August 18th, 2025 | 07:05 CEST

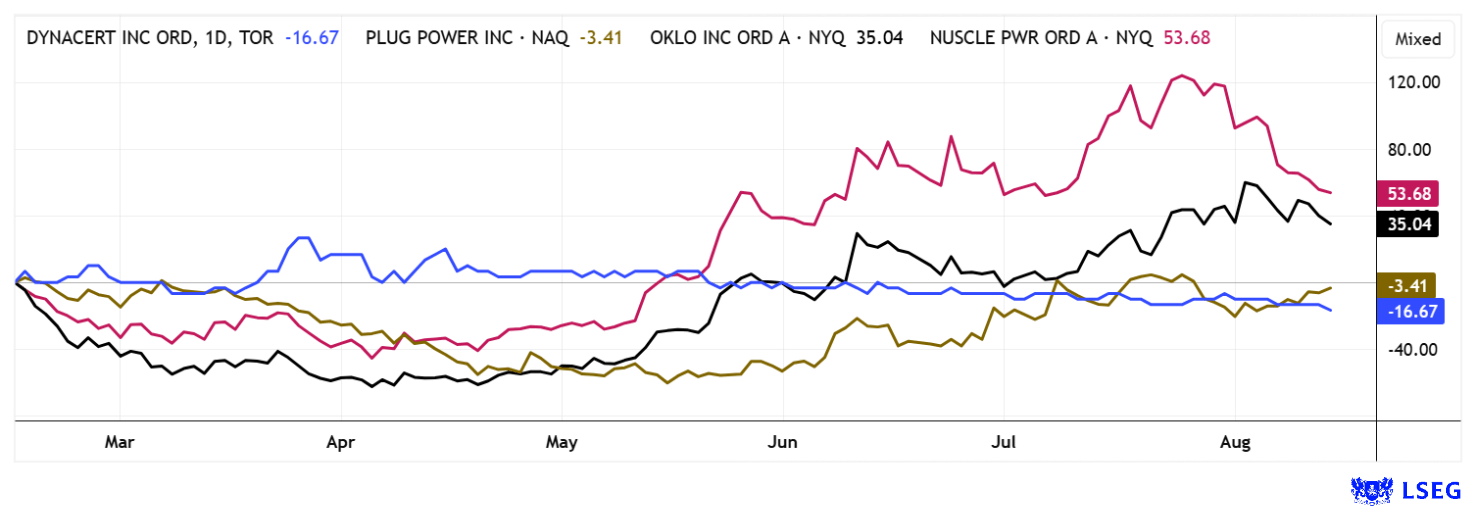

Hydrogen versus nuclear power – 300% with Plug Power and dynaCERT, caution advised with Oklo and NuScale

Fuel cells have long been seen as a beacon of hope in propulsion technology, though they have only gained limited traction in the automotive sector. While batteries dominate the mass market, fuel cells score points primarily in heavy-duty and long-distance transport due to their range and short refueling times, as well as in stationary systems. Plug Power is working on infrastructure projects, while dynaCERT is making existing drives more efficient with hydrogen systems, thus serving as a bridge to the next era. At the same time, small modular reactors (SMRs) from suppliers like Oklo and NuScale are gaining in importance as they promise a stable, low-carbon energy supply for industry and hydrogen production. This opens up opportunities for investors in two future markets: sustainable mobility and scalable energy solutions – both enjoying political tailwinds and high growth potential. How should investors proceed with their portfolios?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084 , OKLO INC | US02156V1098 , NUSCALE POWER CORPORATION | US67079K1007

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power – It does not look too bad

Plug Power remains synonymous with the highs and lows of the hydrogen industry, with a 2,000% rise followed by a 95% sell-off. The US company also posted mixed figures in Q2 2025. On the one hand, it reported strong revenue growth, but on the other hand, it continued to post high losses. Investors are now wondering whether the stock has finally bottomed out or whether the turnaround is still a long way off.

**In detail, Plug Power increased its quarterly revenue by 21.4% to just under USD 174 million. The electrolyser business stood out particularly positively, with sales tripling year-on-year and now contributing around USD 45 million in revenue. This technology is central to the production of green hydrogen, as it splits water into oxygen and hydrogen using renewable electricity, which is key to decarbonizing energy-intensive industries. On the earnings side, however, the picture remains mixed. Although Plug Power was able to reduce its net loss slightly compared to the previous year, the deficit is still considerable at USD 228.7 million (EPS: USD -0.20). A year ago, the loss was even higher at USD 262.3 million. The cost-cutting measures are therefore beginning to have an effect, but are still far from sufficient to break even.

In terms of chart analysis, the stock is now in a delicate phase: between USD 1.50 and USD 2.10, it will be decided whether Plug Power can lay the foundation for a trend reversal. A break above USD 2.15 could unleash new momentum, while a break below USD 1.45 would dash hopes of a bottoming out.

dynaCERT – This could soon go through the roof

dynaCERT delivers pure hydrogen solutions with immediate emission effects. The Canadian company specializes in hydrogen optimization for diesel engines and continues to push forward with innovation and expansion. The patented HydraGEN™ system enables fuel savings of 5–15%, depending on the application, while achieving measurable reductions in emissions. A standout feature: the technology is eligible for VERRA certification, allowing fleet operators and companies to generate carbon credits through verified emission reductions. Recent installations in the port of Rochefort and for vehicles participating in the 2025 Dakar Rally highlight the versatility and reliability of the technology.

dynaCERT is particularly well-positioned in the global mining and transportation sector. Several open-pit mining operations in South America and Canada have already been equipped with specially developed 4C and 6C HydraGEN™ devices, including Caterpillar haul trucks and large diesel generators. Numerous transport service providers, construction companies, and logistics companies also use HydraGEN™ to meet increasingly ambitious ESG requirements. The technology is robust enough for demanding conditions such as extreme temperatures and high altitudes, which has led to its widespread acceptance in industry.

With over 1,000 new devices in pre-production and the new listing on the NASDAQ OTCQB, the Company is laying the foundation for strong revenue growth and increased trading liquidity. With German management and international experts such as Seth Baruch on the advisory board, a competitive market strategy is being pursued that will firmly establish dynaCERT as a sustainable solution and promising investment story for mining, transportation, and many public ESG projects. At the beginning of July, CAD 5 million in financing was secured, which should now be reflected in sales. The next quarterly figures are likely to show the first effects. For responsible investors, DYA shares represent climate protection in its purest form – for speculators, they offer a clear 500% opportunity to reach the GBC analysts' price target of CAD 0.75!

Here you can find the latest interview with COO Kevin Unrath on Stockhouse about the planned rollout of the new HydraGEN™ systems.

NuScale Power versus Oklo – The clear difference

Hydrogen and nuclear power are considered combinable green energy building blocks. NuScale Power has already cleared the decisive hurdle with its SMR design: The US Nuclear Regulatory Commission (NRC) has approved the first reactor. This process took over 10 years and has now been finalized since 2025. NuScale is therefore ready to start construction and is targeting specific markets such as data centers, AI operations, the conversion of old coal-fired power plants, industrial process heat, hydrogen production, and seawater desalination, all with real customer interest and robust projects. Oklo, on the other hand, is still in its infancy. The Company is dependent on government support, Pentagon contracts and, ultimately, the NRC license. Oklo is currently in the pre-application process for its first Aurora plant. There is no revenue yet, and initial revenue is not expected until 2028 at the earliest.

Nevertheless, Oklo's stock has risen by over 700% in the last 12 months and is trading at an extremely high price-to-book ratio of 36.8, significantly higher than NuScale at 26.3. Investors are paying for hope for the future, not for substance. While NuScale is already regulated and ready for commercialization, making it a solid investment case with medium-term growth potential, Oklo remains a bet on the distant future for the time being. Those looking for security are likely to be better off with NuScale. Oklo is suitable for investors who are willing to take high risks in order to potentially reap above-average returns at the end of the decade. Analysts on the LSEG platform expect average 12-month price targets of USD 67.45 for Oklo and USD 38.75 for NuScale. Oklo has already risen above USD 80 and only corrected noticeably for the first time last Friday. Tech boom 3.0 is on its way!**

Global stock markets continue their record-breaking run, creating attractive conditions for technology-driven growth stocks. Oklo and NuScale have already performed well, and Plug Power could be on the verge of a noticeable turnaround. dynaCERT is excellently positioned in this phase to benefit from rising investment in sustainable mobility and efficient industrial processes. For investors focusing on greentech and sustainable infrastructure, the stock remains an exciting investment case with potential for multiple gains.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.