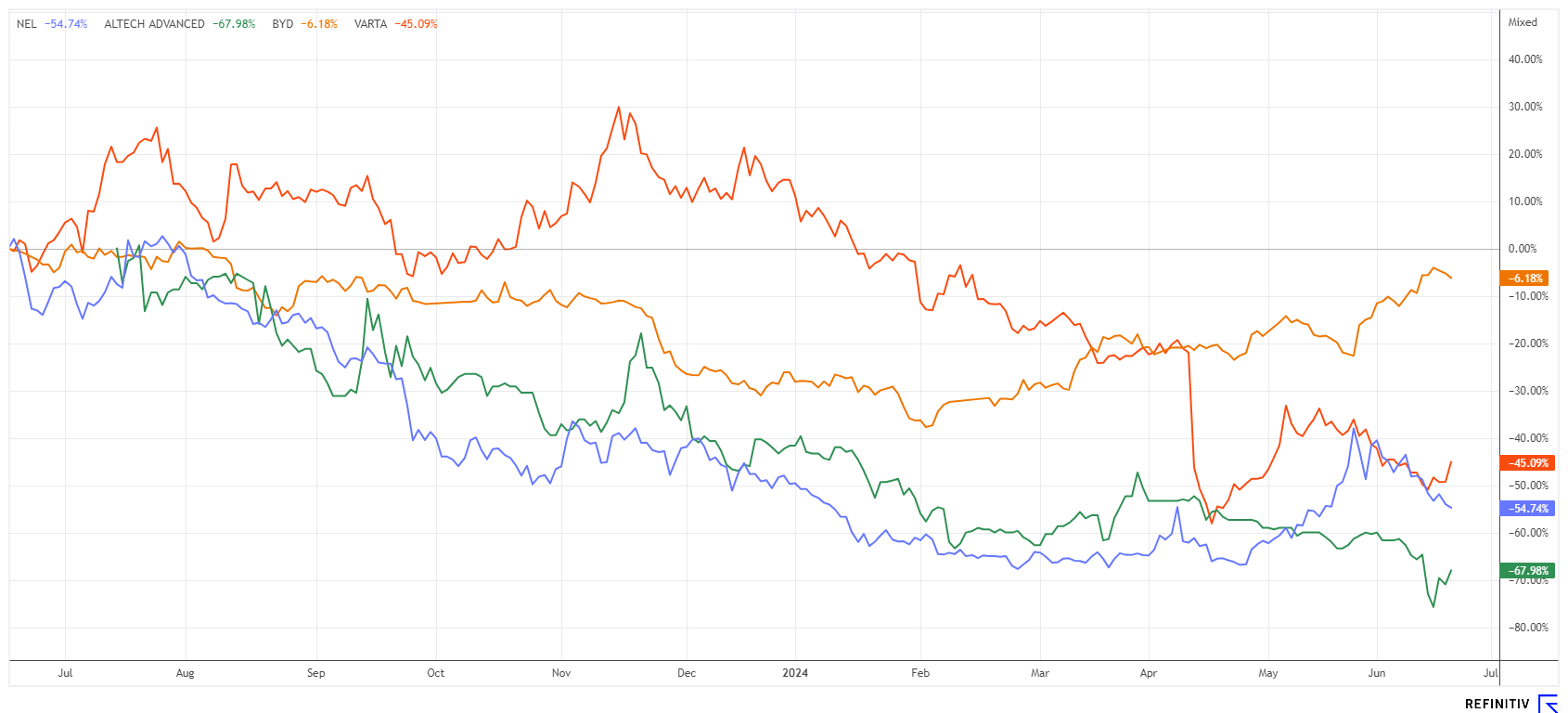

Every day, new records on the NASDAQ make investors' dreams come true, but at the end of last week, there were the first signs of a correction, with top stock Nvidia losing 10% from its peak. This is a minor setback after a rise of almost 100% since mid-April. The IPO market is also picking up again as newcomers want to seize the opportunity. The Norwegian hydrogen pioneer Nel ASA successfully floated its filling station subsidiary on the stock exchange. This creates more transparency within the Company and fills the coffers. While Varta has issued another revenue warning, Altech Advanced Materials is launching its new battery technologies. In terms of achievements, "Made in Germany" is still "top", but the right stock selection remains the trump card.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VARTA AG O.N. | DE000A0TGJ55 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4 , NEL ASA NK-_20 | NO0010081235 , CAVENDISH HYDROGEN ASA | NO0013219535

Table of contents:

"[...] Silumina Anodes® is a ceramic-coated graphite/silicon anode composite material that we plan to produce in Schwarze Pumpe, Saxony. Here, we aim to supply manufacturers of batteries for e-cars with an application-ready drop-in technology that is low-cost, high-performance and safe. [...]" Uwe Ahrens, Direktor, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Altech Advanced Materials - Faster, higher, further!

With visionary companies such as Altech Advanced Materials AG from Heidelberg, it makes perfect sense to pay close attention to the words of the management. Their success depends on it, as rarely has an innovation sold itself - except perhaps the cigarette. The "Renewable Energies Conference" by mwb research provided insights into the current situation at the Schwarze Pumpe Industrial Park. In his presentation, CEO Uwe Ahrens only touched briefly on the battery refinement "Silumina Anodes"; presumably, the situation in the German e-mobility business has not been quite so sparkling since BYD's impact in Europe. Anyone following the European Championship will notice that the advertising boards no longer feature Mercedes, BMW, Audi, or Volkswagen, but the rising Chinese company "Build Your Dreams" (BYD), prominently displayed alongside the supermarket chain Lidl. These small signs aptly describe the state of Germany as an industrial location.

Investors were able to hear a lot about the "CERENERGY®" innovation at the mwb online conference. The feasibility study has been completed and all internal planning for the production set-up of the sodium chloride-based solid-state battery has been finalized. "We want to become the world market leader in this area!" said the CEO. All that remains is a capital requirement of just under EUR 180 million to implement the project. Altech intends to raise this over the next few months through a mix of promotional shares, borrowed capital and, if necessary, equity, whereby the dilution should remain as low as possible. A green bond is to cover the main expenditure, meaning that the first batteries could roll off the production line as early as 2026. On the procurement side, negotiations are already underway with players such as Energie Sachsen and LEAG.

That sounds promising, as analysts expect strong growth for the global energy storage market, averaging 28% per year until 2040. Altech could really come up trumps here as a German niche player. Finally, all new shares in the main category are now tradable. A total of 7.542 million shares have been in circulation since last week, bringing the market capitalization to around EUR 33 million. With this set-up, Altech remains a promising German battery and GreenTech story with great potential for risk-conscious investors.

Nel ASA - The fueling subsidiary Cavendish causes a sensation

Nel ASA surprised its investors with a spin-off deal. On June 12, the Norwegian hydrogen pioneer spun off its fueling division under the name Cavendish Hydrogen and listed it on the Oslo Stock Exchange. After a disappointing start, the situation for the stock market newcomer quickly improved, and the share price is now trading well above the original placement price of NOK 29. In the middle of last week, the price was briefly as high as NOK 38, giving Cavendish Hydrogen a market value of over NOK 1 billion. Nel CEO Håkon Volldal sees the opportunity for both companies to become market leaders. Nevertheless, the share price of the parent company, Nel ASA, fell back below the critical support level of EUR 0.50. It will be exciting to see what happens next.

Varta - Another revenue warning

Revenue and profit warnings from Varta seem to have become a regular occurrence. Since February 2021, there has been a constant stream of bad news from Ellwangen, which caused the share price to plummet from just under EUR 174 to an incredible EUR 7.50. A 96% discount for a high-tech stock in the battery sector is quite significant. The revenue forecast for 2024 has now been lowered again from EUR 900 million to between EUR 820 million and 870 million. There were no statements on profits; a restructuring program has been underway since autumn 2022, likely resulting in the loss of up to 800 full-time positions. Currently, there is little information about this.

The rocky road still seems to have a few twists and turns in store for Varta, with the share price falling well below the EUR 10 mark again at the end of last week. None of the 6 experts on the Refinitiv Eikon platform are enthusiastic about the Company from Ellwangen, with the average 12-month price target at a low EUR 8.73. This consensus may be the only good sign for the bombed-out share price. In any case, the price/sales ratio for 2024 has already fallen back to 0.4. If the operational turnaround succeeds despite some revenue losses, Varta is a clear buy below EUR 10. The Q2 figures are expected on August 12. Put the share back on your watchlist .

Investors have pounced on stable tech stocks such as Apple, Microsoft, Google, and Nvidia in the last 6 months. Good cash flows are being generated here despite high valuations and an unfavourable interest rate climate. Smaller growth companies, which still need a lot of investor capital to implement their ideas, are currently less favoured. Should the central banks lower interest rates, the focus could quickly shift back to small caps.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.